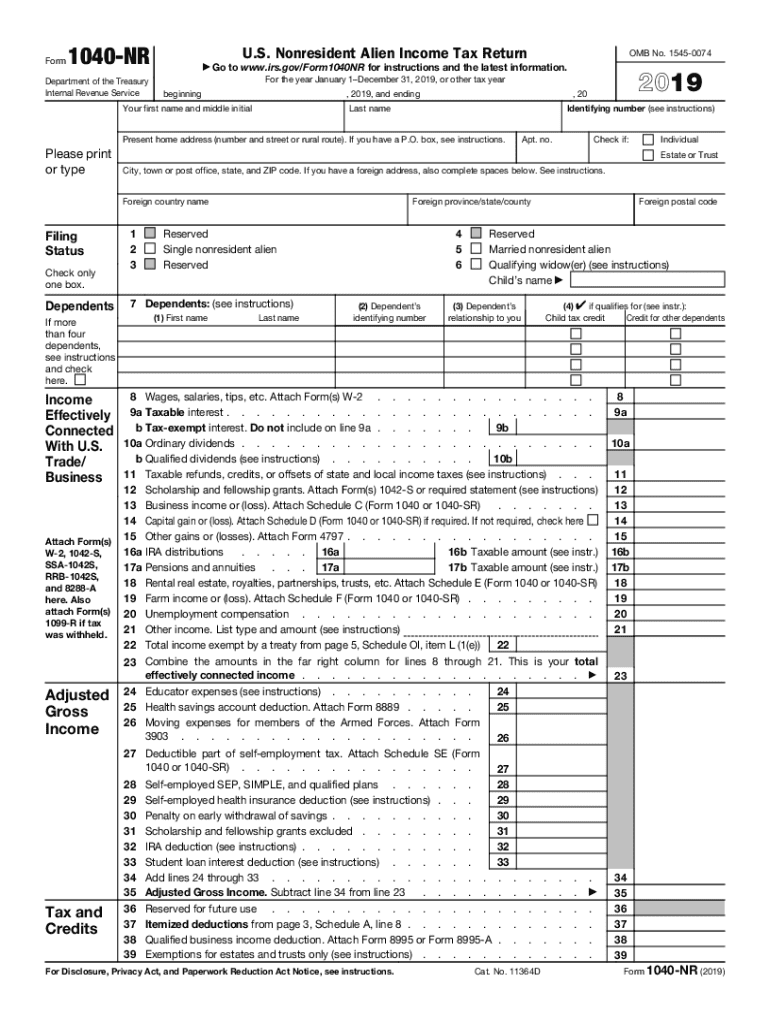

Get the free Form 1040NR, U.S. nonresident alien income tax return.

Get, Create, Make and Sign form 1040nr us nonresident

How to edit form 1040nr us nonresident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1040nr us nonresident

How to fill out form 1040nr us nonresident

Who needs form 1040nr us nonresident?

