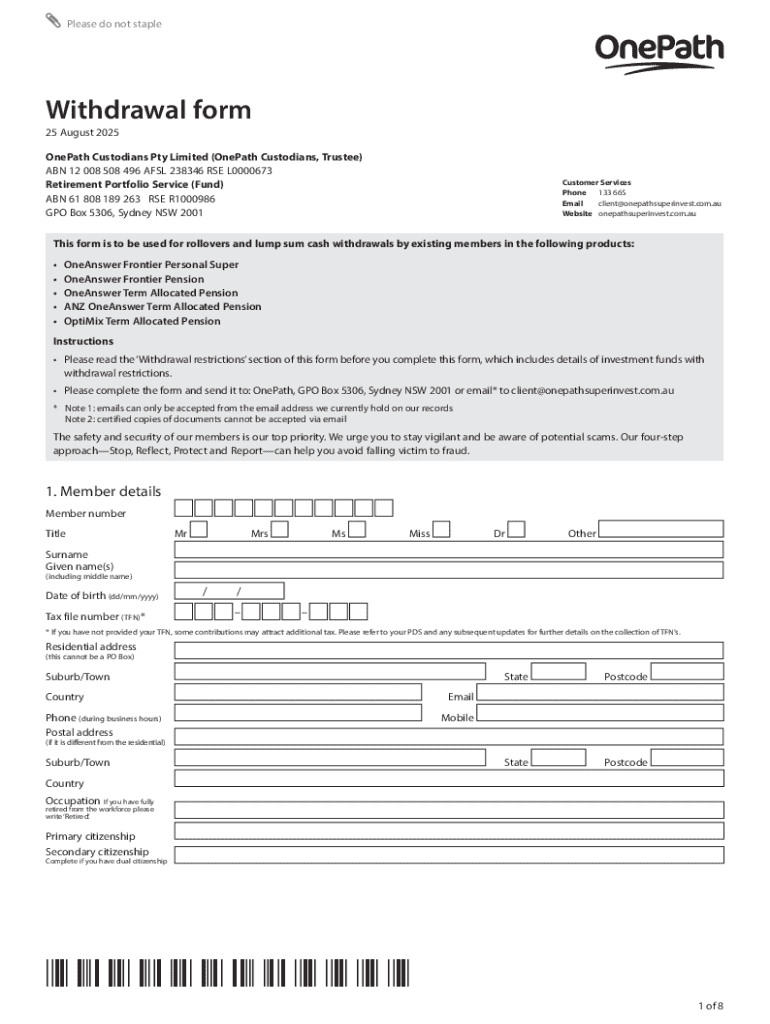

Get the free Current details for ABN 12 008 508 496

Get, Create, Make and Sign current details for abn

Editing current details for abn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out current details for abn

How to fill out current details for abn

Who needs current details for abn?

Current details for ABN form: Your essential guide

Understanding the ABN form

The Australian Business Number (ABN) form is a crucial document for businesses operating in Australia. It serves as a unique identifier for your business and is used in dealings with the Australian Taxation Office (ATO) and other government bodies. The primary purpose of the ABN form is to register your business and ensure compliance with federal laws. Whether you are a sole trader, a partnership, or a corporation, having an ABN is a necessary step as it helps streamline taxation and reporting processes.

Furthermore, an ABN helps you distinguish your business from others, facilitating legitimate dealings and transparency. Its importance cannot be overstated, as it is integral to your business operations, affecting everything from invoicing to tax obligations. Without an up-to-date ABN, businesses could encounter significant roadblocks in their operational activities, including potential legal ramifications.

Importance of keeping ABN details current

Updating your ABN information is not merely a bureaucratic step; it is an essential part of maintaining compliance and operational integrity. If your business undergoes structural changes, such as incorporating or changing ownership, it is crucial to update your ABN information to reflect these changes. Failure to do so can lead to legal implications and cause inconsistencies in your financial reporting.

Additionally, keeping your ABN details current is vital for tax obligations. Outdated information can lead to erroneous tax assessments or missed deadlines, making it a financial liability for your business. It is advisable to review your ABN details at least annually or whenever significant changes occur, such as a business name change, a shift in business structure, or a change in your business location.

Steps to check your current ABN details

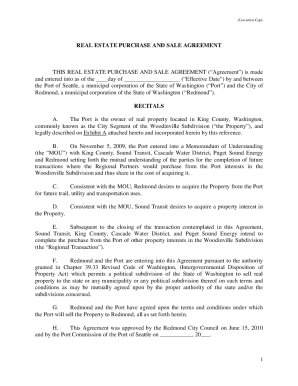

To ensure your ABN is accurate and up-to-date, the first step is to check the current details listed in the Australian Business Register (ABR). The ABR is the official government database that maintains records of all registered businesses in Australia. Accessing this resource is straightforward and can be done online without any cost.

