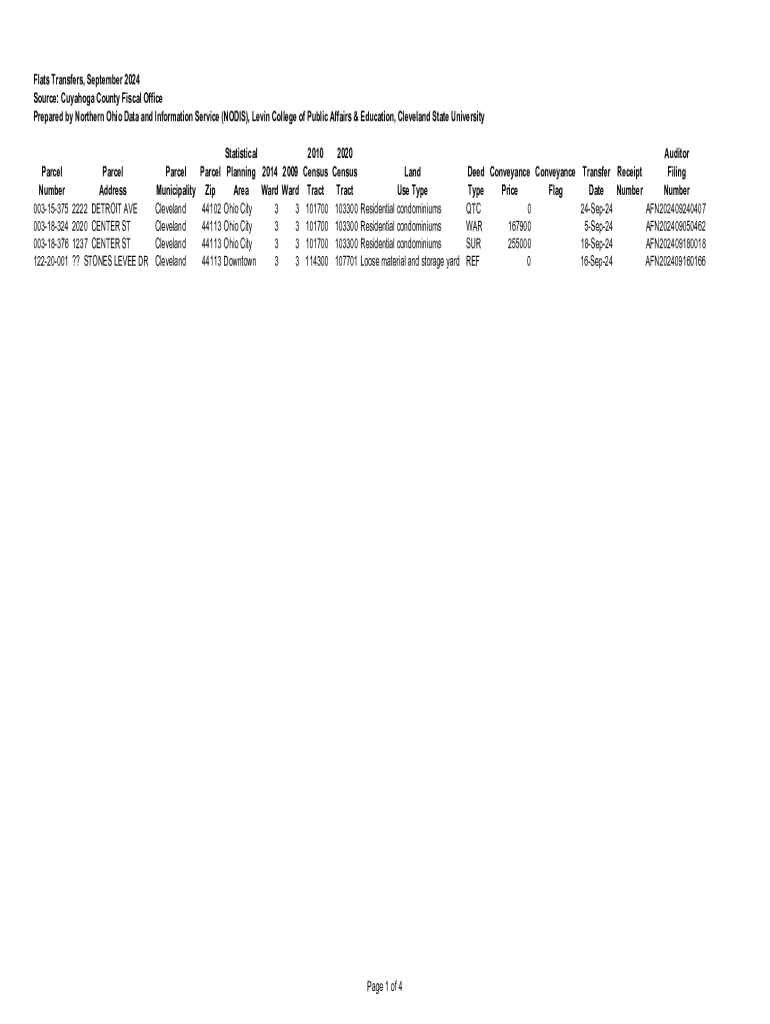

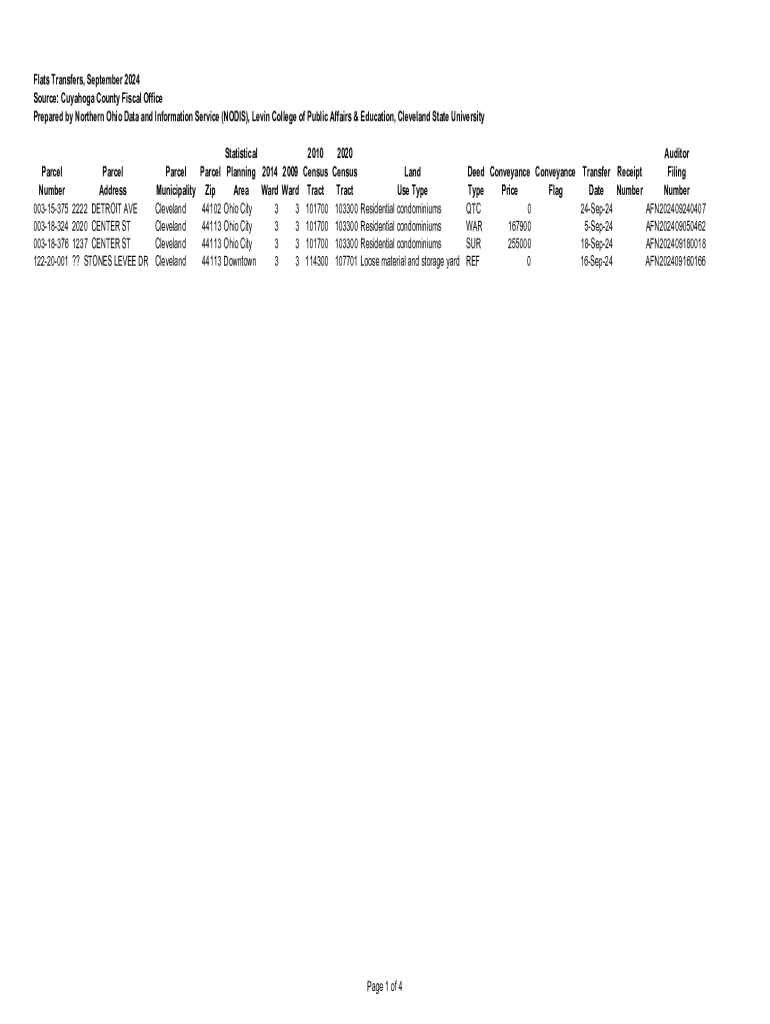

Get the free Cuyahoga County Fiscal Office Prepared by Northern Ohio Da

Get, Create, Make and Sign cuyahoga county fiscal office

How to edit cuyahoga county fiscal office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cuyahoga county fiscal office

How to fill out cuyahoga county fiscal office

Who needs cuyahoga county fiscal office?

Cuyahoga County Fiscal Office Form: Your Comprehensive Guide

Overview of Cuyahoga County Fiscal Office

The Cuyahoga County Fiscal Office plays a critical role in managing the financial resources and fiscal policies of Cuyahoga County, Ohio. Established to ensure transparency and accountability, the Fiscal Office oversees budgeting, revenue collection, and financial reporting. Its primary responsibility is to maintain fiscal health, ensuring that funds are managed efficiently while adhering to state and federal regulations.

The importance of this office in county governance cannot be overstated. It provides financial insight that influences local policy decisions, supporting a variety of services that residents rely on, such as education, public safety, and infrastructure.

Mission and vision

The mission of the Cuyahoga County Fiscal Office is to safeguard the county’s financial assets and ensure the public's trust through transparent fiscal practices. Its vision is focused on empowering the community with accessible and clear financial information.

