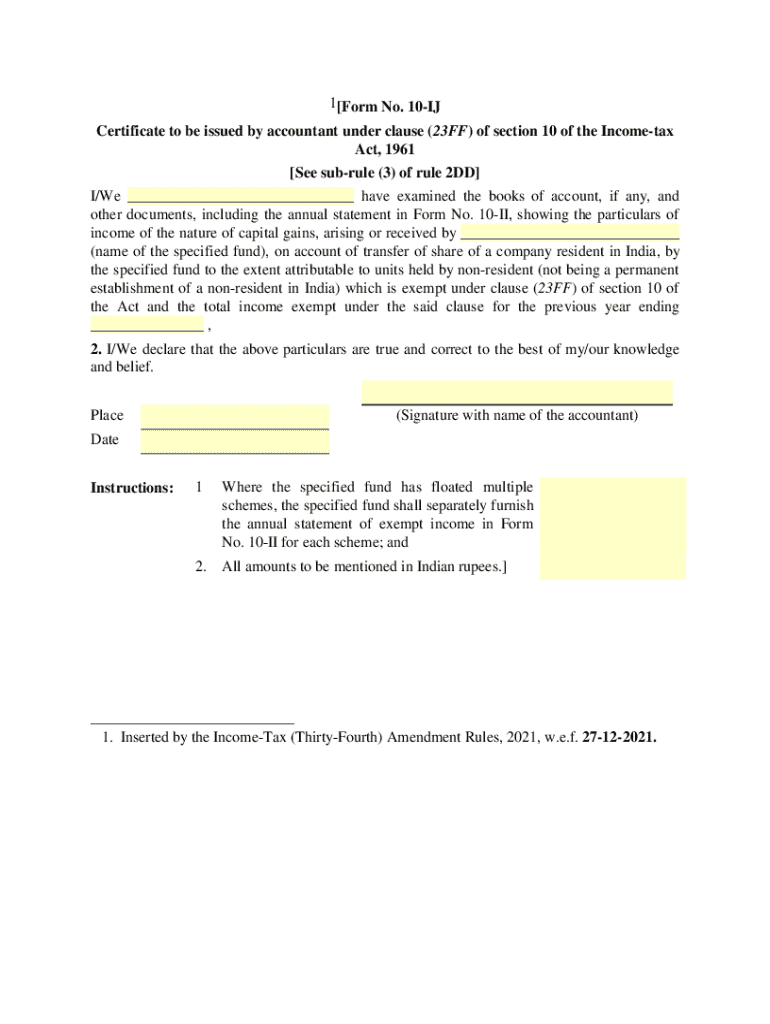

Get the free Form No. 10IJ - Certificate to be issued by accountant ...

Get, Create, Make and Sign form no 10ij

How to edit form no 10ij online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 10ij

How to fill out form no 10ij

Who needs form no 10ij?

Understanding Form No 10IJ: A Comprehensive Guide

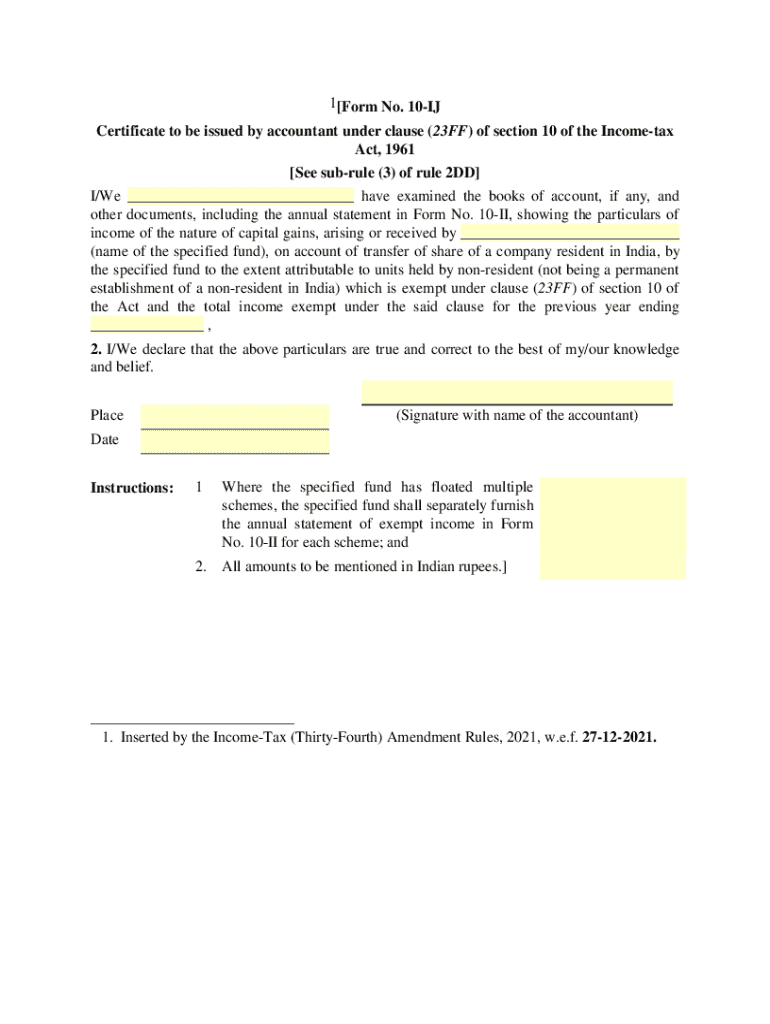

Overview of Form No 10IJ

Form No 10IJ is a critical document utilized for tax filings in India. It is specifically used by taxpayers who claim benefits under the Income Tax Act. This form allows taxpayers to report their eligible income and thus ensure compliance with the taxation laws laid out by the government.

