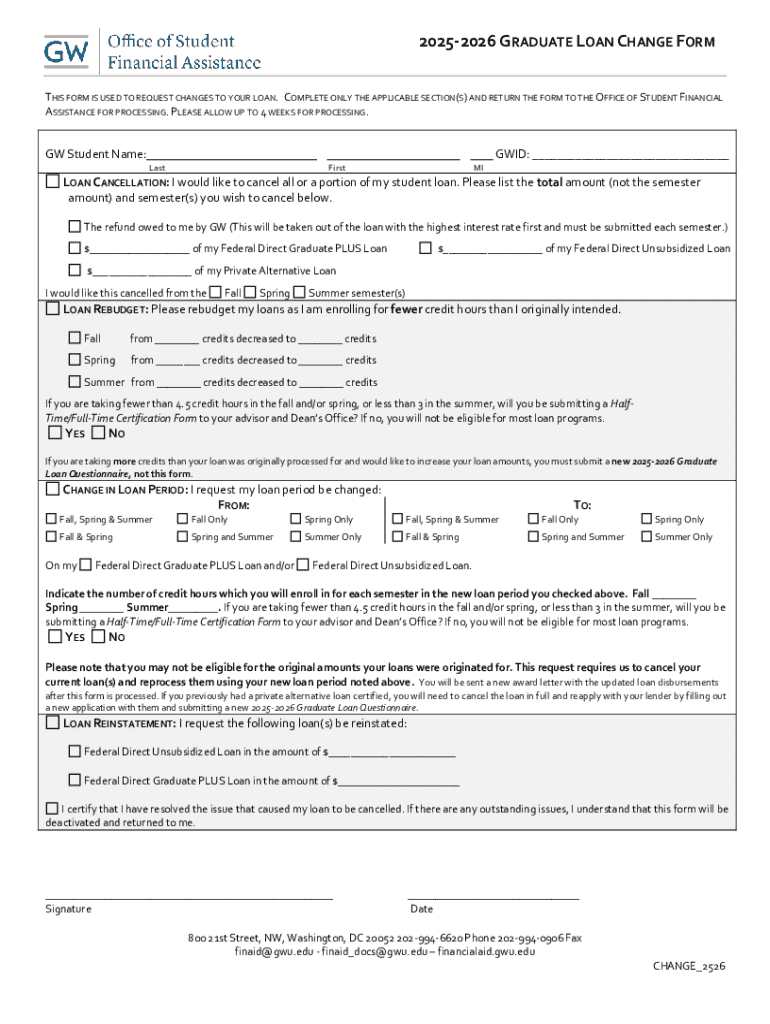

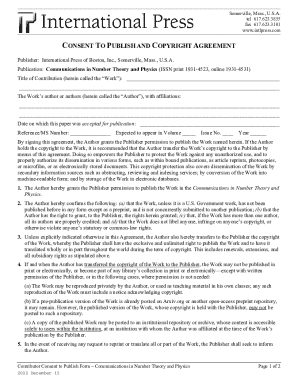

Get the free 2025-2026 Graduate Federal Loan Change Request Form

Get, Create, Make and Sign 2025-2026 graduate federal loan

How to edit 2025-2026 graduate federal loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 graduate federal loan

How to fill out 2025-2026 graduate federal loan

Who needs 2025-2026 graduate federal loan?

Your comprehensive guide to the 2 graduate federal loan form

Understanding the federal loan landscape for graduate students

Federal student loans are a crucial funding source for graduate students pursuing advanced degrees. These loans come in various forms, primarily including Direct Unsubsidized Loans and Direct Grad PLUS Loans. Direct Unsubsidized Loans are available to all graduate students, regardless of financial need, while Direct Grad PLUS Loans enable borrowers to access additional funds to cover educational costs that exceed the cost of attendance. Understanding the type of loans available and their implications is paramount for effective financial planning and management during your graduate studies.

When considering federal loans, it’s essential to grasp key terms and definitions. Interest rates for these loans are fixed, meaning they do not fluctuate over time, providing stability for borrowers. Additionally, understanding the various repayment plans—such as Standard, Graduated, and Income-Driven Plans—can significantly influence your financial strategy post-graduation. Loan limits also play a critical role; for instance, while the annual limit for Direct Unsubsidized Loans for graduate students is $20,500, Grad PLUS loans can cover up to the total cost of attendance.

Preparing for the 2 graduate federal loan application

Before filling out the 2 graduate federal loan form, it's important to gather essential documentation. This includes academic records confirming your enrollment status, recent federal tax information—using IRS tax return forms such as the 1040 forms— and identification documents like a driver’s license or social security card. These documents establish your identity, income level, and eligibility for federal loan assistance.

