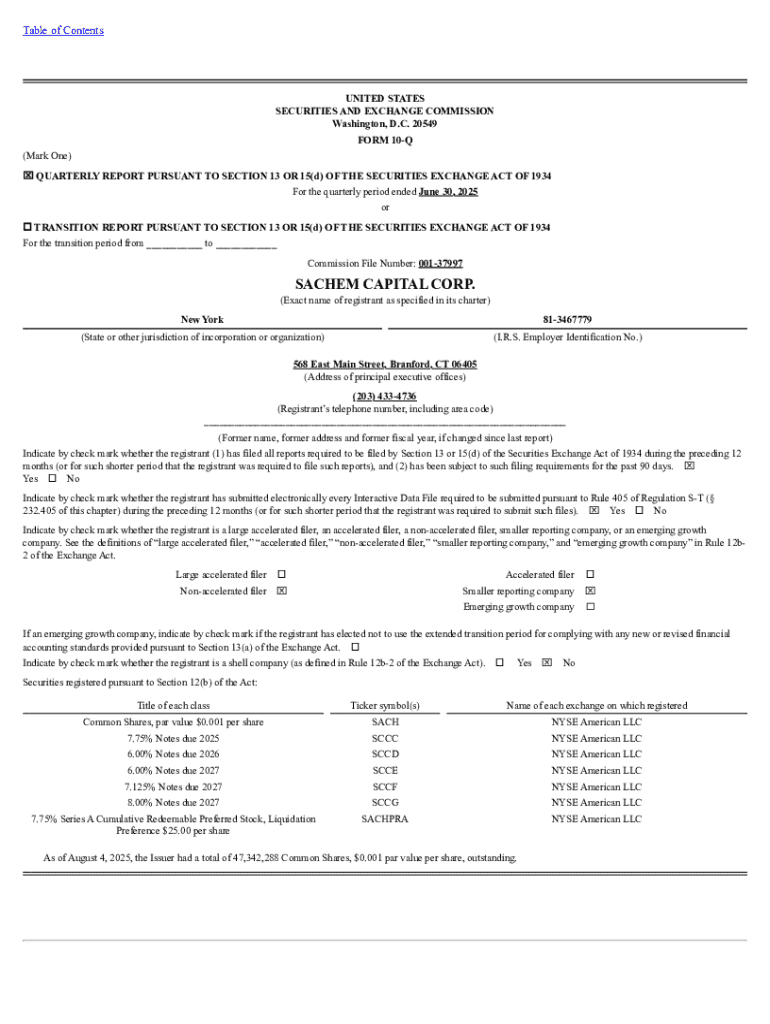

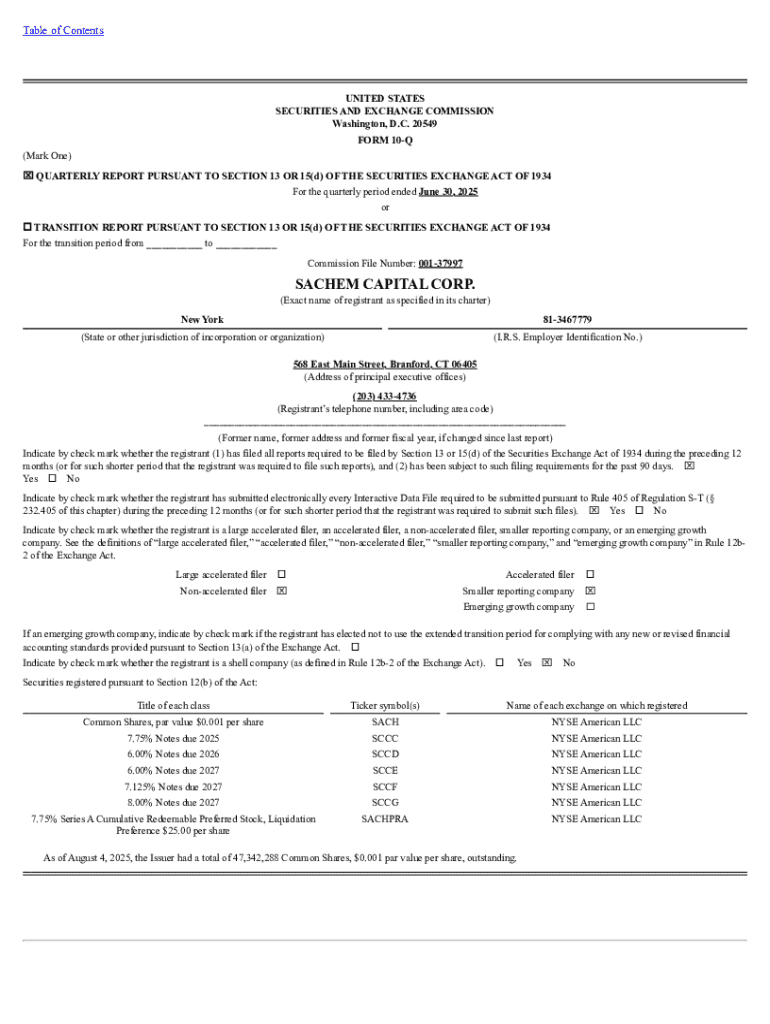

Get the free 0001682220-25-000044. Form 10-Q filed on 2025-08-05 for the period ending 2025-06-30

Get, Create, Make and Sign 0001682220-25-000044 form 10-q filed

How to edit 0001682220-25-000044 form 10-q filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001682220-25-000044 form 10-q filed

How to fill out 0001682220-25-000044 form 10-q filed

Who needs 0001682220-25-000044 form 10-q filed?

