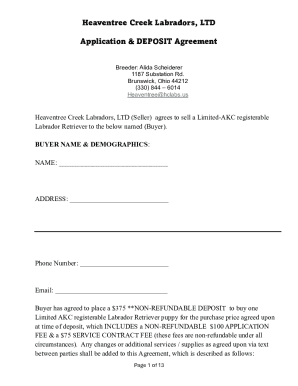

Get the free Form 5306-A, application for approval of prototype simplified ...

Get, Create, Make and Sign form 5306-a application for

Editing form 5306-a application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5306-a application for

How to fill out form 5306-a application for

Who needs form 5306-a application for?

Understanding Form 5306-A Application for Form

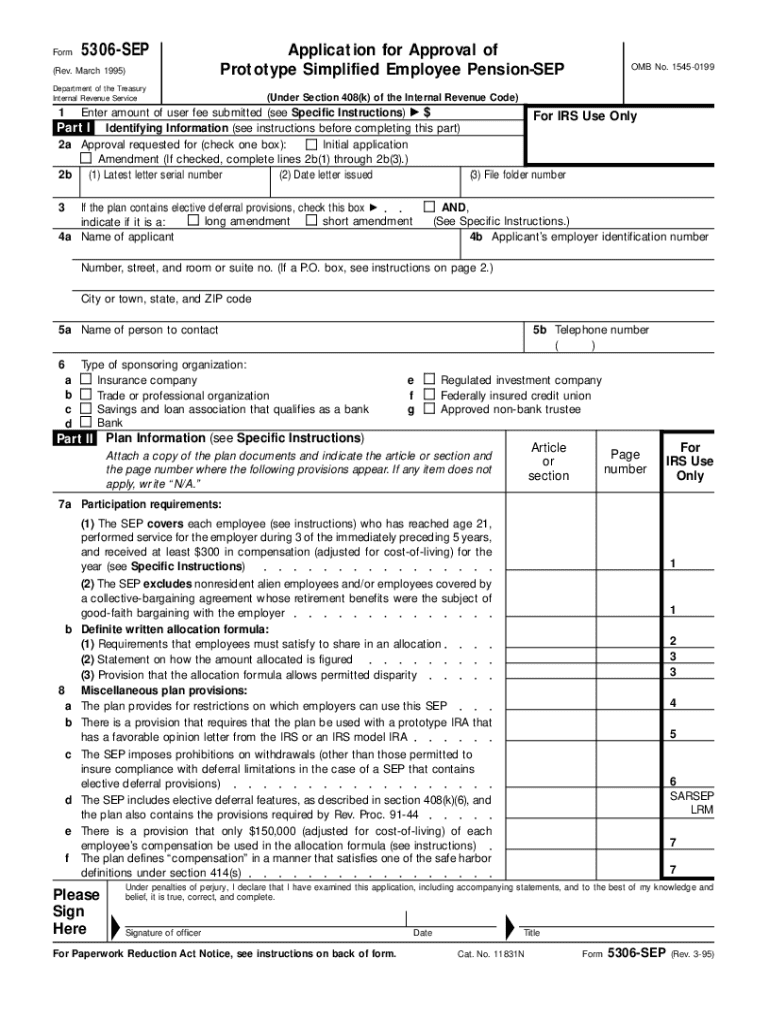

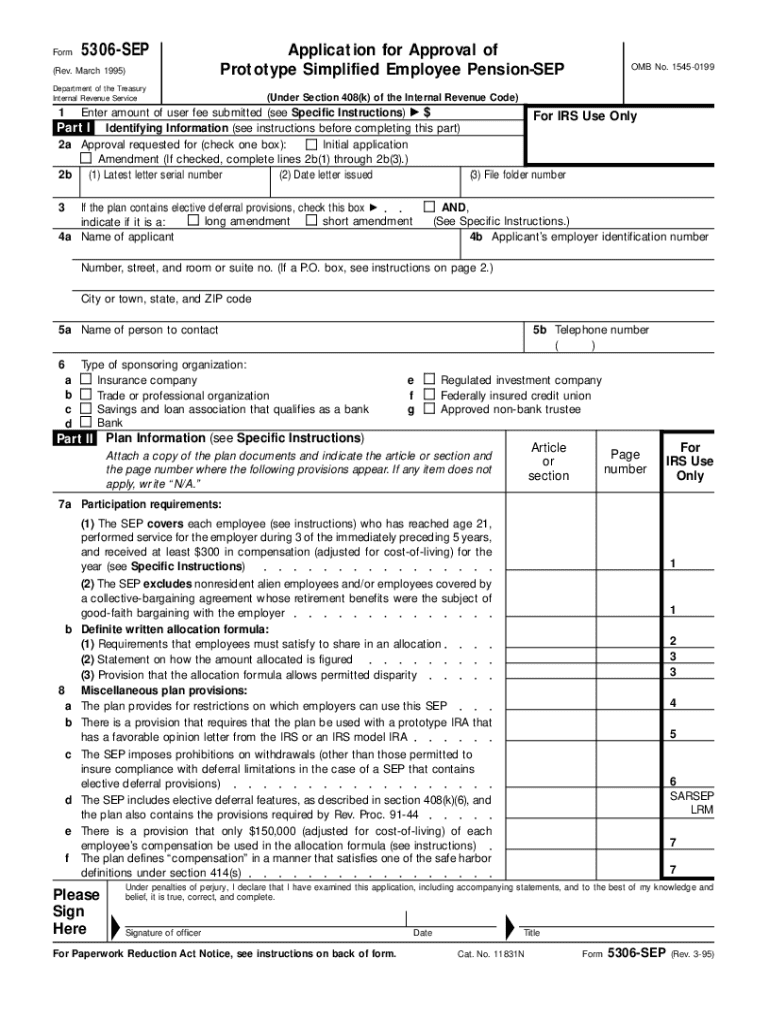

Overview of Form 5306-A

Form 5306-A is a critical document used in the application process for individuals and organizations seeking various tax exemptions and permissions from the IRS. This form serves as a gateway, enabling applicants to request group exemptions or other specific tax-related allowances. Without Form 5306-A, many entities would face hurdles in their application processes, as it lays out required information clearly for the IRS's review.

