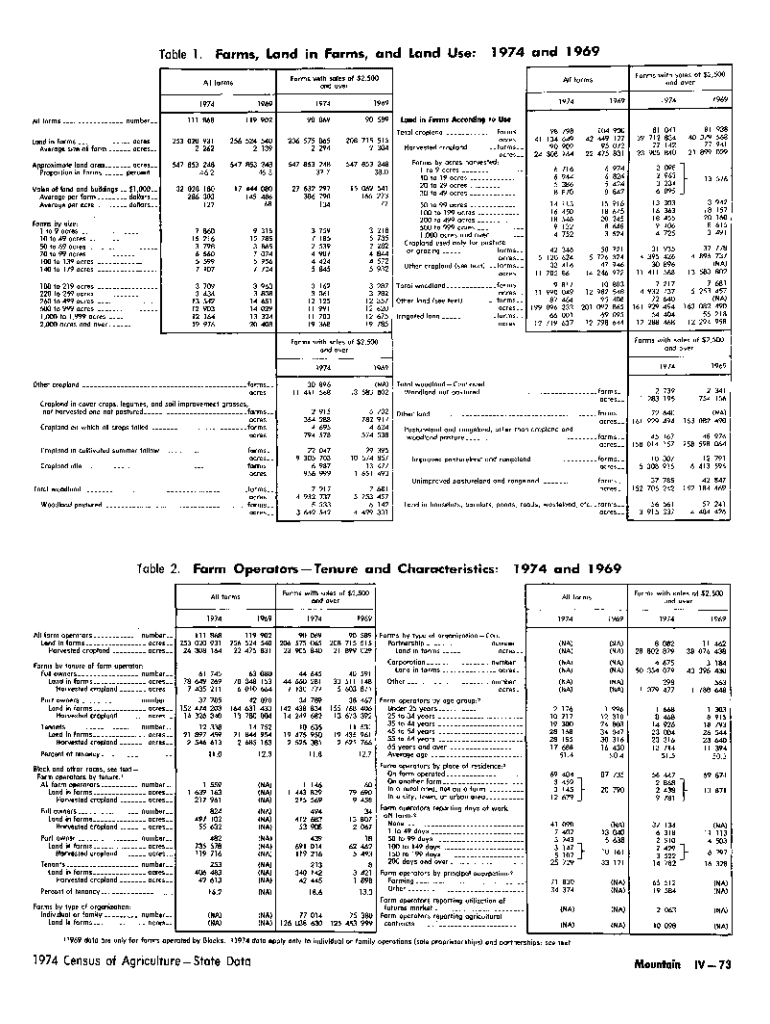

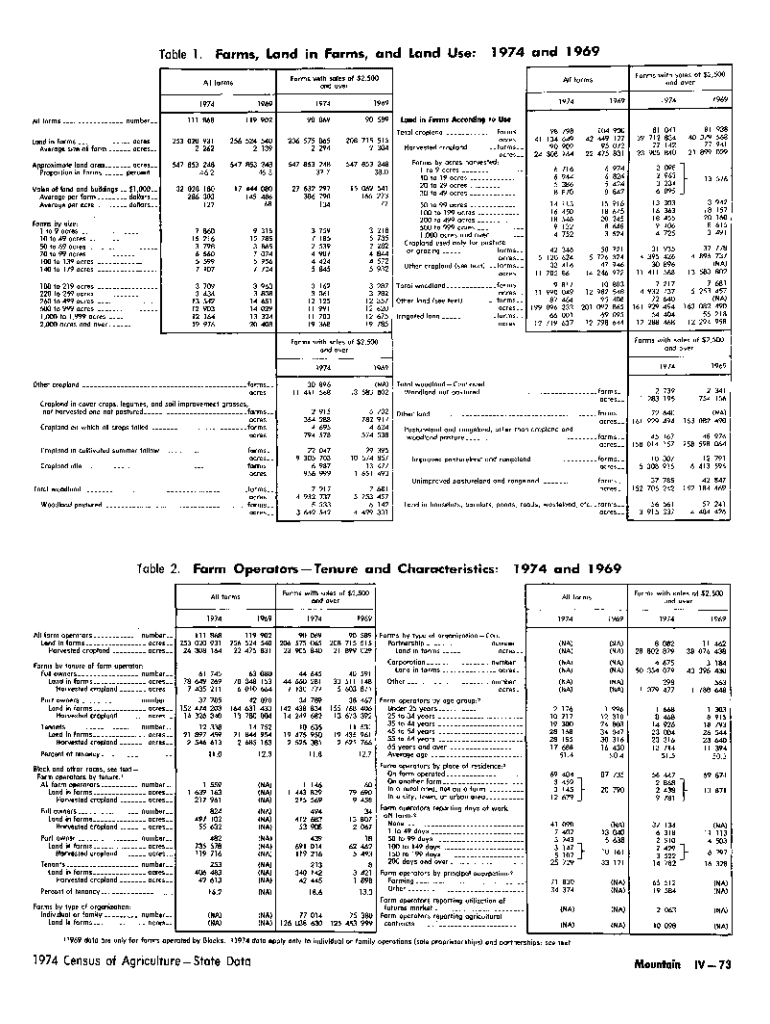

Get the free Value of land ond buildings $1,000

Get, Create, Make and Sign value of land ond

Editing value of land ond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out value of land ond

How to fill out value of land ond

Who needs value of land ond?

Understanding the Value of Land and Form Management

Understanding land valuation

Land valuation is the process of estimating the worth of a parcel of land based on various factors influencing its market price. It plays a crucial role in real estate transactions, taxation, and investment analysis. An accurate land valuation ensures that buyers and sellers are entering into fair agreements, potentially influencing long-term investment decisions.

Determining the value of land is not just an exercise in appraising real estate; it helps stakeholders—developers, investors, and local governments—understand the opportunities and challenges associated with specific locations. The wide range of methods available means that professionals must select the most effective one tailored to the specifics of each situation.

Key factors influencing land value

Several factors determine land value, paramount being location and accessibility. Properties located near essential amenities or with easy access to major highways often command higher prices. Zoning laws and regulations also greatly impact land use, which directly correlates to its value; restrictions can either limit or enhance development potential, affecting market interest.

Market demand and economic indicators such as employment rates or regional growth prospects further influence the perceived value. Moreover, any improvements made to land—like adding utilities, access roads, or landscaping—can significantly increase its marketability and worth, demonstrating the dynamic nature of land valuation.

Valuation methods explored

Understanding various valuation methods is critical for accurate land assessments. Each method serves different purposes based on how value is derived and the context of the property. Below, we explore several approaches tailored to specific valuation scenarios.

Direct comparison method

The direct comparison method involves comparing the subject property with similar properties recently sold in the same market. This straightforward approach provides a tangible assessment rooted in actual transactions.

While effective, this method has its limitations. Variability in property conditions or differences in market exposure can skew results. The process consists of collecting data on comparable sales, making adjustments for differences, and determining a final value.

Income approach to value

