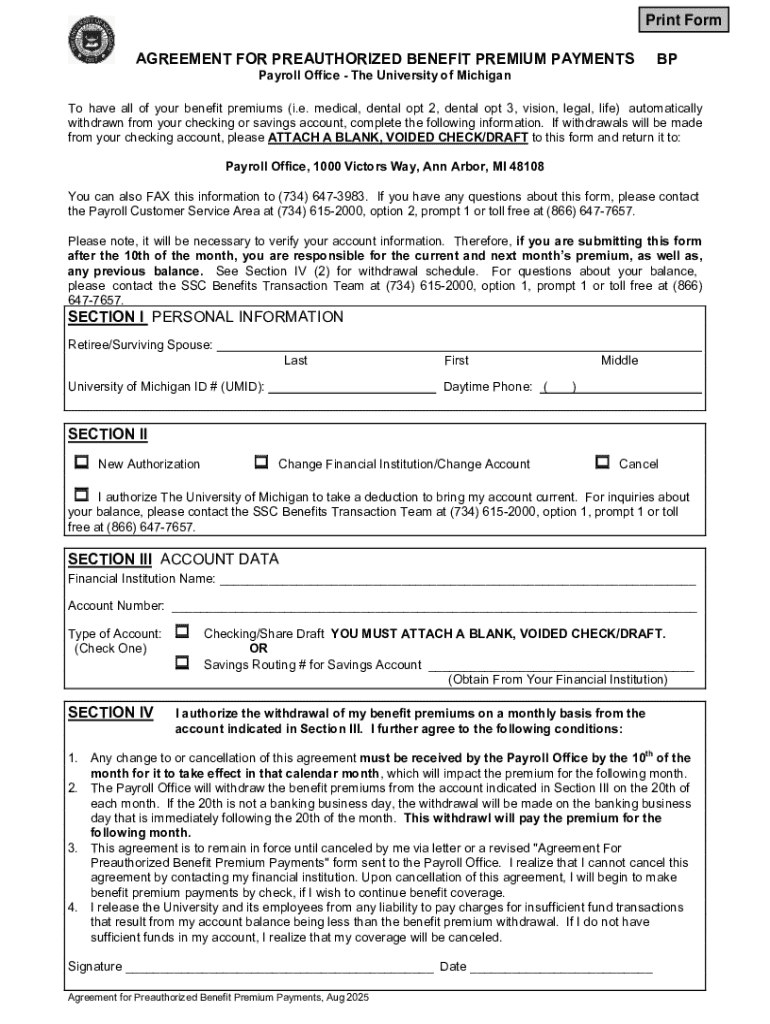

Get the free Payroll Office - The University of Michigan - finance umich

Get, Create, Make and Sign payroll office - form

How to edit payroll office - form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll office - form

How to fill out payroll office - form

Who needs payroll office - form?

