Get the free Down Payment & Closing Cost Assistance Program

Get, Create, Make and Sign down payment closing cost

How to edit down payment closing cost online

Uncompromising security for your PDF editing and eSignature needs

How to fill out down payment closing cost

How to fill out down payment closing cost

Who needs down payment closing cost?

Understanding the Down Payment Closing Cost Form

Understanding the down payment closing cost form

A down payment closing cost form serves as a crucial document in real estate transactions, detailing the financial obligations that a buyer must fulfill to complete the purchase of a home. Typically, it outlines both the down payment and the associated closing costs, which can include a variety of fees necessary for finalizing the loan and transferring the property.

This form is essential for buyers because it provides a transparent and itemized view of the costs involved, allowing them to prepare financially and avoid surprises during the closing process. In addition, lenders and real estate professionals rely on it to ensure all necessary fees are accounted for, fostering a smooth transaction.

The role of the down payment in home purchasing

A down payment is a percentage of the home's purchase price that the buyer pays upfront. The percentage required varies based on the loan type, typically ranging from 3% for conventional loans to as high as 20% or more for some finance options. Understanding down payments is vital as many buyers underestimate their financial obligations.

Addressing the relationship between the down payment and closing costs is also critical; a higher down payment often leads to lower monthly payments and may even reduce some closing costs. Additionally, certain loan types, such as FHA and VA loans, offer specific benefits that can ease the impact of upfront costs.

Filling out the down payment closing cost form

Completing the down payment closing cost form involves a few straightforward steps that require careful attention to detail to avoid errors and ensure accuracy.

Common mistakes to avoid include errors in calculating total costs, misplacing decimal points, and omitting essential costs like title insurance, which could lead to unexpected financial burdens at closing.

Interactive tools on pdfFiller for managing your form

Utilizing interactive tools on pdfFiller can significantly streamline the process of managing your down payment closing cost form. One of the primary features available is the ability to create and customize templates for your closing cost forms. This allows for the easy modification of existing documents or the creation of new ones tailored specifically to your needs.

These tools not only enhance the user experience but also ensure that all parties involved in the transaction are on the same page, reducing the chances of error or miscommunication.

Real-world examples and scenarios

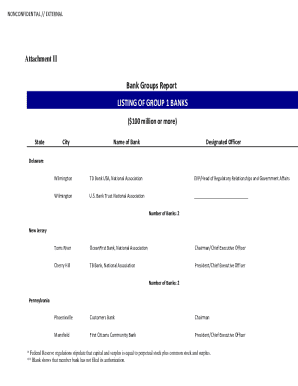

Examining completed sample down payment closing cost forms can provide invaluable insight into the variations that arise based on different loan types and down payment sizes. A conventional loan might reflect a down payment of 20%, while an FHA loan could show a down payment as low as 3.5%.

Case studies of different home-buying situations can highlight the unique costs associated with each scenario. For example, first-time homebuyers might face different fees compared to seasoned investors or those moving between properties. Understanding these nuances helps potential buyers better prepare financially.

Frequently asked questions (FAQs)

Navigating the complexities of down payment closing costs can lead to many questions. Here are some frequently asked questions to clarify common concerns:

Other essential forms and documents related to closing costs

In addition to the down payment closing cost form, several other essential documents contribute to the transaction. Understanding these documents can be pivotal in preparing buyers for the complete financial picture of their home purchase.

pdfFiller provides direct access to templates for these forms, enabling buyers to streamline their closing processes effectively.

Conclusion: Empowering your home buying journey

Completing a home purchase is an exciting yet complex journey, particularly when it comes to managing financial documents like the down payment closing cost form. Utilizing tools available on pdfFiller can simplify this process, reducing stress and enhancing accuracy in paperwork management.

By leveraging the platform’s document editing, eSigning, and collaborative features, users can navigate their home-buying journey more smoothly. Knowing what to expect and utilizing available tools will empower you as a buyer, ensuring a successful and fulfilling investment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete down payment closing cost online?

How do I fill out the down payment closing cost form on my smartphone?

How do I edit down payment closing cost on an iOS device?

What is down payment closing cost?

Who is required to file down payment closing cost?

How to fill out down payment closing cost?

What is the purpose of down payment closing cost?

What information must be reported on down payment closing cost?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.