This approach capitalizes on the present value of expected future income generated by a property. It's commonly used for investment properties or land planned for rental or commercial development. Key calculations include determining net operating income and selecting an appropriate capitalization rate.

The income approach is especially suitable when cash flow is central to valuing a property. However, it requires accurate projections and knowledge of market conditions, emphasizing the importance of market trend analysis.

Cost approach

The cost approach focuses on calculating the cost to rebuild the property or to replace it. It’s ideal for newly constructed or specialized structures where sales data is scarce. The method distinguishes replacement costs from reproduction costs, emphasizing the expense of creating similar structures.

This method is beneficial when fair market comparisons are lacking, though it may not effectively account for depreciation factors affecting older properties.

Residual land value technique

The residual land value technique enables valuators to assess land by deducting development costs from the expected sale price of completed projects. This approach is primarily used in development assessments where viability is key.

To execute this technique, one calculates the expected future value, estimates total development costs, and subtracts these costs from the potential sale price to arrive at the land value.

Sales comparison approach

In the sales comparison approach, comparable sales data is collected to determine market value. This method considers the specifics of each property and adjusts for market conditions, allowing for an accurate comparative analysis.

Special attention is given to gather accurate comparable sales data from reliable sources, emphasizing the need for comprehensive local market knowledge.

Navigating forms related to land valuation

Forms are instrumental in land valuation, serving to document assessments, ownership transfers, and regulatory compliance. A variety of forms needs attention, including land appraisal reports and property transfer forms, each requiring specific and accurate completion.

Properly filling out valuation forms is essential to uphold the value of land during transactions. These documents should clearly outline the property details, valuation method applied, and final estimates, ensuring clear communication among stakeholders.

Detailed instructions for filling out valuation forms

When completing valuation forms, ensure all sections are comprehensively filled out. Here's a checklist: begin with property identification, followed by the valuation method chosen, appraiser's credentials, date of assessment, and other relevant remarks regarding the condition or unique market factors of the property.

