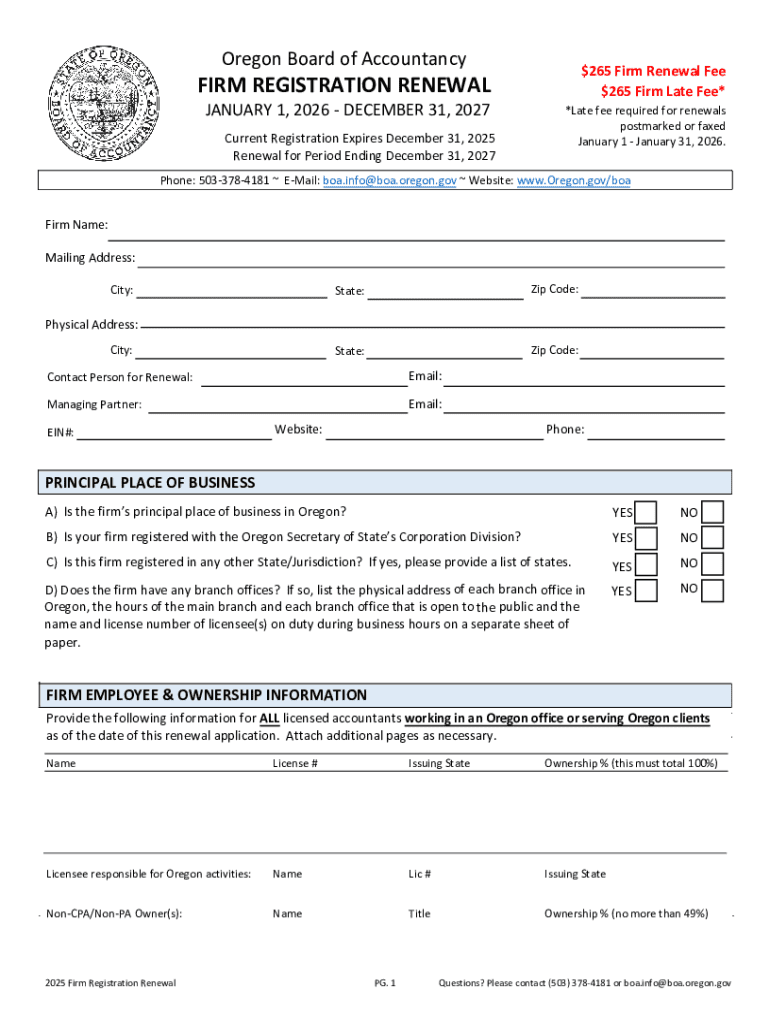

Get the free Board of Accountancy : Firm Registration Forms

Get, Create, Make and Sign board of accountancy firm

How to edit board of accountancy firm online

Uncompromising security for your PDF editing and eSignature needs

How to fill out board of accountancy firm

How to fill out board of accountancy firm

Who needs board of accountancy firm?

Board of Accountancy Firm Form: A How-to Guide

Understanding the Board of Accountancy

The Board of Accountancy plays a crucial role in regulating accountancy firms within each state. It ensures that firms meet specific professional standards and legal requirements, safeguarding public interest by maintaining the integrity of the accountancy profession. The board oversees licensing requirements for practitioners, ensuring that only qualified individuals engage in accountancy services.

Compliance with the board's regulations is imperative for accountancy firms. Non-compliance can lead to severe legal implications, including fines or loss of license. Conversely, adherence to the board's guidelines enhances a firm's credibility, strengthens client trust, and ultimately contributes to long-term success in the competitive accountancy market.

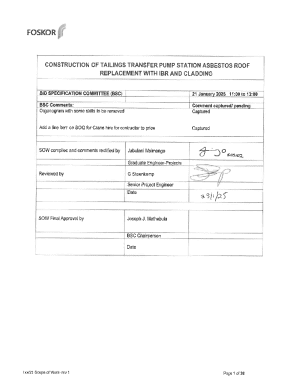

Overview of the Board of Accountancy Firm Form

The Board of Accountancy Firm Form serves as essential documentation for the registration of accountancy firms. This form outlines the requirements for a firm to maintain good standing with the state’s board and operate legally within the profession. Completing this form is the first step for firms aiming to establish a legitimate presence in the accountancy landscape.

Different types of firms must submit this form based on their structural format and services offered. National firms and local boutiques might face varying requirements in terms of documentation and compliance based on the services they provide. For example, firms specializing solely in tax services may encounter different regulations compared to those offering a broader range of accounting services.

