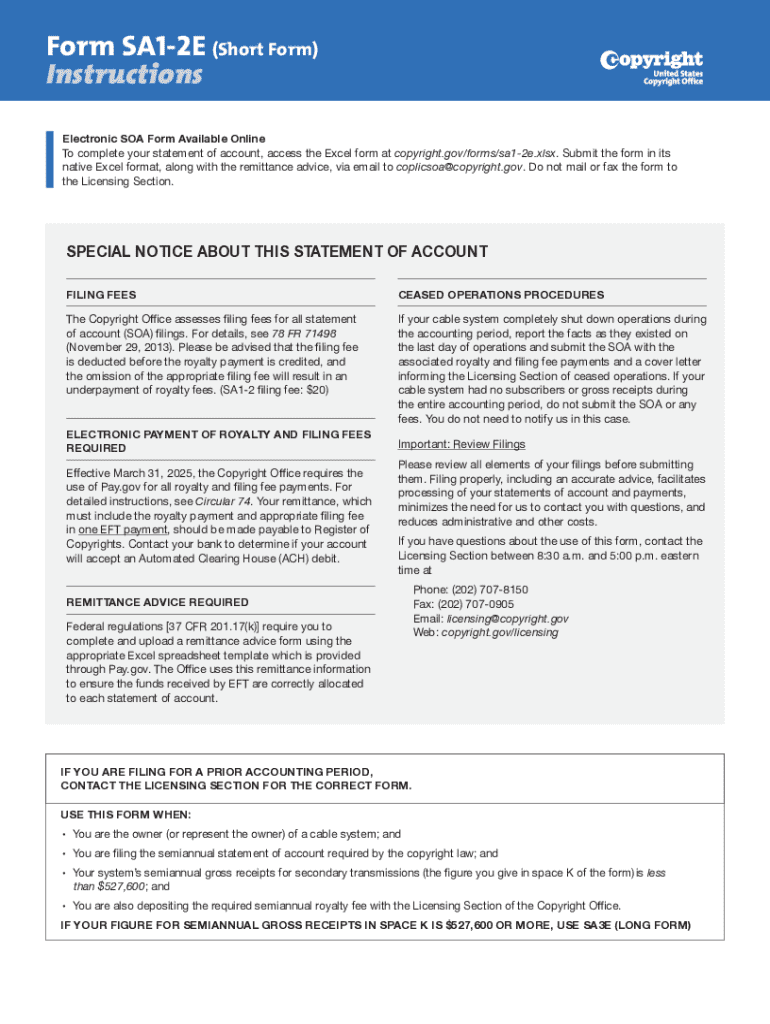

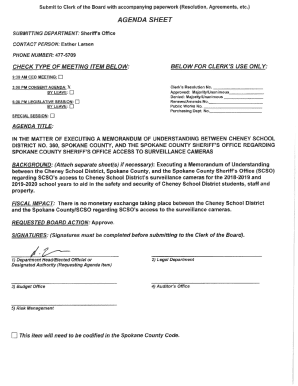

Get the free Form SA1-2E (Short Form) Instructions

Get, Create, Make and Sign form sa1-2e short form

How to edit form sa1-2e short form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sa1-2e short form

How to fill out form sa1-2e short form

Who needs form sa1-2e short form?

