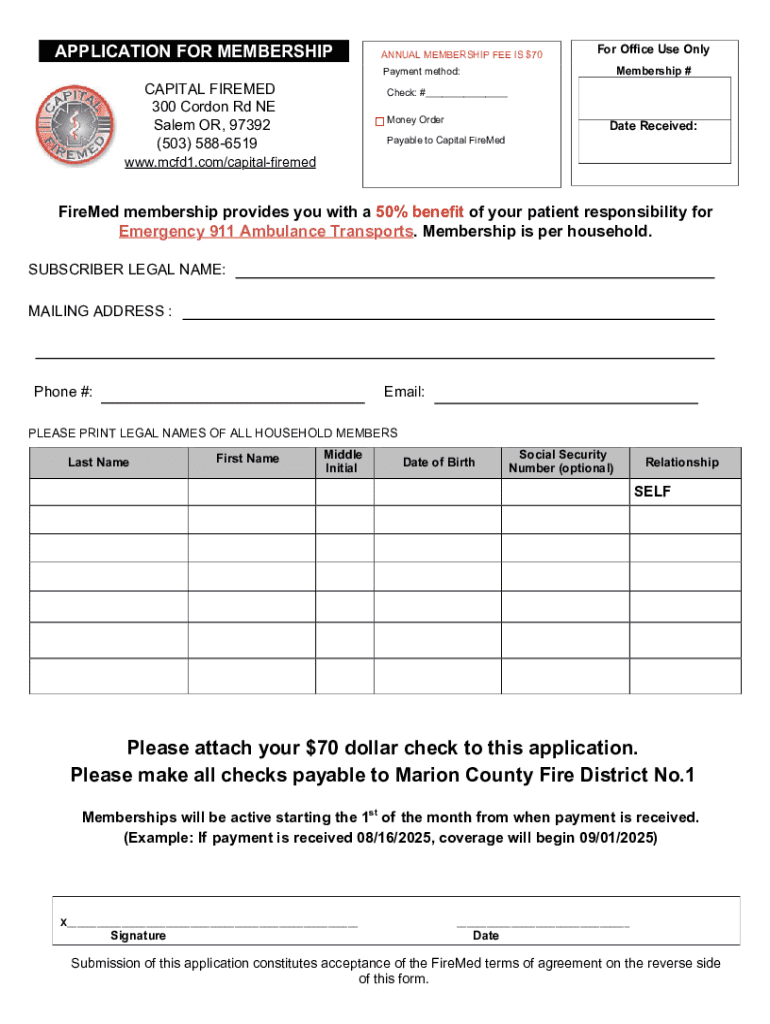

Get the free Please attach your $70 dollar check to this application. ...

Get, Create, Make and Sign please attach your 70

How to edit please attach your 70 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out please attach your 70

How to fill out please attach your 70

Who needs please attach your 70?

Please attach your 70 form: A comprehensive guide

Understanding Form 70: Overview and importance

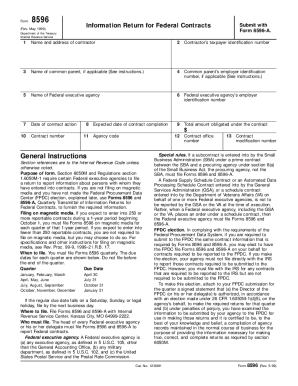

Form 70, often referenced among filers as a critical document, serves as a crucial accountability tool for individuals and employees in various sectors. This form is designed to transparently disclose essential information, particularly regarding economic interests pursuant to the regulations of the Fair Political Practices Commission (FPPC). Understanding the specifics of Form 70 is essential for any individual required to submit it, as it lays the groundwork for honest and ethical reporting.

Submitting Form 70 is important for several key reasons. Primarily, it contributes to a culture of transparency within organizations and promotes accountability among employees. Furthermore, an accurate Form 70 helps prevent conflicts of interest by documenting any potential disclosures. The consequences of failing to attach your 70 form can be serious, including penalties from regulatory agencies, which may include fines or other punitive measures. Thus, ensuring that you attach your form when required is not just a procedural formality; it's a significant part of responsible governance.

