IRS 8050 2025-2026 free printable template

Get, Create, Make and Sign IRS 8050

Editing IRS 8050 online

Uncompromising security for your PDF editing and eSignature needs

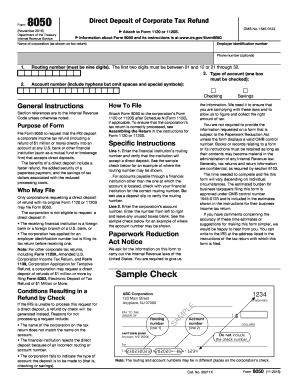

IRS 8050 Form Versions

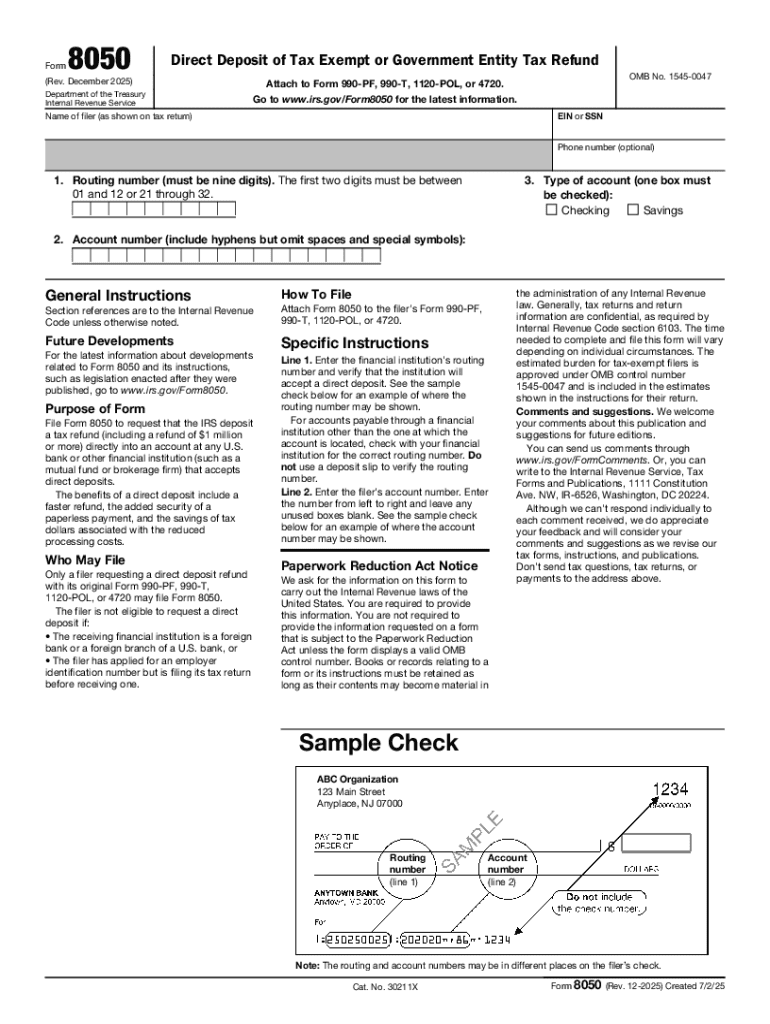

How to fill out IRS 8050

How to fill out form 8050 rev december

Who needs form 8050 rev december?

Comprehensive Guide to Form 8050 Rev December Form

Overview of Form 8050 Rev December

Form 8050, revised in December, is a crucial document primarily used for aircraft registration in the United States. This form facilitates the registration process for aircraft owners, ensuring adherence to the regulations set forth by the Federal Aviation Administration (FAA). Accurate completion of Form 8050 is of utmost importance as it helps streamline communication between aircraft owners and government agencies, thereby minimizing potential legal complications and ensuring compliance with federal regulations.

This form is typically employed by individuals and entities seeking to register new aircraft or transfer existing registrations. The primary entities involved in the process include the FAA's Aircraft Registration Branch and any organization acting on behalf of the aircraft owner. Ensuring that Form 8050 is completed correctly and submitted promptly is essential for maintaining ownership records, securing loans against the aircraft, and facilitating the sale and purchase of aircraft.

