Get the free 0599 Form 8596. Information Return for Federal Contracts

Get, Create, Make and Sign 0599 form 8596 information

Editing 0599 form 8596 information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0599 form 8596 information

How to fill out 0599 form 8596 information

Who needs 0599 form 8596 information?

Comprehensive Guide to the 0599 Form 8596 Information Form

Understanding the 0599 Form 8596 Information Form

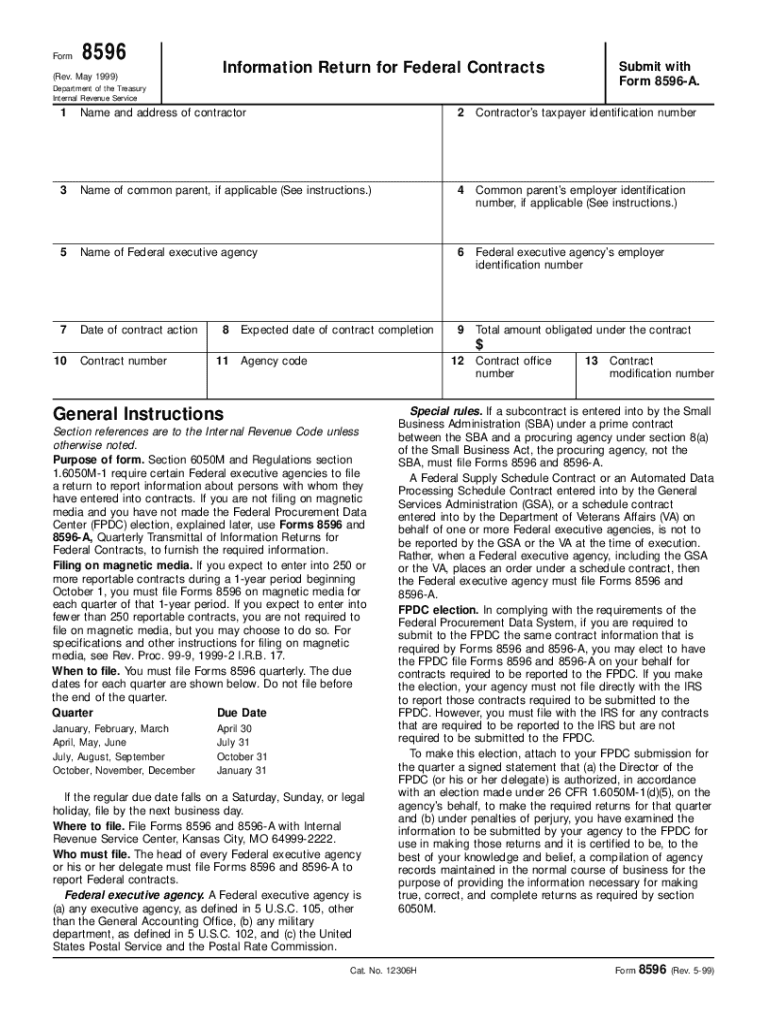

The 0599 Form 8596 is an essential document used primarily in various financial and tax-related situations. This form serves as an information return required by the IRS and is utilized by individuals and businesses to report specific data to the Internal Revenue Service. Its primary purpose includes facilitating compliance with tax regulations and ensuring that all relevant financial details are accurately recorded for the IRS.

The importance of the 0599 Form 8596 cannot be overstated. Accurate filing enhances transparency and can significantly affect one’s tax obligations or refund eligibility. Whether you are an individual taxpayer or a business owner, this form plays a critical role in your financial reporting.

Who needs to use the 0599 Form 8596?

The audience for the 0599 Form 8596 encompasses various groups. Individuals who may have received certain payments, such as from side hustles or freelance work, are often required to report this income using the form. Similarly, businesses disbursing payments that need to be reported to the IRS fall under this category.

Tax professionals also frequently utilize this form on behalf of their clients. Knowledge of the 0599 Form 8596 ensures that they can guide individuals and businesses in meeting their tax obligations efficiently.