Form SA1-2E Short Form: Your Comprehensive How-to Guide

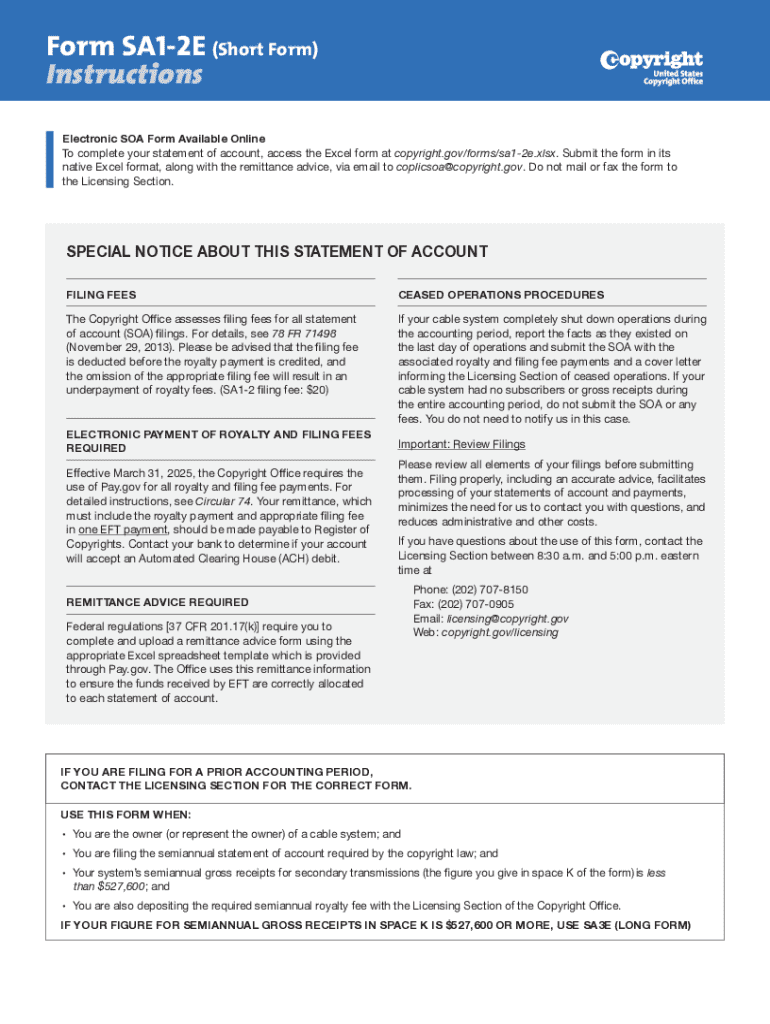

Understanding the Form SA1-2E

Form SA1-2E serves as a vital tool in various administrative processes. Essentially, it streamlines the collection of critical information from individuals and organizations, ensuring that all necessary data points are captured efficiently. The primary purpose of this form is to standardize submissions for specific applications, aiding in better governance and management.

Common scenarios where the Form SA1-2E is used include tax filings, compliance reports, and other essential administrative documentation. Whether you are an individual seeking tax relief or a business operating under regulatory scrutiny, understanding how to leverage this form can significantly impact your efficiency.

Who needs this form?

The target audience for Form SA1-2E primarily includes individuals, small business owners, and non-profit organizations. For instance, an individual filing taxes may need this form to avail certain exemptions, while an organization may use it to comply with local laws.

Accurate completion of Form SA1-2E is critical. Mistakes can lead to delayed processing times and even penalties. Thus, understanding your specific needs and the requirements of the form is paramount.

Key features of the Form SA1-2E

Form SA1-2E includes several essential components that users must complete accurately to ensure a smooth submission process. Each section of the form has been thoughtfully designed to capture specific information relevant to the application.

Essential information required on the form can typically be broken down into personal identification data, financial details, and compliance attestations. Understanding the importance of each section can help users avoid common pitfalls.

Understanding terminology

Familiarizing oneself with the terminology used in Form SA1-2E can be beneficial. Terms such as 'refined_entities' and 'eSignatures' can appear technical but are crucial to the process. Misunderstanding these could lead to incorrect submissions.

Step-by-step guide to filling out Form SA1-2E

To successfully complete Form SA1-2E, users must follow a clear sequence of steps that ensure they collect all necessary information before submission.

Step 1: Gathering required information

Start by compiling all documents and data necessary for filling out the form. This includes personal identification documents, financial records, and any relevant compliance documentation.

Organizing this information systematically—perhaps using folders both digitally and physically—can make the actual form-filling process significantly smoother.

Step 2: Completing the form

When filling out the Form SA1-2E, start with the personal information section. Capture your full name, contact information, and any required identification numbers accurately.