Ensure all numeric figures are accurate, using standardized units and formats. Double-check for any required signatures before submission. Adhering to these guidelines will enhance the reliability and acceptance of the submitted forms.

Editing forms with pdfFiller

pdfFiller's capabilities for editing valuation forms present significant advantages in maintaining the quality and accuracy of document submissions. Users can leverage its features to import existing valuation forms, modify details as necessary, and correct any errors quickly.

pdfFiller allows for user-friendly editing, ensuring that valuation reports can be polished efficiently. Integration with various document formats increases flexibility for users working on diverse projects.

eSigning valuation documents

Utilizing e-signatures for land valuation documents simplifies the signing process while ensuring compliance with regulatory standards. The eSigning process involves selecting the document, adding eSignature fields, and sending it for recipients to authenticate, which can speed up transaction times significantly.

Using a secure eSigning solution ensures the integrity of the documents, providing an additional layer of protection against manipulation or fraud. With pdfFiller, users can achieve a seamless signing experience while ensuring that all parties are on the same page concerning document authenticity.

Collaborative document management with pdfFiller

Collaboration is key in land valuation projects, facilitating input from various stakeholders and experts. pdfFiller’s tools allow teams to share, review, and refine valuation forms efficiently, promoting an organized approach to document management.

The ability to track changes and comments directly within the forms enhances communication, making it easier to address feedback and implement improvements. This interactive environment ensures that everyone involved remains informed, enhancing the quality of the final outcome.

Interactive tools available on pdfFiller

pdfFiller provides numerous interactive tools to streamline the land valuation process. Templates catering to various forms enable quick setups, ensuring users can focus on content rather than formatting.

Additionally, interactive calculators can provide quick valuation estimates based on user-input data, allowing for preliminary assessments without extensive calculations. Integration with other real estate tools further enhances the efficiency of form management in land valuation scenarios.

Real-world scenarios and case studies

Case studies serve as valuable learning tools in the field of land valuation. For instance, analyzing a successful land valuation for residential development, stakeholders learned that combining the income approach with the direct comparison method helped establish a compelling project viability narrative.

Industry expert analysis reveals critical lessons about adaptive strategies in various market conditions and demographics. Recognizing trends and adjusting techniques accordingly can yield valuable insights, helping buyers, sellers, and appraisers alike in achieving optimal outcomes.

Managing changes in land value

Monitoring market trends and changes in property values are fundamental to safeguarding investments. Land value can fluctuate due to shifts in interest rates, zoning changes, or evolving economic conditions; therefore, staying attuned to these elements is crucial.

As changes in land values occur, appraisers should adjust their valuation techniques accordingly, maintaining accuracy in reports. Regularly updating records and reporting changes to relevant authorities enhances transparency, fostering trust among stakeholders.

Legal considerations in land valuation

Understanding the legal implications of land valuation is paramount in ensuring compliance with established standards. Property tax rules, such as property tax rule 4 and property tax rule 8, dictate specific assessment criteria and can impact overall valuations significantly.

Staying informed about local regulations and ensuring adherence can mitigate legal exposure and enhance the legitimacy of valuations. Consulting with professionals knowledgeable in property law can provide essential insights, ensuring robust compliance and understanding of any legal considerations during the process.

Innovations in land valuation technologies

Emerging technologies are revolutionizing land valuation processes. Technologies like AI and machine learning are improving accuracy through data analysis and predictive modeling, allowing for highly precise assessments of market conditions and property values.

Future trends suggest a growing reliance on automated systems for property evaluations, which will likely enhance speed and efficiency while providing comprehensive insights into land value dynamics. Keeping abreast of these innovations will be essential for all stakeholders involved in land valuation.

User tips and best practices for using pdfFiller with land valuation

Optimizing form management with pdfFiller is vital for efficiency. Users should familiarize themselves with the array of features available, such as templates, editing tools, and eSigning capabilities, to streamline their workflow.

Ensuring secure access and sharing is paramount, particularly in collaborative environments where multiple stakeholders engage with sensitive valuation data. Implementing best practices in document management with pdfFiller enhances productivity, keeps data organized, and supports accurate decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify value of land ond without leaving Google Drive?

How do I fill out the value of land ond form on my smartphone?

How can I fill out value of land ond on an iOS device?

What is value of land ond?

Who is required to file value of land ond?

How to fill out value of land ond?

What is the purpose of value of land ond?

What information must be reported on value of land ond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.