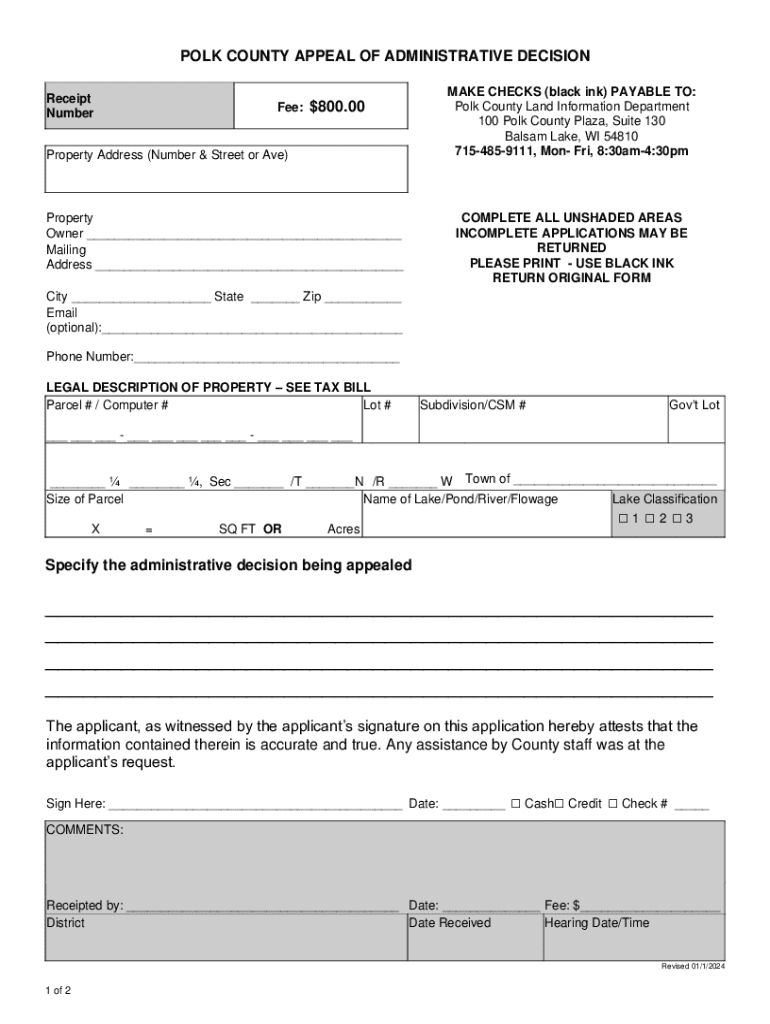

Get the free Fee: $800

Get, Create, Make and Sign fee 800

Editing fee 800 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fee 800

How to fill out fee 800

Who needs fee 800?

Your Comprehensive Guide to the Fee 800 Form

Understanding the Fee 800 form

The Fee 800 form is a critical document used by corporations to report their estimated franchise taxes to the state authorities. This form is primarily intended for shareholders who manage or operate a business, especially corporations. By filing the Fee 800, businesses ensure compliance with state tax regulations and help avoid potential penalties that could arise from late submissions. It's essential for both small businesses and large corporations alike, ensuring they meet their financial obligations to maintain good standing with the state.

Timely filing of the Fee 800 form is crucial, as missing deadlines can result in significant financial ramifications, including late fees and interest on unpaid amounts. Given these stakes, understanding the process and requirements surrounding the Fee 800 becomes necessary for business owners and corporate officers. This guide is tailored for individuals and teams seeking a comprehensive, accessible solution for document management and specific insight into the Fee 800 form.

Key features of the Fee 800 form

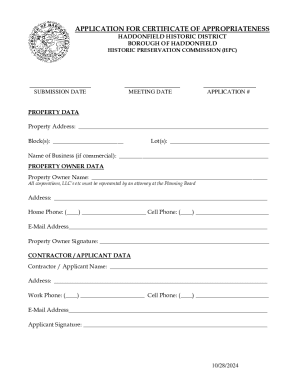

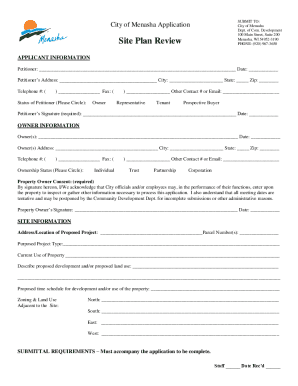

The Fee 800 form comprises several structured sections aimed at facilitating the accurate reporting of a corporation's financial particulars. Each section is designed to collect specific information essential for estimating the franchise tax. Key features include identification details such as the name and taxation identification of the corporation, along with an outline of its financial activity during the reporting period.

