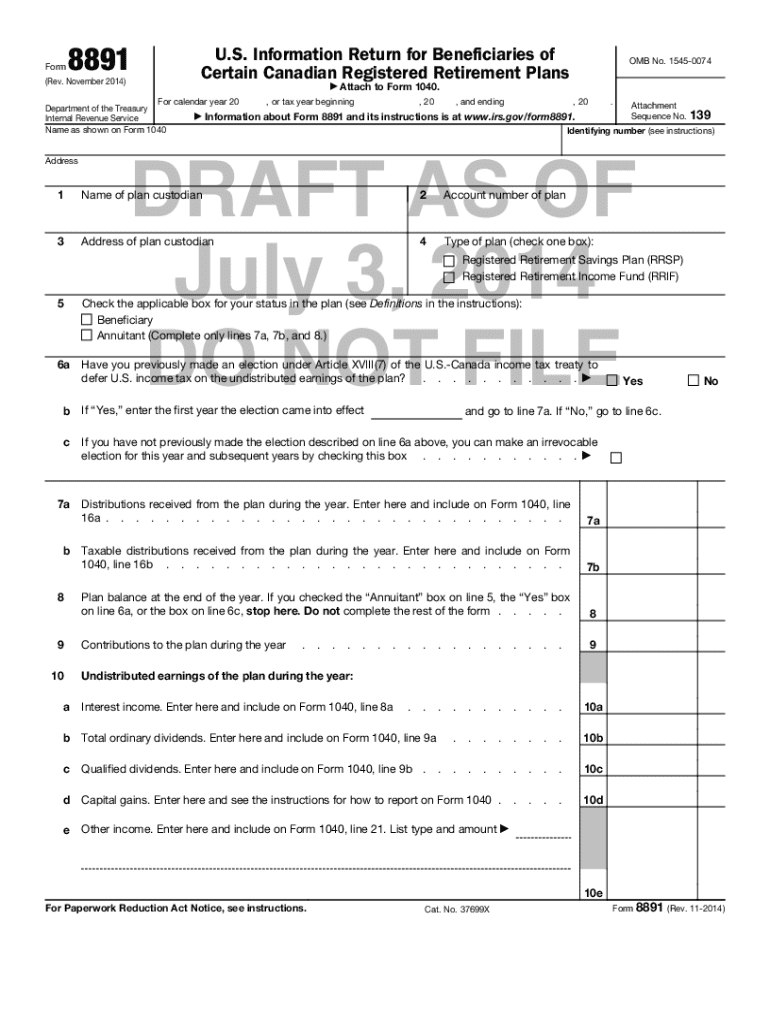

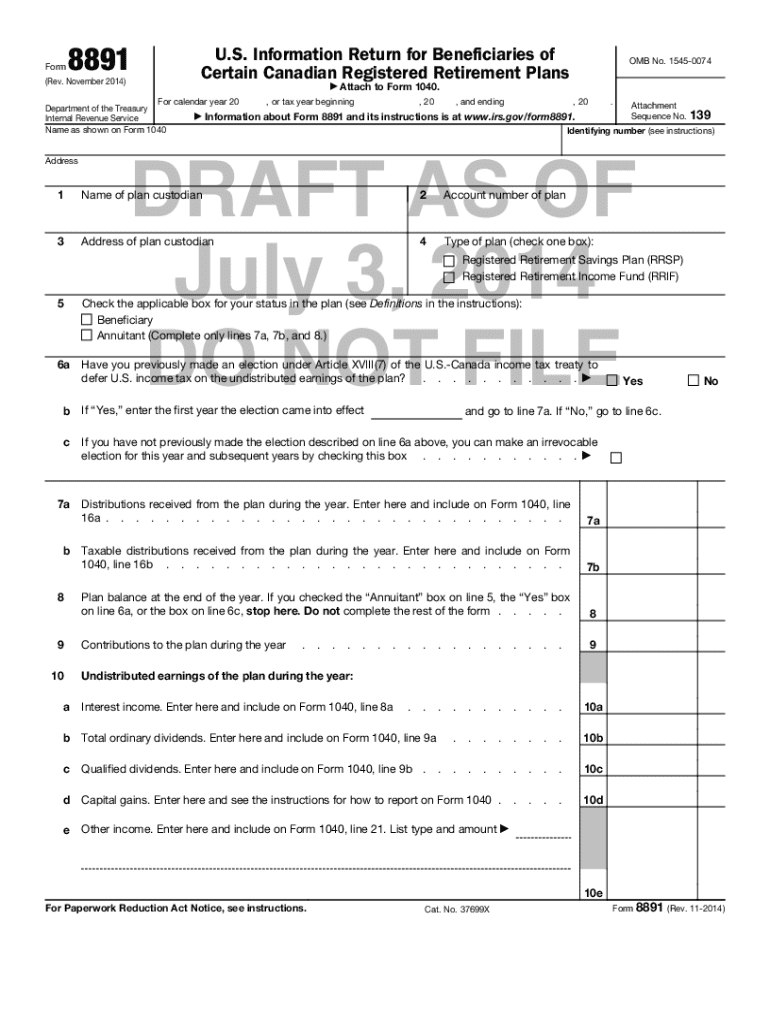

IRS 8891 2014-2026 free printable template

Get, Create, Make and Sign irs form 8891

Editing IRS 8891 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8891 Form Versions

How to fill out IRS 8891

How to fill out form 8891 rev november

Who needs form 8891 rev november?

Comprehensive Guide to Form 8891 Rev November Form

Understanding Form 8891 Rev November

Form 8891 Rev November is a pivotal document for U.S. taxpayers holding Canadian Registered Retirement Savings Plans (RRSPs) or Registered Retirement Income Funds (RRIFs). This form serves as a declaration to the IRS, allowing individuals to report their income from these Canadian trusts while benefitting from the U.S.-Canada Tax Treaty provisions. Adhering to this form can significantly influence tax planning and compliance for American expatriates and Canadian citizens engaged in cross-border taxation.

Taxpayers who should consider using Form 8891 generally include U.S. citizens and residents who have, or have had, interests in RRSPs or RRIFs. If you’re a Canadian citizen residing in the U.S., or a dual citizen, understanding this form is crucial for ensuring you navigate your tax obligations effectively. Without proper documentation, you may face penalties and taxation issues in both countries.

Key dates and deadlines

To maintain compliance, it is essential to be aware of key filing deadlines associated with Form 8891. Generally, the IRS expects this form to be attached to your annual tax return, which is due on April 15. However, U.S. taxpayers residing abroad may qualify for an automatic extension to June 15. That said, any tax owed is still due by April 15, making early planning necessary.

