Get the free Personal E-Statements

Get, Create, Make and Sign personal e-statements

Editing personal e-statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal e-statements

How to fill out personal e-statements

Who needs personal e-statements?

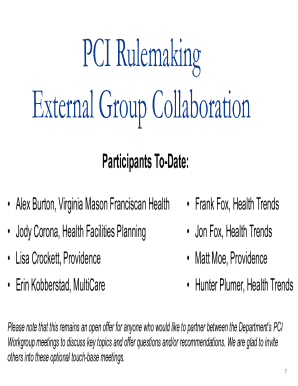

Understanding and Managing Personal E-Statements Form

Understanding personal e-statements

Personal e-statements are digital versions of your financial statements, which replace traditional paper documents. This transformation allows individuals to access their financial information conveniently through online platforms. The importance of transitioning to digital statements cannot be overstated, as it not only enhances usability but also contributes to environmental sustainability.

The environmental benefits of reducing paper usage are significant. By opting for personal e-statements, you help decrease deforestation and lower carbon footprints associated with paper production and shipping. Additionally, the advanced accessibility provided by e-statements facilitates better organization, enabling users to search for and retrieve documents faster than flipping through piles of paper.

Advantages of using personal e-statements

One of the primary advantages of using personal e-statements is quicker access to financial information. Users can instantly retrieve their current and past statements, making tracking expenses and managing budgets much more efficient. This immediate access ensures that individuals are always aware of their financial standing, which is critical when making informed decisions regarding mortgages, home equity loans, or consumer loans.

Enhanced security features accompany the transition to digital statements. Personal e-statements often use secure encryption and data protection measures, ensuring that sensitive financial information remains safe from unauthorized access. Additionally, improved organization capabilities allow users to categorize and file their statements digitally, boosting overall financial management efficiency.

Getting started with personal e-statements

To begin receiving personal e-statements, it's essential to understand the enrollment process. This typically involves a series of straightforward steps that can be completed quickly. Users need to sign up for e-statements through their banking or financial institution's website. Key information required for registration may include account details, personal identification information, and preferences regarding statement delivery.

By completing the enrollment process, users can embark on their digital journey and begin reaping the benefits that come with personal e-statements, such as improved accessibility and organization.

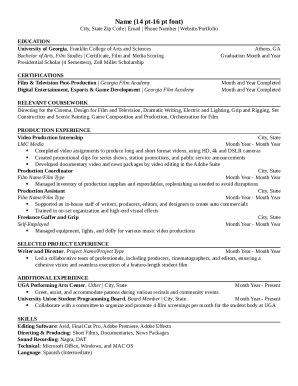

How to fill out the personal e-statements form

Filling out the personal e-statements form typically involves several steps to ensure that all necessary information is provided accurately. Step 1 is providing basic information, including your full name, address, date of birth, and contact details. It’s crucial to input this data accurately to avoid any future complications in accessing your statements.

Step 2 involves selecting your statement preferences. Users can choose how frequently they wish to receive statements—monthly or quarterly, for example. In Step 3, confirming your email address is essential for the reliable delivery of your e-statements. Ensure your email is valid and regularly monitored. Finally, in Step 4, reviewing terms and conditions allows you to understand the user agreements and service conditions attached to your e-statements service.

Editing and managing your personal e-statements

Once you’ve enrolled, accessing your digital statements is straightforward. Simply log into your account on the bank or financial institution’s website, where you’ll find a dedicated section for e-statements. Once logged in, you can navigate to your statements easily, allowing immediate access to important documents for financial activities such as mortgage loan evaluations or tracking home equity loan repayments.

Editing your statement preferences is also easy. Users can update their delivery preferences and notification settings through their account profile. To ensure that you retain important documents, archiving and storing statements safely is vital. Best practices for digital document management include using encrypted cloud services and ensuring backups of important files are maintained.