To check your ABN, visit the ABR website and enter your business name or ABN in the search field. The site will display your current details, including your business's name, status, and whether your ABN is active. It is advisable to be vigilant and verify your ABN periodically to avoid compliance issues down the line. Additionally, you can make use of various online tools developed for ABN validation, which provide instant feedback on the status of your ABN.

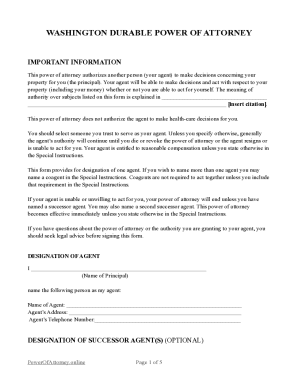

How to update your ABN details

Updating your ABN details can be done through a few simple steps. If you are an individual, the process begins at the ABR website, where you can log in using your previous details or create an account if necessary. Follow the prompts to locate your existing ABN registration and navigate to the update section. For businesses, ensure that you have all relevant documentation ready to support changes, such as proof of name change or changes in business structure.

You will be prompted to fill out an online form, providing the updated information. After you submit the changes, keep an eye on your email for confirmation of the updates. It’s essential to double-check that all information is entered correctly to avoid delays in processing your updates.

Common mistakes when updating can include entering incorrect details or failing to submit required supporting documents. To avoid these pitfalls, always review your entries before final submission and ensure that all necessary documentation is attached.

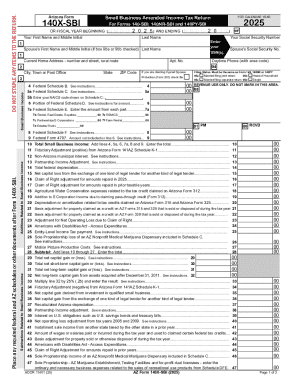

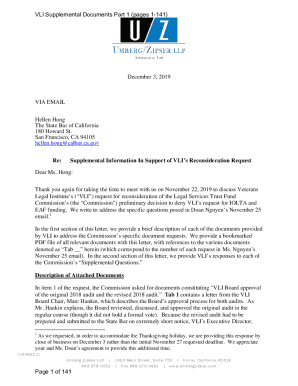

Managing your ABN with pdfFiller

pdfFiller offers users a seamless platform for managing all ABN-related documents. Whether you need to fill out the ABN form, update your information, or sign documents electronically, pdfFiller simplifies the process through its user-friendly interface. Editing PDFs becomes a straightforward task, allowing for quick updates and alterations without the hassle of reprinting. Moreover, pdfFiller ensures that your documents remain secure and compliant with applicable regulations.

Collaboration features available within pdfFiller also make it easy to work as a team. Multiple users can work on the same document simultaneously, ensuring that everyone is in sync and all required updates are made efficiently. This cloud-based management system not only increases productivity but also alleviates the burdens of document handling associated with traditional paper forms.

FAQs about ABN forms

When it comes to managing your ABN, questions often arise. One common query is, 'What should I do if I can’t find my ABN?' If you happen to misplace it, you can retrieve it by using the ABR website's search feature, or by looking at official documents such as tax returns or invoices where your ABN might have been used.

Another frequent question is, 'How long does it take to update my ABN?' Typically, updates are processed within a few business days, but it can vary depending on the volume of requests. As for what happens if your ABN is inactive, businesses with inactive ABNs need to reactivate or re-register to avoid penalties and ensure they remain compliant with Australian laws.

Leveraging pdfFiller for all your document needs

With pdfFiller, you have a powerful ally in document creation and management. Beyond just managing your ABN form, pdfFiller offers a robust platform for a wide variety of documents, making it easy to create, edit, and manage your business documents from anywhere. The extensive features mean that you can quickly prepare important documents, with eSigning capabilities allowing for fast and secure transactions.

Choosing pdfFiller also leads to enhanced security and accessibility. With cloud-based technology, your documents are accessible from any device, which means you can manage your paperwork on the go. This platform is designed with usability in mind, ensuring that even those not tech-savvy can navigate the features effortlessly and make the most of the tools available.

Related topics

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get current details for abn?

How do I edit current details for abn straight from my smartphone?

How can I fill out current details for abn on an iOS device?

What is current details for abn?

Who is required to file current details for abn?

How to fill out current details for abn?

What is the purpose of current details for abn?

What information must be reported on current details for abn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.