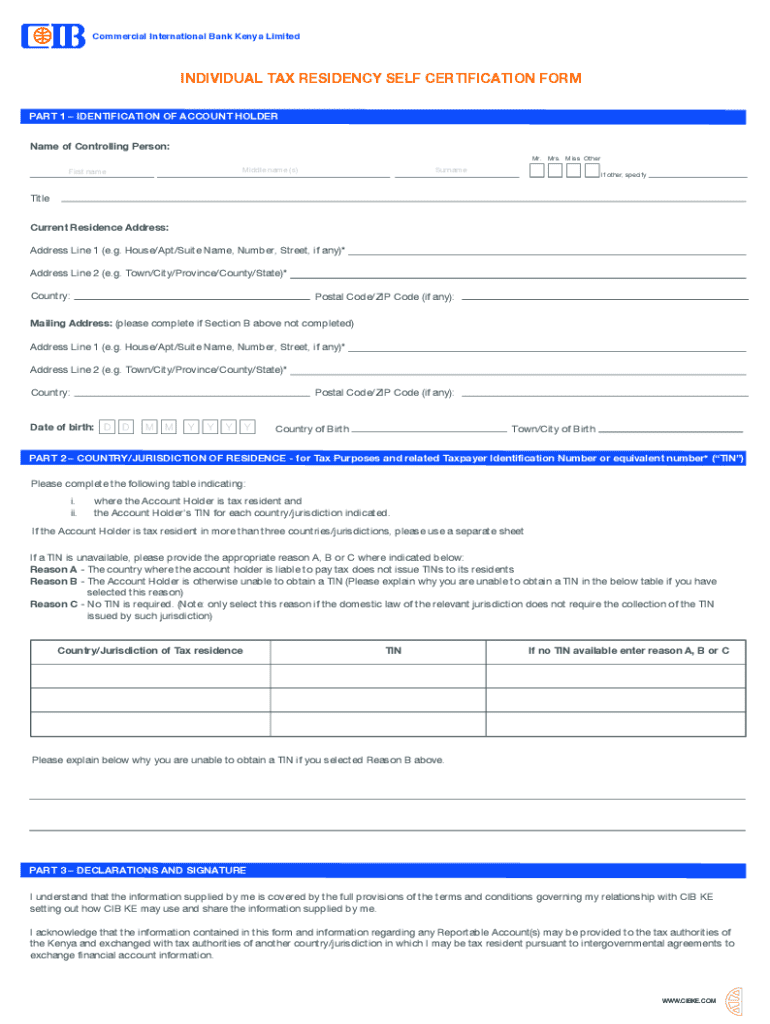

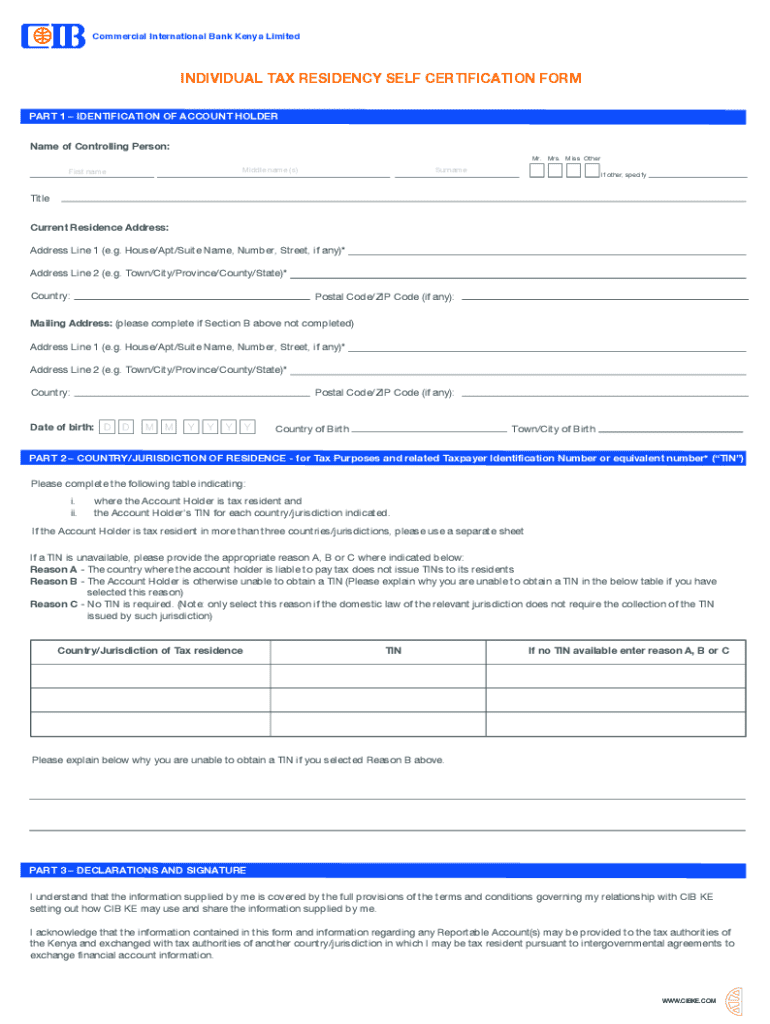

Get the free Controling Person Tax residency self certification form

Get, Create, Make and Sign controling person tax residency

Editing controling person tax residency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out controling person tax residency

How to fill out controling person tax residency

Who needs controling person tax residency?

