Get the free mam-application-to-invest-in-additional-funds-form. ...

Get, Create, Make and Sign mam-application-to-invest-in-additional-funds-form

Editing mam-application-to-invest-in-additional-funds-form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mam-application-to-invest-in-additional-funds-form

How to fill out mam-application-to-invest-in-additional-funds-form

Who needs mam-application-to-invest-in-additional-funds-form?

MAM Application to Invest in Additional Funds: A Comprehensive Guide

Understanding MAM and its importance

MAM, or Multi-Account Manager, is a sophisticated system designed for investors who wish to manage multiple accounts simultaneously. This system allows fund managers to execute trades across several client accounts in a streamlined manner. Investors benefit from a singular point of management, drastically simplifying investment processes while enhancing efficiency.

Key features of MAM systems include real-time allocation of trades, comprehensive reporting features, and the ability for managers to make collective decisions that reflect the best interests of all investors involved. These systems have been adopted widely due to their adaptability and ease of use.

Considering additional funds within a MAM structure can amplify potential returns. Increasing your investment may maximize profits during favorable market conditions, while the consolidated management provides an opportunity to reassess strategies and minimize risks. However, it's essential to weigh these benefits against potential risks, such as market volatility and manager performance.

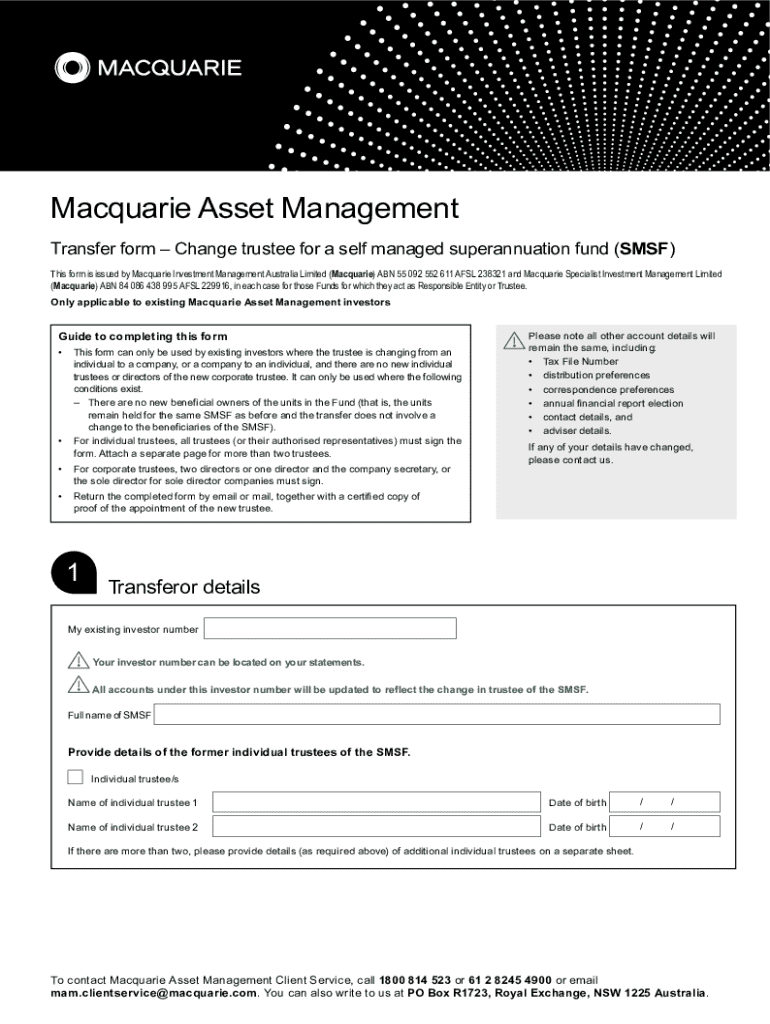

The MAM application process

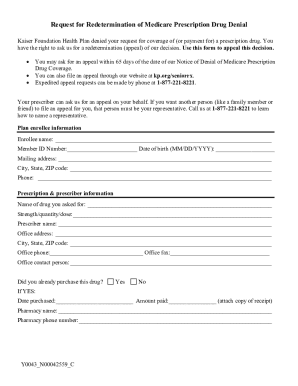

The MAM application process involves several steps, beginning with assessing eligibility and preparing necessary documentation. Ensuring you meet the eligibility criteria, such as minimum investment amounts and necessary experience, is critical for a successful application.