Understanding important dates relevant to Canadian taxation is equally crucial. For instance, Canadian tax deadlines often align similarly with those of the U.S., but Canadian citizens living in the U.S. may have unique considerations influenced by both jurisdictions. Being informed of these deadlines ensures that taxpayers don’t miss the opportunity to file accurately and on time.

Detailed instructions for completing Form 8891

When filling out Form 8891, attention to detail is paramount. The form is divided into several sections, starting with the Personal Information Section, where you’ll need to provide your name, address, and Social Security Number (SSN). Accuracy in this section reduces the risk of processing delays and errors. Ensure all names and identifiers perfectly match those listed on your official documents.

Next, the Income Reporting Section focuses on any income generated from your RRSPs or RRIFs. It is essential to understand how to report this income properly. For instance, amounts converted to U.S. dollars must correspond with current exchange rates to maintain accuracy. Examples of reportable income include any withdrawals made during the year or the amount earned through investments in these trusts.

Deductions and tax benefits that apply to Form 8891 can often be overlooked. Familiarizing yourself with common deductions related to RRSP contributions can provide noteworthy tax savings. Additionally, individuals may qualify for tax credits ensuring they are not double-taxed for their Canadian income. Therefore, reviewing the eligible deductions with a knowledgeable tax adviser can further optimize your tax strategy.