The goals of the office extend beyond mere compliance; they aim to promote fiscal responsibility, enhance public service delivery, and foster community engagement through financial literacy and accessible information.

Understanding Cuyahoga County Fiscal Office Forms

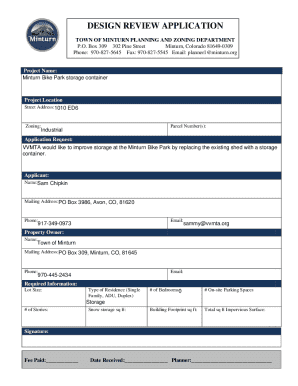

Cuyahoga County Fiscal Office forms serve as essential tools for residents and businesses to interact with government services. These forms cover a broad spectrum of needs, ranging from tax obligations to property assessments, and each form fulfills a specific purpose within county operations.

Using the correct forms is crucial, as inaccuracies can lead to delays in service, potential fines, and missed deadlines. To streamline your engagement with local government, it’s advisable to utilize only official forms provided by the Fiscal Office.

Types of forms offered

Detailed insights on specific forms

Several key forms provided by the Fiscal Office are essential for residents and businesses alike. These include the Property Tax Appeal Form, which allows homeowners to contest their property assessments, and the Homestead Exemption Application, providing tax relief for eligible senior citizens and disabled individuals.

The Business License Application is another important form, enabling local entrepreneurs to comply with regulations while starting or maintaining their businesses in Cuyahoga County. Each of these forms is designed with specific criteria that must be met to ensure successful processing.