Eligibility for federal loans depends on several criteria. Generally, you must be a U.S. citizen or eligible non-citizen, enrolled at least half-time in an eligible program, and maintaining satisfactory academic progress. Financial need assessments, which analyze your family’s economic situation, also play a crucial role in determining your eligibility for grants and subsidized loans. Thus, having a clear understanding of these requirements ensures you maximize your funding opportunities.

Completing the 2 graduate federal loan form

Filling out the 2 graduate federal loan form requires careful attention to detail. Start with your personal information, including your name, address, and Social Security Number. Moving to the financial information section, provide accurate income details based on your IRS forms. It’s crucial to double-check that the financial figures match the information on your tax returns to avoid processing delays.

Next, you will fill out the school information section, providing details about the institution you are attending. Lastly, in the loan amount requests section, specify how much funding you require but be mindful of borrowing only what you need. Common pitfalls include overlooking critical sections, such as dependency status or not signing the form, which can lead to unnecessary processing delays.

Editing and reviewing your federal loan application

Before submitting your application, utilize tools like pdfFiller to enhance document editing. With features designed for form management, pdfFiller allows you to fill out, edit, and eSign your federal loan application seamlessly. Collaboration tools are also beneficial for sharing your documents with financial aid advisors or peers to get feedback or confirmations.

To ensure accuracy, create a checklist for final review. Verify that all sections are complete, your information is accurate, and that you've signed and dated your application. Neglecting to double-check your entries can lead to quick denial or a delayed application process.

Submitting your 2 graduate federal loan form

Once your application is ready, submission options include online through the FAFSA platform or via mail. Opting for online submission is generally faster and provides immediate confirmation of receipt, which can significantly reduce anxiety over waiting times. If you choose to mail your application, be mindful of the processing times; sending it through certified mail can provide peace of mind that your documents were sent and received.

After submission, wait for confirmation of receipt. You can typically check your application status online, which allows you to stay informed about the processing of your loan application and when to expect further communication.

After submission: What to expect next

Understanding the processing timeframes for federal loans is essential to managing expectations post-application. Applicants can expect processing to take anywhere from 3 to 6 weeks. During this time, you can check your application status online, which can provide insight into any outstanding issues that may require your attention.

Once approved, you will receive an award letter detailing your loan amounts and terms. Familiarizing yourself with this document is essential, as it may include grant funds, work-study offers, and expected out-of-pocket expenses. Should the offered loans be insufficient for your needs, immediate communication with your financial aid office is necessary to discuss your options.

Managing your federal loans once funded

Successfully obtaining your loans is only the first step; managing them effectively is critical for your financial health. An overview of various loan repayment plans is vital. Options include the standard repayment plan, which typically spans 10 years, and income-driven repayment plans, which adjust payments based on your income level. Reviewing these options thoroughly can help you select the plan best suited to your projected financial situation.

Additionally, developing strategies to handle loan debt is essential for long-term success. Creating a budget that factors in loan repayment can provide structure as you transition into your post-graduate career. Resources are available for those seeking loan forgiveness through initiatives like Public Service Loan Forgiveness, which can further alleviate the burden of educational debt for qualified individuals.

FAQs and troubleshooting common issues

Navigating the loan application process can lead to questions or even concerns about potential hurdles. If your application is denied, it’s vital first to understand the reasons behind the denial. Common issues include incomplete information or failure to meet eligibility requirements. Reaching out to your school’s financial aid office can provide clarity and steps for rectification.

If application errors arise, know that corrections can usually be made through the FAFSA platform even after submission. pdfFiller also offers customer support to assist you in editing or adjusting your completed form, ensuring you have access to timely assistance throughout the process.

Leveraging pdfFiller for future document management

Using pdfFiller can tangibly benefit your future document management needs. The platform provides long-term advantages by streamlining processes for future applications and forms, allowing you to repurpose previously completed documents. Document storage features provide peace of mind, knowing that important information is accessible and organized for your convenience.

Additionally, maximizing pdfFiller's potential involves utilizing templates for commonly repeated forms. Sharing documents for collaboration among peers can enhance teamwork during group submissions, making it easier to manage information securely and effectively from anywhere you have internet access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 graduate federal loan for eSignature?

How do I edit 2025-2026 graduate federal loan straight from my smartphone?

How do I fill out the 2025-2026 graduate federal loan form on my smartphone?

What is 2025-2026 graduate federal loan?

Who is required to file 2025-2026 graduate federal loan?

How to fill out 2025-2026 graduate federal loan?

What is the purpose of 2025-2026 graduate federal loan?

What information must be reported on 2025-2026 graduate federal loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.