Interactive tools for form management

pdfFiller offers a valuable Step-by-Step Interactive Tool designed specifically for creating and filling out Form 8891. This tool helps users navigate through each section seamlessly, ensuring no critical information is overlooked. Its user-friendly interface guides taxpayers from the start to the finish of the form, simplifying the often daunting process of tax documentation.

Moreover, editing and customizing your form with pdfFiller tools is straightforward and efficient. You can correct errors in real time, add or remove sections, and ensure the format adheres to IRS requirements. This editing capability is integral for ensuring compliance and correctness, which is vital to avoid potential penalties.

eSigning and collaborating on Form 8891

Utilizing pdfFiller for eSignatures streamlines the signing process compared to traditional methods. eSigning not only saves time but enhances the security and legality of your document submission. The platform guarantees that your signed documents are encrypted and securely stored, reducing the risks associated with handling paper copies.

Collaboration features within pdfFiller allow multiple team members to work on Form 8891 simultaneously. This is particularly beneficial for tax professionals assisting clients with their forms. Sharing options enable real-time editing and communication, ensuring tax submissions are reviewed for accuracy before finalization.

Managing Form 8891 after submission

After you have submitted Form 8891, it’s crucial to track the submission status. pdfFiller provides a clear pathway to follow up on your filed form, enabling users to quickly determine whether their application has been processed or requires further attention. This visibility is essential for maintaining the peace of mind associated with well-managed tax documentation.

Additionally, retaining copies of your filed Form 8891 for personal records cannot be overstated. Keeping these documents organized is vital for future references or in the case of audits. pdfFiller's document storage solutions facilitate easy access to your important files, ensuring that they are readily available when you need them.

Common questions and troubleshooting

Frequently asked questions surrounding Form 8891 often pertain to what to do if errors are made on the form. Taxpayers should promptly file an amended return to rectify any inaccuracies. It's imperative to communicate with the IRS if significant changes occur post-filing. Clarifications regarding the specific provisions of the U.S.-Canada Tax Treaty can also often be a source of confusion for individuals utilizing this form.

Furthermore, key troubleshooting tips include being mindful of common pitfalls, such as misreporting income or omitting essential details. Identifying these issues early through review or utilizing pdfFiller's collaborative features can help ensure a clean and compliant submission.

Additional considerations related to Form 8891

Failing to file Form 8891 can have severe implications, including potential penalties from the IRS and complications surrounding future tax filings. Non-compliance not only influences immediate tax obligations but can lead to long-term consequences that may affect one’s ability to adhere to taxation rules in both the U.S. and Canada. Consequently, citizens should prioritize this aspect of their tax planning.

Staying updated with any changes to Form 8891 is equally important. The IRS periodically revises tax forms and regulations, which can impact how income from Canadian trusts is reported. Regularly checking for announcements and maintaining open communication lines with a tax professional can help keep your filings accurate and compliant.

Final thoughts on using Form 8891

In conclusion, utilizing pdfFiller to manage Form 8891 can significantly enhance efficiency and accuracy in tax reporting. The platform's interactive tools, eSigning features, and collaboration options create a comprehensive solution for both individuals and tax professionals. Leveraging these features ensures that taxpayers not only meet compliance requirements but can also benefit from tax treaty provisions effectively.

To maximize the advantages offered by these digital tools, individuals are encouraged to explore every feature provided by pdfFiller. The convenience of accessing, editing, signing, and managing tax documents from a cloud-based platform cannot be overstated, making the tax season far less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS 8891 in Gmail?

How can I edit IRS 8891 on a smartphone?

How do I fill out IRS 8891 on an Android device?

What is form 8891 rev november?

Who is required to file form 8891 rev november?

How to fill out form 8891 rev november?

What is the purpose of form 8891 rev november?

What information must be reported on form 8891 rev november?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.