Steps to filling out the Board of Accountancy Firm Form

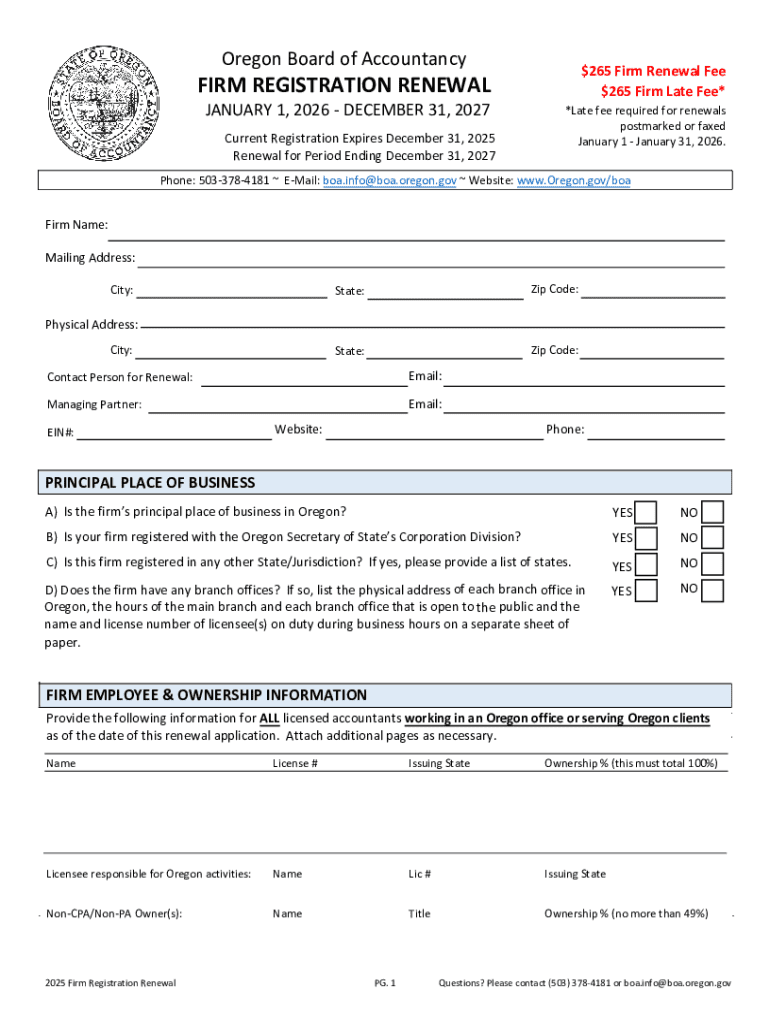

Filling out the Board of Accountancy Firm Form can be simplified by following a structured approach. First, prepare by gathering the necessary information required for a successful submission. This includes the firm’s legal name, address, structure, and details regarding designated control persons within the firm. Essential documentation might include proof of qualifications, licenses, and other regulatory compliance certificates.

Once you have all necessary documents, proceed with these steps:

Before submission, it's imperative to conduct a final review to ensure accuracy and completeness. Utilize a checklist to verify all required elements are accounted for and avoid common pitfalls, such as incomplete information or incorrect documentation.

Editing and managing your submission

Editing and managing your submission is crucial, and tools like pdfFiller can significantly streamline this process. With pdfFiller, users can edit PDFs, eSign documents, and collaborate seamlessly with team members. This collaborative feature is especially beneficial when multiple parties are involved in completing the Board of Accountancy Firm Form.

Tracking your submission status is just as essential. Most boards have an online system where you can check the current status of your application. Should you need to follow up with board staff, ensure you have all pertinent details, such as submission dates and assigned application numbers, ready for reference.

Common issues and troubleshooting

During the submission process, you may encounter several common issues. Technical glitches can arise, such as difficulties uploading documents or saving form entries. Usually, refreshing the page or trying a different browser can resolve these problems. Additionally, users often face documentation-related issues, like misfilings or incomplete forms.

If your submission is rejected or the board requests additional information, it is crucial to understand the reasons behind these actions. Review any communication from the board carefully and respond promptly with the requested details. Create a plan to address any points of contention to expedite further processing of your application.

Resources and tools for accountancy professionals

Accountancy professionals can benefit from a variety of resources to aid their understanding of the registration process and ongoing compliance. The official Board of Accountancy website is an invaluable resource, providing access to necessary forms, newsletters, laws, and rules pertinent to the profession. Additionally, downloadable templates for the firm registration application can save time and ensure accuracy.

Community and support networks also play a pivotal role. Joining forums and groups tailored for accountants can provide insights into common issues and innovative solutions. Networking with other firms can also open opportunities for collaboration, mentorship, and sharing best practices.

Best practices for future filings

Staying updated with regulatory changes is vital for maintaining compliance and ensuring the smooth operation of your firm. Engage in continuous learning through various professional development resources and training programs to stay aware of changes in the laws and rules governing the accounting profession.

Additionally, leveraging tools like pdfFiller not only helps streamline the current Board of Accountancy Firm Form process but can also assist with future document needs, such as contracts and agreements. The benefits of consistent document management—including efficiency, accuracy, and accessibility—are essential for any growing firm.

Key takeaways for setting up your accountancy firm

In summary, submitting the Board of Accountancy Firm Form involves a series of essential steps, from gathering required information and documentation to conducting final reviews before submitting the application. Embracing technology solutions such as pdfFiller to manage documentation can simplify this process and reduce the likelihood of errors.

Recognizing the long-term benefits that efficient document handling brings can empower your firm to thrive in a competitive environment. Ultimately, being proactive and embracing digital solutions for documentation will significantly impact your firm's operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the board of accountancy firm in Chrome?

How can I edit board of accountancy firm on a smartphone?

How do I complete board of accountancy firm on an iOS device?

What is board of accountancy firm?

Who is required to file board of accountancy firm?

How to fill out board of accountancy firm?

What is the purpose of board of accountancy firm?

What information must be reported on board of accountancy firm?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.