Get the free satisfaction of mortgage: fillable, printable & blank pdf form ...

Get, Create, Make and Sign satisfaction of mortgage printable

Editing satisfaction of mortgage printable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out satisfaction of mortgage printable

How to fill out satisfaction of mortgage printable

Who needs satisfaction of mortgage printable?

Satisfaction of Mortgage Printable Form: A Comprehensive Guide

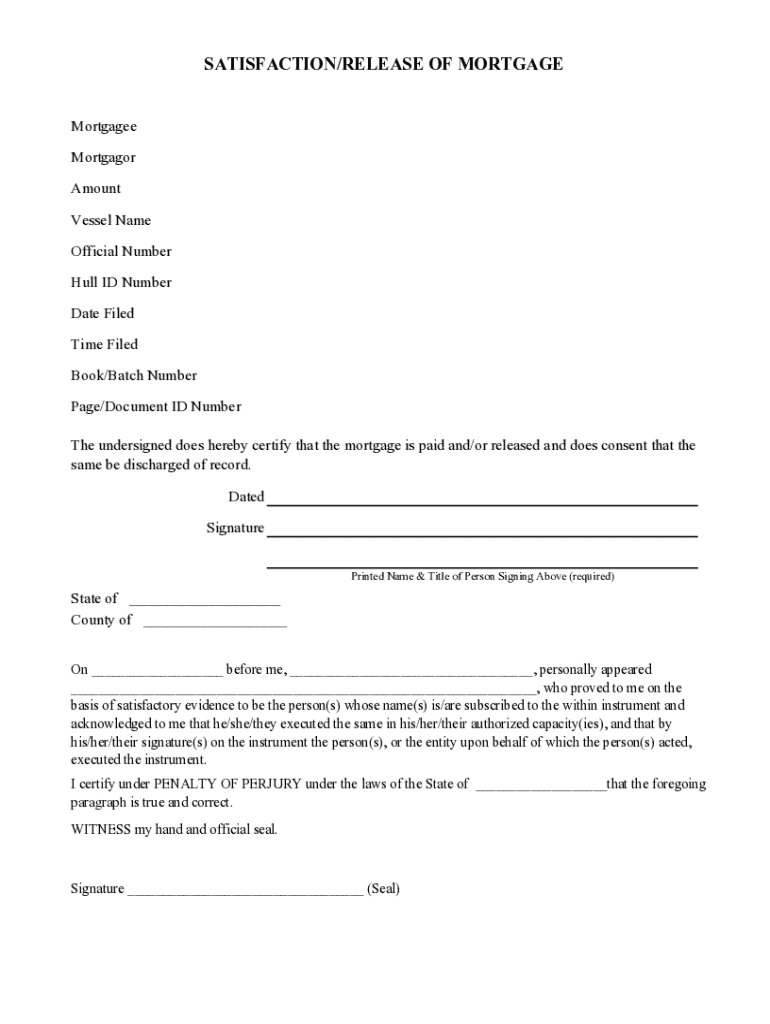

Understanding the satisfaction of mortgage

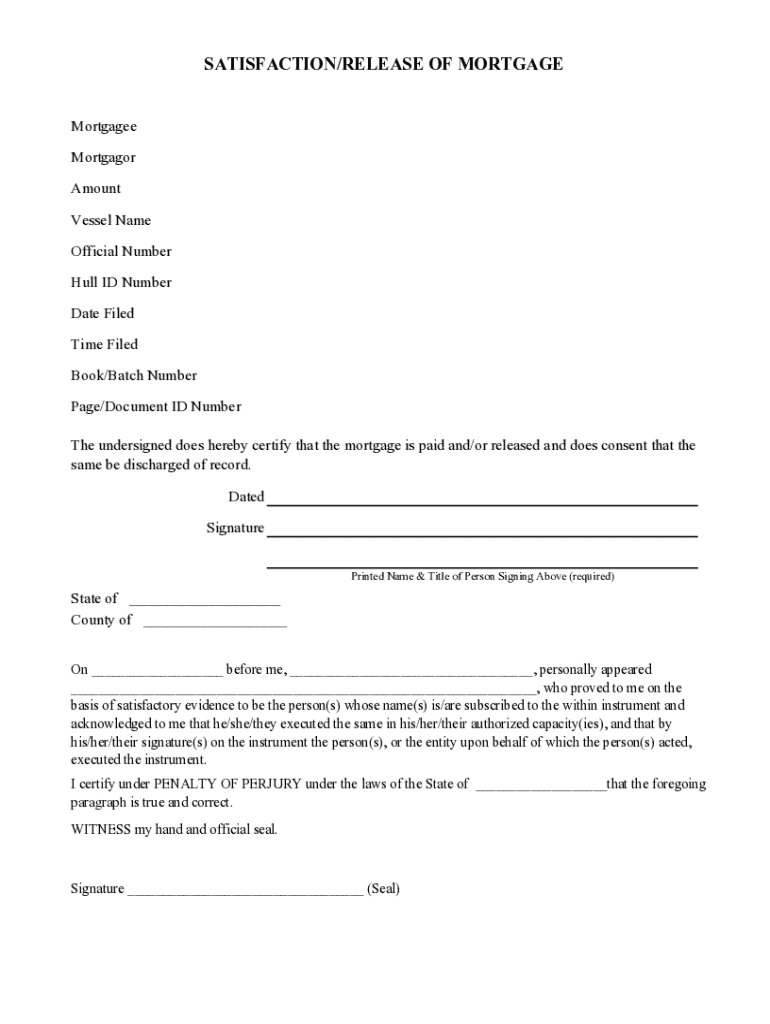

A Satisfaction of Mortgage is a document provided by a lender that indicates a mortgage loan has been paid in full. It serves as a legal acknowledgment that the borrower has fulfilled their obligation, and thus, the lender releases their claim on the property. This form is critical because it not only formalizes the end of the mortgage agreement but also serves to clear the property title for future transactions.

Utilizing a Satisfaction of Mortgage form is essential for both borrowers and lenders. For borrowers, it protects against future claims on the property and is vital when selling or refinancing. For lenders, it fulfills their duty to provide proper documentation once the loan is settled.

When is it required?

The completion of a Satisfaction of Mortgage is required in specific circumstances. Primarily, this document is necessary when a borrower has paid off their mortgage loan, whether through a lump-sum payment or regular installments. Additionally, circumstances such as foreclosure or a short sale completion may also warrant a Satisfaction of Mortgage to formally close the loan account.

It’s advisable to engage with this process promptly after the final payment to ensure legal clarity and proper ownership transfer.

How to obtain the satisfaction of mortgage form

Obtaining a Satisfaction of Mortgage printable form is relatively straightforward. Many state and local government websites provide access to this form to ensure compliance with specific regulations. Additionally, reputable online resources such as pdfFiller offer a robust collection of legal forms, including the Satisfaction of Mortgage form, ensuring ease of access and usability.

Specifically, on the pdfFiller platform, users can navigate to the document catalog, where the Satisfaction of Mortgage form is readily available. This platform not only allows you to download the form but also provides options to fill it out digitally.

Format options

Users can typically download the Satisfaction of Mortgage form in multiple formats, including PDF and DOCX, depending on their preference. pdfFiller supports compatibility with various devices and operating systems, ensuring the user experience remains seamless regardless of how they access the form.

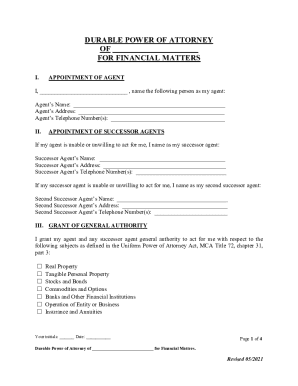

Step-by-step instructions for completing the form

Filling out the Satisfaction of Mortgage form requires careful attention to detail. Before you begin, gather essential information, including loan details, borrower information, and any necessary account numbers. This preparation will save time and lead to more accurate completion.