The primary purpose of Form No 10IJ is to facilitate the declaration of accurately computed income from various sources, ultimately ensuring that taxpayers avail themselves of lawful benefits and deductions. Filing this form correctly is essential in streamlining the overall tax compliance process for individuals and businesses.

Who needs to file Form No 10IJ?

Form No 10IJ is mandatory for taxpayers who have income from various sources and claim deductions under relevant sections of the Income Tax Act. This includes individual taxpayers, professionals, and businesses looking to accurately represent their financial details in order to availing of tax benefits.

Specific situations that necessitate the filing of Form No 10IJ include those opting for tax deductions under various schemes, especially as outlined under sections concerning professional income or other specific provisions rendered by the Income Tax Department.

Key features of Form No 10IJ

Form No 10IJ comprises several significant sections that effectively capture the required taxpayer information. One of the primary components is the section detailing personal information, where taxpayers provide their name, PAN, and contact details. This is followed by sections that require detailed information on sources of income, any applicable deductions, and proof of tax liabilities.

Understanding these sections is crucial as they guide the taxpayer in navigating the complexities of the tax filing process. Each segment is specifically designed to collect and convey essential information to tax authorities, ensuring transparency and accuracy.

Step-by-step guide to completing Form No 10IJ

Completing Form No 10IJ requires thorough preparation and accurate data entry. First, it is essential to gather all relevant information, including income details, deduction claims, and past tax returns. This initial step minimizes the likelihood of errors during the filling process.

The following subsections delineate a detailed approach to filling out Form No 10IJ effectively:

Focusing on each step methodically can significantly streamline the process, allowing for a more accurate submission.

Tips for accurate completion

To ensure your Form No 10IJ is completed accurately, adhere to best practices during data entry. It’s advisable to take time to double-check all entries, ensuring that numerical values are correct and match supporting documents such as bank statements and accounting records.

Moreover, keeping a record of communications and confirmations received during submission can be extraordinarily beneficial in case of queries from tax authorities or discrepancies arising thereafter.

Editing and managing Form No 10IJ

Once Form No 10IJ is completed, you may want to make edits or adjustments. Utilizing pdfFiller’s range of tools can simplify the editing process, allowing for modifications to fields without starting anew. The platform supports PDF editing, ensuring any changes you need to make retain the integrity of the document.

It’s advisable to regularly save and backup your edits to avoid loss of data. This practice ensures that all changes are preserved and that the final version of the form remains intact.

Collaborating with team members

For teams working on Form No 10IJ, collaboration is vital. Sharing the form for feedback allows for greater accuracy, as different perspectives can lead to catching errors that a singular viewpoint might overlook. Features available on pdfFiller allow for easy sharing and comments, facilitating constructive collaboration.

Using cloud capabilities makes it easier to share the document in real-time. Team members can review and provide feedback instantaneously, making it much easier to finalize the form before submission.

Signing and submitting Form No 10IJ

After ensuring that your Form No 10IJ is completed accurately and reviewed, the next step is to sign and submit the form. For those looking to use electronic signatures, multiple options are available on pdfFiller, ensuring a legally binding and secure method of signing documents.

It's essential to understand that electronic signatures hold the same legal validity as traditional signatures, providing a seamless experience in document execution. After signing, users can submit either online through the e-filing portal or opt for offline methods by mailing physical copies to the tax department.

Troubleshooting common issues with Form No 10IJ

Filing any tax document comes with its fair share of potential errors and common issues. Understanding the typical pitfalls associated with Form No 10IJ can assist taxpayers in avoiding mistakes. These can range from incorrect data entry to miscalculations in deductible items.

If corrections or amendments are needed post-filing, it is advisable to contact the tax authorities directly to understand the appropriate process to rectify any discrepancies that may arise.

Recent updates & changes to Form No 10IJ

Over recent years, there have been several legislative updates impacting Form No 10IJ. Understanding these changes can effectively prepare taxpayers for any adjustments in the filing requirements or associated benefits. Tax policies are continually evolving, and staying informed is crucial for compliance.

It's important to track key filing dates and extension opportunities as the submission timeline can directly affect taxpayer obligations and penalties. Advisories from the Income Tax Department often contain valuable changes, making it imperative to stay engaged with such updates to ensure compliance.

Interactive tools and resources

pdfFiller offers unique features that align with the creation and management of Form No 10IJ. From easy-to-use editing tools to built-in eSignature capabilities, it provides a comprehensive document management solution for individuals and teams. Using pdfFiller can not only simplify form filling but also streamline the entire process from start to finish.

Additionally, accessing a dedicated FAQ section on pdfFiller can help clear common inquiries related to Form No 10IJ. This proactive approach ensures that you have immediate answers, fostering a smoother filing experience.

Additional insights and tips

Implementing best practices in document management can significantly improve your efficiency. Keeping your tax-related documents organized will save time during filing periods. Creating a consistent filing system—whether digital or physical—will help in maintaining document integrity and ease of access.

For future filings, staying updated on procedural changes is essential to maximize the benefits of deductions and the efficiency of the filing process. Engaging with professional advisory services or utilizing educational resources can further enhance your understanding and execution of tax-filing duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form no 10ij online?

Can I create an eSignature for the form no 10ij in Gmail?

Can I edit form no 10ij on an Android device?

What is form no 10ij?

Who is required to file form no 10ij?

How to fill out form no 10ij?

What is the purpose of form no 10ij?

What information must be reported on form no 10ij?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.