Form 1040-NR: The U.S. Nonresident Tax Return Explained

Understanding Form 1040-NR

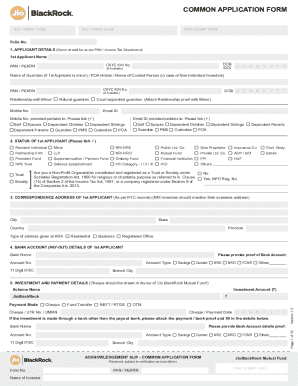

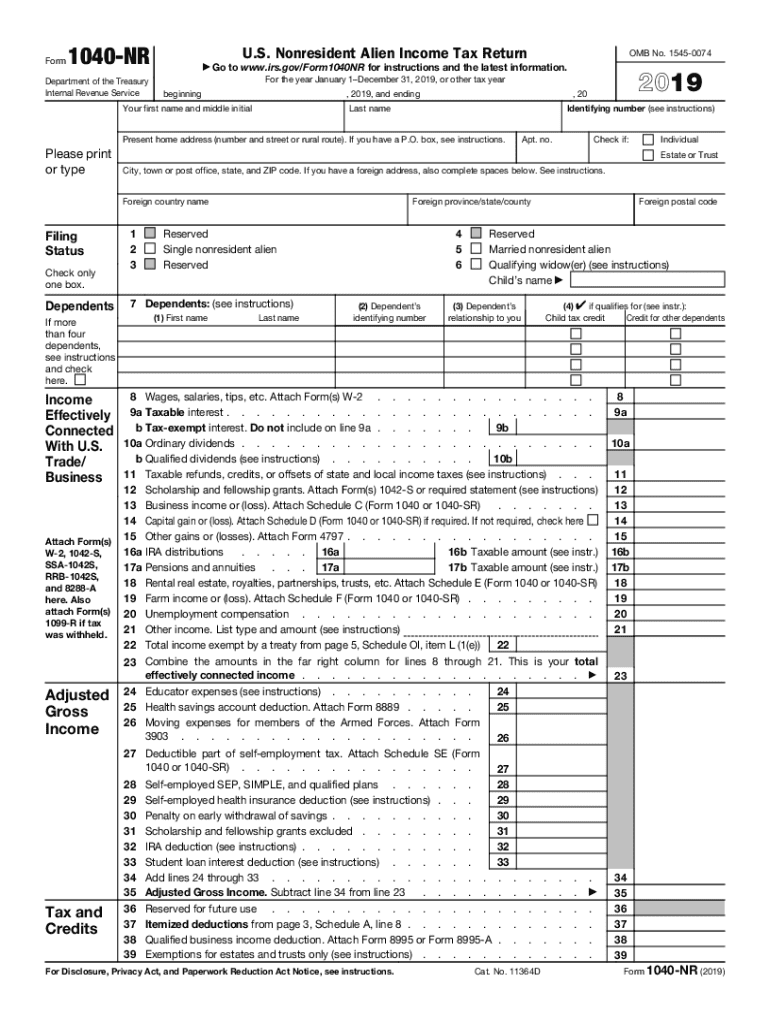

Form 1040-NR is the U.S. tax return form specifically designed for nonresident aliens. Unlike U.S. citizens and residents, nonresidents have unique tax obligations based on their income sources and presence within the United States. This form is essential for reporting income earned from U.S. sources, ensuring compliance with IRS regulations, and determining any tax owed or refund due.

Nonresident aliens have distinct tax routines that necessitate the use of Form 1040-NR instead of the standard Form 1040. Key differences include the exclusion of certain deductions and credits available to residents, as well as the tax rates applied. Understanding these differences is vital for accurately fulfilling tax responsibilities.

Who needs to file Form 1040-NR?

Nonresident aliens are individuals who do not meet the IRS criteria for residency, primarily determined by the substantial presence test. This includes foreign students, business travelers, and professionals who spend limited time in the U.S. Each situation that requires filing Form 1040-NR can vary based on individual circumstances and types of income received.

Preparing for filing Form 1040-NR

Prior to filing Form 1040-NR, it is vital to gather all necessary documentation. First and foremost, personal identification information, including your Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN), must be readily available. Additionally, accurate income records like W-2 forms or 1099 statements reflecting U.S.-sourced income are essential.

It’s also prudent to compile evidence of any applicable deductions. For instance, nonresidents may be eligible for certain itemized deductions related to their income; however, this is limited compared to residents. Understanding tax residency implications can profoundly impact how you report income on your tax return.

Step-by-step instructions for filling out Form 1040-NR

Filling out Form 1040-NR involves careful attention to detail across several sections. Begin with providing your personal information, ensuring your name, address, and identification number are correct. The next critical section pertains to the income you earned from U.S. sources, which needs to be detailed in the designated area; you must report all income accurately as this affects your overall tax responsibility.

When moving to the deductions and credits section, proceed cautiously, since nonresidents have limitations on available deductions. Specifically, standard deductions are not applicable to most nonresident aliens, making itemized deductions essential for reducing taxable income. Afterward, calculate your tax based on the applicable rates from the IRS tax tables for nonresidents, which differ from those used by residents. Finally, avoid common pitfalls by ensuring no omission or inaccuracies occur throughout the process.

Filing methods for Form 1040-NR

When it comes to filing Form 1040-NR, you have the option of electronic or paper filing. Electronic filing is generally more efficient, allowing for faster processing and confirmation receipts from the IRS. However, if you prefer a traditional approach, you can opt for paper filing, although this method may take longer for processing.

