Get the free Kansas - We can't help you find your true love, but we may ...

Get, Create, Make and Sign kansas - we can039t

Editing kansas - we can039t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kansas - we can039t

How to fill out kansas - we can039t

Who needs kansas - we can039t?

Kansas - We Can't Form: A Comprehensive Guide to Understanding and Managing Your Forms

Understanding the Kansas form: A comprehensive overview

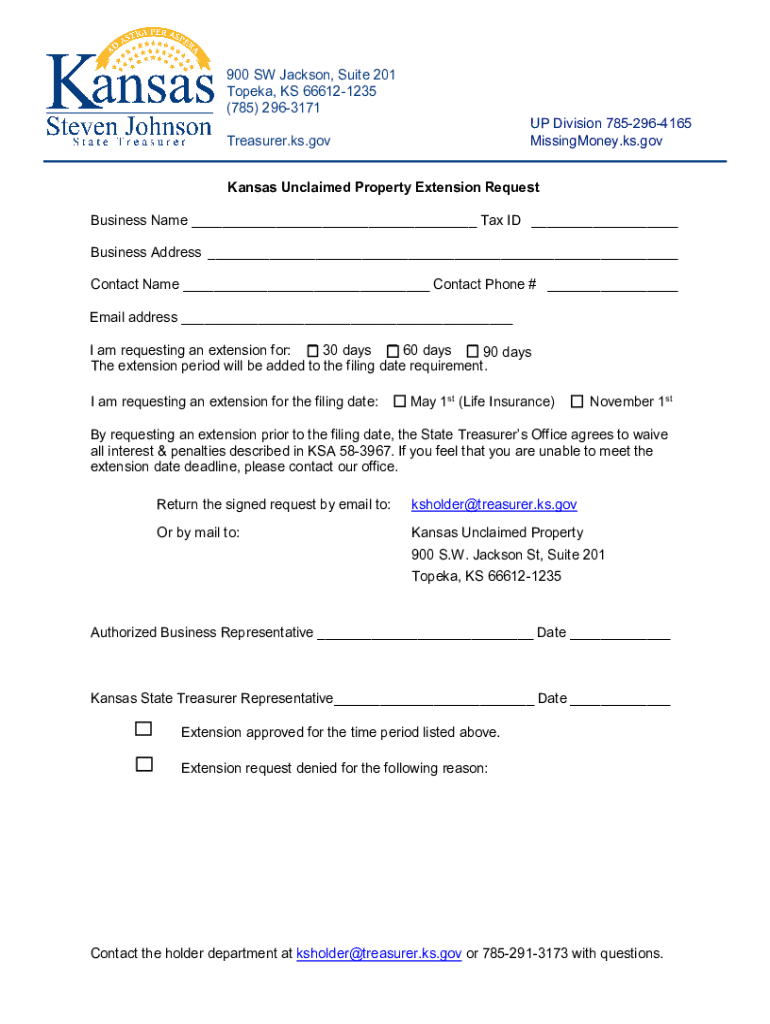

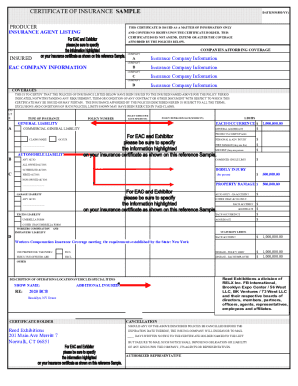

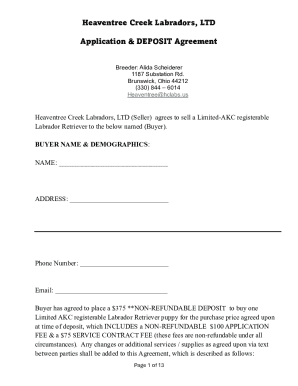

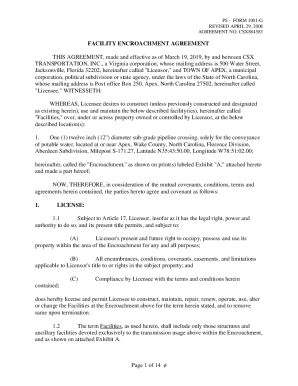

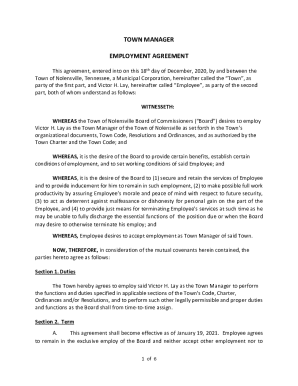

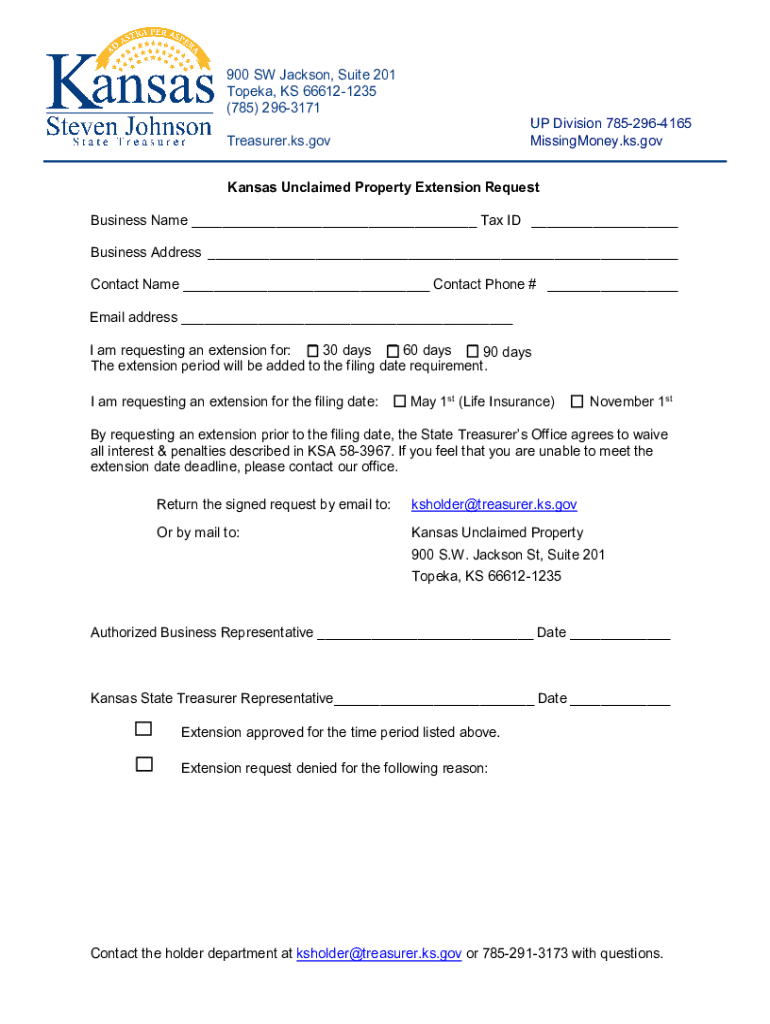

The term 'Kansas form' encompasses various documents required for administrative, tax, and legal purposes within the state. These forms serve as vital tools for individuals and businesses ensuring compliance with local regulations. Accurate completion of these forms is essential as inaccuracies can lead to delays, penalties, or even rejection of submissions. Understanding the importance of filling these forms correctly cannot be overstated.

Common issues faced when filing Kansas forms include missing information, incorrect calculations, or failure to follow the prescribed format. Each type of form has its unique requirements which can be confusing, particularly for first-time filers. Recognizing these challenges can significantly enhance one's ability to navigate the Kansas form landscape effectively.

Types of Kansas forms

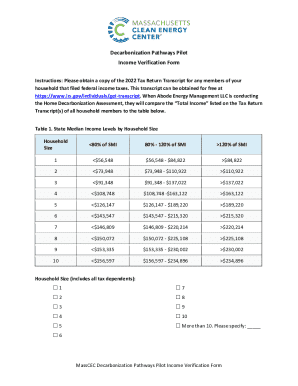

Kansas offers a variety of forms tailored to different needs, ranging from income tax to property tax forms. Each category of forms serves specific purposes, designed to facilitate state revenue collection and compliance with legal requirements. Understanding the specifics is crucial for efficient management.