Form-specific instructions

Interactive tools for form management

The integration of technology in managing Cuyahoga County Fiscal Office forms has drastically improved user experience. With platforms like pdfFiller, residents can fill out and edit forms directly from their computers or mobile devices, eliminating the need for physical paperwork.

Unique functionalities offered by pdfFiller include the ability to save progress, utilize templates, and access forms from anywhere, making the process more efficient and user-friendly.

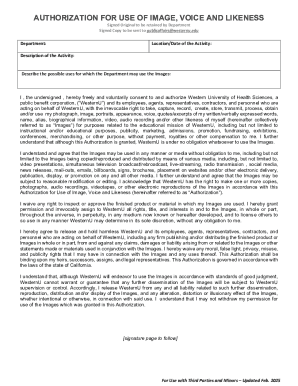

eSigning and collaboration tools

For those needing to sign documents, pdfFiller provides secure electronic signature options. This feature is crucial for professionals who need to share forms among teams or clients without the hassle of printing and scanning.

Comprehensive guide to filling out forms

To assist users, we provide a step-by-step guide for filling out forms correctly. Each key form from the Cuyahoga County Fiscal Office is accompanied by clear instructions, numbered to enhance clarity.

Moreover, example forms with completed fields offer insight into expected entries, thus minimizing confusion and errors during submission.

Accessing necessary documents

Before filling in the forms, understanding the required supporting documentation is imperative. Users can streamline their process by gathering all necessary documents, such as proof of income, ID verification, and any relevant tax filings.

Managing your forms with pdfFiller

pdfFiller acts as a vital companion for managing Cuyahoga County forms. The platform offers distinct features designed specifically to assist users with filling, editing, and managing their documents effectively.

This includes integration capabilities with other cloud services, allowing users to store and retrieve their documents effortlessly from multiple locations.

Collaborating with teams on form management

Effective team management is crucial when working with forms. pdfFiller allows users to share documents easily, assign permissions for view or edit access, and track any changes made in the documents. This collaborative approach enhances accuracy and mitigates errors, ensuring that all necessary stakeholders are involved in the document submission process.

Frequently asked questions

Navigating the realm of Cuyahoga County Fiscal Office forms often raises common inquiries regarding submission processes, deadlines, and documentation needs. Addressing these questions can clarify the often complex landscape of fiscal paperwork.

In addition, troubleshooting common issues, such as form access problems or submission errors, can alleviate potential frustrations. For example, users often inquire about what to do if they lose access to a submitted form or how to amend errors in already submitted documents.

Contact information for further assistance

For additional support, the Cuyahoga County Fiscal Office provides several channels for contact. Users can reach out through phone or email, and the office also maintains regular hours for in-person inquiries.

Moreover, online resources such as FAQs and help sections are available, providing guidance on various forms and issues encountered during submission.

Conclusion

Summing up the services offered by the Cuyahoga County Fiscal Office, it is clear that utilizing the proper forms can greatly enhance your interactions with the county. The efficiency and clarity brought by structured forms streamline processes that are essential for the community.

By leveraging tools like pdfFiller, users are empowered to manage their documents effectively, ensuring timely submissions and compliance with county regulations. This is an invaluable asset for individuals and teams seeking a seamless document creation solution.

Important deadlines and dates

To stay on top of your duties, being aware of submission deadlines is paramount. Cuyahoga County Fiscal Office posts a calendar of important dates relevant to various forms. Timely submission can result in financial benefits and avoid penalties.

Footer

For further information and resources related to Cuyahoga County Fiscal Office forms, users can access official links to related documents, state authorities, and organizations overseeing property and business regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cuyahoga county fiscal office in Chrome?

How do I edit cuyahoga county fiscal office on an iOS device?

How do I fill out cuyahoga county fiscal office on an Android device?

What is cuyahoga county fiscal office?

Who is required to file cuyahoga county fiscal office?

How to fill out cuyahoga county fiscal office?

What is the purpose of cuyahoga county fiscal office?

What information must be reported on cuyahoga county fiscal office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.