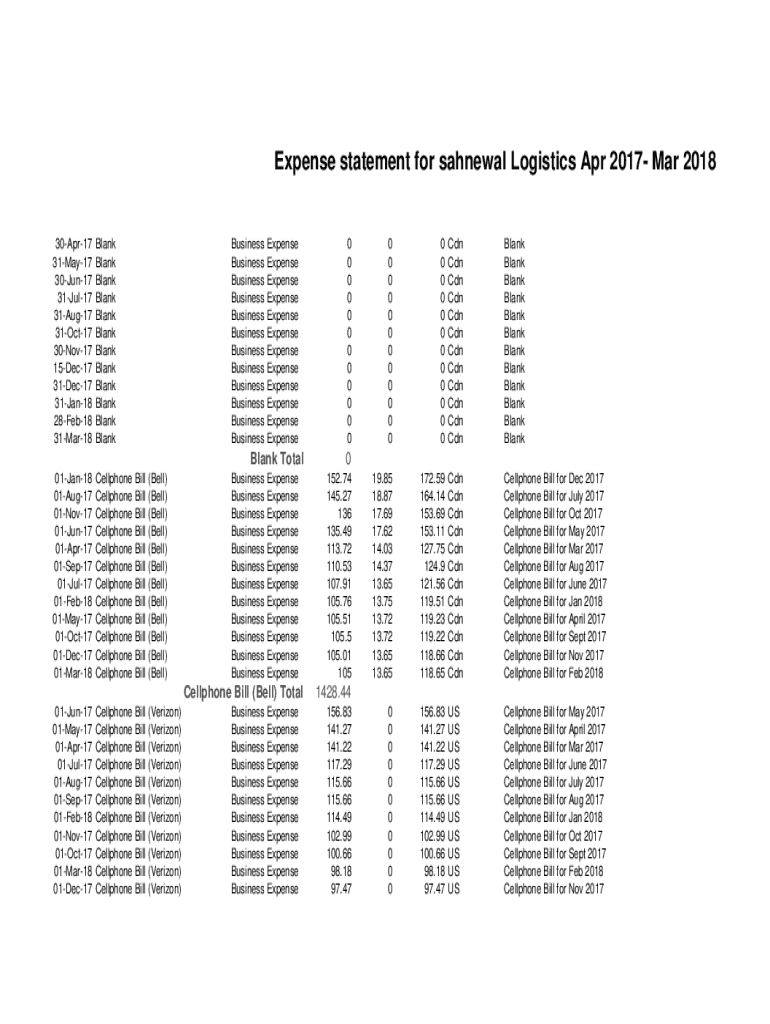

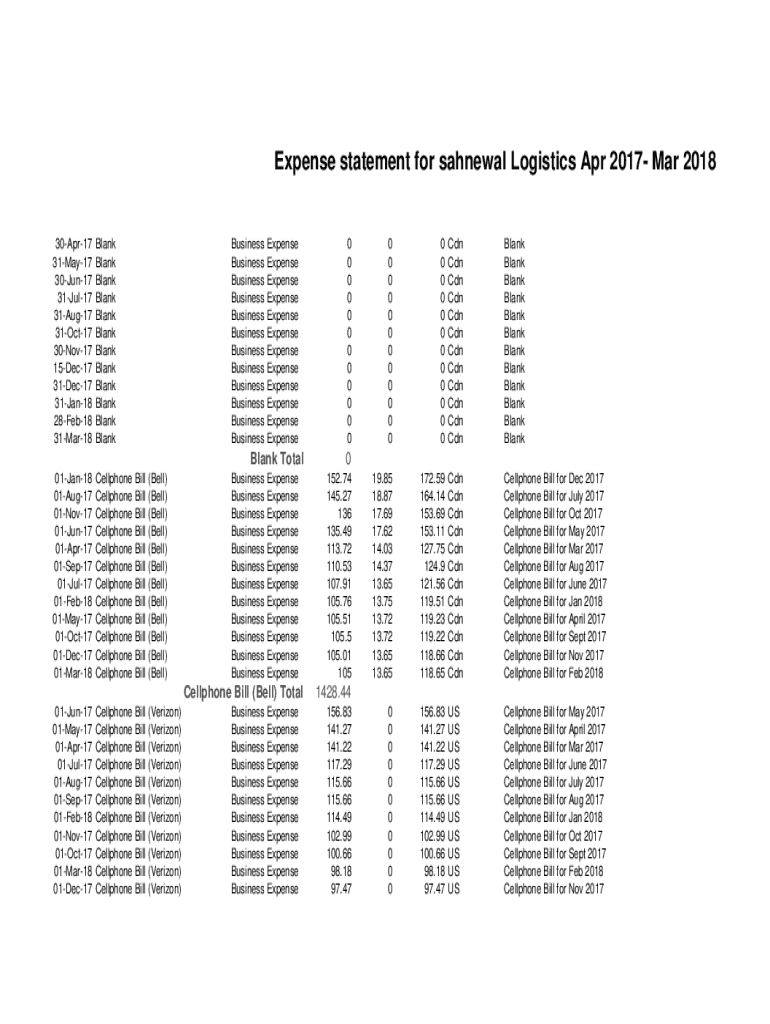

Get the free Expense statement for sahnewal Logistics Apr 2017- Mar 2018

Get, Create, Make and Sign expense statement for sahnewal

How to edit expense statement for sahnewal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out expense statement for sahnewal

How to fill out expense statement for sahnewal

Who needs expense statement for sahnewal?

