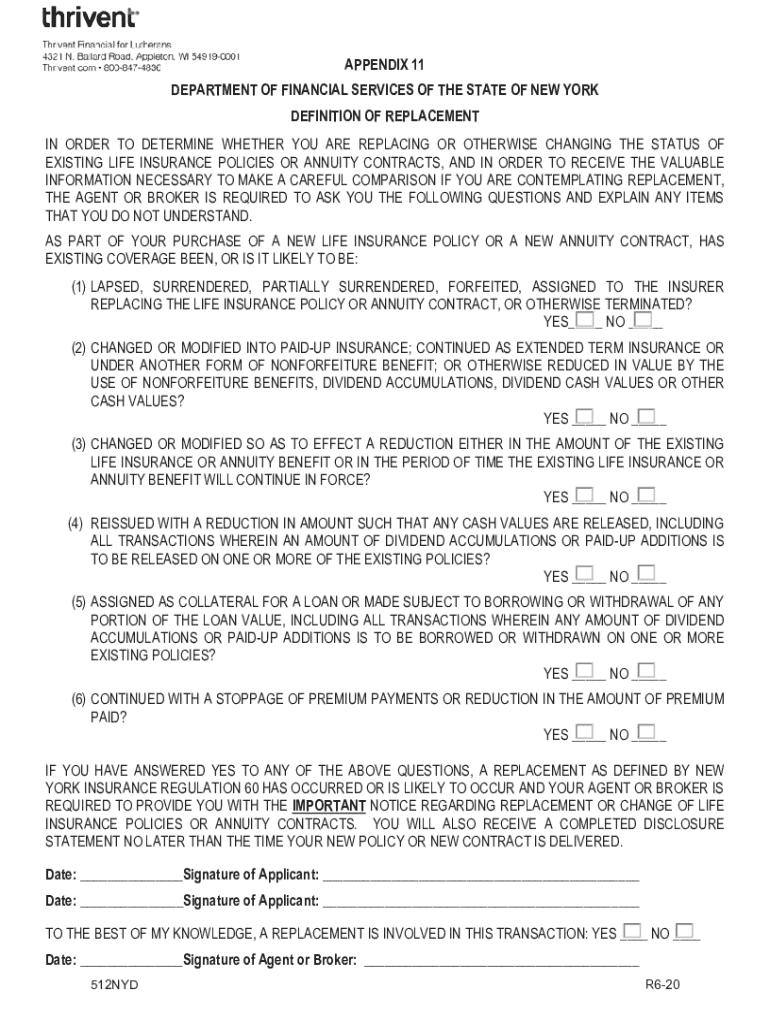

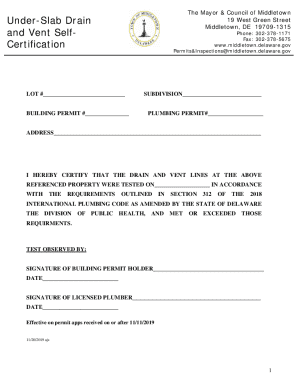

Get the free department of financial services of the state of new york ...

Get, Create, Make and Sign department of financial services

Editing department of financial services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out department of financial services

How to fill out department of financial services

Who needs department of financial services?

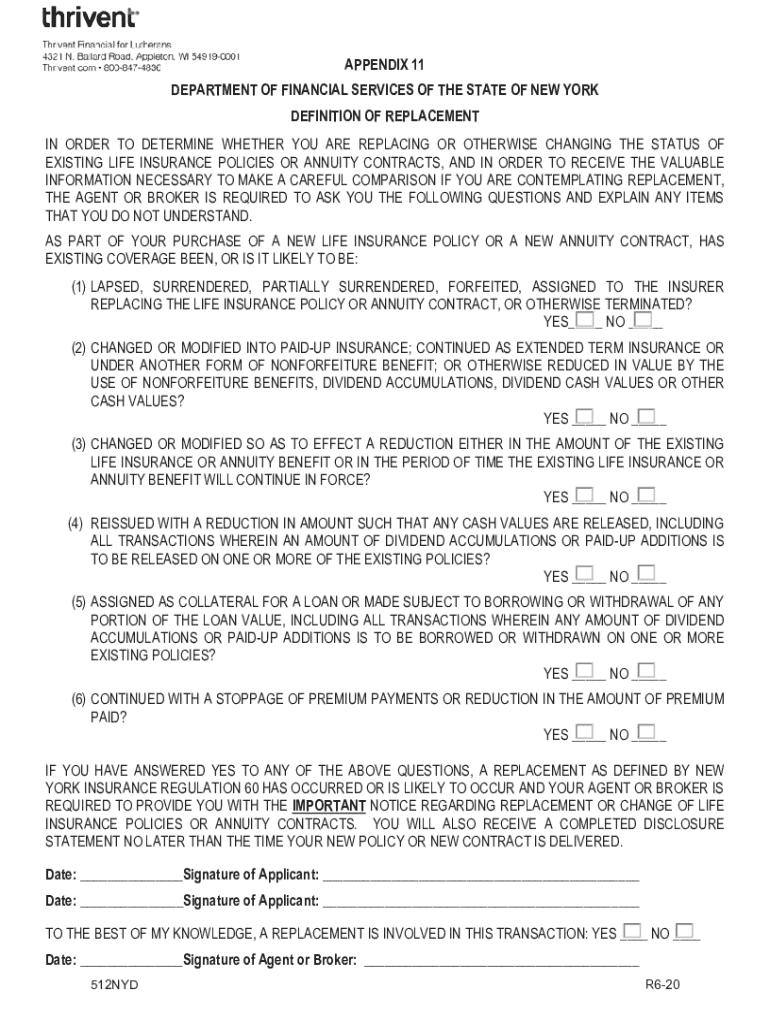

Understanding the Department of Financial Services Form: A Comprehensive Guide

Overview of the Department of Financial Services forms

The Department of Financial Services (DFS) plays a crucial role in the oversight and regulation of financial services within various jurisdictions. One critical aspect of this oversight is the utilization of financial services forms, which are essential for ensuring that individuals and institutions comply with regulatory requirements. These forms serve as the backbone for collecting and reporting financial data necessary for transparency, consumer protection, and financial integrity.