A specific example is the Kansas Individual Income Tax Form, which allows individuals to report their income, claim deductions, and calculate their tax obligations. Additionally, Kansas has many miscellaneous forms, each serving unique purposes such as permits, licenses, and compliance documents.

Detailed instructions for completing the Kansas form

Filling out Kansas forms requires careful attention to detail. A well-structured approach can make this often daunting task much simpler. Start by gathering all necessary information, including personal identification details, financial records, and any previous tax filings. Organizing this information facilitates a smoother completion process.

Each section of the form must be completed accurately. Ensure that you understand what information is needed for each section - common areas where mistakes occur include financial data and personal information. Pay special attention to formatting requirements and calculation accuracy.

To ensure accuracy, it's advisable to double-check your completed form. This can include comparing it against the requirements specified by the Kansas Department of Revenue or any relevant regulatory body. A thorough review helps avoid potential filing issues.

Editing and managing your Kansas form

In today’s digital age, managing forms has been made easier with tools like pdfFiller. Using pdfFiller’s tools, individuals can effortlessly edit their PDF documents, ensuring that changes are both straightforward and accurate. This provides an efficient solution to any errors or updates that may be required.

Saving and organizing your completed forms efficiently is also paramount. With pdfFiller, documents can be stored securely in the cloud, allowing for easy access from anywhere. It's beneficial to adopt strategies for collaboration, especially if you're part of a team where multiple stakeholders need to provide input or review forms together.

eSigning your Kansas form

An often overlooked aspect of form submission is the importance of signing your document electronically. Electronic signatures are not only time-efficient but also legally valid in Kansas. This streamlines the process, allowing users to complete and submit forms without the need for physical documentation.

Using pdfFiller’s eSignature capability is straightforward. Simply upload your form, use the platform’s tools to add your signature, and ensure it’s placed in the required area. By doing so, you enhance the overall efficiency of your document management.

Troubleshooting common issues with Kansas forms

Filing errors can occur for various reasons, ranging from simple mistakes to misunderstandings of the required information. Recognizing these frequent problems is the first step to addressing them. Common issues include incorrect filing status, omitted income, and errors in calculation.

If you do encounter errors, there are several strategies for resolution. The first should always be reviewing the instructions provided for your specific form. If necessary, consult with tax professionals or other experts on Kansas forms to gain clarity. It may also be beneficial to contact the state’s Department of Revenue for further assistance.

Interactive tools to enhance form completion

pdfFiller provides users with a range of interactive tools designed to streamline the form completion process. These tools include templates and autofill features, which significantly reduce the time required to complete forms and minimize the potential for errors.

Using a cloud-based solution for document management means that users can access their forms anytime, anywhere. This flexibility is especially beneficial for individuals managing multiple forms or teams needing to collaborate on submissions and reviews.

Case studies: Successful usage of Kansas forms

Exploring real-life examples of individuals and businesses successfully navigating the Kansas form process yields valuable insights. For instance, a small business initially struggled with understanding its tax obligations but streamlined its process through pdfFiller, enabling efficient completion and filing.

These case studies demonstrate the importance of adopting effective tools and practices. The lessons learned can pave the way for best practices, helping others avoid common pitfalls and capitalize on efficiency strategies witnessed in successful applications.

FAQs about Kansas forms

Individuals often have questions regarding the Kansas forms and the filing process. For example, what should one do if an error is discovered after submission? Typically, a correction can be submitted alongside the original form to amend any issues.

Other common inquiries include understanding timelines for form submission and the different requirements for various forms. Staying informed about these elements is crucial for compliance and avoiding penalties.

Future considerations for Kansas form users

Looking ahead, users of Kansas forms must stay abreast of changes in legislation that may impact form requirements. As digital tools continue to evolve, understanding how these innovations can assist in form management will be essential for maintaining compliance and efficiency.

As pdfFiller evolves, users can expect enhancements in response to their needs, particularly regarding accessibility and the overall user experience. Keeping an eye on these advancements ensures that you are equipped to efficiently handle the challenges of form submission and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in kansas - we can039t without leaving Chrome?

How do I edit kansas - we can039t on an iOS device?

Can I edit kansas - we can039t on an Android device?

What is kansas - we can039t?

Who is required to file kansas - we can039t?

How to fill out kansas - we can039t?

What is the purpose of kansas - we can039t?

What information must be reported on kansas - we can039t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.