Detailed insights on the 0599 Form 8596

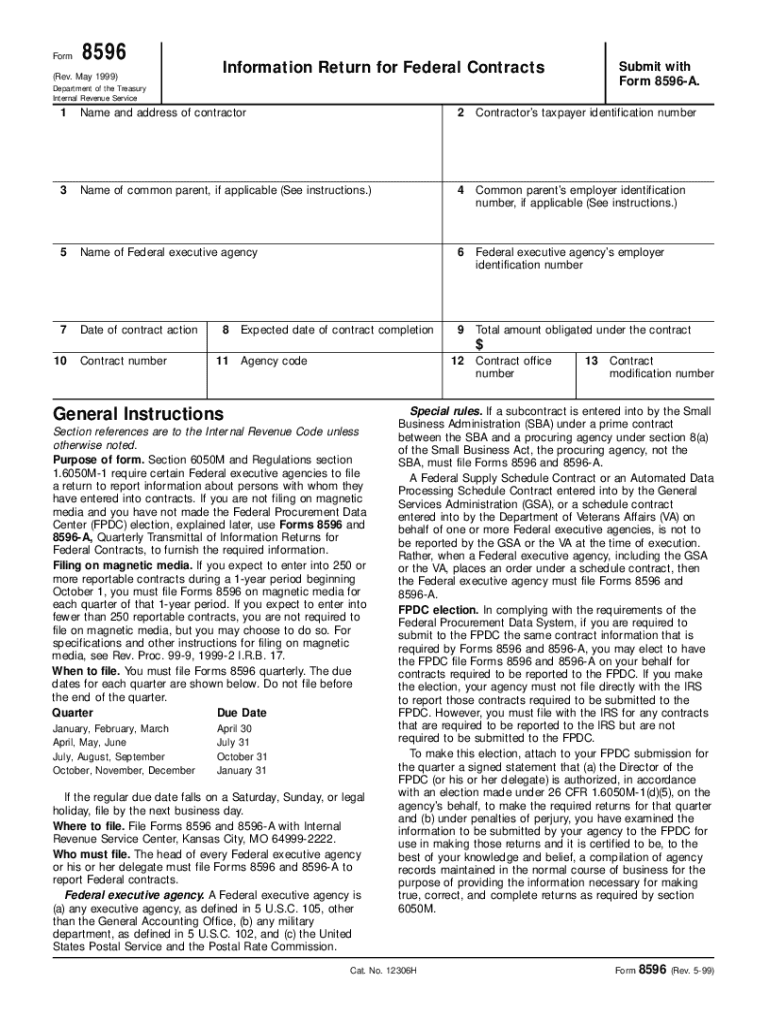

Understanding the layout of the 0599 Form 8596 is crucial for proper completion. The form typically consists of several key sections, which include personal information, financial details, and declaration sections. Each segment must be filled out carefully to avoid common pitfalls that could lead to processing delays or errors in tax filings.

One must note the significance of each field within these sections. Fields may include names, social security numbers, addresses, and details of financial transactions. Accuracy in these sections is paramount, as discrepancies can lead to discrepancies with the IRS, which may result in fines or audits.

Frequently asked questions

Addressing common questions regarding the 0599 Form 8596 is vital for users unfamiliar with tax forms. One common misconception is who must file this form and under what circumstances. It’s important to clarify that anyone who has received reportable payments should be utilizing this form, not just businesses.

Another typical confusion surrounds the completion of the form. Errors often occur in the recording of personal information, such as typos in social security numbers, which can be easily avoided by double-checking all data before submission.

Step-by-step guide to filling out the 0599 Form 8596

Before you begin filling out the 0599 Form 8596, it’s important to gather all necessary documents and information. This preparation phase can prevent errors and save time during the actual completion. Common documents needed include tax identification numbers, payment records, and previous year's tax returns, which will assist in accurately reporting current financial data.

A checklist of necessary data might include items like personal identification details, financial transaction records relevant for the reporting year, and any relevant IRS documentation from previous years. By having these on hand, you'll enhance the efficiency of the process.

Completing the form: A section-by-section breakdown

As you fill out the 0599 Form 8596, begin by entering your personal information in the designated section. This includes your full name, current address, and tax identification number. Each detail should be accurate to facilitate proper identification by the IRS.

