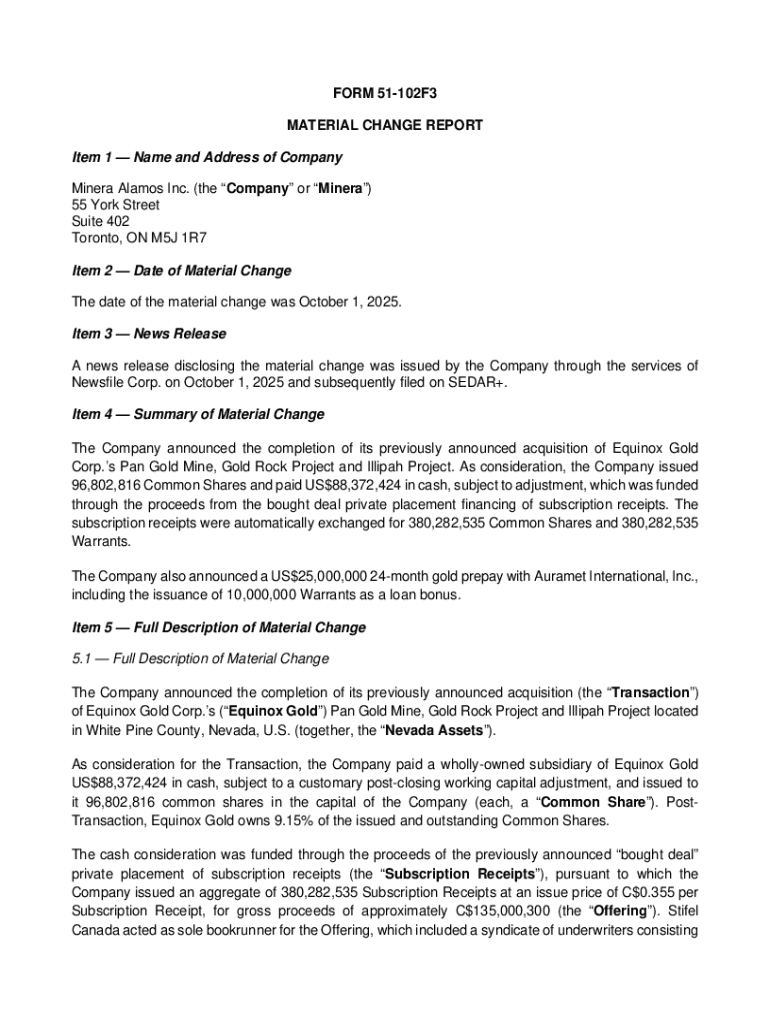

Get the free FORM 51-102F3 MATERIAL CHANGE REPORT Item 1Name ...

Get, Create, Make and Sign form 51-102f3 material change

How to edit form 51-102f3 material change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 51-102f3 material change

How to fill out form 51-102f3 material change

Who needs form 51-102f3 material change?

Understanding the Form 51-102F3 Material Change Form

Understanding the Form 51-102F3 Material Change Form

The Form 51-102F3 Material Change Form is a critical document in the realm of securities regulation in Canada. This form is utilized by public companies to disclose significant changes affecting their financial situation, operations, or governance. It serves as a crucial mechanism for ensuring that investors and the public have timely access to crucial information, thereby maintaining transparency and market integrity.

The significance of the Form 51-102F3 lies in its role in facilitating compliance with Canadian securities laws. By mandating public companies to report material changes promptly, the regulatory framework aims to safeguard investors and promote informed decision-making. Failure to file this form can lead to severe repercussions, including regulatory penalties and damage to a company's reputation.

Who needs to file this form?

The Form 51-102F3 must be filed by public companies as well as certain individuals in managerial positions who may have knowledge of material changes. This encompasses CEOs, CFOs, and other senior executives responsible for the company’s strategic direction. Additionally, any entity involved in mergers, acquisitions, or significant structural changes must adhere to filing this form to fulfill their regulatory obligations.

Contextually, this form is particularly pertinent when a company experiences major events such as a merger, acquisition, significant operational change, or financial distress. Understanding the circumstances that trigger the requirement to file is essential to remain compliant with the various regulations stipulated by the governing bodies.