You will need specific documents, such as proof of identity, financial statements, and any prior investment records to facilitate the review process. These documents must be submitted alongside the application to demonstrate your readiness to invest additional funds.

Following the initial preparations, begin the MAM application by accessing the pdfFiller template. This tool allows you to fill out the necessary forms efficiently, utilizing its user-friendly interface to ensure accuracy and completeness.

While filling out the form, you'll encounter sections that require specific data entries, such as personal information and investment intentions. Make sure to pay attention to these sections, as accurate data input is vital to avoid delays in processing your application.

Managing your MAM application

Once your MAM application is submitted, it enters the review process. Understanding how to track your application status is vital to ensuring you remain informed about any updates or additional requirements. Typically, you can track your application through the pdfFiller platform or the investment firm’s client portal.

If any changes are required post-submission, you can amend your application using the pdfFiller tools. However, it's essential to understand the implications of these changes and to communicate with your fund manager if necessary. Keeping a clear line of communication will help navigate any adjustments smoothly.

Frequently asked questions about MAM applications

A common inquiry pertains to processing timelines for MAM applications. Typically, applications may take a few days to several weeks to process, depending on the firm's workload and the completeness of your application. If denied, understanding the reasons behind this decision is crucial. Often, it may involve a lack of sufficient documentation or unmet eligibility criteria.

Another common question revolves around comparing MAM to other investment strategies, such as PAMM (Percentage Allocation Management Module) and LAMM (Lot Allocation Management Module). Each system has unique features and benefits, and choosing the right one depends on your investment goals, risk tolerance, and trading frequency.

Utilizing pdfFiller for your MAM application

pdfFiller offers exciting interactive features that enhance the MAM application experience. Collaborating effectively with team members can streamline the process significantly. By sharing the document, team members can review the application, make necessary edits, and provide feedback instantly, ensuring accuracy before submission.

By taking advantage of cloud-based tools for document management, users can save time and enhance efficiency. Utilizing templates for not only the MAM application but future applications as well can help create uniformity across your documentation practices, saving you countless hours in the long run.

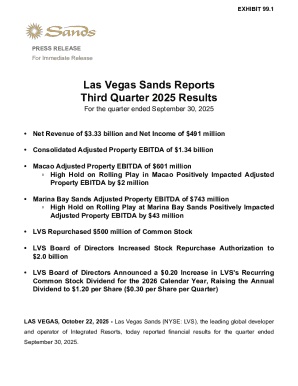

Case studies: successful MAM investments

Real-life examples of successful MAM applications illustrate the practical benefits involved. For instance, a small investment team utilized MAM systems to effectively manage their clients' diverse portfolios. As a result, they reported significant increases in returns due to timely decision-making and effective risk management strategies deployed through MAM.

Lessons learned from these successful investments include prioritizing communication among team members and staying updated on market trends. Sharing insights regularly allowed them to adjust strategies proactively, ensuring better investment outcomes.

Next steps beyond the MAM application

Building a diverse investment portfolio is crucial once you’ve applied for additional MAM funds. It’s wise to supplement your MAM strategy with other investment types to mitigate risks and enhance overall returns. Beyond just the MAM application, consider including stocks, bonds, or alternative investments to your portfolio mix.

Engaging with financial advisors can provide further insights tailored to your specific investment needs. When meeting with an advisor, it's essential to ask pertinent questions, such as their experience with MAM investments or how they approach risk management. This will help ensure that your investments align with your overall financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mam-application-to-invest-in-additional-funds-form to be eSigned by others?

Where do I find mam-application-to-invest-in-additional-funds-form?

How do I edit mam-application-to-invest-in-additional-funds-form on an iOS device?

What is mam-application-to-invest-in-additional-funds-form?

Who is required to file mam-application-to-invest-in-additional-funds-form?

How to fill out mam-application-to-invest-in-additional-funds-form?

What is the purpose of mam-application-to-invest-in-additional-funds-form?

What information must be reported on mam-application-to-invest-in-additional-funds-form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.