Controlling Person Tax Residency Form: A Comprehensive Guide

Understanding the controlling person tax residency form

A controlling person is typically defined as an individual who has the ultimate control over a legal entity, often holding significant influence or ownership in an organization. The controlling person tax residency form serves a critical role in confirming the tax residency status of individuals who fall under this category. Establishing tax residency is important because it delineates the tax obligations of individuals across different jurisdictions, enabling tax authorities to assess liability for taxes appropriately.

Legal implications can arise from incorrect declarations or a lack of clarity in residency status, potentially leading to severe penalties. With increasing global scrutiny on tax evasion and compliance, it is essential for controlling persons to accurately complete and submit their tax residency forms, fulfilling their responsibilities while mitigating risks.

When is the controlling person tax residency form needed?

The controlling person tax residency form is required in several scenarios, particularly when engaging in international business transactions. For instance, if a controlling person has financial accounts or investments across borders, proper documentation of tax residency is fundamental to ensure compliance with local laws as well as international tax regulations.

Additionally, financial institutions often require this form to adhere to the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) regulations. Failure to produce the necessary documentation can lead to withholding taxes and other compliance-related issues, highlighting the crucial nature of tax residency confirmation in such contexts.

Key components of the controlling person tax residency form

To effectively complete the controlling person tax residency form, specific components must be accurately filled out. Basic information requirements begin with personal information, which includes the full name, current address, and date of birth of the controlling person. Furthermore, it is essential to provide the relevant tax identification numbers and any additional identifiers that may pertain to the jurisdiction of tax residency.

Equally important is the section pertaining to the declaration of tax residency. This part of the form requires a clear understanding of residency definitions that may vary by jurisdiction. Additional considerations include clarifying which countries the individual identifies as their tax residence to avoid ambiguity and future compliance issues.

Step-by-step guide to filling out the form

Before beginning the actual task of filling out the controlling person tax residency form, a few preparation steps are advisable. First, collect all required documents such as proof of identity, previous tax filings, and any correspondence from tax authorities. It’s also prudent to review the specific tax residency rules applicable in your jurisdiction to avoid any misinterpretations.

Once ready, follow these detailed instructions for each section of the form:

Common mistakes to avoid

While filling out the controlling person tax residency form, several common pitfalls can lead to significant delays or complications. One major mistake is entering inaccurate personal information, which can stem from typos or misinterpretations of the requirements. Always double-check the name, address, and other identifiers prior to submission to avoid unnecessary headaches.

Another frequent issue involves neglecting to provide supporting documents that validate residency claims. Wherever applicable, include documentation such as utility bills, tax returns, or bank statements to justify your residence status. Additionally, misunderstanding tax residency definitions based on local laws can lead to incorrect declarations; hence, it is essential to be familiar with the specific terminology and requirements of your taxation jurisdiction.

Reviewing and editing the form

Accuracy in the controlling person tax residency form is paramount. Mistakes can result in tax complications or penalties that could easily be avoided with diligent proofreading. Before submission, take the time to review the form, ensuring that all information is consistent and complete.

Utilizing tools such as pdfFiller can streamline this process. With interactive features for editing, users can easily alter any section of the form or add annotations. Furthermore, pdfFiller’s collaboration features enable teams to work effectively, allowing multiple individuals to review and make necessary adjustments before the final submission.

eSigning the controlling person tax residency form

Adding an electronic signature to the controlling person tax residency form provides legal validity and is increasingly accepted worldwide. This route not only saves time but also ensures that documents are processed more swiftly than traditional signatures. Individuals can conveniently eSign the document directly through pdfFiller.

To eSign with pdfFiller, follow these straightforward steps: first, open the form in pdfFiller; then select the eSign option. You can draw, type, or upload an image of your signature. Lastly, confirm your signature by clicking 'Finish,' ensuring that your compliance with eSignature laws is upheld throughout the process.

Submitting the form

Once completed, the next step is submitting the controlling person tax residency form. There are two common methods: electronic submission and traditional paper submission. Depending on the requirements of the jurisdiction in which you are filing, one method may be preferred or mandated.

For electronic submission, follow the guidelines provided by your local tax authorities, typically through a secure online portal. Alternatively, if opting for paper submission, ensure the form is mailed to the appropriate address and track the submission for confirmation. Understanding processing times and official acknowledgment of receipt is crucial to prevent any lapses in compliance.

Managing your tax residency compliance

Maintaining ongoing tax residency compliance requires well-structured document management practices. Utilizing pdfFiller’s cloud-based features allows users to store and access their forms and related documents from anywhere, streamlining sustenance of compliance in an increasingly mobile world.

Moreover, keeping thorough records for future reference is essential in case of audits or inquiries from tax authorities. Regularly monitor changes in tax laws and residency rules, as this landscape can evolve, impacting your tax obligations. Staying informed ensures that you remain compliant and avoid potential penalties.

Frequently asked questions (faqs)

Addressing common concerns related to the controlling person tax residency form can provide clarity to many individuals and teams. Questions often include how to rectify submission errors, or what documentation is necessary for specific jurisdictions. Knowing where to direct these inquiries is also crucial in form management.

Support is available through pdfFiller, where users can find assistance regarding form submission, typical troubleshooting steps, and contact information for further help. This encouragement from a supportive document management platform fosters confidence in users as they navigate legal and fiscal obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in controling person tax residency without leaving Chrome?

How can I edit controling person tax residency on a smartphone?

How do I fill out controling person tax residency on an Android device?

What is controlling person tax residency?

Who is required to file controlling person tax residency?

How to fill out controlling person tax residency?

What is the purpose of controlling person tax residency?

What information must be reported on controlling person tax residency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.