Key components of the Form 51-102F3

Filling out the Form 51-102F3 requires careful attention to detail as various key components must be addressed. The form typically consists of specific sections such as the identification of the issuer, the details surrounding the material change, and the timing of the occurrence. Each section plays a pivotal role in conveying necessary information to stakeholders.

Common terminology explained

The Form 51-102F3 includes specialized terminology that can be daunting for many preparers. To simplify the understanding of the document, some common terms include:

Step-by-step instructions for completing the form

Completing the Form 51-102F3 is a structured process that requires thorough preparation. To ensure compliance and accuracy, gather necessary documents and information, such as meeting minutes, financial statements, and other records reflecting the material change.

As you prepare to fill out the form, consider creating a checklist to streamline the process. Recommended practices include double-checking the accuracy of the data, understanding all sections of the form, and having a second party review before submission.

Detailed filling instructions

To prevent common mistakes, verify that the information is not only accurate but consistent across all submitted documentation. One common pitfall is failing to report the change within the required timeframe, leading to compliance issues.

eSigning the completed form

Once the form has been thoroughly completed, it’s essential to eSign the document. Digital signatures provide a secure way to verify the identity of the signer and are legally accepted under various jurisdictions. Utilize reliable eSignature solutions that align with the legal standards laid out by regulatory bodies.

Editing and managing your Form 51-102F3

After completing the Form 51-102F3, you may find the need to edit the document for corrections or additional updates. Using tools like pdfFiller, users can easily edit PDFs by adding annotations or comments, directly addressing any points that require clarification or adjustment.

Using pdfFiller to edit your form

To store your Form 51-102F3 securely online, opt for cloud storage solutions that offer encryption. Regularly back up your documents and maintain version control to prevent any discrepancies in future filings.

Submitting the form

Filing the Form 51-102F3 can be accomplished through various submission methods, each catering to different user preferences. E-filing has gained popularity due to its speed and efficiency, allowing companies to file directly with regulatory bodies via their online platforms.

Methods of submission

Once you have submitted the Form 51-102F3, monitor for updates regarding your filing. It's advisable to maintain open communication with regulatory agencies to ensure that your submission has been received appropriately.

Insights and tips for regulatory compliance

Timeliness is paramount when filing the Form 51-102F3. Late submissions can trigger significant penalties, including reputational damage and potential legal scrutiny. By establishing a timeline for filing early and ensuring that all required information is prepared in advance, organizations can mitigate the risks associated with delays.

Ongoing obligations after filing

After filing the Form 51-102F3, companies are not off the hook; ongoing obligations require continuous disclosure of relevant information. Developing a solid plan for managing these ongoing disclosures is crucial for maintaining compliance with securities regulations.

Utilizing pdfFiller for your document needs

pdfFiller stands out not only for editing capabilities but also for its broad array of document management features. Users can create, edit, sign, and manage PDFs seamlessly from any device with internet access, exemplifying the convenience of a cloud-based solution.

Features to enhance document management

Accessing your documents from anywhere ensures that teams remain effective, even in a hybrid work environment. Collaboration tools enhance teamwork, allowing seamless information sharing, and document management.

Case studies and examples

Real-life scenarios showcasing successful management of material changes can provide insights into best practices for utilizing the Form 51-102F3. Companies that have engaged in prompt and thorough disclosures have seen favorable outcomes, maintaining investor trust and adherence to regulatory requirements.

Lessons learned from common pitfalls

Several case studies highlight frequent mistakes such as inadequate detailing of material changes leading to misunderstandings and compliance issues. Learning from these examples can help other companies avoid similar pitfalls and enhance their filing process.

Feedback and support

Engaging with regulatory bodies effectively can streamline the filing process and reduce misunderstandings. Whether through direct contact or official forums, maintaining clear communication is key to a problem-free filing experience.

Accessing support from pdfFiller

Should you encounter any difficulties while using pdfFiller, their customer support is readily available. Whether seeking guidance on form usage or troubleshooting assistance, their support team is equipped to help ensure that you successfully navigate the document management landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form 51-102f3 material change in Gmail?

How can I fill out form 51-102f3 material change on an iOS device?

How do I fill out form 51-102f3 material change on an Android device?

What is form 51-102f3 material change?

Who is required to file form 51-102f3 material change?

How to fill out form 51-102f3 material change?

What is the purpose of form 51-102f3 material change?

What information must be reported on form 51-102f3 material change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.