Understanding Payroll Office - Form: A Comprehensive Guide

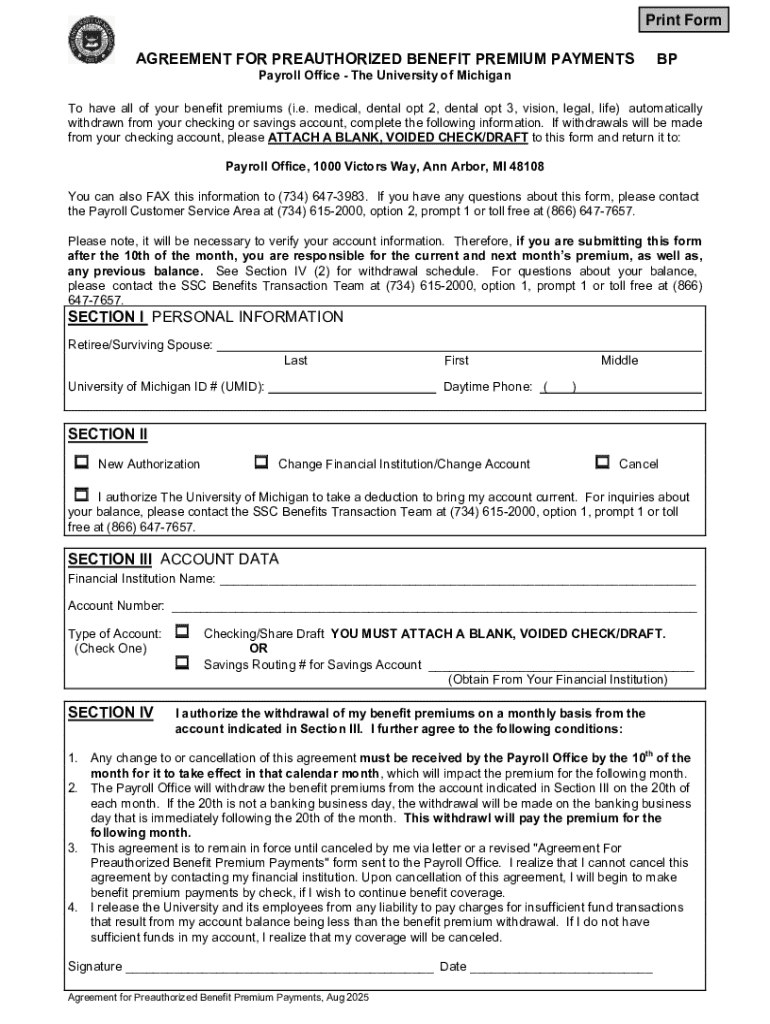

Understanding payroll forms

Payroll forms are essential documents used by employers to manage employee compensation, tax withholdings, and benefits. These forms play a crucial role in the payroll process by accurately reporting the earnings of employees and ensuring compliance with tax regulations. The significance of payroll forms goes beyond mere paperwork; they facilitate proper record-keeping, help in financial planning, and ensure employees are properly compensated for their work.

Accurate payroll forms are vital for employee management, as they prevent discrepancies that could lead to legal issues or employee dissatisfaction. Common types of payroll forms include tax-related documents, time sheets, and records of wage changes, each serving specific purposes in the payroll cycle.

Essential payroll forms overview

Understanding the key payroll forms used by your business is essential for maintaining compliance and accuracy. Each form has its specific function, and knowing how to use these efficiently is critical for any payroll office. The most common forms include the W-4, which employees fill out to indicate their tax withholding preferences, and the W-2, which provides a summary of an employee's annual wages and taxes withheld for federal and state purposes.

The 1099 form comes into play for individuals working as independent contractors, ensuring that they receive proper tax documentation. Additionally, payroll change forms are critical for keeping employee records up-to-date, ensuring that any changes in personal details are reflected accurately in payroll processing. This can help avoid problems such as wrong tax submissions or delays in compensation.

How to fill out payroll forms

Filling out payroll forms accurately requires careful attention. Begin by gathering all necessary personal and employment information. For a W-4, you’ll need details such as your filing status, the number of allowances you claim, and any additional amount you wish to withhold. Understanding each section of the form is crucial to avoid mistakes that could lead to incorrect withholdings or additional taxes owed later on.

It's essential to avoid common mistakes like miscalculating allowances or failing to sign and date the form, as both can invalidate the submission and lead to complications. To ensure the highest accuracy, check the entries twice, and seek assistance from a payroll professional if you're uncertain about any sections.

Editing and managing payroll forms

Once payroll forms are filled out, you may need to edit or manage them for various reasons, such as correcting an error or adding an annotation. Using tools like pdfFiller for editing payroll forms can simplify this process. Uploading your forms is straightforward, and you can easily make changes or add comments right on the document, altering it without losing formatting or essential information.

Additionally, collaborative features allow team members to review and suggest edits, fostering a more significant degree of accuracy and thoroughness before final submission. Effective management of these documents ensures that both employers and employees have consistent and clear records, aiding in compliance and minimizing misunderstanding.

Signing payroll forms digitally

In an age where efficiency is paramount, signing payroll forms digitally has become commonplace. Electronic signatures offer several benefits, including quicker processing times and enhanced security. When using platforms such as pdfFiller, the eSigning process is intuitive and ensures that all required parties can comply without the hassles of printing and scanning.

The legality of digital signatures has been established in many jurisdictions, making them a secure alternative to traditional methods. To eSign payroll forms on pdfFiller, simply follow a few easy steps: select the document, sign using your saved signature or draw a new one, and submit it. This creates a legally valid document, keeping your records streamlined.