The importance of financial services forms cannot be overstated. They not only facilitate necessary financial operations but also ensure accountability among various stakeholders. Their effective completion is vital in areas like payments, reporting systems, and compliance with fiscal services regulations. Each form is designed to gather specific types of information, which ultimately aids in the functioning of various government programs and services.

Step-by-step guide to accessing and filling out the form

To begin the process of utilizing a department of financial services form, the first step is to locate the specific form you need. Accessing the DFS official website can streamline this process. Look for sections designated for forms or downloads, where the various types of forms are categorized. It is advisable to utilize search functionalities with specific keywords related to your need for efficient navigation.

Once you have located the desired form, downloading it is the next step. Most forms are available in easily accessible formats such as PDF, which ensures complete compatibility with various platforms. To download, simply click on the designated link and save the document to your chosen location on your device. Ensure you have a reliable PDF reader to open the form seamlessly.

Detailed instructions for filling out the form

Filling out the form correctly is crucial to avoid any delays or rejections. Generally, you will need to provide detailed personal or business information, including your contact details, identification numbers, and the nature of your financial operations. Depending on the form, additional documentation may also be required to support your submission.

Each section of the form will typically have instructions or prompts. Pay close attention to these as they provide essential guidelines on the information needed. Common pitfalls include omitting required fields or misinterpreting the requested information. Making use of tools like pdfFiller can greatly simplify the filling process, allowing for easy adjustments and edits.

Tips for editing and customizing your form

Using sophisticated tools like pdfFiller enhances your ability to manage your forms efficiently. pdfFiller allows you to edit, enhance, and customize your documents without any cumbersome installations. You can adjust text formats, add annotations, and even rearrange sections to best suit your needs. This flexibility is invaluable, especially when managing multiple financial services forms that may require individual attention.

In addition to basic editing, pdfFiller also offers interactive features that uplift your forms. For instance, you can incorporate text boxes for added information, checkboxes for options, and even digital signatures, making it a comprehensive platform for document management. Furthermore, if your form requires additional documentation such as images, attaching them directly within the form is a breeze, streamlining the submission process.

eSigning the Department of Financial Services form

Digital signatures have transformed the way financial documents are handled, making the process much more efficient and secure. The ability to use eSignatures on department of financial services forms not only expedites the signing process but also adheres to various legal standards, ensuring the validity of your documents. eSignatures provide proof of consent and authenticate the signer's identity, which is critical in financial transactions.

To eSign a form using pdfFiller, start by uploading your completed document to the platform. Next, navigate to the eSignature option where you can either create a new signature, upload an image of your handwritten signature, or select from predefined signature styles. Once you’ve added your signature to the appropriate field, you can save or send the document directly, adding to the convenience of online form management.

Submitting the completed form

After thoroughly filling out and signing your form, the next critical step involves its submission. Depending on the specific requirements of the department of financial services, you may submit your completed form via multiple channels. Most commonly, forms can be submitted online through the DFS website, ensuring a quick and efficient processing time. Alternatively, some forms may require physical submission via mail, necessitating that you confirm the correct address to prevent any postal delays.

To verify your submission status, keeping records of any confirmation emails or receipts received upon submission is advisable. Depending on the complexity of your form, processing times can vary significantly. For many straightforward submissions, you can expect a direct acknowledgment, while more complex cases may require follow-up communications to confirm receipt or request additional information.

Frequently asked questions (FAQs)

When dealing with department of financial services forms, it's common to have several questions regarding their use. One frequent inquiry is regarding the next steps if your submission is denied or requires revisions. Typically, the issuing department will provide specific feedback on what needs to be corrected, and your best course of action is to address these issues promptly before resubmission.

Additionally, users often ask about the timelines associated with processing these forms. Although it varies, many departments strive to respond within a standard timeframe. However, it is advisable to follow up if you have not received communication regarding your submission within the expected period to ensure there are no outstanding issues.

Don’t see what you’re looking for?

If you are struggling with the department of financial services forms or have further inquiries, there are additional support channels available. The DFS typically has dedicated resources on their website directed towards assisting individuals with common problems. You can also reach out directly to their customer service through the contact details provided on their official website to get tailored assistance.

Moreover, exploring additional resources in pdfFiller can expand your capabilities when it comes to document management. They provide access to a multitude of related forms and templates that could be beneficial based on your specific needs, allowing you to create, edit, and manage all your documents efficiently from a single platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send department of financial services for eSignature?

How do I edit department of financial services online?

How do I edit department of financial services straight from my smartphone?

What is department of financial services?

Who is required to file department of financial services?

How to fill out department of financial services?

What is the purpose of department of financial services?

What information must be reported on department of financial services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.