Get the free Access forms for investors, advisers and third parties

Get, Create, Make and Sign access forms for investors

Editing access forms for investors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out access forms for investors

How to fill out access forms for investors

Who needs access forms for investors?

Access forms for investors form: A comprehensive guide

Understanding access forms for investors

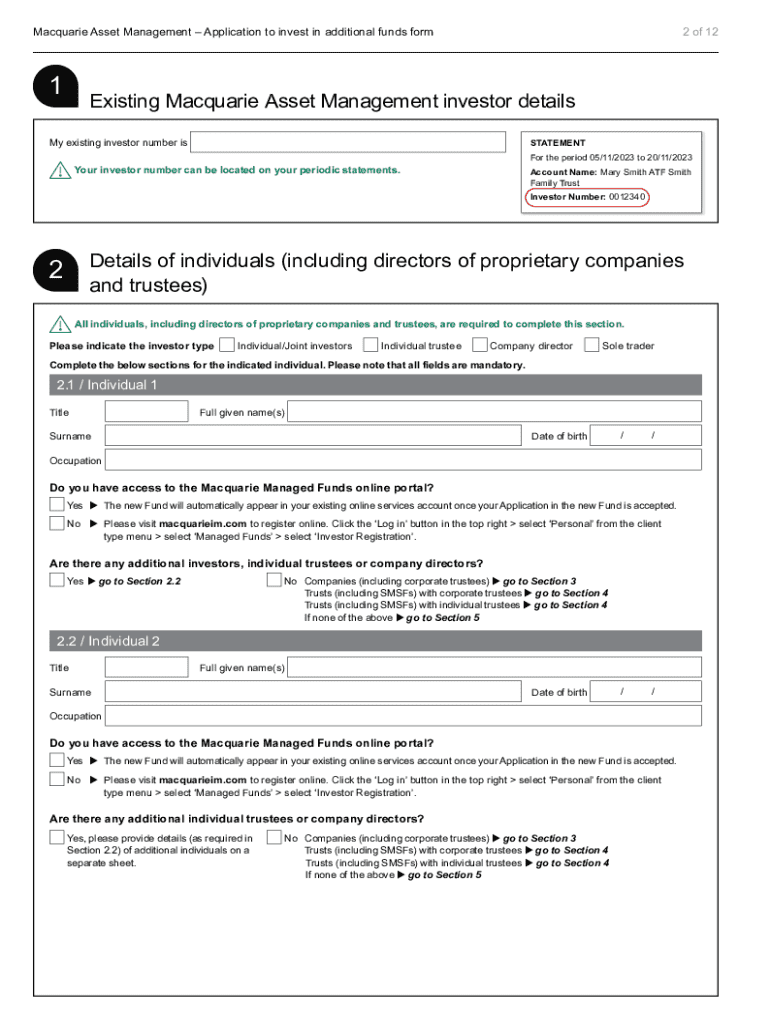

Access forms for investors are essential documents that facilitate communication between investors and fund administrators or investment firms. These forms, often required before engaging in any investment activity, serve to formalize the investor's intent and provide vital information about their financial standing and investment preferences.

The importance of access forms is underscored by their role in compliance with regulatory standards, ensuring that investors are adequately informed about the risks and requirements associated with their investments. By requiring specific data through these forms, investors can better align their goals with suitable investment opportunities, ultimately promoting informed decision-making.

Types of access forms for investors

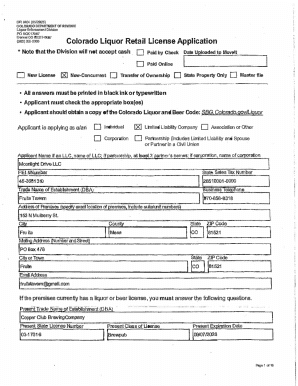

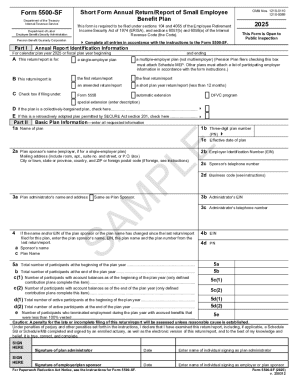

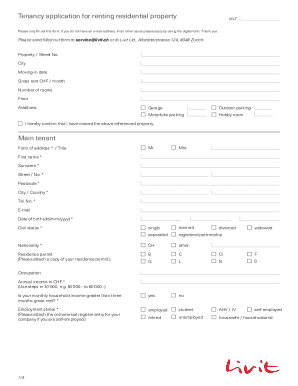

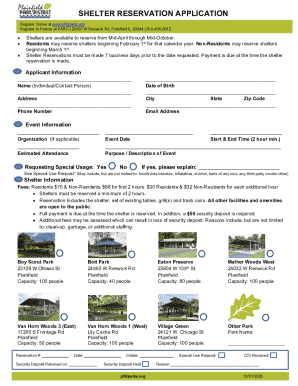

Access forms can vary widely, depending on the type of investment being pursued. Commonly, investors encounter several specific forms that streamline the investment process and ensure all relevant information is gathered and assessed.

The most prevalent among these are subscription agreements, risk assessment questionnaires, and investment agreements. Each serves its unique purpose in creating a comprehensive profile of the investor while solidifying the terms of their engagement.

Specific forms like Form A: the Subscription Agreement, Form B: the Risk Assessment Questionnaire, and Form C: the Investment Agreement embody critical functions in this process.

