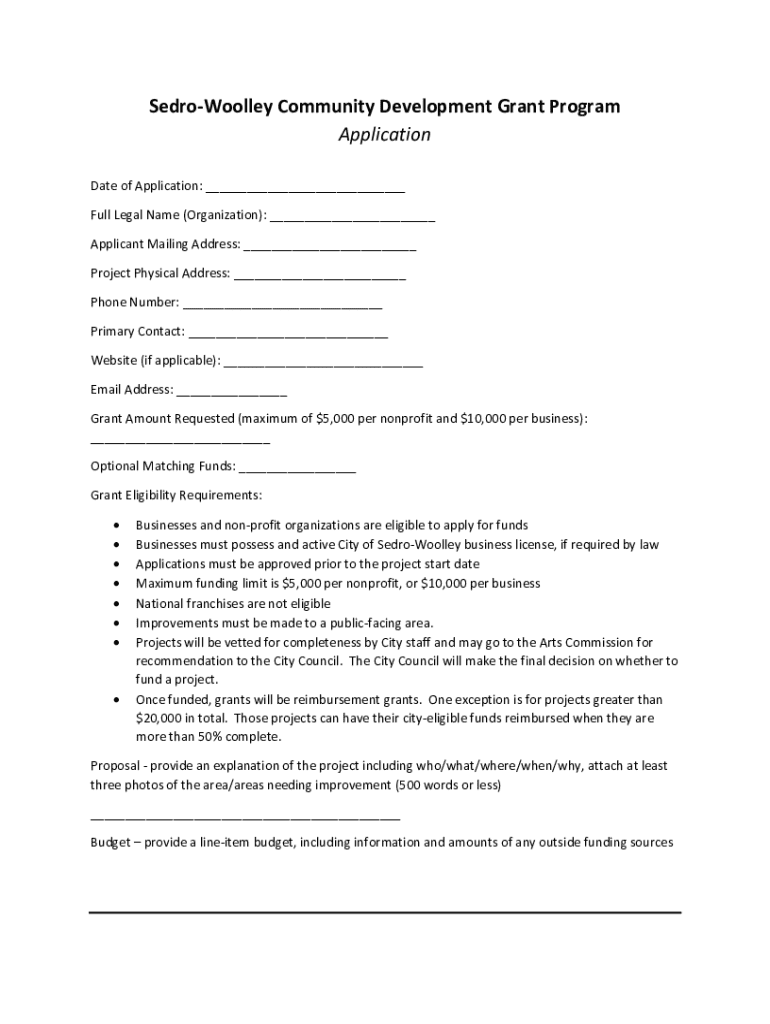

Get the free 9% LIHTC Addendum Forms (Excel)

Get, Create, Make and Sign 9 lihtc addendum forms

How to edit 9 lihtc addendum forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 9 lihtc addendum forms

How to fill out 9 lihtc addendum forms

Who needs 9 lihtc addendum forms?

