Get the free JioBlackRock Nifty 50 Index Fund (An open-ended scheme ...

Get, Create, Make and Sign jioblackrock nifty 50 index

Editing jioblackrock nifty 50 index online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jioblackrock nifty 50 index

How to fill out jioblackrock nifty 50 index

Who needs jioblackrock nifty 50 index?

Understanding the Jioblackrock Nifty 50 Index Form: A Comprehensive Guide

Overview of the Jioblackrock Nifty 50 index form

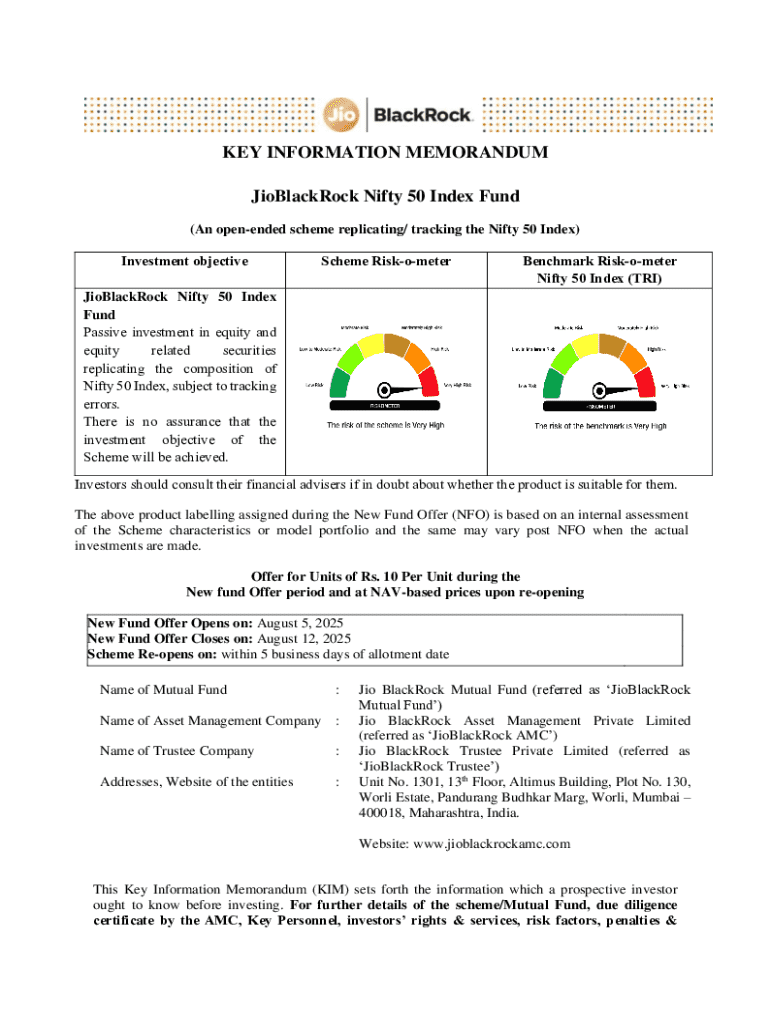

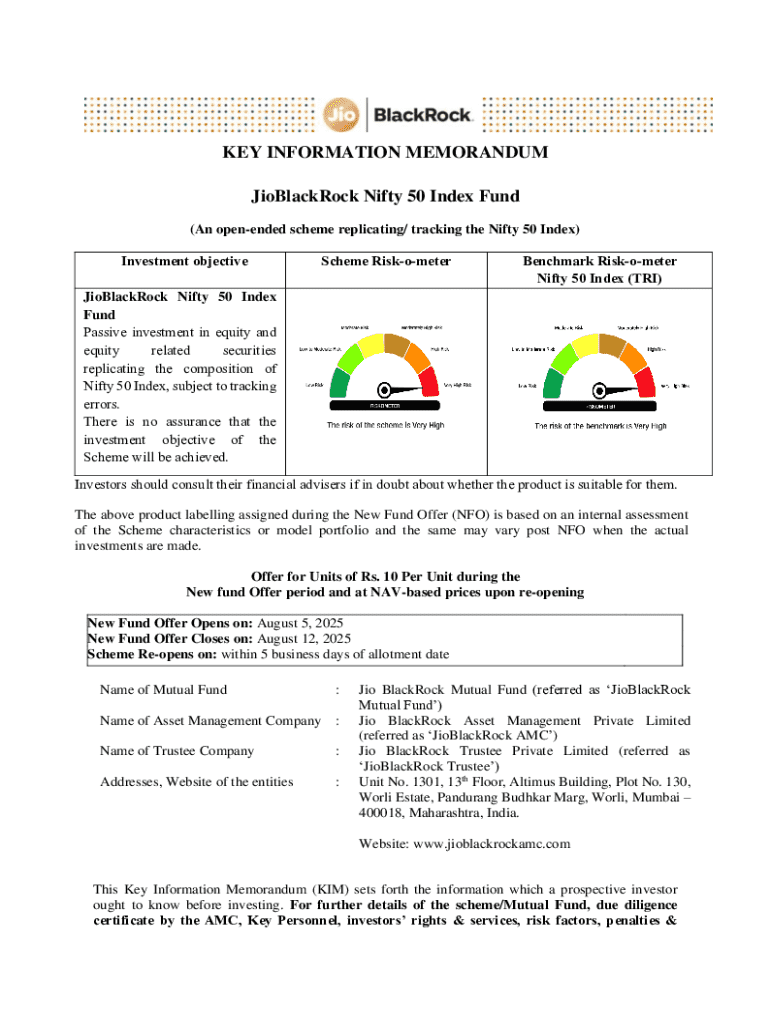

The Jioblackrock Nifty 50 Index Form serves as a crucial document for investors looking to engage with one of India's most prominent equity indices. This index comprises 50 leading companies listed on the National Stock Exchange of India (NSE), representing a diverse cross-section of various sectors. The purpose of the Jioblackrock Nifty 50 Index is to provide investors with a benchmark to gauge market performance and investment opportunities. In essence, it acts as a springboard for individuals and teams seeking structured investment strategies and insights into India’s equity markets.

