Get the free NRI Housing Loan Application FormPDFBanksTaxes

Get, Create, Make and Sign nri housing loan application

How to edit nri housing loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nri housing loan application

How to fill out nri housing loan application

Who needs nri housing loan application?

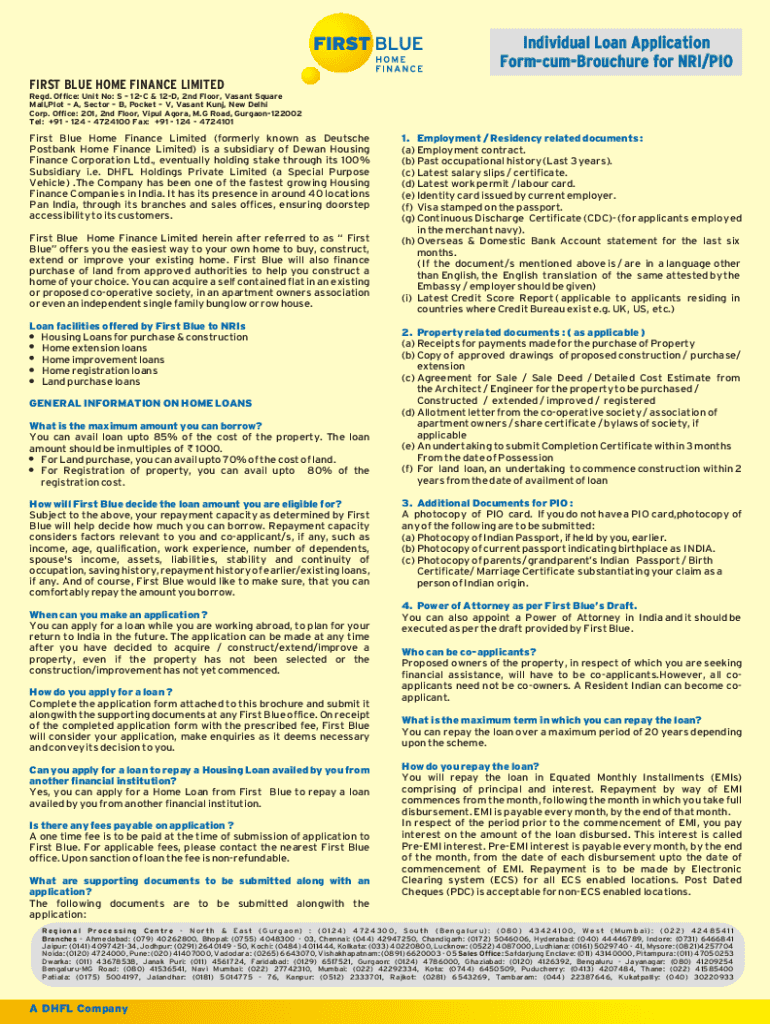

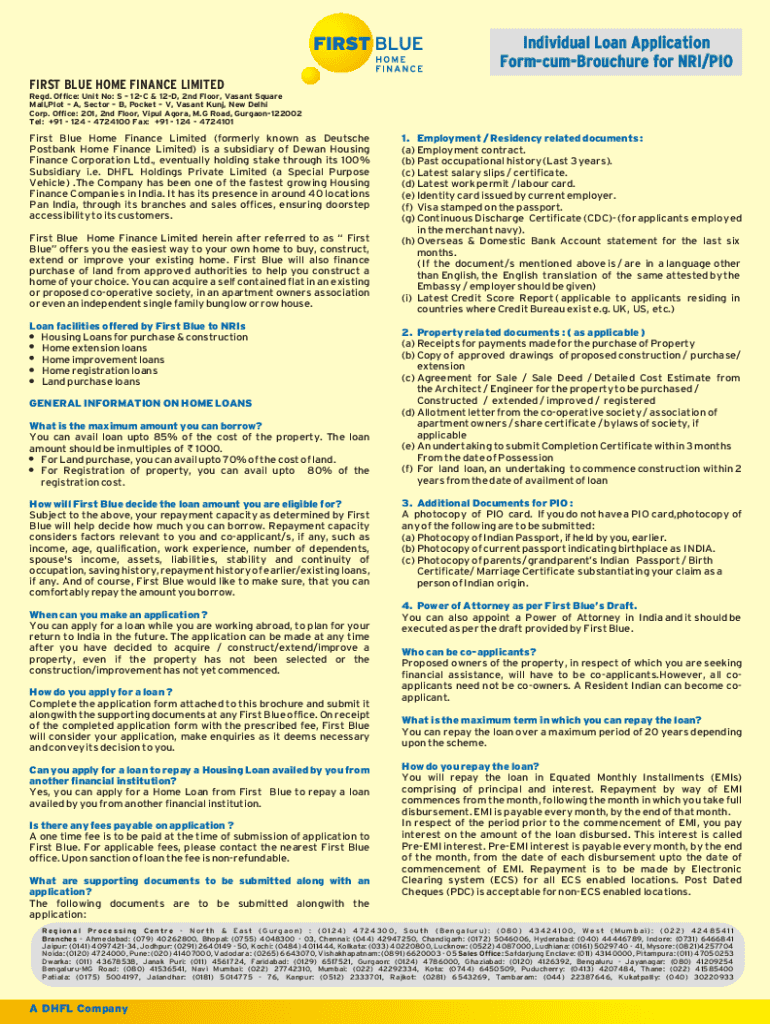

Understanding the NRI Housing Loan Application Form

Understanding NRI housing loans

NRI housing loans are customized financial products offered exclusively to Non-Resident Indians (NRIs) looking to purchase or invest in real estate properties back in India. Given the increasing trend of NRIs seeking to own property in their home country, these loans play a vital role in facilitating investments that enable them to connect with their roots while also securing a lucrative asset.

Owning property back home often signifies a solid investment strategy for NRIs as property prices are noticeable investments over time. Unlike standard housing loans available to resident Indians, NRI housing loans come with specific terms and eligibility criteria designed to cater to the unique needs and situations of foreigners living abroad.

Key features of NRI housing loans

NRI housing loans come with various features that make ownership of property feasible and accessible for NRIs. These attributes cater directly to the logistic and financial challenges faced by those abroad. A typical NRI housing loan can be tailored to meet specific needs while maintaining competitive standards, ensuring affordability.

Who is eligible for an NRI housing loan?

Eligibility for NRI housing loans encompasses a checklist of requirements, ensuring that only qualified candidates are considered. These criteria aim to mitigate risks for lenders while accommodating the specific nuances of NRIs. Understanding the eligibility factors can streamline the application process.

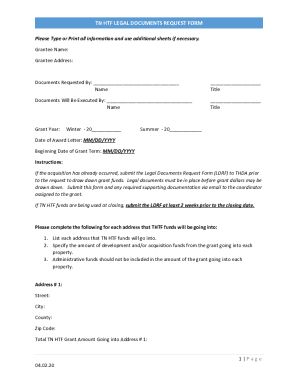

Detailed NRI housing loan application process