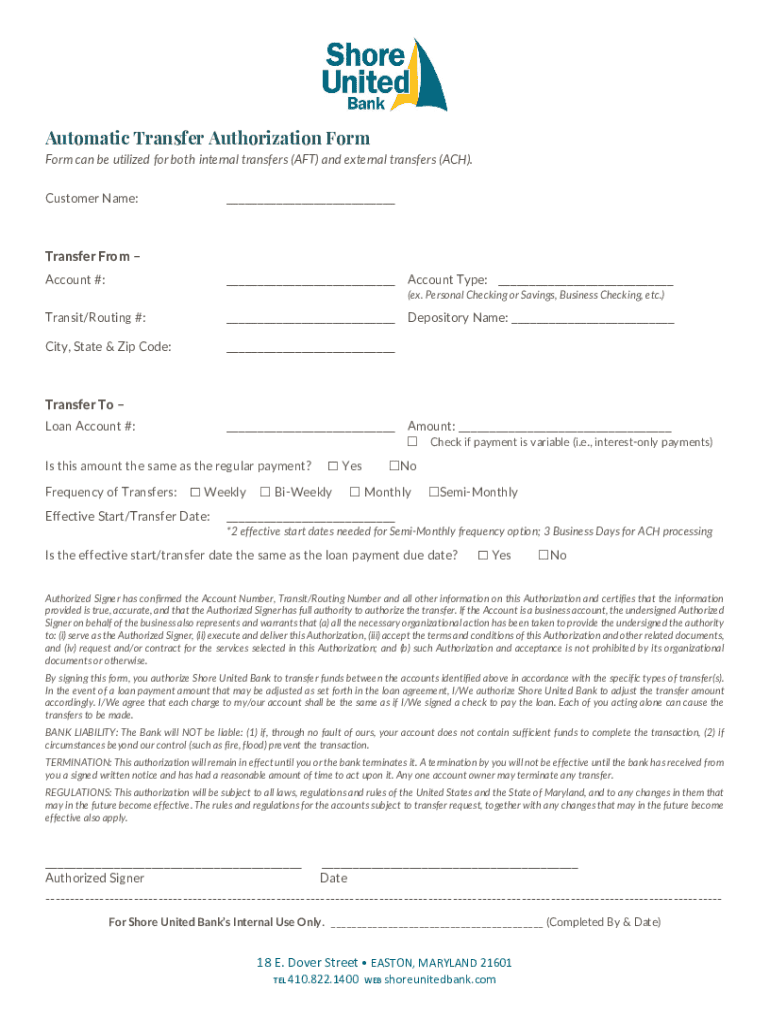

Collaborating and sharing personal e-statements

Collaborating and sharing personal e-statements securely is an essential feature for many individuals, particularly those working with teams or financial advisors. With tools provided by platforms like pdfFiller, sharing e-statements can be done safely while ensuring that sensitive information remains protected. Utilizing the collaborative features enables multiple users to access documents simultaneously for joint financial management.

Sharing options may include generating secure links or exporting statements as PDFs. This flexibility simplifies interactions with advisors who may require your financial documents for research or guidance on mortgages or consumer loans, ensuring everyone involved is up to date with the latest information.

Troubleshooting common issues

Despite their advantages, users may encounter common problems with personal e-statements, such as not receiving statements on time. To address this, first, verify that your email settings are correct and check your spam folder. If problems persist, contacting customer support for assistance is crucial. Support teams are typically available through email, chat, or phone, ready to help rectify any issues quickly.

The rapid response to these issues ensures that users can maintain continuity in their financial management without disruption, allowing them to keep tabs on critical financial aspects like loan payments or budgeting.

FAQs about personal e-statements

Individuals may have questions regarding personal e-statements, such as what happens if they wish to revert to paper statements. Most financial institutions allow users to switch back to paper formats upon request. Another common inquiry is about mobile access; many platforms now provide apps that facilitate access to e-statements on mobile devices, ensuring you can check your financial documents on the go.

Security is another notable concern among new users. Personal data and statements are typically kept secure through robust encryption technologies, safeguarding your information from unauthorized access. Always ensure you are using trusted platforms like pdfFiller that prioritize your security needs.

Future of personal e-statements

Looking ahead, the future of personal e-statements seems promising with the emergence of new trends in document management. Anticipated advancements in e-statement technologies may lead to more intuitive user experiences, including advancements like biometric security measures and AI-assisted document organization. These improvements would ensure that managing financial documentation becomes even more streamlined and secure.

Additionally, as society increasingly shifts towards more sustainable banking practices, personal e-statements will play a crucial role in promoting eco-friendly financial habits. The more users adopt digital formats, the better the move towards a greener planet becomes, creating a positive feedback loop beneficial for both consumers and the environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal e-statements for eSignature?

How do I complete personal e-statements online?

Can I edit personal e-statements on an Android device?

What is personal e-statements?

Who is required to file personal e-statements?

How to fill out personal e-statements?

What is the purpose of personal e-statements?

What information must be reported on personal e-statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.