Get the free form-8937-report-of-organizational-actions-affecting-basis-in ...

Get, Create, Make and Sign form-8937-report-of-organizational-actions-affecting-basis-in

Editing form-8937-report-of-organizational-actions-affecting-basis-in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form-8937-report-of-organizational-actions-affecting-basis-in

How to fill out form-8937-report-of-organizational-actions-affecting-basis-in

Who needs form-8937-report-of-organizational-actions-affecting-basis-in?

Form 8937: Report of Organizational Actions Affecting Basis in Form

Understanding Form 8937

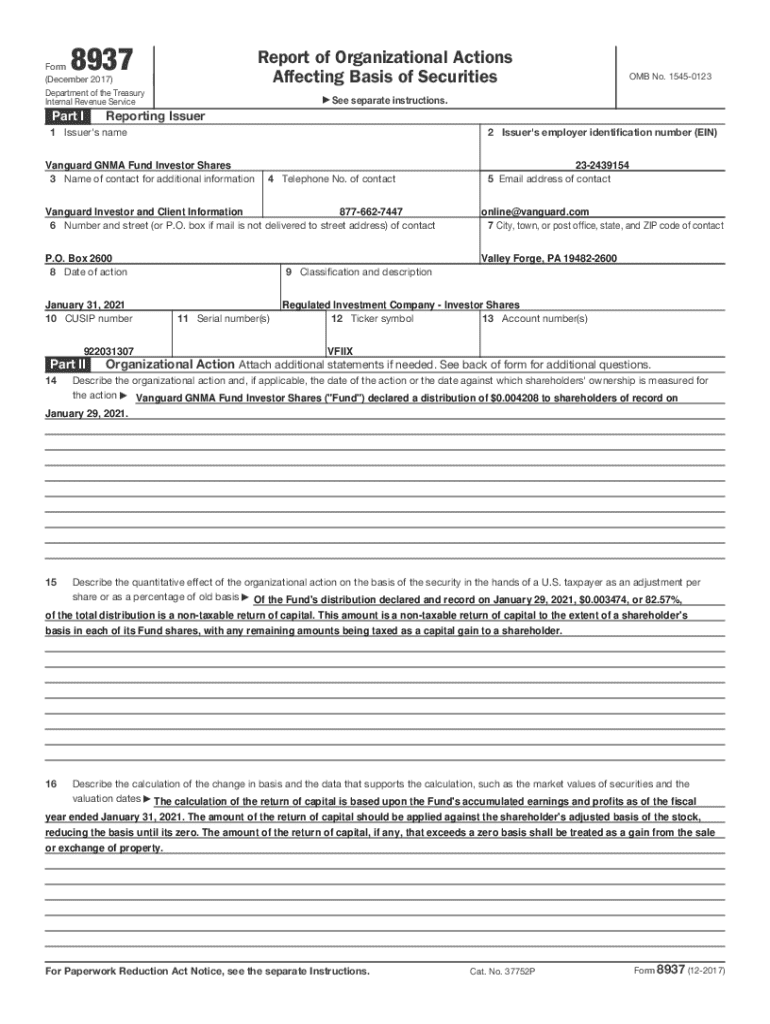

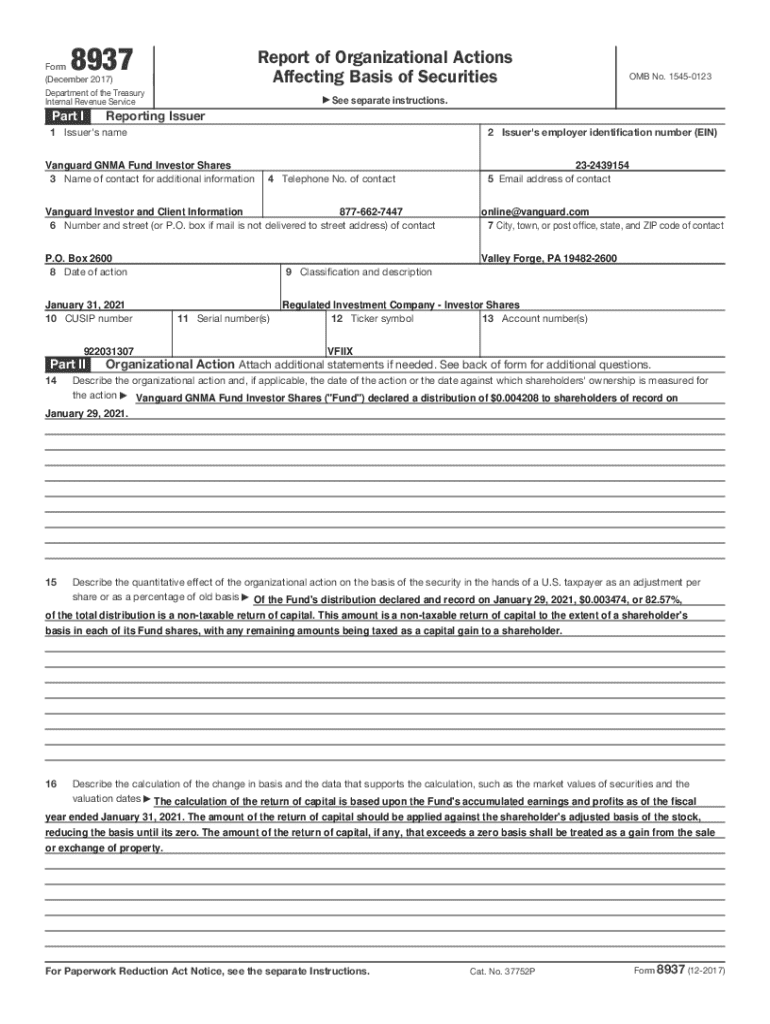

Form 8937 serves as a critical tool for reporting organizational actions affecting the basis of securities. It is primarily utilized by corporations to report such actions to the Internal Revenue Service (IRS) as well as securities holders, ensuring transparency in any alterations that influence the tax basis of their assets. This includes actions like mergers, stock splits, and reorganizations, where the value of securities can change significantly.

The importance of reporting these organizational actions cannot be overstated, as accurate reporting safeguards both the organization and the tax obligations of the securities holders. By accurately completing Form 8937, the organization supports its shareholders in understanding their potential tax liabilities, thereby promoting compliance and minimizing disputes in tax assessments.

Who needs to file Form 8937?

Not every organization is required to file Form 8937. Generally, the eligibility criteria dictate that publicly traded corporations involved in organizational actions that impact the basis of their securities must file this form. This could include large publicly traded companies and certain investment firms.

