IRS W-7 (COA) 2025 free printable template

Get, Create, Make and Sign IRS W-7 COA

How to edit IRS W-7 COA online

Uncompromising security for your PDF editing and eSignature needs

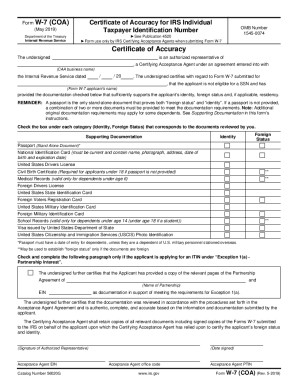

IRS W-7 (COA) Form Versions

How to fill out IRS W-7 COA

How to fill out form w-7-coa rev 8-2025

Who needs form w-7-coa rev 8-2025?

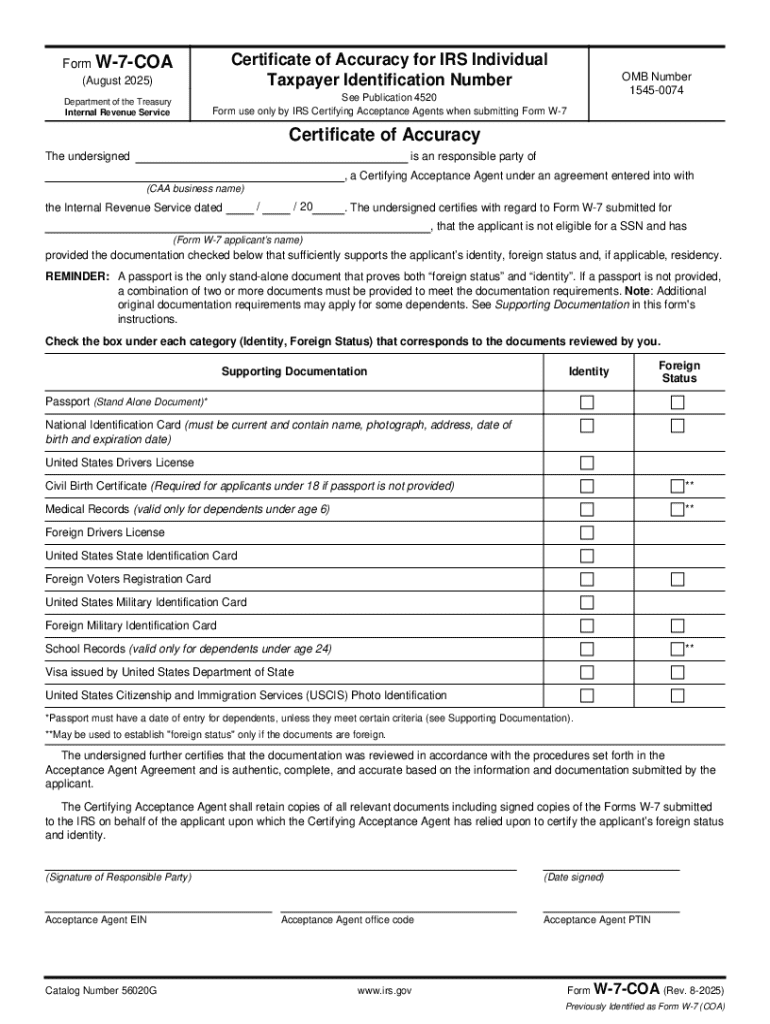

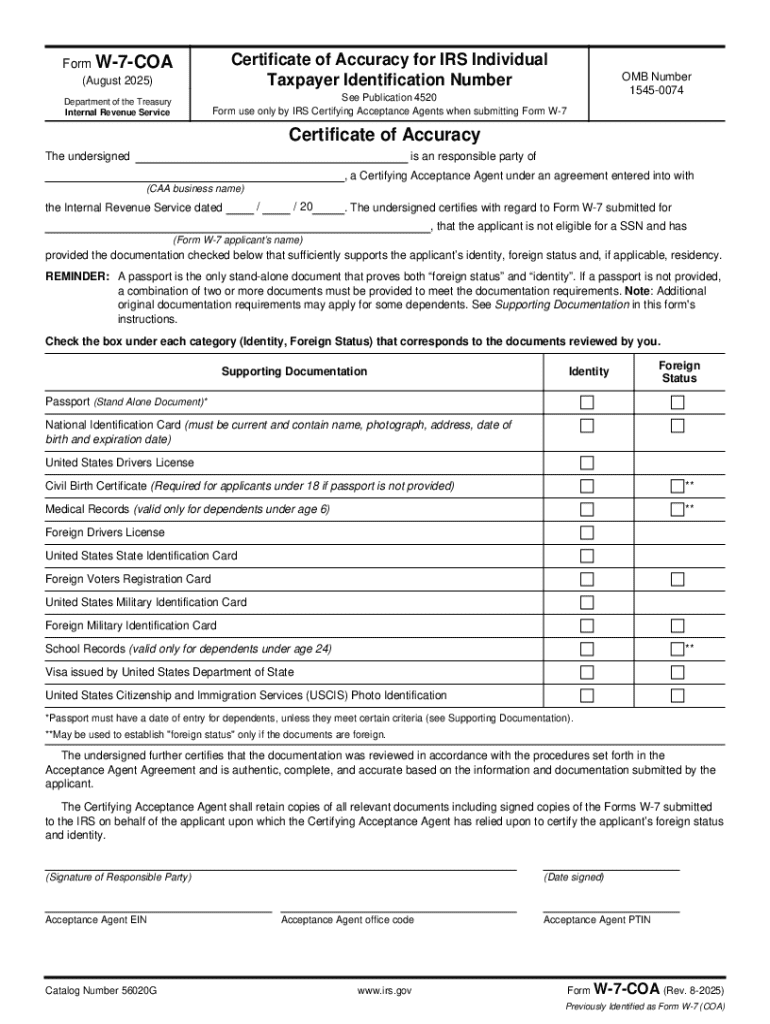

Understanding the Form W-7-COA rev 8-2025 Form

Understanding the W-7-COA Form

The W-7-COA Form is an essential document used for specific tax-related purposes within the United States, primarily focusing on the needs of individuals who do not qualify for a Social Security Number (SSN). This form serves as the application for Individual Taxpayer Identification Numbers (ITINs) and is crucial for those looking to file taxes, claim benefits, or comply with U.S. tax laws. Its role cannot be understated as it facilitates tax reporting and ensures compliance with IRS regulations.

For both individuals and teams, the W-7-COA Form is an integral part of the tax filing process. The proper completion and submission of this form enable non-resident aliens and their dependents to meet their tax obligations. The importance of this form extends beyond mere compliance; it represents an opportunity for many individuals to access benefits that might otherwise be out of reach.

Who needs to use the W-7-COA Form?

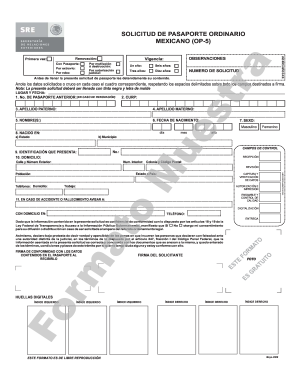

The W-7-COA Form is specifically intended for individuals who do not possess a valid SSN but need to meet tax duties. This includes non-resident aliens and their dependents who require an ITIN for taxation purposes. Typical use cases involve foreign students, expatriates, and individuals claiming a tax benefits or credits under specific tax treaties.