The application process for NRI housing loans is meticulous, designed to ensure that all necessary information is collected efficiently. Understanding these steps can lead to a more straightforward experience and higher chances of successful approval.

Navigating the approval process

Once your application has been submitted, understanding the approval timeline is crucial. Generally, the review process can take anywhere from a few days to several weeks, contingent upon various factors including the lender's workload and the complexity of your application.

Managing your NRI housing loan

Managing your NRI housing loan effectively is vital for maintaining financial health. It involves thorough understanding and continual monitoring of various aspects related to repayments and loan terms.

FAQs about NRI housing loans

Frequently asked questions can provide clarity and insight for NRIs contemplating applying for a housing loan. These queries often touch upon eligibility and general process aspects that can seem daunting.

Leveraging pdfFiller for your NRI housing loan application

Utilizing pdfFiller can significantly enhance your application experience for NRI housing loans. The platform offers you the ability to manage documents efficiently and provides an array of tools suited to modern document management needs.

Troubleshooting common issues

Navigating through application hurdles can sometimes be disheartening. Understanding common issues can empower you to avoid setbacks during the application process.

Next steps after completing your application

Completing your NRI housing loan application is just the beginning. What follows is equally important, and planning your steps can lead to successful property ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nri housing loan application in Gmail?

Where do I find nri housing loan application?

Can I edit nri housing loan application on an iOS device?

What is nri housing loan application?

Who is required to file nri housing loan application?

How to fill out nri housing loan application?

What is the purpose of nri housing loan application?

What information must be reported on nri housing loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.