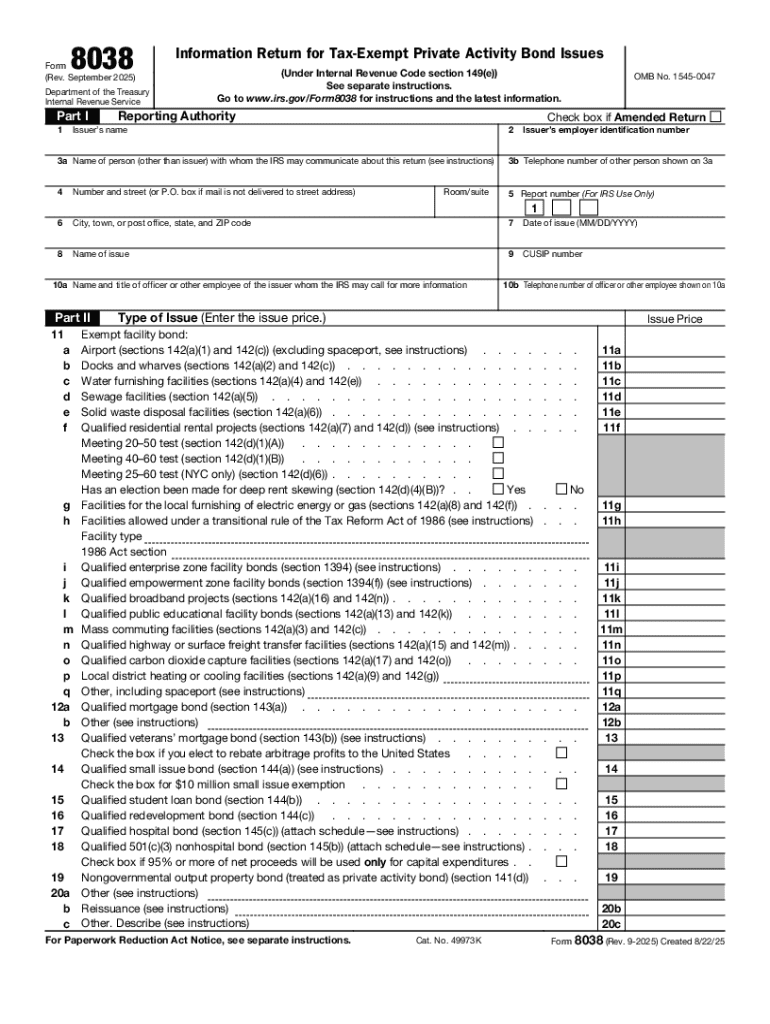

IRS 8038 2025-2026 free printable template

Get, Create, Make and Sign irs form 8038

How to edit IRS 8038 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8038 Form Versions

How to fill out IRS 8038

How to fill out form 8038 rev september

Who needs form 8038 rev september?

Understanding Form 8038 Rev September: A Comprehensive Guide

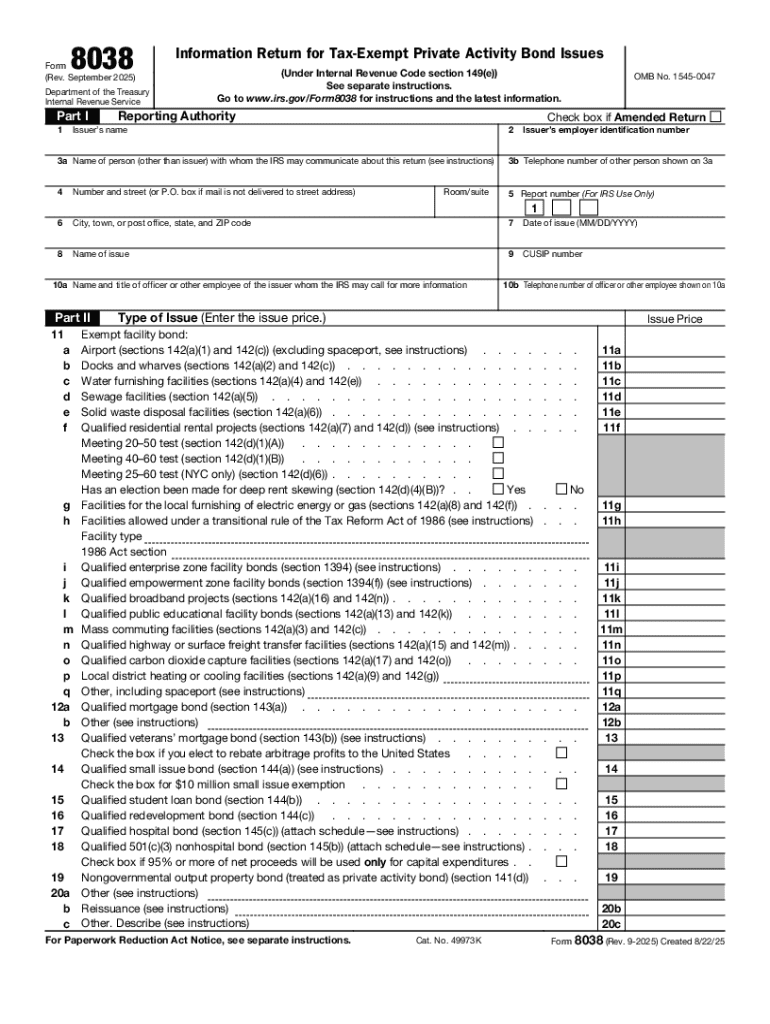

Overview of Form 8038 Rev September

Form 8038, specifically the Rev September version, is a crucial document utilized by issuers to report information regarding tax-exempt bonds to the IRS. This form is pivotal for maintaining compliance with federal tax laws concerning the issuance of bonds, particularly those classified under the category of 'activity bonds.'