Detailed overview of the W-7-COA Form

The W-7-COA Form is structured to elicit detailed information from applicants. Key features of this form include various sections aimed at collecting personal details, reasons for applying, and any additional pertinent information necessary to process the application accurately. Understanding these sections is critical to ensuring successful completion.

The financial landscape is constantly evolving, influencing revisions made to forms like the W-7-COA. In the 8-2025 revision, several adjustments were made to streamline the data collection process. These changes reflect feedback from stakeholders and align with current best practices related to document submissions within the IRS framework.

Understanding the revision history

The revision history of the W-7-COA Form provides insight into how it has been tailored to meet changing regulations and best practices. The 8-2025 version incorporates specific formatting changes designed to improve clarity and ease of use. Notably, these adjustments can impact how the form is utilized, necessitating that applicants are aware of the latest version to avoid processing delays.

Step-by-step guide to filling out the W-7-COA Form

Before diving into the details of filling out the W-7-COA Form, it's essential to prepare the required documents and information. Essential documents typically include a government-issued identification, tax documentation, and proof of residency or current status in the U.S. To streamline the process, it’s advisable to gather this information beforehand.

Pre-filling considerations

Collecting necessary materials ahead of time not only speeds up the process but minimizes errors. Familiarize yourself with the exact requirements specified by the IRS regarding documentation to avoid potential complications during submission.