0001682220-25-000044 Form 10-Q Filed Form: A Comprehensive Guide

Understanding the form 10-Q

Form 10-Q is a quarterly report mandated by the Securities and Exchange Commission (SEC). This form serves to provide a comprehensive overview of a publicly traded company's financial performance during the preceding quarter. Unlike the annual Form 10-K, the 10-Q is a less extensive document but is equally significant in offering investors and stakeholders timely insights into a company's financial health.

The importance of Form 10-Q cannot be overstated. By capturing key financial metrics and business operations, it allows investors to make informed decisions about their investments. It's a pivotal tool during earnings season when companies report their quarterly performance, providing both qualitative and quantitative data that reflect market conditions and potential growth.

Filing requirements stipulate that public companies must submit Form 10-Q within 45 days of the end of each fiscal quarter. This timeline ensures that stakeholders receive timely and relevant information, vital for tracking the company’s performance over time and evaluating its trajectory.

Key components of the 10-Q form

The Form 10-Q includes several key components that together paint a clear picture of a company's financial health. Among these, financial statements are paramount, consisting of the balance sheet, income statement, and cash flow statement, each providing vital insights into the company’s operations and financial position.

Another crucial section is the Management Discussion and Analysis (MD&A), where management provides subjective analysis of financial results, discusses challenges, and outlines future strategies. Stakeholders gain valuable insights into how management views the company’s performance and future prospects, which can influence investment decisions.

Furthermore, the 10-Q features quantitative and qualitative disclosures that detail market risk factors and operational analyses, offering a broader context for understanding the company's performance amidst shifting market conditions.

Filing requirements and procedures

Not all companies are required to file Form 10-Q; this obligation typically falls on publicly traded companies registered with the SEC. The frequency of submissions corresponds with the company's fiscal quarters, compelling them to file three times a year unless they report on a different basis. However, if a company has not gone public yet or fails to meet specific criteria, they may not be required to file.

Meeting deadlines is crucial. The 10-Q must generally be filed within 45 days after the end of the fiscal quarter, ensuring that stakeholders receive timely information about the company's performance and any relevant changes in operations. Adapting to changes in reporting standards, such as new GAAP rules, is essential for accurate and compliant reporting.

Navigating the filing process

Filing Form 10-Q may seem complex, but breaking it down into a step-by-step process can facilitate efficient completion. Here’s a comprehensive guide:

Avoiding common mistakes during this process is essential to prevent unnecessary delays and penalties. Ensure all data is up-to-date and properly reported, as discrepancies can trigger scrutiny from regulators and stakeholders alike.

Utilizing pdfFiller for efficient filing

pdfFiller offers a robust platform to streamline the filing process for Form 10-Q. It enhances document management, allowing users to edit PDFs easily, eSign, collaborate, and manage documents from anywhere in a cloud-based environment.

Interactive tools offered by pdfFiller, such as editing features and electronic signing options, make the process more efficient than ever. Users can work collaboratively with team members, ensuring that each contribution is captured seamlessly.

pdfFiller empowers users to be proactive in their document management, adapting quickly to changes without compromising data integrity or compliance standards.

Navigating SEC and compliance regulations

Compliance with SEC regulations regarding Form 10-Q filings is paramount. The SEC mandates accurate reporting to protect investors and maintain market integrity. Companies must adhere strictly to the guidelines established by the SEC to avoid repercussions such as fines or legal actions.

The importance of compliance lies in the potential consequences of failing to file correctly or on time. Issues such as inaccurate financial statements or late submissions can damage a company's reputation and lead to loss of investor confidence.

Real-world examples and case studies

Examining a recently filed 10-Q can provide invaluable insights into a company’s performance metrics and operational strategies. For example, a technology company might report a significant increase in revenue driven by innovative product launches, while a financial institution could highlight changes in their loan portfolio, addressing credit losses and capital management.

By analyzing such reports, stakeholders can discern how effectively a company responds to market challenges. Case studies reveal best practices in filing and honing in on specific data points that are most beneficial in evaluating company performance.

Keeping track of upcoming filings

To stay ahead in the fast-paced world of corporate finance, it’s crucial to keep track of key dates and deadlines for upcoming 10-Q filings. Using tools and alerts can help investors and companies alike manage their timelines effectively.

Many subscription services provide notifications about specific filings, company updates, and industry trends, allowing users to stay informed and prepared. Keeping an organized filing schedule not only aids compliance but also arms investors with timely information essential for decision-making.

Conclusion: maximizing the value of your 10-Q

The insights gleaned from Form 10-Q are invaluable for making informed investment decisions. By leveraging data from this quarterly report, investors can better understand a company's financial health and market position. Furthermore, staying abreast of SEC regulations and reporting practices is essential for companies to adapt effectively.

As trends evolve in SEC reporting and filings, continuous learning and adaptation in document management will become pivotal features for corporate reporting. Embracing platforms like pdfFiller will empower users to navigate this landscape with efficiency, ensuring compliance while maximizing the impact of their 10-Q filings.

Frequently asked questions about Form 10-Q

Understanding the nuances of Form 10-Q brings clarity to common concerns surrounding its filing. Here are a few frequently asked questions that investors and stakeholders often have.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 0001682220-25-000044 form 10-q filed from Google Drive?

How do I execute 0001682220-25-000044 form 10-q filed online?

How do I complete 0001682220-25-000044 form 10-q filed on an iOS device?

What is 0001682220-25-000044 form 10-q filed?

Who is required to file 0001682220-25-000044 form 10-q filed?

How to fill out 0001682220-25-000044 form 10-q filed?

What is the purpose of 0001682220-25-000044 form 10-q filed?

What information must be reported on 0001682220-25-000044 form 10-q filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.