Organizational actions necessitating Form 8937 can include corporate actions such as stock splits, mergers, demergers, or any significant events affecting the structure of capital stock. Understanding when to file is crucial for compliance, as failing to report these actions can lead to complications for both the organization and its shareholders.

Key components of Form 8937

Form 8937 consists of several key sections that must be completed to provide accurate information surrounding the organizational action. Part I captures essential details about the reporting organization, such as its name, address, and Employer Identification Number (EIN). This part sets the context for the form and establishes the identity of the filing organization.

Part II focuses on detailing the organizational action itself, including the type and date of action taken. It helps delineate the specifics that influenced the basis change. Finally, Part III outlines the tax consequences to recipients, where organizations describe how these actions will affect the tax basis for their stockholders. Understanding these components and the terminology involved is vital for all stakeholders engaged in the filing process.

Step-by-step guide to completing Form 8937

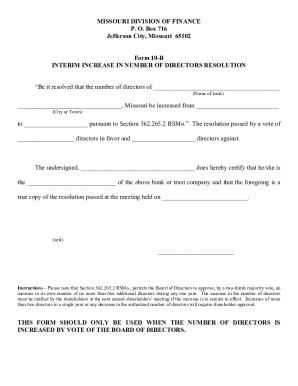

To begin with, gathering the necessary information for Form 8937 is a critical first step. This includes collecting relevant corporate documents, SEC filings, and board resolutions that provide clarity on the organizational actions taken. Important dates, such as the effective date of the action, should also be diligently noted to ensure timely filing and precision in represented data.

Filling out the form follows a structured approach: Each section should be carefully completed, ensuring that all fields are accurate. Common mistakes include providing incorrect tax identification numbers or failing to disclose material data related to the organizational action. Double-checking each entry and adhering to IRS guidelines can drastically improve the accuracy and compliance of the filing.

