Get the free Disclosure-No.-2895-2025-Quarterly-Report-SEC-Form-17-Q ...

Get, Create, Make and Sign disclosure-no-2895-2025-quarterly-report-sec-form-17-q

How to edit disclosure-no-2895-2025-quarterly-report-sec-form-17-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosure-no-2895-2025-quarterly-report-sec-form-17-q

How to fill out disclosure-no-2895-2025-quarterly-report-sec-form-17-q

Who needs disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

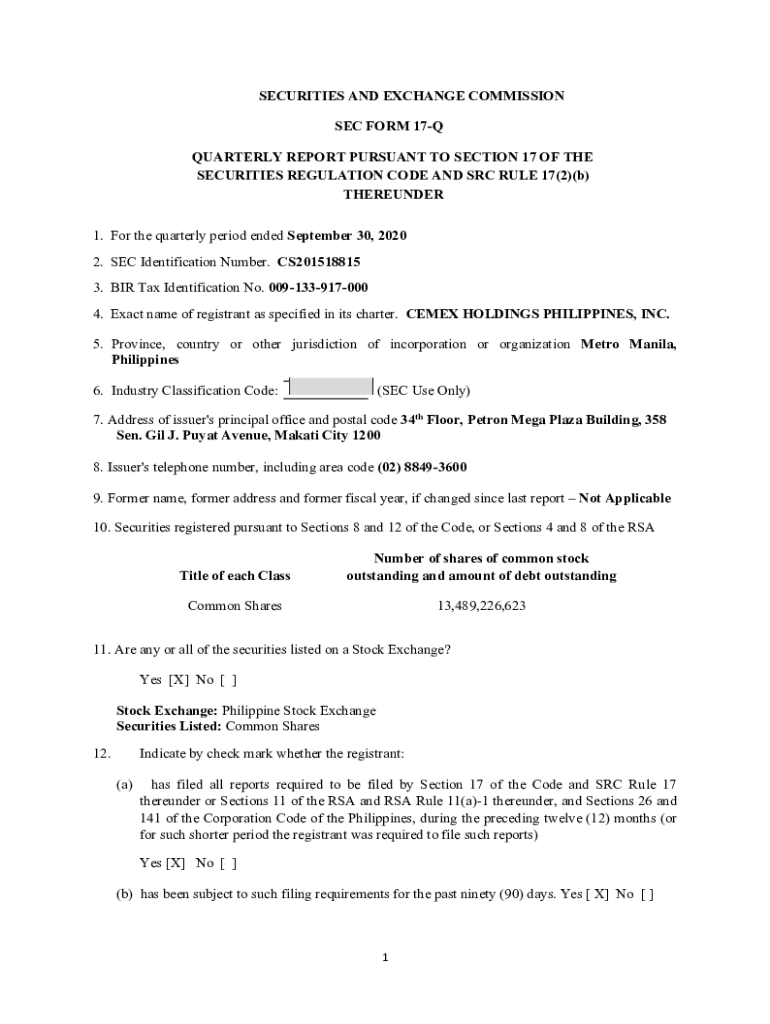

Disclosure No. 2895: 2025 Quarterly Report SEC Form 17-Q

Understanding SEC Form 17-Q

SEC Form 17-Q is a crucial reporting instrument used by publicly listed companies in the United States. It details a company's financial performance on a quarterly basis, focusing on earnings and key financial metrics that inform investors and stakeholders about the company's operational efficiency. This form exists to promote transparency in financial reporting and to ensure that investors are equipped with up-to-date information to make informed decisions.

The importance of the Form 17-Q cannot be overstated. This form enhances accountability among reporting companies by detailing their financial performance, thus promoting investor trust. Key stakeholders, including investors, analysts, and market regulators, rely on the information contained in this report to assess a company's financial health and future viability. Organizations like the Securities and Exchange Commission (SEC) emphasize compliance to protect investors and maintain fair and efficient markets.

Who needs to file Form 17-Q?

Eligibility to file SEC Form 17-Q is primarily contingent upon the company's registration with the SEC as a public entity. Typically, publicly-held companies with total assets over $10 million and a minimum of 500 holders of its voting securities are required to file. This form must be submitted quarterly, reflecting the financial status as of the end of each fiscal quarter.

Filing deadlines for Form 17-Q are specific; companies must submit their report within 45 days of the end of each quarter. Failure to comply with this timeline can lead to substantial penalties, including fines and potential legal repercussions. Prompt and accurate submission not only maintains compliance but also upholds corporate governance standards, fostering trust among investors.

Detailed breakdown of Form 17-Q sections

SEC Form 17-Q is divided into several key sections, each designed to provide a comprehensive snapshot of a company's financial performance. Each section has specific information requirements, which are vital for transparency and regulatory compliance.