Preparing to complete Form 8050

Before diving into the details of Form 8050, it’s essential to prepare by gathering all required information. This preparation includes personal information such as the name, address, and contact details of the owner or organization, as well as financial data, including the aircraft's value, and any relevant aircraft identification numbers. Additionally, supporting documents, such as proof of ownership and previous registration documents, should be meticulously organized to ensure a smooth completion process.

Common mistakes often arise during the completion of Form 8050. Incomplete sections can lead to delays during processing, while incorrect information can result in serious legal issues. One prevalent issue is failing to provide necessary signatures, which can render the entire submission void. Attention to detail is paramount; careful proofreading and revisiting any listed requirements can save time and prevent headaches further down the line.

Detailed step-by-step guide to filling out Form 8050

Filling out Form 8050 requires a methodical approach, as each section serves to capture critical information. Here’s a section-by-section walkthrough to help you navigate through the document effectively, ensuring you complete each box accurately.

Consider including example scenarios to elucidate various contexts in which Form 8050 may be filled out. For instance, if the aircraft is bought from a private party versus a dealer, different supporting documents may be required. Utilizing tools from pdfFiller can ensure precision and that individual scenarios are well accounted for.

Editing and modifying your form

Having access to pdfFiller greatly simplifies the editing and modification process for Form 8050. Users can easily access the template on the pdfFiller platform and utilize interactive editing tools to make necessary changes without hassle. These tools allow users to insert text boxes, add signatures and dates, and generally make adjustments that reflect accurate data entry.

Version control is critical when managing documents. With pdfFiller, users can save changes seamlessly and keep track of different versions of Form 8050, ensuring that the most current and accurate information is being submitted without the risk of reverting to outdated versions.

eSigning Form 8050

The adoption of eSigning in recent years has significantly altered the manner in which documents like Form 8050 are submitted. eSigning ensures that documents can be securely signed electronically, thereby streamlining the submission process. This not only saves time but also enhances security, providing assurance that signatures are verified and authenticated.

To eSign Form 8050 on pdfFiller, users should follow a straightforward step-by-step process. Begin by selecting the eSign option within pdfFiller, then follow the prompts to text sign, draw, or upload a signature. It’s also critical to ensure that all signers are notified, as their acknowledgment is equally essential to the validity of the signing process.

Submitting Form 8050

Once you have completed and eSigned Form 8050, the next step is submission. There are multiple methods available for submitting the form, which can include online submissions through the FAA's official website or traditional mail-in procedures. Each method has its own set of requirements and timelines, which users should familiarize themselves with prior to submitting.

Tracking the submission is also crucial. Most online systems will allow you to check the status of the application, while mailed forms may require you to follow up directly with the relevant agency. Additionally, be prepared to handle any feedback or requests for additional information from the FAA, ensuring swift communication to keep your registration process on track.

FAQs about Form 8050

Navigating the intricacies of Form 8050 can lead to numerous questions. Below are some of the most common inquiries and concerns related to the form’s submission process:

To troubleshoot common issues, be sure to consult the government organization’s website for guidelines or reach out to their customer service for direct assistance when needed.

Additional features of pdfFiller for form management

pdfFiller stands out not only for its ability to edit and manage Form 8050 but also for additional features that enhance collaboration and storage. Users can utilize collaboration tools to invite team members to input information directly on the form, streamlining teamwork on projects related to aircraft registration.

Cloud storage is another pivotal benefit, allowing users to access their documents from anywhere at any time. This is particularly beneficial for individuals in the aviation sector who might travel frequently or need to access information from various locations. When considering document management solutions, comparing pdfFiller with other editing tools sheds light on the unique advantages of using this platform for managing essential documents like Form 8050.

Final thoughts on using Form 8050 with pdfFiller

Utilizing pdfFiller to manage Form 8050 maximizes the user experience through its interactive and intuitive features. From easy editing to seamless eSigning, pdfFiller empowers users to navigate the registration process smoothly, minimizing errors and maximizing efficiency.