Expense Statement for Sahnewal Form: A Comprehensive Guide

Understanding the expense statement for Sahnewal

An expense statement serves as a formal record that details the business-related expenditures incurred by individuals or teams while performing their job responsibilities. In Sahnewal, accurate reporting of expenses is not just a best practice; it's essential for maintaining budgetary constraints and ensuring compliance with local financial regulations. The clarity provided by a well-prepared expense statement can also simplify the process of reimbursement, making it easier for employees to get their due payouts in a timely manner.

One significant value of maintaining an accurate expense statement is its role in minimizing errors and potential fraudulent claims. Moreover, accurate records not only result in smoother accounting processes but also provide crucial insights when reviewing overall spending trends. This, in turn, assists businesses in strategizing their financial outlook.

Essential components of the Sahnewal expense statement

Every comprehensive expense statement for Sahnewal must include critical information that provides an accurate breakdown of all expenditures. This typically starts with the individual's personal information like their name, address, and contact details. Following this, the statement should include the specific date when the expenses were incurred and the purpose of those expenses, as this clarifies the context for each item listed.

A significant part of the expense statement is the itemized list of expenses. This section should categorize different types of expenses, such as travel, meals, lodging, and other necessary costs associated with the job. Furthermore, it is vital to include supporting documents like receipts and invoices to substantiate the claims made in the statement.

Step-by-step guide to filling out the Sahnewal expense statement

To effectively complete an expense statement for Sahnewal, start by gathering all necessary documents such as invoices, receipts, and a record of past expenses. Having these documents at your disposal will make the process smooth and accurate.

Next, you'll need to access the Sahnewal form, which is conveniently available through pdfFiller. Simply locate the form online, download it, and use the online editing tools to fill it out seamlessly.

When completing the form, pay meticulous attention to each section. Ensure accurate totals and calculations to avoid discrepancies. It’s helpful to double-check your entries against your receipts.

Finally, conduct a thorough review of the expense statement before submission. Look for errors or missing information with a detailed checklist to confirm completeness.

Editing and modifying the expense statement

Using pdfFiller's editing tools allows users to adjust the expense statement efficiently. You can add sections or remove redundant items quickly, ensuring that the document remains relevant and compliant with the established guidelines.

To ensure your edited document still meets local regulations, remember to adhere to best practices, such as providing clear explanations for modifications made and keeping backup versions of the initial document for reference.

eSigning your expense statement

An expense statement gains validity and recognizes the commitment to the reported expenditures through signatures. With pdfFiller, eSigning is straightforward and saves time. Once your document is complete, you can employ the eSigning feature to authenticate your expense statement digitally.

To eSign, follow the step-by-step instructions provided by pdfFiller to ensure your signature validates correctly. Pay attention to any prompts that guide you through confirming the authenticity and legality of your eSignature.

Collaborative features for team use

The collaborative features of pdfFiller empower teams to share expense statements efficiently. This can enhance communication and facilitate easier approval processes by enabling team members to input relevant information and feedback directly on the document.

Utilizing collaborative tools fosters an interactive environment where changes and comments can be tracked effortlessly. This minimizes confusion over edits and ensures that every contribution is accounted for.

Managing your expense statements efficiently

With a cloud-based document management system like pdfFiller, organizing your forms and statements becomes significantly easier. Users can categorize their expense statements, ensuring they have quick access to needed documents without digging through piles of paperwork.

For optimal efficiency, develop a system for storing and retrieving past statements. This approach not only aids in keeping records in order but also prepares you for potential audits or financial reviews in the future.

Troubleshooting common issues

Even the most diligent individuals can encounter challenges when preparing expense statements. Common errors usually involve mismatched receipts, incorrect totals, or unclear categorizations of expenses. Being aware of these pitfalls can help in minimizing mistakes.

For any technical issues faced while using pdfFiller, resources are available for troubleshooting or user support. Familiarizing yourself with these resources will enhance your document management experience.

Compliance and submission of your expense statement

Understanding the timing and proper channels for submission is paramount. Different regions may have unique deadlines, and missing them could lead to delays in reimbursements or potential financial issues for your organization.

Timely submission ensures that your expense statement aligns with budget cycles and financial reporting schedules. Security is another essential consideration; utilizing a secure platform like pdfFiller for submission lowers the risk of sensitive information being compromised.

Additional features of pdfFiller relevant to expense management

Apart from the basic functionalities for managing expense statements, pdfFiller offers advanced features that further simplify document management. These features can include customizable templates tailored to specific needs, collaborative editing options, and efficient archiving solutions.

By leveraging the capabilities of a cloud-based platform, users benefit from enhanced flexibility and accessibility, allowing for direct access to important documents from any device without compromising security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the expense statement for sahnewal electronically in Chrome?

How do I fill out the expense statement for sahnewal form on my smartphone?

Can I edit expense statement for sahnewal on an iOS device?

What is expense statement for sahnewal?

Who is required to file expense statement for sahnewal?

How to fill out expense statement for sahnewal?

What is the purpose of expense statement for sahnewal?

What information must be reported on expense statement for sahnewal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.