Printing and distributing payroll forms

After completing payroll forms, the next step involves printing and distributing them appropriately. Best printing practices include ensuring clarity and readability, as any loss of detail can lead to further complications. With cloud-based solutions, documents can be printed from anywhere without needing to email attachments back and forth.

Distribution options should also be considered carefully. While emails are a common method, utilizing secure cloud storage can provide employees with access to their documents at any time. Alongside these methods, maintaining confidentiality and compliance with federal regulations, such as the ADA, involves protecting sensitive information to avoid unauthorized access or breaches.

FAQs about payroll forms

Payroll forms can raise various questions among employees and employers alike. For instance, if an error is found on a submitted form, it's crucial to address the issue immediately with the payroll department or accounting team. Guidelines should be followed to rectify the mistake efficiently to ensure that both parties remain compliant with reporting requirements.

Another common inquiry relates to secure storage practices for payroll forms. Protecting personal data in compliance with security guidelines is paramount. Ensuring the payroll forms are stored in encrypted formats or secured cloud storage systems can mitigate risks associated with unauthorized access. Lastly, it's essential to be aware of deadlines for submitting payroll forms to the IRS, usually January 31 for W-2s and 1099s.

Troubleshooting payroll form issues

It’s not uncommon to encounter issues with payroll forms, such as rejection due to incorrect data or missing information. These problems can usually be resolved by reviewing the form against the submission guidelines. Common issues might include mismatched names, incorrect identification numbers, or unqualified signatures that prevent processing.

If you experience a form rejection, promptly address the errors noted and resubmit the corrected form. Using platforms like pdfFiller can simplify this process, allowing users to edit the forms directly, resubmit, and track their corrections efficiently.

Keeping up with changes in payroll forms

The legislative landscape affecting payroll forms can change, so it's critical to stay informed about any updates from governing bodies. Payroll offices must monitor changes to federal and state payroll forms to ensure continued compliance. Resources such as the IRS website provide essential updates and guidelines on any revisions that need to be implemented.

pdfFiller aids in this regard by offering tools for automatic document updates, helping users to stay ahead of any changes without spending excessive time investigating every potential update manually. Regular training sessions or webinars can also be useful to keep both payroll staff and employees informed of changes in compliance and regulations.

Interactive tools for payroll management

Utilizing interactive tools enhances efficiency in payroll management. Platforms like pdfFiller encompass features that allow users to create and manage payroll documents dynamically. Users can access templates for various payroll scenarios, enabling rapid responses to the changing needs of payroll offices.

With cloud-based document management systems, teams can collaborate seamlessly, edit documents in real-time, and maintain a clear workflow. This ensures that mistakes are minimized and that all compliance checks are performed systematically, which is vital for the operational integrity of any payroll office.

Real-world examples of payroll form usage

Businesses increasingly turn to digital payroll forms to improve efficiency and reduce errors. Several companies have reported a significant decrease in time spent on payroll processing after integrating tools like pdfFiller, leading to increased productivity and employee satisfaction.

Testimonials from users often highlight the ease of navigating their payroll forms and the rapid turnaround times enabled by electronic processing. By embracing technology in managing their payroll documents, companies not only improve accuracy but also enhance the overall employee experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payroll office - form directly from Gmail?

How can I edit payroll office - form from Google Drive?

How do I fill out payroll office - form on an Android device?

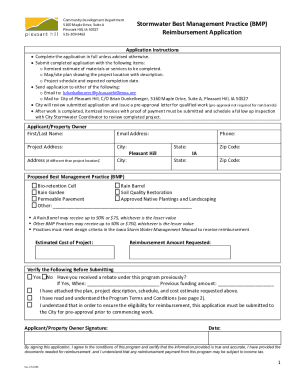

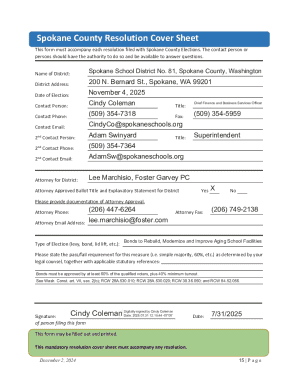

What is payroll office - form?

Who is required to file payroll office - form?

How to fill out payroll office - form?

What is the purpose of payroll office - form?

What information must be reported on payroll office - form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.