Step 1: Personal information

The personal information section of the W-7-COA Form requires careful attention. Applicants should include their full name, date of birth, and address. Common mistakes here include typos or inconsistencies with the information provided in supporting documents. Always double-check this section to ensure accuracy.

Step 2: Reason for applying

Selecting the appropriate reason for applying is pivotal, as it can influence the processing of your application. Common reasons include filing a U.S. tax return or receiving federal benefits. Be sure to review each option carefully and select the one that aligns best with your situation.

Step 3: Additional information

In the additional information section, you may need to provide further context about your application. This could include details of any connections to U.S. businesses or other relevant details. Providing complete and accurate information here ensures your application is processed smoothly.

Step 4: Signature and date

It's crucial to sign and date the W-7-COA Form to validate your submission. The signature affirms the accuracy of the information provided, and omitting it can result in processing delays. Always double-check that your signature aligns with those on your identification and supporting documents.

Editing and reviewing your W-7-COA Form

Utilizing tools such as pdfFiller can significantly streamline the editing of your W-7-COA Form. With interactive features allowing for smooth changes, users can readily collaborate with team members or stakeholders to ensure all details are correct. This collaboration is beneficial, particularly in scenarios involving multiple applicants.

Common pitfalls to avoid include overlooking mandatory fields or submitting an outdated version. Review your form thoroughly before final submission — this can prevent rejection or delays in processing your application.

Submitting the W-7-COA Form

When ready to submit your W-7-COA Form, it’s important to understand the available options for submission. The form can typically be sent electronically or via traditional mail, though electronic submission is increasingly preferred for its speed and efficiency. Required documents, such as proof of identity, should accompany the form to ensure comprehensive processing.

After submission, applicants should anticipate a certain processing time, which can range from several weeks to months, depending on various factors. To monitor your application, keep an eye on your email for any updates or confirmation notices that the IRS may send regarding your submission.

Managing and tracking your W-7-COA Form

Utilizing pdfFiller for document management provides cloud-based solutions, allowing you to access your W-7-COA Form with ease. This advantage ensures that you can retrieve your documents anytime, anywhere, enhancing your overall experience with document management. Benefits include easy sharing and collaboration among team members as needed.

To stay informed post-submission, take advantage of tracking options. Engage with email notifications or use tracking numbers, if applicable, to follow up on your form. Keeping proactive communication can help ease concerns about your application's status.

Troubleshooting common issues with the W-7-COA Form

Common issues applicants face often revolve around delays during processing or missing documentation. To address these issues effectively, ensure you have all required documents submitted correctly, as incomplete submissions are a leading cause of processing slowdowns.

For more complex issues, contacting support is essential. The IRS provides resources and guidelines on how to communicate with their representatives effectively. Detailing your issue and referring to relevant documentation can lead to quicker resolutions.

Real-life scenarios and examples

Success stories around W-7-COA submissions often highlight the uniqueness of individual experiences. One applicant from Colorado shared how timely submission of the W-7-COA Form allowed them to benefit from certain tax credits they were unaware they qualified for due to their residency status.

Conversely, others have encountered challenges—ranging from missed deadlines to missing documentation. These experiences underscore the importance of meticulous attention to detail and thorough preparation when engaging with such essential forms.

Engaging with the pdfFiller community

Connecting with others who are navigating the intricacies of the W-7-COA Form can provide valuable insights. Engaging in discussions within the pdfFiller community allows users to share tips and experiences that may lead to improved form management practices. This dialogue is vital for those looking to optimize their document handling strategies.

Leverage community insights to better understand common barriers and learn from challenges faced by peers. This shared knowledge fosters an environment of support and resourcefulness, essential for efficient document management.

Closing thoughts on the W-7-COA Form and pdfFiller

Understanding the W-7-COA Form is more than just filling out an application; it’s about navigating the complexities of tax obligations in a modern, digital age. pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage their documents, fostering an efficient and stress-free experience.

The advantages of digital tools for document management cannot be overstated. With the ever-evolving landscape of fiscal responsibilities, embracing these tools will ensure that users are not only compliant but also well-informed and prepared for any situation that may arise in their document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS W-7 COA?

Can I create an electronic signature for signing my IRS W-7 COA in Gmail?

How do I fill out IRS W-7 COA on an Android device?

What is form w-7-coa rev 8-2025?

Who is required to file form w-7-coa rev 8-2025?

How to fill out form w-7-coa rev 8-2025?

What is the purpose of form w-7-coa rev 8-2025?

What information must be reported on form w-7-coa rev 8-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.