Get the free Applying for Federal Aid

Get, Create, Make and Sign applying for federal aid

Editing applying for federal aid online

Uncompromising security for your PDF editing and eSignature needs

How to fill out applying for federal aid

How to fill out applying for federal aid

Who needs applying for federal aid?

Applying for Federal Aid Form: A Comprehensive Guide

Understanding federal aid: What you need to know

Federal aid is a crucial source of financial support for students pursuing higher education in the United States. It encompasses various forms of assistance, including grants, loans, and work-study programs, designed to make college more accessible. Understanding the intricacies of federal aid is essential not just for prospective students but also for their families, as this can significantly impact their educational and financial future.

Through federal aid, many students can afford the cost of tuition, books, and living expenses while attending college. Grants, which do not need to be repaid, are a particularly attractive option, while federal loans usually have lower interest rates compared to private loans. Work-study programs provide students with part-time jobs, allowing them to earn money toward their educational expenses. This financial aid can make attending college a viable option for many students from different backgrounds.

Eligibility criteria for federal aid

To apply for federal aid, students must meet specific eligibility criteria. The foundational requirements include being a U.S. citizen or an eligible noncitizen, having a valid Social Security number, and being enrolled in an accredited program at a college or university. These basic requirements form the first step in the federal aid application process.

Additionally, students must demonstrate financial need, which is assessed using the Expected Family Contribution (EFC) formula. This calculation considers various resources, including income and assets, to determine how much a student and their family can contribute toward their education. Understanding these financial assessments is crucial for applicants, as they directly influence the types and amounts of aid for which they may qualify.

Preparing to apply for the federal aid form

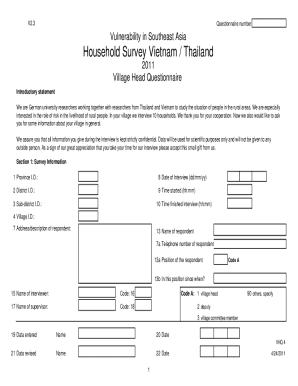

Before filling out the federal aid form, known as the FAFSA (Free Application for Federal Student Aid), it’s essential to gather the necessary documentation. Key materials to have on hand include your tax returns, W-2 forms, and any additional income statements. Additionally, collect your bank statements and other relevant asset documentation to provide a comprehensive picture of your financial situation.

Setting up an FSA ID is also a critical step in this preparation process. This unique identifier allows you to sign your FAFSA electronically and track your federal aid status. The process of creating an FSA ID is straightforward but essential for efficient management of your application and inquiries.

Navigating the federal aid application process

Completing the FAFSA is a structured yet straightforward process. The application is broken down into sections that correspond to different aspects of your personal and financial information. Ensuring accuracy in these sections is vital, as errors can delay your aid or impact your eligibility. Specific tips include double-checking your entries for misreported income and confirming all sections are signed correctly.

Understanding important dates and deadlines

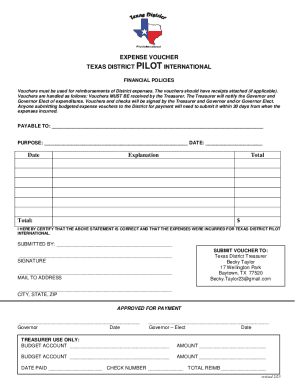

The annual FAFSA application cycle typically opens each year on October 1st. Students are encouraged to apply early to maximize their chances of receiving federal aid. It's critical to be aware of state-specific deadlines, which can vary significantly. Missing these deadlines may result in forfeiting available aid, making timely submission essential for all applicants.

Early submissions not only increase the chance of financial aid eligibility but also allow families to plan their educational expenses more effectively, paving pathways toward funding college education.

What comes next after submitting the federal aid form

After submitting the FAFSA, there’s an expected timeline for receiving feedback, which typically occurs within a few weeks. You will receive a Student Aid Report (SAR) summarizing your FAFSA data and providing your EFC. Understanding this report is crucial; it outlines your eligibility for various types of aid and indicates whether additional information is needed.