While completing the form, avoid common mistakes such as incorrect spellings or providing incomplete information. Double-check all entries and consider asking a professional for assistance if uncertain.

Editing and customizing your satisfaction of mortgage form

Using tools like pdfFiller allows for efficient editing and customization of your Satisfaction of Mortgage form. Begin by uploading your downloaded form onto the platform. The editing features let you modify text, add required signatures, dates, and even integrate additional notes, if necessary.

Collaboration is made easy with pdfFiller, allowing you to share the document with involved parties for their review and signatures, streamlining the process significantly.

Submitting your satisfaction of mortgage form

Once you have completed your Satisfaction of Mortgage form, the next step is submission. Most often, this involves filing the document with a local government office, such as the county recorder's office or local land registry. Each jurisdiction may have specific submission guidelines, so checking with local authorities is crucial.

Potential costs associated with filing will vary by location, and it’s prudent to be aware of time frames for processing submissions so that you may follow up accordingly.

After submitting: what to expect

Post-submission, you will receive a confirmation that the Satisfaction of Mortgage has been filed. This confirmation is crucial as it serves as proof that the lender's claim on your property has been released.

Retaining copies of the signed form and any confirmation from the local authority is recommended for future reference, particularly for transactions like selling or transferring ownership of the property.

Comparison: satisfaction of mortgage vs. deed of reconveyance

Although the Satisfaction of Mortgage and Deed of Reconveyance serve similar functions in releasing a property claim, they have key differences. The Satisfaction of Mortgage is typically used in states following a mortgage lending process, while a Deed of Reconveyance applies in states that utilize deeds of trust.

Understanding these nuances is essential in determining which form is appropriate for your specific situation.

Frequently asked questions

Here are some common inquiries individuals have regarding the Satisfaction of Mortgage form.

Having answers to these questions can greatly assist in demystifying the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit satisfaction of mortgage printable online?

Can I create an electronic signature for signing my satisfaction of mortgage printable in Gmail?

How do I edit satisfaction of mortgage printable on an iOS device?

What is satisfaction of mortgage printable?

Who is required to file satisfaction of mortgage printable?

How to fill out satisfaction of mortgage printable?

What is the purpose of satisfaction of mortgage printable?

What information must be reported on satisfaction of mortgage printable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.