The next step is entering your financial details. This may involve detailing any reportable payments or transactions and ensuring that all figures are accurate and correspond with your supporting documents. Finally, remember to complete the final section, which includes signatures and necessary declarations, affirming that all information provided is truthful and complete.

Tips for accurate submission

To ensure compliance and accuracy in your submission of the 0599 Form 8596, here are some practical tips. Always use clear and legible handwriting if filling out the form manually. Additionally, employing a reliable PDF editing tool, such as pdfFiller, can facilitate this process by allowing you to enter data digitally, reducing the likelihood of errors.

Checking through the form post-completion is equally crucial. Look for common pitfalls like missing signatures, incorrect or incomplete fields, and discrepancies between reported amounts and supporting documents. These precautionary steps can save you from future issues with the IRS.

Editing and managing the 0599 Form 8596 using pdfFiller

Utilizing pdfFiller can greatly simplify the process of editing and managing your 0599 Form 8596. Importing your form into pdfFiller is straightforward. Users can upload PDF files or start with a blank form using the platform’s user-friendly interface. Supported formats include various PDF types, making it easy for users to get started.

Once imported, pdfFiller offers a host of editing features, such as text addition, highlighting, and commenting tools. With the ability to customize forms for repeated use through templates, efficiency is significantly enhanced. These features allow both individuals and teams to modify documents swiftly and securely.

Signing the form electronically

The eSigning process for the 0599 Form 8596 via pdfFiller is intuitive and legally valid. Users can digitally sign the form using secure eSignature features, which comply with legal standards for electronic signatures. This process eliminates the need for physical paperwork, facilitating a more efficient workflow.

Furthermore, electronically signing the form ensures a faster turnaround time for submissions and reduces the likelihood of delays due to postal services. The secure encryption used by pdfFiller further safeguards your information throughout the eSigning process.

Collaboration tools for teams with the 0599 Form 8596

For teams handling the 0599 Form 8596, pdfFiller's collaboration tools can be invaluable. The platform allows team members to share the form easily by setting permissions for viewing and editing. This collaborative feature fosters teamwork and ensures that everyone is on the same page regarding document edits and updates.

Additionally, pdfFiller provides real-time collaboration options that let users work together efficiently. This includes tracking changes made by any member, leaving comments, and providing feedback directly within the platform, further enhancing the team's ability to manage tax documents effectively.

Managing your 0599 Form 8596 post-submission

Once you have submitted your 0599 Form 8596, it’s crucial to stay organized. Keeping records of your submission is fundamental for future reference. This could include saving copies of both your filled form and any confirmation received from the IRS. Tracking your submission status helps ensure compliance and catch any potential issues promptly.

In the event of queries or revisions needed on the submitted form, it’s proactive to have a plan in place. Document how to handle any respondent's questions effectively and understand the steps necessary to make amendments should they be required later on.

Additional tools and resources within pdfFiller for related forms

pdfFiller provides users with various templates for tax and financial forms, including those similar to the 0599 Form 8596. This resource is invaluable for maximizing your workflow and ensuring all required documents are readily accessible.

Moreover, users can leverage robust support resources tailored toward assistance with form completion and management. Whether you need help navigating the platform or specific guidance on filing requirements, pdfFiller’s customer support is equipped to provide the necessary assistance.

Conclusion

The 0599 Form 8596 is a vital document for those needing to report certain payments to the IRS. From individuals to businesses and tax professionals, understanding its intricacies can help ensure compliance and prevent potential mishaps during tax seasons. Utilizing tools like pdfFiller makes the management of this form straightforward and efficient.

Leveraging pdfFiller can empower users to navigate the complexities of the 0599 Form 8596 with ease, from editing and signing to collaborating and managing submissions. This cloud-based platform offers a comprehensive solution for all your document management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 0599 form 8596 information to be eSigned by others?

How do I complete 0599 form 8596 information online?

How do I edit 0599 form 8596 information online?

What is 0599 form 8596 information?

Who is required to file 0599 form 8596 information?

How to fill out 0599 form 8596 information?

What is the purpose of 0599 form 8596 information?

What information must be reported on 0599 form 8596 information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.