Get the free 2019 Illinois Land Values and Lease Trends

Get, Create, Make and Sign 2019 illinois land values

How to edit 2019 illinois land values online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2019 illinois land values

How to fill out 2019 illinois land values

Who needs 2019 illinois land values?

2019 Illinois Land Values Form: A Comprehensive Guide

Overview of the 2019 Illinois Land Values Form

The 2019 Illinois Land Values Form serves as a crucial document for landowners and agricultural stakeholders throughout Illinois. Its primary purpose is to report the value and classification of land holdings, allowing for fair and accurate assessment for taxation purposes. This form plays a vital role in determining property evaluations, which ultimately influences property taxes and the broader economic condition of the agricultural sector. Evaluating land values not only impacts individual landowners but also contributes to the state’s overall agricultural policy and economic landscape.

In 2019, the form underwent significant updates to better reflect the current agricultural trends and economic conditions in Illinois. Changes were designed to enhance clarity and accuracy, ensuring that users could more easily provide essential information. The updated form also incorporates new data fields to account for emerging land use practices, thereby aligning with contemporary farming methods and policies.

Understanding land values in Illinois

Various factors have been influencing land values in Illinois throughout 2019. Key factors include market demand, crop yield trends, and external economic conditions affecting agriculture. For instance, the ongoing developments in agricultural technologies have driven some landowners to invest in improved farming techniques, increasing demand for high-quality farmland. Moreover, federal policies impacting trade and commodity prices can swiftly alter expectations around land values, making it crucial for stakeholders to stay informed.

Examining historical trends provides insight into how land values have evolved over time. Over the past decade, land values in Illinois have experienced fluctuations largely dependent on commodity prices, weather patterns, and conservation practices. Understanding these historical shifts allows landowners to anticipate market changes and strategically position themselves within the agricultural landscape.

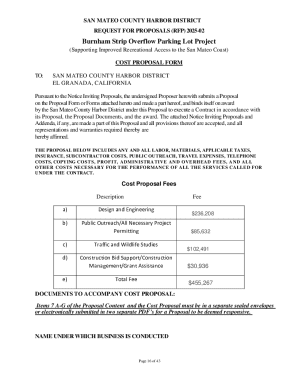

Detailed breakdown of the 2019 Illinois Land Values Form

The 2019 Illinois Land Values Form is structured into several key sections that facilitate the collection of pertinent information from landowners. A thorough understanding of each section is critical for ensuring accurate reporting. The form opens with the Landowner Information section, where individuals must provide personal details, including contact information and ownership status.

Next, the Property Details section requires specific information about the land parcel, including acreage and location. This section is essential as it sets the foundation for property assessments. Lastly, the Land Use Classification section categorizes the type of land (e.g., agricultural, residential, or commercial), which substantially impacts its valuation. Each designation has different implications for tax assessment and land use rights, making accuracy vital.

How to complete the 2019 Illinois Land Values Form

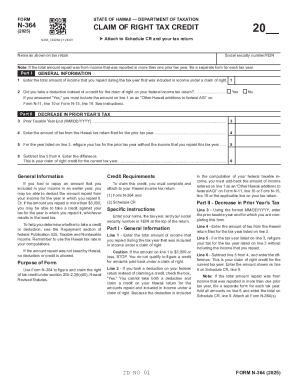

Completing the 2019 Illinois Land Values Form is an essential yet straightforward process when broken down into manageable steps. First, gather all necessary information regarding your land ownership and its characteristics. This may include previous assessments for comparison and documentation of land use practices.

Next, fill out the Landowner Information section with your details accurately. In the Property Details section, provide comprehensive information about your property, such as total acreage and location specifics. In the Land Use Classification section, carefully classify the land according to its primary use—a decision that significantly affects its value assessment. Before finalizing, review your responses diligently to ensure every piece of information is correct and complete.

While filling out the form, be mindful of common mistakes such as omitting significant property details or misclassifying land use. These errors can result in inaccuracies that affect your property assessment and tax obligations.