Section A: Company information

This section requires the company's name, address, and contact information. Accurate details here ensure that the SEC and stakeholders can promptly reach the organization for inquiries or clarification.

Section B: Financial summary

In this section, companies need to provide a snapshot of their financial data, including revenue, expenses, and net income. Clear definitions of terms, such as earnings before interest and taxes (EBIT) or operating income, help investors understand the company's profitability and operational efficiency.

Section : Management discussion

Management must provide qualitative commentary concerning the financial results. This narrative is crucial in explaining variances in performance relative to prior periods. It's essential to use clear, concise language that provides insights rather than overly technical jargon that might confuse stakeholders.

Section : Comparisons and highlights

Visual aids, such as charts and graphs, can enhance this section by presenting comparative financial analysis effectively. This segment should highlight significant trends and variations in financial performance against prior quarters, allowing stakeholders to quickly comprehend the company's trajectory.

Filling out the form: Step-by-step guide

Completing the SEC Form 17-Q may seem daunting, but breaking it down into manageable steps can streamline the process. Here’s a step-by-step guide to efficiently fill out the form.

Step 1: Gathering necessary documentation

Start by collecting essential financial records and reports, such as income statements, balance sheets, and cash flow statements. It’s also essential to gather historical financial data for comparative analysis.

Step 2: Accessing the form

The official SEC Form 17-Q can be accessed through the SEC's EDGAR database. Ensure you download the latest version to comply with current reporting standards.

Step 3: Completing each section

Go through each section methodically, entering accurate data. Avoid assumptions and use verified figures to ensure compliance. If necessary, consult an accountant for clarification on complex financial terms.

Step 4: Reviewing your submission

Before submission, double-check all inputs for accuracy. Utilize checklists and review the documentation against each section to confirm that no significant information is missing.

Step 5: Submission process

Form 17-Q can be filed electronically through the SEC's EDGAR system. Electronic filing is preferred due to efficiency and instant confirmation upon submission. Companies should adhere to SEC guidelines for paper submissions, if necessary.

Interactive tools for completing Form 17-Q

Utilizing interactive tools can significantly enhance the process of completing SEC Form 17-Q. Platforms like pdfFiller provide online capabilities that allow users to fill, sign, and edit documents conveniently. These tools offer a user-friendly interface that guides users through each section.

The benefits of using interactive PDFs include automated calculations, easy corrections, and the ability to save progress. Users can easily share completed forms with team members or stakeholders securely, facilitating collaboration and real-time updates.

Managing your filed documents

After filing SEC Form 17-Q, it's essential to maintain organized records. Best practices for document retention involve storing everything electronically while ensuring you comply with regulatory retention schedules.

Using a platform like pdfFiller ensures that your filed documents are accessible securely at any time. Collaborating with team members through cloud-based platforms promotes a streamlined approach to document management, making it easier to retrieve information when needed.

Common challenges and how to overcome them

Organizations may encounter several challenges when filling out SEC Form 17-Q. Frequent mistakes include miscalculating financial data or failing to attach necessary documentation. To overcome these issues, it's crucial to establish an internal review process involving accountants or financial analysts.

Additionally, navigating complex financial data reporting can be simplified by utilizing resources like industry forums, webinars, or expert advice from financial consultants. Acquiring external support can provide clarity on accounting requirements and regulations associated with SEC reporting.

Best practices for future reporting

To ensure seamless future reporting, it's beneficial for companies to establish a systematic timeframe for quarterly reporting. Planning ahead enables the allocation of resources for data gathering and analysis in accordance with filing deadlines.

Staying informed on changes in financial legislation is critical for maintaining compliance. Leveraging pdfFiller for ongoing document management and collaborative capabilities serves as an asset that simplifies the process of adapting to new requirements.

FAQs about SEC Form 17-Q

Frequently asked questions about SEC Form 17-Q usually revolve around filing requirements, deadlines, and common pitfalls. Understanding these concerns is essential for effective compliance and preparation.

Addressing these questions directly can help demystify the reporting process and facilitate smoother interactions with the SEC. Links to relevant SEC guidelines should be included in the FAQs for easy access.

Final thoughts on compliance and reporting

Accurate and timely reporting via SEC Form 17-Q is fundamental in maintaining investor trust and confidence. Companies that prioritize transparency and adherence to regulatory standards signal their commitment to ethical governance.

As financial reporting practices evolve, continuous improvement becomes vital. Utilizing effective document management solutions like pdfFiller empowers organizations to maintain compliance while enhancing operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send disclosure-no-2895-2025-quarterly-report-sec-form-17-q to be eSigned by others?

Where do I find disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

How do I edit disclosure-no-2895-2025-quarterly-report-sec-form-17-q straight from my smartphone?

What is disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

Who is required to file disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

How to fill out disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

What is the purpose of disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

What information must be reported on disclosure-no-2895-2025-quarterly-report-sec-form-17-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.