Its importance in financial reporting cannot be overstated. Issuers include governmental and non-profit entities using bond financing for various projects, such as infrastructure or broadband projects. Accurately completing and submitting this form ensures that these issuers remain compliant and avoid penalties.

Key features and updates in the Rev September version

The Rev September version of Form 8038 introduces a series of modifications aimed at improving both the accuracy and ease of filing. Notable changes from previous iterations include refinements in section categorizations to enhance clarity for users. These updates address the compliance requirements set forth by the IRS, which continue to evolve alongside the financial landscape.

Moreover, the revamped form emphasizes a streamlined approach, allowing issuers to input key details without excessive redundancy. This enhances the overall filing efficiency, making it easier to meet IRS reporting requirements and minimize errors.

Filing deadlines: What you need to know

Filing Form 8038 is time-sensitive. Key deadlines typically align with the date of bond issuance, with specific timelines established by the IRS. For the tax year 2025, it is essential for issuers to document and report their bond issues promptly to avoid penalties.

Missing these deadlines can result in penalties, which could significantly impact the financial health of an issuer. To remain compliant, issuers should be proactive about tracking crucial filing dates and setting internal reminders well in advance of these deadlines.

Step-by-step guide to completing Form 8038

Completing Form 8038 requires careful attention to detail. It is critical to gather all necessary information and documentation beforehand to streamline the process. The form comprises several sections, each designed to capture essential data that reflects the issuer's bond details.

Beginning with Page 1, issuers must provide basic information, including the name and description of the issuer, type of bond, and the amount issued. On Page 2, financial details such as projected sources of repayment and debt service coverage ratios are recorded. Page 3 emphasizes compliance with IRS regulations, detailing required documentation.

Common mistakes include providing inaccurate bond types or financial information. Utilizing interactive fillable features on platforms like pdfFiller can help mitigate these issues.

Filing options: Where and how to submit Form 8038

Submitting Form 8038 can be accomplished through various means, but understanding IRS guidelines on where to file is essential. Issuers can opt for electronic filing, particularly through platforms like pdfFiller, which offers numerous benefits such as convenience and immediacy.

For those who prefer traditional paper filing, understanding the mailing protocols is crucial. The correct address must be used to ensure timely processing of submissions. Electronic submissions not only expedite the filing process but also reduce the chances of filing errors through built-in validation checks.

Recent developments: Key changes affecting your filing

Legislative changes continuously impact the compliance landscape for Form 8038. Monitoring these changes is critical for issuers, as IRS announcements can introduce new requirements or modify existing guidelines affecting the way filings are processed.

Recent IRS pronouncements emphasize the need for accurate reporting and can lead to enhanced scrutiny if compliance is not achieved. As we look to the future, staying abreast of expected changes and advancements in IRS procedures will play an essential role in effective bond issue management.

Tips for successful submission and document management

To maximize the chances of successful submission, issuers should embrace organizational strategies that enhance reporting accuracy. Engaging tools like pdfFiller’s collaboration features allow teams to work together efficiently, ensuring every detail is checked and validated before submission.

Moreover, using eSignature options simplifies the signing process, enabling quicker transaction closures. This can greatly enhance the speed and efficiency of document management, which is vital for maintaining compliance in fast-paced financial environments.

Troubleshooting common issues with Form 8038

Even with meticulous attention to detail, issues may arise when submitting Form 8038. Common questions often relate to the proper completion of sections or how to respond to IRS rejections. When faced with rejections, issuers should understand the common reasons cited and prepare to provide additional information promptly.

For further assistance, resources such as IRS contact centers and professional experts can provide guidance tailored to specific situations. Addressing these issues diligently will lead to smoother filings in subsequent years.

Maximizing efficiency in document management with pdfFiller

pdfFiller enhances the document creation experience with features designed for ease of use. Users benefit from cloud-based solutions that allow access to forms anytime, anywhere, streamlining workflows dramatically. The platform also offers powerful collaboration features, enabling team members to edit, share, and sign forms efficiently.

By harnessing these features, organizations can experience increased productivity and reduced time spent on administrative tasks. Case studies demonstrate that companies utilizing pdfFiller are able to navigate the complexities of forms like the Form 8038 Rev September more effectively.

Preparing for future filing seasons

As the financial landscape changes, so too do the best practices for maintaining compliance year-round. Organizations should establish a routine for reviewing changes in IRS regulations, particularly those affecting Form 8038, to avoid unpleasant surprises during filing season.

Integrating tools provided by pdfFiller can further future-proof the filing process, ensuring organizations remain on the cutting edge of compliance requirements. This proactive approach ensures that institutions can adapt to regulatory changes smoothly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 8038 from Google Drive?

Where do I find IRS 8038?

How do I make changes in IRS 8038?

What is form 8038 rev september?

Who is required to file form 8038 rev september?

How to fill out form 8038 rev september?

What is the purpose of form 8038 rev september?

What information must be reported on form 8038 rev september?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.