Preparing to complete Form 70

Before diving into filling out Form 70, gather all required information. This initial step is vital for accuracy and efficiency. You will need your personal identification details, including your full name, address, position, and any other relevant identifiers to complete the form correctly. Moreover, be prepared to disclose financial information or potential conflicts of interest that may impact your role or your organization’s integrity.

In addition to personal and financial data, familiarize yourself with tools that can simplify this process. Programs like pdfFiller are recommended for their user-friendly interface and robust capabilities. Users can access templates and guides directly related to Form 70, making the form-filling process less daunting. Using the right technology not only streamlines your completion of Form 70 but also ensures that you can make any necessary edits before final submission.

Step-by-step instructions for filling out Form 70

Filling out Form 70 can seem overwhelming, but breaking it down into manageable sections ensures clarity. Begin with the Personal Information Section, where you provide essential identification details. This section sets the stage for your disclosures and helps verify your identity as a filer.

Next, transition to the Financial Information Section. Here, be meticulous about listing any economic interests that pertain to your role. Additional relevant fields may require information about transactions or gifts received which could influence evaluation decisions. It’s vital to attach supplemental documents supporting your disclosures. Ensure that you're adhering to allowed file formats such as PDF or JPEG for seamless submission.

Finally, reviewing your completed inputs is crucial. Always double-check for common errors such as typos or omitted entries, as inaccuracies can lead to significant issues with your filing.

Interactive tools for Form 70 completion

pdfFiller's interactive features greatly enhance the experience of completing your Form 70. Leveraging tools like PDF editing offers flexibility in making real-time changes. eSignature capabilities also streamline the approval process, allowing for a legally binding signature to be added swiftly.

Another valuable feature is the ability to track changes and previous versions of your document. This functionality ensures that you can closely monitor your edits for accuracy or revert to an earlier version if necessary. Collaboration capabilities are equally essential; inviting team members to review the form can lead to a more polished final submission, thereby minimizing potential discrepancies.

Best practices for submitting Form 70

When preparing to submit your Form 70, consider the differences between digital and physical submission methods. Digital submissions, facilitated through platforms like pdfFiller, often provide a more efficient process with instant confirmations. However, be mindful of the submission timing; verify whether your form must be submitted by a specific deadline to avoid penalties.

Keeping meticulous records of your submission can prove invaluable. With pdfFiller, users can organize documents effectively, ensuring all forms are easily retrievable for future reference. Knowing you have a backup of your submission can provide peace of mind in compliance matters.

Frequently asked questions about Form 70

Understanding the nuances of Form 70 often leads to several common questions among individuals and teams. For instance, what should you do if you discover a mistake after submission? Generally, you can amend your Form 70 by reaching out to the relevant agency. It's essential to take immediate action to correct any discrepancies that might reflect poorly on your accountability.

Additionally, knowing whom to contact for assistance can alleviate much of the stress associated with completing and submitting Form 70. Official agencies often have resources dedicated to helping filers navigate their inquiries, ensuring clarity in the process.

Potential challenges and solutions

While completing Form 70 provides a structured approach to disclosure, challenges can arise. Technical issues during online submissions are among the most frustrating, but having alternate submission methods like a physical copy can be a backup plan. Moreover, be aware of late penalties associated with delayed filings. Implementing a strict timeline for completion and submission can mitigate this risk.

Finally, if your form is denied or requires revision, take note of the feedback provided by the agency. Understanding the reasons behind the denial can ensure a more accurate re-submission, saving time and maintaining compliance without unnecessary penalties.

Testimonials: Success stories using Form 70

User experiences often provide valuable insights into the effectiveness of tools like pdfFiller in completing Form 70. Many individuals report that the ability to access their documents from any location has dramatically improved their efficiency, particularly when they need to collaborate with team members swiftly.

Success stories share how streamlined editing and immediate feedback have led to more accurate submissions, ultimately fostering a culture of transparency and accountability within organizations. This showcases the integral role technology plays in enhancing compliance and ethical practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in please attach your 70?

How do I edit please attach your 70 straight from my smartphone?

How do I complete please attach your 70 on an iOS device?

What is please attach your 70?

Who is required to file please attach your 70?

How to fill out please attach your 70?

What is the purpose of please attach your 70?

What information must be reported on please attach your 70?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.