With the growing interest in investment options among various demographics, the Jioblackrock Nifty 50 Index Form plays a pivotal role in facilitating easy access to fund investment. Investors, be they seasoned professionals or newcomers, can streamline their applications and fund allocations using this form, ensuring they meet their financial goals. Additionally, understanding how to navigate this form is essential, as it tailors to the diverse needs of different user profiles, especially those who prioritize online accessibility.

Key features of the Jioblackrock Nifty 50 index form

One of the remarkable aspects of the Jioblackrock Nifty 50 Index Form is its cloud-based accessibility, allowing users to complete and manage their documents from virtually anywhere. This level of accessibility is invaluable for investors with busy lives, enabling them to engage with their investment strategies during commutes or while traveling, further underscoring a commitment to user convenience.

Interactive tools embedded within the form enhance the user experience, offering functionalities such as real-time data analysis and investment calculators. Moreover, the user-friendly interface is designed for seamless editing, making it simple for users to modify their entries without the hassle usually associated with traditional paperwork. These features come together to provide a comprehensive solution that meets the modern investor's demands.

Filling out the Jioblackrock Nifty 50 index form

Completing the Jioblackrock Nifty 50 Index Form can be broken down into several manageable steps. A thorough understanding of each step is crucial for an effective and efficient completion, ensuring that all necessary information is accurately captured. Here's a step-by-step guide to navigate through the form:

For accuracy, take your time and double-check entries before submission. Common pitfalls include entering incorrect details or miscalculations in investment amounts. Utilizing the interactive features of the form can also mitigate these risks.

Managing your Jioblackrock Nifty 50 index form

Management of your Jioblackrock Nifty 50 Index Form does not stop at submission. Users have the flexibility to edit and update their applications even after they've been submitted. Transitioning between different document versions is made easy, with history tracking features ensuring you never lose sight of your changes. This provides peace of mind as you refine your investment strategy over time.

In collaborative scenarios, sharing and inviting team members to view or edit your form can amplify productivity. Teams can work together efficiently to keep track of investments, review fund performance, or revisit management decisions. This collaboration is especially beneficial for companies or groups focused on collective investment strategies.

Compliance and legal considerations

Filling out the Jioblackrock Nifty 50 Index Form involves adhering to several compliance and legal considerations. When investing, ensuring you possess the necessary legal documents such as identification proof, address verification, and any relevant financial statements is vital. Before submitting, familiarize yourself with the terms related to investing, including fees, minimum investment amounts, and any clauses about capital gains taxes that may apply.

Some sections of the form may be pre-filled based on previous interactions or available data, enhancing the ease of use. It's important to review these sections as inaccuracies might lead to compliance issues or errors in investment processing. Always consult with financial advisors when in doubt about legal terminologies and implications, including those surrounding long-term capital gains (LTCG) and taxation related to returns.

Benefits of using pdfFiller for your Jioblackrock Nifty 50 index form

Utilizing pdfFiller for your Jioblackrock Nifty 50 Index Form streamlines document management extensively. The platform offers comprehensive solutions that address almost every aspect of creating, editing, and managing documents. With its advanced cloud storage features, users can retrieve past forms easily, ensuring they are always working with the most current information.

In an age where time is money, pdfFiller's eSigning capabilities expedite the investment process, allowing users to quickly finalize documents without the need for physical signatures. This combination of access, ease, and efficiency empowers users to concentrate on their investment strategies rather than being bogged down by paperwork.

Frequently asked questions (FAQs)

Investors often ponder various aspects of the Jioblackrock Nifty 50 Index Form. Below are some common inquiries that arise during the completion and submission process:

Troubleshooting tips for form-related issues can often be found in support sections of pdfFiller, addressing common errors or queries about investment strategies or specific terms related to the Jioblackrock Nifty 50 Index.

Additional tips for effective investment management

To maximize the benefits derived from investing in the Jioblackrock Nifty 50, leveraging best practices for investment tracking is essential. Regularly evaluate your investments against industry benchmarks and performance metrics. Familiarizing yourself with the average returns, management fees, and expense ratios associated with the funds can inform your future decisions and adjustments.

Utilize tools available on pdfFiller for ongoing investment management. Being proactive in your financial strategy involves active monitoring of market conditions and potential shifts in the Nifty 50 Index. Lastly, consider attending investment workshops or seminars that focus on navigating public equity markets to enhance your knowledge base and refine your investment approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute jioblackrock nifty 50 index online?

How can I edit jioblackrock nifty 50 index on a smartphone?

How do I fill out the jioblackrock nifty 50 index form on my smartphone?

What is jioblackrock nifty 50 index?

Who is required to file jioblackrock nifty 50 index?

How to fill out jioblackrock nifty 50 index?

What is the purpose of jioblackrock nifty 50 index?

What information must be reported on jioblackrock nifty 50 index?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.