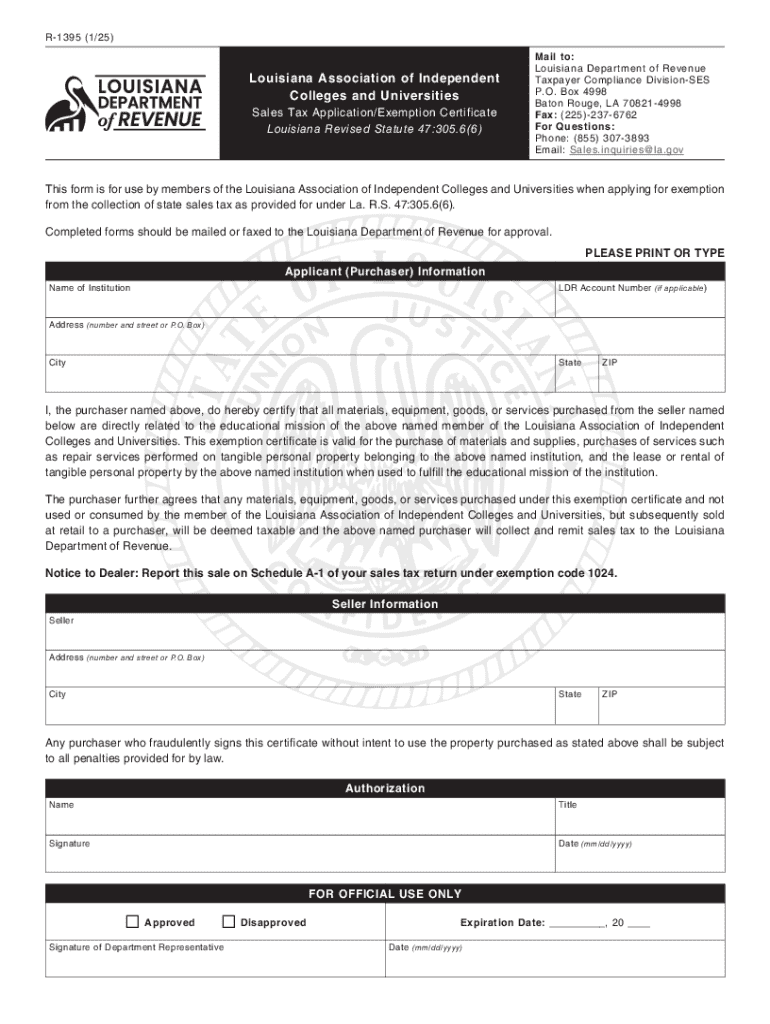

Get the free State Sales Tax Exemption Certificate - TAMS

Get, Create, Make and Sign state sales tax exemption

How to edit state sales tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state sales tax exemption

How to fill out state sales tax exemption

Who needs state sales tax exemption?