The importance of using this form cannot be understated, as it simplifies the application process, increases the likelihood of approval, and reduces delays in processing. Therefore, understanding the purpose and usage of Form 5306-A is essential for any applicant navigating the complex realm of IRS regulations.

Who should use Form 5306-A?

Form 5306-A is primarily targeted towards individuals and entities needing to obtain specific permissions from the IRS. This includes nonprofit organizations seeking to apply for group exemptions, as well as teams applying for specific allowances related to employee benefits or tax deductions. The form is vital for those who require official acknowledgment from the IRS in a clear and efficient manner.

There are specific situations that necessitate the use of Form 5306-A, such as when organizations wish to cover multiple affiliates under a single group exemption. Understanding who should use the form and under what circumstances is vital for effective application. Recognizing these needs ensures that applicants are fully prepared when submitting their documents.

How to access and complete Form 5306-A

Accessing Form 5306-A is straightforward. The official IRS website provides the form as well as detailed instructions on the application process. For those looking for more user-friendly options, pdfFiller offers a seamless interface to access the form, allowing users to edit, sign, and manage their documents with ease.

To complete Form 5306-A accurately, follow these step-by-step instructions: First, gather all required information and supporting documentation. Next, access pdfFiller and upload the form. Utilize the interactive tools for filling out the necessary fields, ensuring clarity and correctness.

Once all entries are completed, take a moment to review the form meticulously for any inaccuracies or missed fields. This final review step is crucial to prevent delays in processing your application.

Tips for efficiently filling out Form 5306-A

Filling out Form 5306-A can seem daunting, but simple strategies can streamline the process. One common mistake to avoid is entering incorrect information or leaving fields blank. It's essential to read the requirements thoroughly and ensure all sections are completed accurately. Misunderstanding the expectations can lead to delays or rejections.

Best practices also include maintaining clear communication with team members involved in the application process. If using pdfFiller’s collaboration features, ensure everyone understands their roles in filling out the form. This approach diminishes the chances of overlapping information and increases the quality of your submission.

Managing and submitting your Form 5306-A

Once Form 5306-A is completed, applicants must choose how to submit it. Depending on personal preferences and organizational capabilities, there are options for both electronic submission and traditional paper submission. Electronic submission through platforms like pdfFiller often provides advantages, such as faster processing times and the benefit of e-signatures to enhance security and verification.

After submission, tracking the status of your application is essential. Resources are available on the IRS website to check application status and understand processing times. Typically, applicants can expect varying turnaround times depending on the complexity of their requests.

Frequently asked questions (FAQs) about Form 5306-A

Many applicants encounter challenges while filling out Form 5306-A. Common issues include navigating complex requirements and ensuring all necessary documentation is provided. If an applicant wishes to amend a submission after it has been sent, they must be cautious; changes may complicate the review process.

Understanding the protocol for handling rejections is equally important. If a Form 5306-A is rejected, applicants are encouraged to review the feedback from the IRS and make necessary adjustments before resubmission. Clear lines of communication with the IRS can alleviate many concerns during the process.

Interactive tools and resources available at pdfFiller

pdfFiller equips users with a suite of document management features, making the process of filling out Form 5306-A more seamless. Users can take advantage of editing tools, e-signature capabilities, and collaboration features which enhance the overall experience, ensuring that forms are filled out correctly and efficiently.

Accessing user help is crucial for those experiencing difficulties. pdfFiller’s customer service is designed to assist with any form-related inquiries, ensuring that users feel supported throughout their application process.

Case studies: successful applications using Form 5306-A

Several organizations have achieved success through effectively utilizing Form 5306-A. For instance, a community nonprofit was able to secure group exemptions collectively for multiple affiliated organizations, streamlining their operational efficiencies and enhancing their collaborative efforts. Such insights can serve as useful guidance for new applicants.

The successful experiences shared by these organizations exemplify the importance of proper preparation and understanding of Form 5306-A. Learning from these cases can provide valuable insights into application strategies and timelines, ultimately reducing the chances of rejection.

Closing remarks on using Form 5306-A with pdfFiller

In conclusion, using pdfFiller for Form 5306-A applications offers numerous advantages. The platform empowers users to manage document-related tasks confidently and efficiently, combining essential tools like e-signing and collaborative functionalities.

By leveraging pdfFiller's features, applicants can simplify the application process, avoid common pitfalls, and improve their chances of success. The resources, support, and tools available through pdfFiller ensure that users are well-equipped to navigate the complexities of submitting Form 5306-A effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 5306-a application for in Gmail?

How can I send form 5306-a application for to be eSigned by others?

How do I fill out form 5306-a application for using my mobile device?

What is form 5306-a application for?

Who is required to file form 5306-a application for?

How to fill out form 5306-a application for?

What is the purpose of form 5306-a application for?

What information must be reported on form 5306-a application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.