Utilizing pdfFiller enhances your filing process significantly. With pdfFiller's interactive tools, you can easily fill out Form 1040-NR, edit, sign, and manage your forms seamlessly. If you choose to file by mail, ensure you send your completed form to the correct address specified by the IRS based on your state of residence.

Tax treaties and their impact on Form 1040-NR

Tax treaties are agreements between countries that aim to prevent double taxation and provide tax benefits for nonresident aliens. Understanding which tax treaties apply to you can directly influence the amount of tax withheld from your U.S. income. If you are from a country that has a tax treaty with the U.S., you may be eligible for reduced withholding rates or exemptions on certain income types.

To claim these benefits on Form 1040-NR, you’ll need to determine the treaty's applicability and ensure you document your claim correctly on the form. Properly referencing the treaty and providing any required documentation can streamline your tax filing experience and potentially decrease your tax liability.

Important deadlines for filing Form 1040-NR

Filing Form 1040-NR comes with crucial deadlines that must be adhered to in order to avoid penalties. Generally, the due date for nonresident aliens to file their tax return is April 15 of the year following the tax year, but it can vary in cases where you are claiming certain tax treaty benefits or if you are self-filing for the first time.

Extensions may be possible for individuals who need additional time. It's important to note that nonresidents can file for an extension up to six months using Form 4868; however, this only extends your filing deadline, not the payment deadline. Ensuring timely submission and awareness of deadlines can substantially reduce your financial stress during tax season.

Consequences of late filing Form 1040-NR

Failure to file Form 1040-NR on time can lead to various penalties imposed by the IRS. If you miss the deadline, expect to incur a failure-to-file penalty, which can accumulate over time and elevate your total tax bill considerably. Additionally, interest will accrue on any unpaid taxes from the due date until you settle your debt, increasing your financial responsibilities.

For those who miss the deadline, options are available to manage the consequences. You can seek to file your taxes promptly even after the due date, mitigating penalties to some extent. This approach may help you minimize the financial fallout and work towards compliance.

Amending Form 1040-NR

Situations may arise that necessitate amending Form 1040-NR, whether due to incorrect information reported, overlooked income, or changes in deductions. The IRS provides a specific form, Form 1040-X, for individuals seeking to correct their previously filed return. It's crucial to follow the outlined steps to ensure accurate adjustments.

Using pdfFiller for this process simplifies the amendment procedure significantly. You can easily access and fill out Form 1040-X, making the process more efficient while ensuring all necessary documentation is in order, leading to successful submission and correction of records.

Utilizing pdfFiller for enhanced tax filing experience

pdfFiller empowers users by offering a comprehensive cloud-based platform for filing taxes, including Form 1040-NR. With its interactive features, individuals can fill, sign, and manage their documents conveniently from any location. The user-friendly interface fosters seamless collaboration, making it a go-to solution for anyone handling tax-related forms.

Among the many advantages of utilizing pdfFiller is the ability to store all tax documents securely in a cloud environment, allowing easy access whenever needed. This ensures your tax filing is organized and efficient, enabling you to focus on ensuring accuracy without the stress surrounding document management.

Frequently asked questions about Form 1040-NR

Many nonresident aliens have queries regarding Form 1040-NR, especially regarding specific filing situations or tax obligations. Common questions can include clarification on residency definitions, eligibility for claimed deductions, or advice on how to navigate challenges during the filing process. Connecting with resources like tax professionals or the IRS website can provide further insights.

Creating a successful filing strategy often hinges on understanding your unique circumstances. Hence, tapping into community forums or support networks for shared experiences can prove valuable. Approaching this tax season armed with information and prepared documentation can ease the filing burden and ensure compliance with the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 1040nr us nonresident?

How do I edit form 1040nr us nonresident online?

How do I edit form 1040nr us nonresident on an Android device?

What is form 1040nr us nonresident?

Who is required to file form 1040nr us nonresident?

How to fill out form 1040nr us nonresident?

What is the purpose of form 1040nr us nonresident?

What information must be reported on form 1040nr us nonresident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.