Step-by-step guide to filling out access forms

Successfully completing access forms for investors requires careful attention to detail. Start by gathering all necessary personal and financial information. This typically includes identification details and a clear outline of your investment goals.

When filling out the forms, it's essential to follow specific guidelines. For Form A: the Subscription Agreement, focus on accurately providing the required sections while being mindful of signature blocks and dates. For Form B: the Risk Assessment Questionnaire, take the time to answer all questions truthfully and thoughtfully, ensuring your risk profile is accurate. Lastly, with Form C: the Investment Agreement, scrutinize critical clauses that affect your rights and obligations, while signing and dating it correctly.

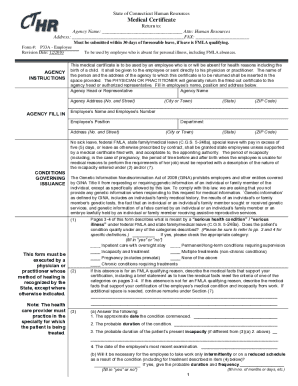

Tools for managing and editing access forms

Utilizing advanced document management tools, such as those offered by pdfFiller, can simplify the process of completing and managing access forms. With its user-friendly interface, pdfFiller allows for seamless edits, annotations, and highlights within your PDF documents, eliminating the hassle of paper-based filing.

Editing PDFs in pdfFiller is straightforward. Users can easily import forms, add their data, and export them once completed. The collaborative features of the platform enable teams to share access forms, allowing multiple users to track changes, input comments, and contribute in real-time to the editing process.

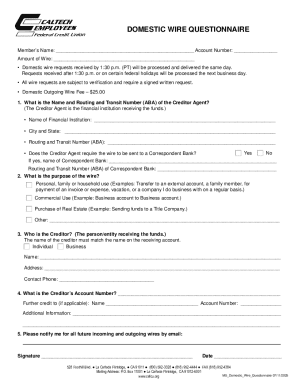

eSigning access forms: A modern solution

Electronic signatures (eSign) are transforming the way investors complete and manage their access forms. eSigning provides a convenient, fast, and secure method for signing documents online. This is particularly invaluable when you consider the need for quick execution in the dynamic investment landscape.

Using pdfFiller to eSign documents is a streamlined process. After completing your forms, simply select the option to eSign and follow a step-by-step guide that ensures your electronic signature is valid and secure. Verification measures within the platform protect both the integrity of your signature and the document itself.

Common challenges and how to overcome them

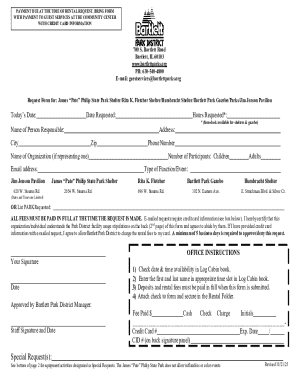

Navigating the access forms for investors process can present various challenges. Issues frequently arise due to incomplete information submitted, misunderstandings of legal terms, or failure to adhere to specific requirements mandated by investment authorities.

To mitigate these challenges, it's advisable to thoroughly review your forms before submission. Make use of interactive help features available through platforms like pdfFiller to clarify any uncertainties. By approaching the completion of your access forms with diligence and attention to detail, you can avoid common pitfalls that lead to form rejections.

Frequently asked questions about access forms for investors

Investors often have queries regarding the handling of access forms. Common questions might include, 'What should I do if I make a mistake on my form?' or 'How can I handle form rejection?' Preparing answers to these inquiries not only aids in clarifying concerns but also ensures that investors feel confident throughout the process.

For mistakes on forms, the best practice is to correct them promptly while retaining all relevant documentation. In the event of rejections, it’s critical to understand the reasons provided and make appropriate adjustments before resubmitting. Familiarizing yourself with best practices, such as verifying all information is accurate before submission, is also beneficial.

Case studies and success stories

Examples of successful investments often begin with properly completed access forms. Consider an investor who utilized a thorough risk assessment questionnaire to clarify their risk tolerance. This systematic approach enabled them to choose a fund that matched their investment profile perfectly, leading to substantial returns, demonstrating the importance of diligence during the access form process.

Testimonials from users of pdfFiller highlight how the platform simplified their form completion journey. By leveraging pdfFiller’s features, investors have reported increased efficiency and reduced errors, ultimately enhancing their overall investment experience.

Additional considerations when using access forms

When engaging with access forms for investors, staying informed on relevant legal information is paramount. Adhering to securities regulations and guidelines set forth by regulatory authorities ensures compliance and minimizes risk. Investors should also consider participating in investment communities and networks for real-time insights and updates related to investment opportunities and best practices.

Consulting related sites or resources from regulatory bodies is advisable for ongoing education. Keeping abreast of changes within federal investment programs or auctions can impact your investment strategy or choices.

Best practices for ongoing management of investment forms

Ongoing management of investment forms is critical in maintaining an organized portfolio. Regular updates and revisions of access forms not only reflect changes in personal circumstances but also help investors stay aligned with evolving investment opportunities.

Keeping forms organized and maintaining a digital record allows for easy access and reference. Setting reminders for renewals or updates ensures you never miss a critical date, allowing for proactive management of your investments. Utilizing tools like pdfFiller is instrumental in enhancing your document management efficiency, making it easy to navigate through all necessary documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit access forms for investors from Google Drive?

How can I send access forms for investors for eSignature?

How can I fill out access forms for investors on an iOS device?

What is access forms for investors?

Who is required to file access forms for investors?

How to fill out access forms for investors?

What is the purpose of access forms for investors?

What information must be reported on access forms for investors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.