Interactive tools for form management

Utilizing pdfFiller for managing the 2019 Illinois Land Values Form can enhance your experience tremendously. This cloud-based platform allows you to edit documents easily, making any necessary changes on the fly. If you're working collaboratively with a team, pdfFiller's cloud-based collaboration features enable multiple users to engage with the document concurrently, providing feedback and ensuring that all relevant parties have input before submission.

Additionally, pdfFiller offers eSigning capabilities, allowing you to sign the form securely online. Gone are the days of printing, signing, and scanning documents—this seamless process facilitates quicker submissions while ensuring compliance. You can easily track the status of your documents to stay informed and organized.

Reporting and submission processes

Once you have completed the 2019 Illinois Land Values Form, knowing where and how to submit it is vital. Typically, these forms need to be sent to the local county assessment office, where they will be reviewed by assessment officials. It's crucial to check the specific submission requirements for your county, as these may vary.

Be aware of submission deadlines to prevent any delays in your property assessment. Missing these deadlines can lead to complications in property tax assessments, which could add unnecessary stress and potential financial implications. Once submitted, ensure that you receive an acknowledgment from the office. Follow up to confirm that your form has been processed, maintaining open communication with assessment officials is essential to address any potential issues promptly.

Importance of accurate reporting in land assessments

Accurate reporting in land assessments is not just a bureaucratic requirement; it has real implications for landowners. Inaccurate or incomplete information can lead to incorrect property valuations, resulting in overtaxation or underreporting that could attract scrutiny from tax authorities. For landowners, the fallout of such inaccuracies can be significant, affecting not only their tax obligations but also potential financing opportunities and the overall marketability of their land.

The Supervisor of Assessments plays a critical role in overseeing the property valuation process, ensuring that assessments are based on accurate and reliable data. Engaging with the assessment process and understanding property value assessments empowers landowners to advocate effectively for fair valuations, ensuring that their properties are rightly valued in the eyes of the law.

Additional considerations for 2019 land values

In 2019, there were several additional considerations for landowners submitting their Illinois Land Values Form. For example, specific instructions were provided for landowners affected by flood crop loss, emphasizing that these circumstances could affect land value and should be reported accurately. Furthermore, updates related to farmland assessment as per Bulletin 810 were introduced, reflecting ongoing changes in agricultural policy and assessment guidelines.

It’s equally important to address common concerns that landowners have regarding the land values process. Frequently asked questions often revolve around reservation of rights, changes in classification, and appeals processes. Understanding these nuances can significantly affect how landowners approach their assessments and interact with local authorities.

Future outlook on Illinois land values

As we look beyond 2019, the future of land values in Illinois remains dynamic. Economic forecasts suggest that with the increasing adoption of sustainable practices and technological advancements in agriculture, there may be significant shifts in land use and value. Stakeholders should remain vigilant, monitoring lease trends reports and market indicators to anticipate upcoming trends that may influence their land investments.

Furthermore, landowners are encouraged to utilize tools and platforms that track land value changes over time. These resources can provide critical insights into regional market shifts, crop value increases, and other relevant factors impacting valuation. Being informed empowers landowners to make strategic decisions regarding their land holdings.

User testimonials

Landowners who have utilized pdfFiller for managing their 2019 Illinois Land Values Form have shared positive experiences regarding the platform's capabilities. Users have noted that the convenience of editing and sharing documents through pdfFiller enhances their ability to collaborate effectively with stakeholders. The ease of eSigning has been particularly praised, as it allows for quicker processing times and more efficient submissions.

Feedback highlights that landowners appreciate the sensitivity and security that pdfFiller offers to their personal documents, ensuring that their information remains confidential throughout the submission process. These testimonials underline how a streamlined document management solution can significantly enhance the overall experience around vital tasks such as completing the Illinois Land Values Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2019 illinois land values from Google Drive?

How do I make edits in 2019 illinois land values without leaving Chrome?

How do I complete 2019 illinois land values on an Android device?

What is 2019 illinois land values?

Who is required to file 2019 illinois land values?

How to fill out 2019 illinois land values?

What is the purpose of 2019 illinois land values?

What information must be reported on 2019 illinois land values?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.