Comprehensive Guide to 9 LIHTC Addendum Forms

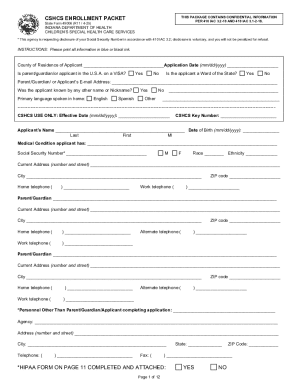

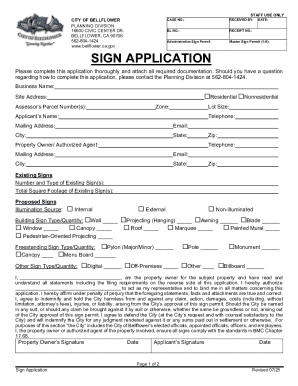

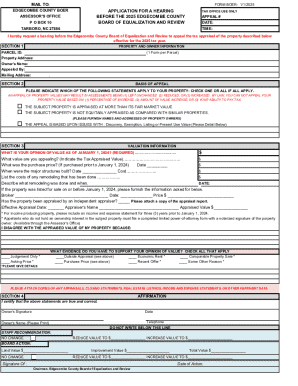

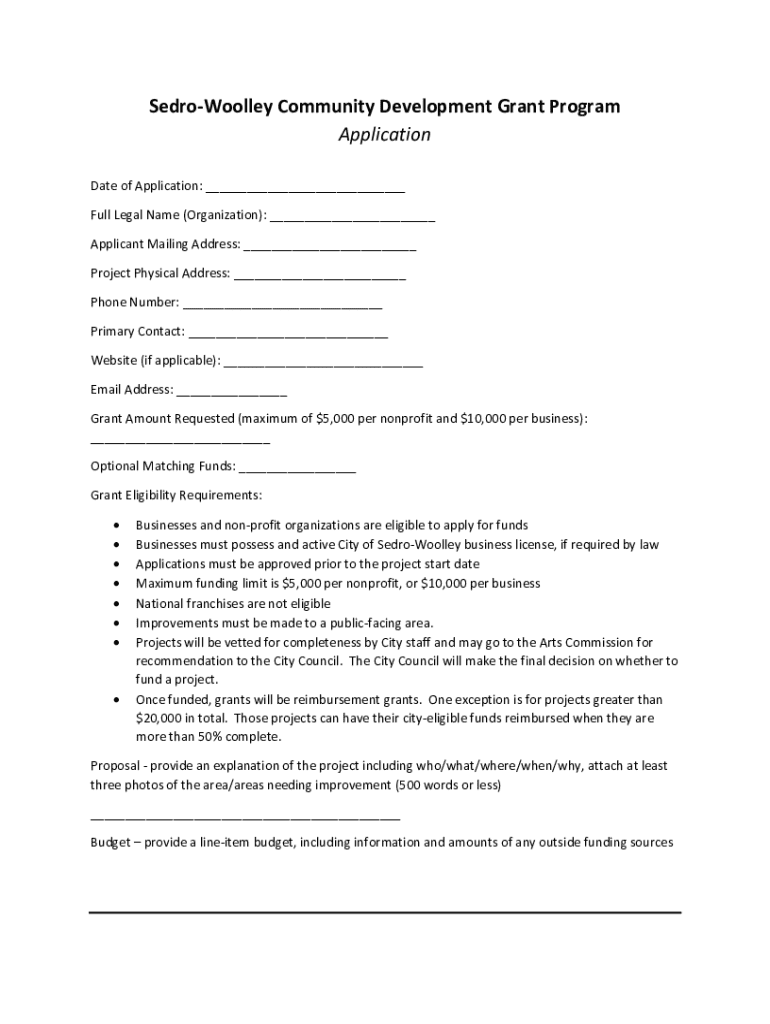

Understanding the 9 LIHTC addendum forms

The Low-Income Housing Tax Credit (LIHTC) program incentivizes private sector investment in affordable housing projects. Understanding how to navigate the complexities of the various paperwork, including the nine specific LIHTC addendum forms, is crucial for compliance. These forms are essential for documenting tenant eligibility, income certification, and ongoing compliance with federal and state regulations surrounding low-income housing.

The nine LIHTC addendum forms serve as critical tools for property owners, managers, and tenants alike. They provide a structured framework for maintaining compliance, ensuring that all parties involved are aligned on the requirements and processes involved in administering LIHTC properties. Each of these addendum forms serves a distinct purpose, which can significantly affect project outcomes and tenant experiences.

Essential components of each LIHTC addendum form

A closer look at each of the nine LIHTC addendum forms reveals their specific purposes and requirements. Here's a breakdown of each form, including essential fields that need to be filled out for compliance.

How to fill out LIHTC addendum forms

Filling out LIHTC addendum forms requires careful preparation and attention to detail. Before diving into the forms, gather necessary documentation such as income verification sources (pay stubs, tax returns), eligibility criteria, and any previously submitted forms. Understanding the specific requirements for each tenant is critical to mitigate errors during the completion process.

A step-by-step instruction for each form is pivotal, as filling out these forms improperly could result in compliance issues. Here are some notable tips: double-check the income information for accuracy, make sure all signatures are present where necessary, and maintain copies of all completed forms along with the supporting documents. Leveraging tools like pdfFiller can streamline the process by allowing real-time edits and collaborative features, preventing many common pitfalls associated with traditional paper forms.