Among the critical components of the form are sections dedicated to financial information, certifications, and signatures. Specialized terminology such as "franchise tax," "estimated payments," and "reporting year" frequently appears, and understanding these terms is key to completing the form correctly. Successfully navigating these sections increases the chances of a timely and accepted submission.

Step-by-step guide to filling out the Fee 800 form

Preparation

Before diving into the completion of the Fee 800 form, preparation is critical. Begin by gathering all necessary documents, including financial statements and any previous tax filings. Understanding your business’s revenue estimates for the upcoming year will also ensure you input accurate numbers.

Additionally, determine if you need to submit any supplementary forms along with the Fee 800. Depending on the corporation’s status or if there have been any changes, you may require additional documentation that clarifies the financial situation or provides supplemental details.

Completing the form

To fill out the Fee 800 form accurately, follow this detailed walkthrough for each section:

Keep in mind that attention to detail is essential. Mistakes in this section can delay the processing of the form or even lead to rejections from the state's tax authority.

Common mistakes to avoid

When filling out the Fee 800 form, several common pitfalls can lead to complications. Avoiding these mistakes will enhance the likelihood of a smooth submission process. Here are some critical errors to watch out for:

Double-checking all entries and possibly consulting with a tax professional can also help ensure everything is accurate and complete.

Interactive tools for the Fee 800 form

Utilizing online tools can significantly streamline the process of completing the Fee 800 form. One prominent tool is pdfFiller, which offers a range of interactive features. Users can take advantage of its sophisticated editor, which allows for seamless form filling and ensures that all necessary fields are completed correctly. This tool enables users to input data directly into the form and make edits as needed swiftly.

Moreover, within pdfFiller, digital signature tools enhance the efficiency and security of submitting your Fee 800 form. By allowing electronic signatures, users can expedite the approval process without the need for physical document handling. This innovation not only saves time but also facilitates a more efficient communication experience between shareholders and state authorities.

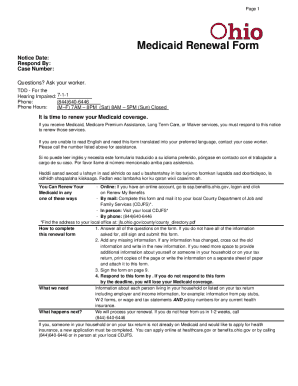

Managing your Fee 800 submission

Once you’ve completed the Fee 800 form, the next step is submitting it correctly. Ensure you follow all submission guidelines provided by your state’s tax authority. This may include specific formats for electronic submissions or mailing addresses for physical forms. Adhering to these guidelines is vital to avoid processing delays.

After submission, it’s essential to understand the follow-up process and timelines. Some states provide confirmations of receipt while others may take longer to process the application. Keep an eye on the timelines mentioned by your state to track your submission effectively. Additionally, utilizing tools from pdfFiller allows you to monitor the stages of your submission whether submitted remotely or in-person.

FAQs regarding the Fee 800 form

Filing the Fee 800 form raises several questions among individuals and corporate shareholders. Here are some frequently asked queries that may help clarify the process:

Conclusion and final tips

Successfully filing the Fee 800 form requires careful preparation and a thorough understanding of each requirement. Ensure that you gather all relevant documents, complete each section carefully, and double-check your entries to avoid common mistakes. Leveraging online tools from pdfFiller can simplify the entire process, from filling to submission, making compliance manageable and efficient.

Always be proactive in tracking the status of your submission and remain informed about deadlines to mitigate any potential issues. Remember that resources and support are available to assist you throughout this process, ensuring you can focus on running your business optimally.

Additional considerations

In some cases, the intricacies of the Fee 800 form may call for professional guidance. Consider seeking help if your corporation has undergone significant changes, such as alterations in corporate status, which could necessitate different submissions or additional forms. Consulting with a tax professional can provide tailored advice, ensuring compliance while optimizing your tax obligations.

Recognizing these special circumstances is essential for business leaders and shareholders. Taking proactive steps in understanding filing requirements will safeguard your corporation’s standing and financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fee 800?

Can I create an electronic signature for signing my fee 800 in Gmail?

How do I fill out the fee 800 form on my smartphone?

What is fee 800?

Who is required to file fee 800?

How to fill out fee 800?

What is the purpose of fee 800?

What information must be reported on fee 800?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.