Encouragement for first-time users is paramount; the platform’s tools are designed to facilitate learning and understanding of the form-filling process. With everything at your fingertips, take full advantage of pdfFiller’s functionalities to ensure that your Form 8050 is completed accurately and efficiently.

People Also Ask about

How do I buy bonds with tax refund?

How long does it take for HMRC to refund?

What is Form 8888 used for?

What does Form 8888 total refund per computer mean?

What is CRA direct deposit?

What is direct deposit?

What is tax topic 152?

When should I expect my tax refund 2022?

What is Form 8888 for?

Can you get a corporate tax refund?

How long does it take to get your tax refund back direct deposit?

How long does direct deposit take?

How long does it take to get corporate tax refund?

How do I check the status of my corporate tax refund?

What is Form 8888 total refund per computer?

Can tax refunds be direct deposited?

Can corporate refunds be direct deposited?

How do I submit a form 8888?

What is direct deposit for refunds?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 8050 without leaving Google Drive?

How can I send IRS 8050 to be eSigned by others?

How do I edit IRS 8050 on an Android device?

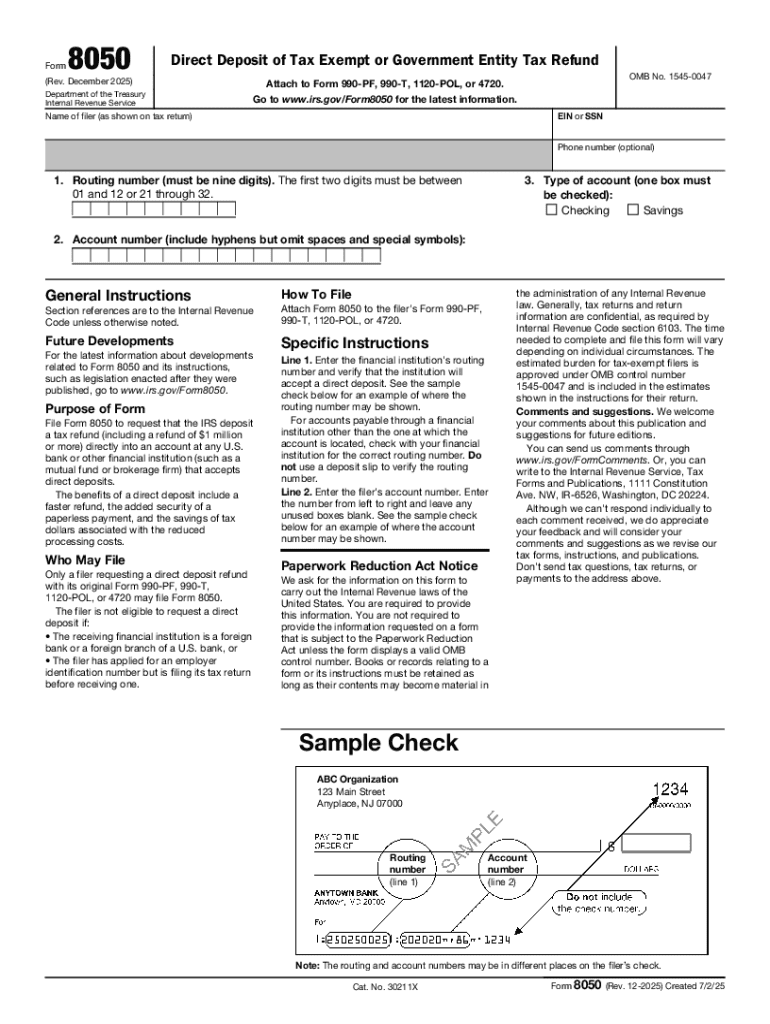

What is form 8050 rev december?

Who is required to file form 8050 rev december?

How to fill out form 8050 rev december?

What is the purpose of form 8050 rev december?

What information must be reported on form 8050 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.