Managing your LIHTC forms

Managing LIHTC forms has become increasingly efficient with digital tools. Platforms such as pdfFiller provide cloud-based access, allowing you to store, edit, and eSign documents from anywhere. This flexibility is critical for teams that may be working remotely or in different locations, enhancing collaboration.

Best practices for managing LIHTC forms include regular updates to document templates that reflect any changes in regulations, ensuring that all team members are on the same page regarding document versions, and using dedicated folders for easy access to forms. Familiarizing yourself with the electronic signature process also promotes efficiency, making it easier for tenants and management to complete necessary documentation without delays.

Collaborating with teams on LIHTC documentation

Collaboration is vital when managing LIHTC documentation due to the range of requirements and stakeholders involved. Utilizing tools that allow real-time editing and commentary can improve the accuracy and completeness of forms, ensuring that all voices are heard in the process. Cloud-based platforms not only facilitate easy document sharing but also protect sensitive information which is essential when dealing with tenant data.

To enhance compliance efforts, establish clear roles for team members, detailing who is responsible for which parts of the forms. Consider implementing checklists that can guide team members in filling out specific sections of each form, preventing any oversight that could compromise compliance.

Common challenges with LIHTC addendum forms

Managing LIHTC addendum forms is often fraught with challenges that can impede compliance. Common issues include misunderstanding form requirements, missing documentation, and miscommunication among team members. Delays in the process can lead to missed deadlines, which may jeopardize funding and tax credits for housing projects.

Solutions to these problems involve regular training for staff on the latest regulations, maintaining an active project list, and utilizing checklists to verify form completion. Establishing a centralized resource for consulting with legal experts can provide additional support to navigate complex situations, ensuring compliance with HUD, state, and local regulations.

Keeping up-to-date with compliance requirements

Remaining informed about compliance requirements is essential in the ever-evolving landscape of LIHTC regulations. This involves regularly reviewing industry publications, attending relevant workshops, and participating in webinars focused on compliance updates. Tax credit allocation plans and adjustment to local regulations can impact how addendum forms are filled out.

Utilizing platforms like pdfFiller offers added value by providing real-time updates on compliance requirements. Being able to access the latest tips and guidelines can save teams significant time, ensuring that documentation is kept current and aligned with what is required by regulatory bodies, ultimately safeguarding your projects against compliance risks.

Utilizing pdfFiller for a seamless experience

pdfFiller stands out as an innovative cloud-based solution that simplifies the process of managing LIHTC addendum forms. With features like document editing, electronic signing, and real-time collaboration, users can effortlessly prepare and manage their forms from virtually anywhere. This level of accessibility can significantly reduce the potential for errors in documentation, enhancing compliance.

Real-life testimonials showcase the efficiency experienced by teams that leverage pdfFiller. The platform's seamless integration with collaborative tools ensures that everyone involved in the document creation process can contribute and remain updated. This collaborative environment not only streamlines the completion of LIHTC addendum forms but also enhances user satisfaction and confidence in the completeness and accuracy of submissions.

FAQs about LIHTC addendum forms

When navigating LIHTC addendum forms, users often have key questions regarding timelines, required documentation, and compliance necessities. It's crucial to clarify these points to prevent delays and inaccuracies. For example, how often should forms be submitted? Generally, annual submissions are required for tracking tenant income and compliance. However, submitting certain forms, such as the tenant eligibility addendum, may be necessary at the onset of tenancy.

Addressing these common queries upfront allows teams to operate smoothly and ensure that compliance requirements are fully understood. By consolidating questions into a dedicated FAQ section, users can seek guidance effectively without disrupting workflow, ensuring that every aspect of the LIHTC addendum process is managed efficiently from start to finish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 9 lihtc addendum forms online?

Can I edit 9 lihtc addendum forms on an iOS device?

Can I edit 9 lihtc addendum forms on an Android device?

What is 9 lihtc addendum forms?

Who is required to file 9 lihtc addendum forms?

How to fill out 9 lihtc addendum forms?

What is the purpose of 9 lihtc addendum forms?

What information must be reported on 9 lihtc addendum forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.