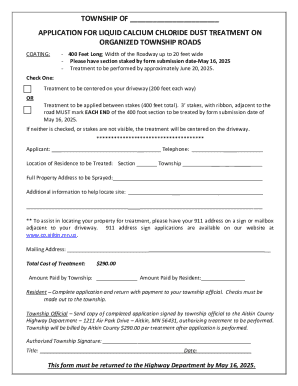

Filing requirements and deadlines

Filing Form 8937 with the IRS is not just a compliance measure — it is a necessary action that directly affects the tax positions of both the organization and its shareholders. Organizations typically must file Form 8937 within 45 days after the organizational action is completed. This tight timeline necessitates preparedness and efficiency in gathering and processing the required information.

Late or inaccurate filings can result in significant penalties from the IRS, including fines based on the number of days late. Organizations should also be aware of specific scenarios that may alter deadline requirements, such as administrative or judicial delays. Staying informed and organized is crucial to meeting all filing obligations diligently.

Managing supporting documents

Supporting documentation accompanies Form 8937, providing evidence for the reported organizational actions. Types of supporting documents can include board meeting minutes, corporate announcements, and specific SEC filings that clarify the action's context. These documents not only substantiate the filing but also assist in protecting the organization from future compliance issues.

Proper organization and secure storage of these documents are imperative. A structured filing system should be adopted, allowing for easy retrieval during audits or inquiries from the IRS. Retaining these documents is equally vital, as they may be needed to defend the organizational actions taken in case of disputed tax assessments.

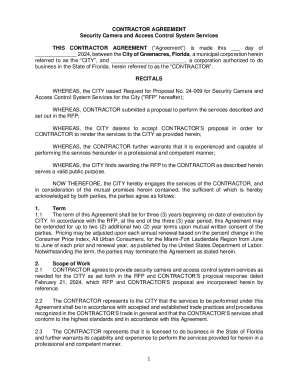

Using pdfFiller for Form 8937

pdfFiller stands out as an invaluable resource for individuals and teams managing Form 8937. Its cloud-based document management capabilities allow users to edit, sign, and collaborate seamlessly. The ease of access from anywhere means that users can work on their filings without the constraints of physical document storage.

Utilizing pdfFiller involves straightforward steps: After uploading Form 8937, users can edit the necessary fields, sign digitally, and share it directly with stakeholders. This integrated process enhances workflow efficiency, allowing users to maintain compliance while minimizing potential errors.

FAQs about Form 8937

FAQ sections help clarify common uncertainties surrounding Form 8937. For instance, many might wonder what happens if an organization does not file this form. The repercussions can include penalties from the IRS and potential loss of goodwill with investors who depend on transparent reporting.

Another prevalent question addresses the amendment process: Yes, organizations can amend Form 8937 if errors are identified. However, timely submission of amendments is crucial to avoid complications with tax assessments. Furthermore, organizations often need clarification on how this form affects their overall tax returns, emphasizing the importance of comprehensive advice from tax professionals.

Recent updates and changes to Form 8937

Recent updates from the IRS indicate that organizations must stay vigilant regarding changes in reporting guidelines and requirements associated with Form 8937. This includes additional clarifications regarding specific types of organizational actions that must be reported and any new documentation requirements introduced through recent legislative changes.

Staying updated is essential for individual and organizational compliance. Resources such as the IRS website, professional tax advisory services, or even informative platforms like pdfFiller provide vital information needed to navigate these changes effectively.

Real-life examples and case studies

Understanding the practical implications of Form 8937 is best illustrated through hypothetical scenarios and case studies. For example, consider a mid-sized company undergoing a stock split. If the company accurately files Form 8937, it allows shareholders to adjust their basis correctly, thereby maintaining clarity in their tax obligations and preserving investor trust.

Conversely, companies that poorly navigate this process often face scrutiny and penalties. Learning from these case studies and identifying best practices can prove invaluable for organizations striving to enhance their compliance regarding Form 8937.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form-8937-report-of-organizational-actions-affecting-basis-in to be eSigned by others?

Can I create an electronic signature for the form-8937-report-of-organizational-actions-affecting-basis-in in Chrome?

Can I create an electronic signature for signing my form-8937-report-of-organizational-actions-affecting-basis-in in Gmail?

What is form-8937-report-of-organizational-actions-affecting-basis-in?

Who is required to file form-8937-report-of-organizational-actions-affecting-basis-in?

How to fill out form-8937-report-of-organizational-actions-affecting-basis-in?

What is the purpose of form-8937-report-of-organizational-actions-affecting-basis-in?

What information must be reported on form-8937-report-of-organizational-actions-affecting-basis-in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.