Next, proceed to the financial section if applicable. This may involve attaching supplementary documents or providing monetary figures directly on the form. Lastly, complete the compliance and certifications section to confirm that you meet all necessary criteria.

Step 3: Reviewing your form

Once the form is filled, scrutinize each section for accuracy and completeness. Utilize best practices such as checking entries against your gathered documents.

Common mistakes include missing signatures, incorrect identification details, and inaccurate financial data, which can complicate the review process.

Step 4: Submitting the form

With the form complete, submit it through the preferred method—either electronically via a cloud service like pdfFiller or by mailing it physically. Be aware of the specific deadlines associated with Form SA1-2E to avoid complications.

Editing and managing your Form SA1-2E

Even after submitting Form SA1-2E, users may find themselves needing to make changes. This is where editing tools come into play. Services like pdfFiller offer an array of editing capabilities for managing submissions.

If errors occur or whether further information is required, utilizing pdfFiller allows users to make these adjustments seamlessly. Users can also easily modify their documents online instead of dealing with cumbersome hard copies.

Signing your form electronically

When using pdfFiller, applying an electronic signature is effortless. The platform provides straightforward tools for users to sign forms digitally, thus enhancing workflow efficiency.

It's important to remember that eSignatures hold legal standing, thereby offering the same accountability as traditional signatures.

Collaboration features for teams

If more than one person is involved in completing Form SA1-2E, collaboration features are essential. pdfFiller allows multiple users to review and contribute input towards the form's completion.

Setting this up is as easy as inviting collaborators to the document, encouraging teamwork and refining input. This feature significantly enhances accuracy and ensures all perspectives are considered.

Managing feedback and revisions

Once feedback is received from collaborators, users can track changes and incorporate suggestions effectively using pdfFiller's tools. Maintaining an organized overview of revisions greatly improves the final submission.

Frequently asked questions (FAQs) about Form SA1-2E

As users engage with Form SA1-2E, several questions frequently arise. Clarifying specific sections of the form can prevent confusion and ensure accuracy.

Clarifications on specific sections

For instance, individuals often ask about what constitutes compliant financial documentation. It’s crucial to refer to the guidelines provided with the form to understand what's acceptable.

Re-submissions and corrections

If mistakes are found post-submission, users should be aware of how to correct or re-submit forms. Guidance is typically available from the issuing body, offering clarity on the steps to take.

Dispute resolution and support

For further assistance, users can reach out to designated contact points provided with the form. Resources such as FAQs and help centers can also offer solutions for resolving issues.

Additional tips and best practices

To maximize success with Form SA1-2E, seasoned users recommend specific strategies. Keeping a checklist handy can help ensure that all parts of the form are addressed before submission.

Another beneficial tip is to utilize tools like pdfFiller for enhanced document management. Continuous access to previously submitted forms simplifies the process of future filings.

Real-life applications and case studies

Case studies illustrate the importance of accurate Form SA1-2E submissions. For example, a local startup successfully utilized the form to claim tax credits, thus showcasing significant financial benefits stemming from proper documentation.

Additionally, businesses that have adopted pdfFiller often report gains in efficiency and precision, demonstrating the advantages of using innovative document management solutions.

Conclusion and user experience

Utilizing pdfFiller streamlines and enriches the process of managing Form SA1-2E effectively. The platform maximizes the ease with which users can edit, sign, and submit their forms, making it an indispensable tool for individuals and teams alike.

By harnessing the capabilities of pdfFiller, users can ensure they submit accurate forms promptly, thus minimizing headaches and maximizing compliance. Exploring additional features can further enhance long-term document handling strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form sa1-2e short form?

How do I execute form sa1-2e short form online?

How do I make edits in form sa1-2e short form without leaving Chrome?

What is form sa1-2e short form?

Who is required to file form sa1-2e short form?

How to fill out form sa1-2e short form?

What is the purpose of form sa1-2e short form?

What information must be reported on form sa1-2e short form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.