Understanding the State Sales Tax Exemption Form: A Comprehensive Guide

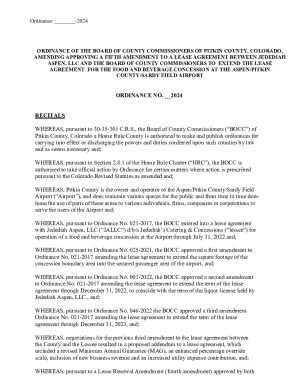

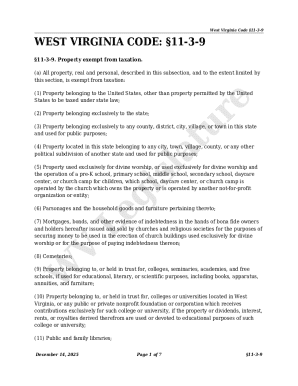

Understanding state sales tax exemptions

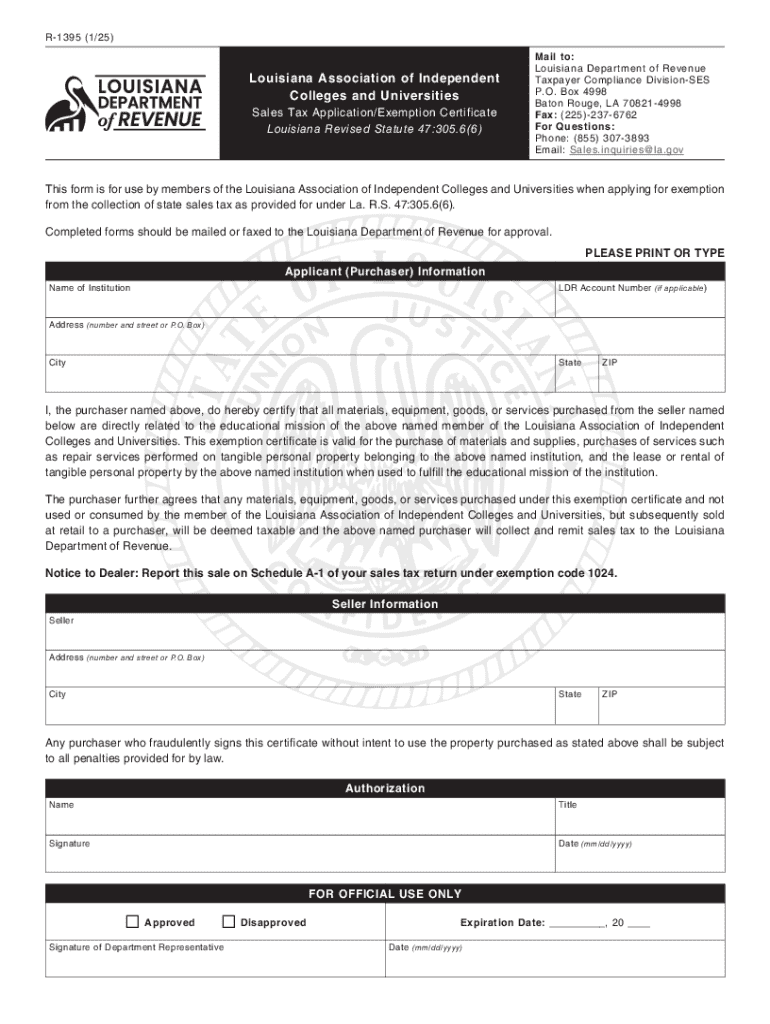

A sales tax exemption allows qualifying individuals and organizations to purchase items without paying the associated sales tax. In many states, these exemptions are crucial for non-profit organizations, schools, and government entities that operate within a tight budget. By obtaining a state sales tax exemption form, applicants can save substantial amounts over time, paving the way for enhanced financial flexibility.

The importance of sales tax exemptions cannot be understated. They enable various sectors to allocate funds more effectively to their core missions. For businesses, acquiring this tax exemption can lead to significant savings in procurement costs, thus making it easier to thrive in competitive markets.

However, not every purchase qualifies for exemption. Each state has specific eligibility requirements. Generally, organizations must prove their tax-exempt status through proper documentation or a sales tax exemption form. Understanding these requirements is vital for ensuring compliance and maximizing benefits.

Types of sales tax exemption forms

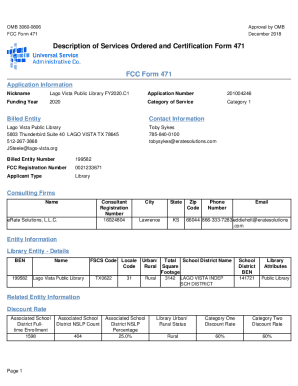

Sales tax exemption forms can be categorized into two primary types: general exemption forms and specialized forms for particular entities. General sales tax exemption forms are typically used by businesses and individuals who meet specific requirements laid out by state law.

Specialized exemption forms cater specifically to niche groups, including:

By understanding your eligibility for these various forms, whether general or specialized, you can ensure that you're making well-informed decisions when applying for sales tax exemptions.

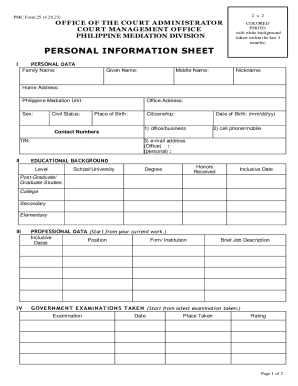

Key components of the state sales tax exemption form

When filling out your state sales tax exemption form, several critical components must be accurately completed for the application to be processed smoothly. These components typically include:

Completing these components with care fosters transparency and facilitates a smoother approval process, bolstering your chances of successfully obtaining an exemption.

Step-by-step instructions for completing the sales tax exemption form

Completing a state sales tax exemption form may initially seem cumbersome, but breaking it down into manageable steps can simplify the process. Here are the steps you need to follow:

Understanding each step ensures that your sales tax exemption form is submitted correctly, providing peace of mind and potentially securing your financial advantages.

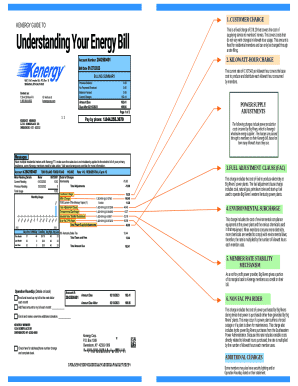

Editing and managing the sales tax exemption form

After completing your state sales tax exemption form, it may need adjustments or sharing with team members. Using platforms like pdfFiller can streamline this process significantly. Here’s how:

Leveraging cloud-based document solutions like pdfFiller not only alleviates potential headaches associated with document management but also offers benefits like secured storage and document tracking.

Common mistakes to avoid when submitting the exemption form

Submitting a state sales tax exemption form can be straightforward, yet applicants often fall into common pitfalls that can jeopardize their approval. To safeguard your application, avoid these mistakes:

By being aware of these common mistakes, you can enhance your application’s chances of success and avoid unnecessary rejections.

Frequently asked questions (FAQs) about state sales tax exemption forms

Navigating the complexities of sales tax exemptions can lead to a myriad of questions. Here are answers to some frequently asked questions surrounding state sales tax exemption forms:

Equipping yourself with answers to these questions ensures that you approach your state sales tax exemption form with confidence and clarity.

Additional considerations for managing sales tax exemption

Sales tax laws are dynamic, and staying current can significantly impact how businesses operate. It's important to keep these additional considerations in mind:

By actively managing these considerations, organizations can navigate the complex landscape of sales tax exemptions with ease and efficiency.

Conclusion: Making the most of your sales tax exemption

Successfully securing and managing a state sales tax exemption can lead to long-term benefits for individuals and businesses alike. Properly utilizing platforms like pdfFiller empowers users to handle document needs efficiently, from filling to editing and signing.

Encouraging ongoing use of streamlined document management services not only enhances organizational efficiency but also mitigates the risk of costly errors. Embrace a proactive approach to your sales tax exemption form, ensuring your entity capitalizes on every available advantage in this competitive environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state sales tax exemption from Google Drive?

Where do I find state sales tax exemption?

How do I complete state sales tax exemption on an iOS device?

What is state sales tax exemption?

Who is required to file state sales tax exemption?

How to fill out state sales tax exemption?

What is the purpose of state sales tax exemption?

What information must be reported on state sales tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.