Following the review of your SAR, your college will provide a financial aid package, detailing the types and amounts of aid awarded. Review this carefully to understand how your federal aid will integrate with any state aid or scholarships you have secured.

Getting help during the application process

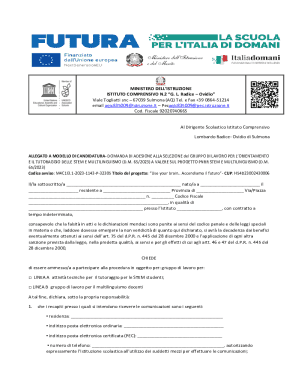

Navigating the federal aid application process may seem daunting, but numerous resources are available for assistance. Your school’s financial aid office is an excellent place to start; they can provide personalized guidance tailored to your specific situation. Additionally, the Federal Student Aid Information Center offers help through various channels, including phone and chat support.

Frequently Asked Questions (FAQs) on the FAFSA website also serve as a valuable resource, addressing common concerns and clarifying the application requirements. Utilizing these resources can ease the application process, ensuring you don’t miss vital steps.

Special circumstances and additional support

Unexpected circumstances can influence your federal aid eligibility. Changes in income or household size can significantly affect your financial situation. If you find yourself in a position that impacts your ability to contribute to educational costs, communicate this with your financial aid office as they can help reassess your eligibility.

Moreover, considering state aid and scholarships can provide additional funding pathways to support your education, especially if federal aid is limited. Researching local scholarships and understanding the eligibility criteria for state aid can bolster your educational financing options.

Post-application: Managing your federal aid

After securing federal aid, tracking your financial assistance is crucial. Familiarize yourself with how to check the status of your aid application through resources like the Federal Student Aid website. Understanding the aid disbursement process ensures that you’re aware of when funds will be available and prepares you for any necessary loan repayment after graduation.

All federal aid recipients must also maintain satisfactory academic progress to remain eligible for continued support. Familiarize yourself with your school’s academic standards and be proactive about your coursework, as staying on top of your studies is essential for sustained financial assistance.

Interactive tools for your federal aid journey

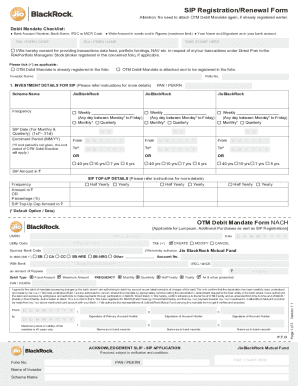

pdfFiller offers a suite of interactive tools that streamline the federal aid application process. Utilize their platform to fill out, edit, and eSign your FAFSA quickly and efficiently. The intuitive design of pdfFiller ensures that you spend less time worrying about paperwork and more time focusing on your education.

In addition, pdfFiller encourages collaboration. You can seamlessly share documents with family members or academic advisors, ensuring you get the assistance you need. This accessibility is vital, as having multiple eyes on your application can prevent mistakes and ensure all necessary documentation is complete.

Additional considerations

Many potential applicants may underestimate their eligibility for federal aid. It is crucial to reconsider this if you feel you may not qualify, as various aid options exist that could support your educational journey. Regularly monitoring policy changes affecting federal aid can also enhance your understanding and eligibility.

Staying informed about the various pathways to securing funding will enable you to take full advantage of federal resources, state aid options, and scholarship opportunities. This comprehensive approach could yield significant financial support in your educational endeavors.

Multimedia and further learning

To facilitate your understanding of the federal aid process, a myriad of tutorial videos and engaging infographics are available online. These resources break down complex information into digestible formats, making it easier for you to grasp the steps involved in applying for aid.

Utilizing these multimedia tools can enhance your learning experience, complementing the comprehensive information found in this guide. Dive into visual aids to supplement your understanding of crucial timelines, eligibility criteria, and document requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the applying for federal aid form on my smartphone?

How do I complete applying for federal aid on an iOS device?

How do I fill out applying for federal aid on an Android device?

What is applying for federal aid?

Who is required to file applying for federal aid?

How to fill out applying for federal aid?

What is the purpose of applying for federal aid?

What information must be reported on applying for federal aid?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.