Get the free a bill for limited liability company (amendment) (no. 2) act, ...

Get, Create, Make and Sign a bill for limited

Editing a bill for limited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a bill for limited

How to fill out a bill for limited

Who needs a bill for limited?

A Bill for Limited Form: Understanding, Managing, and Excelling

Understanding the limited form bill

A limited form bill typically refers to a streamlined document that outlines specific financial obligations between a payer and a biller. Unlike detailed invoices, a limited form bill captures essential information like outstanding amounts and due dates, but omits excessive details. It serves diverse purposes in legal, financial, and commercial contexts, facilitating efficient communication of payment responsibilities.

Limited form bills hold significance for various sectors, including utilities and healthcare. For instance, a utility bill informs consumers of their energy consumption and payment deadlines, preventing service interruptions. Understanding this bill type is crucial for both individuals managing their finances and organizations seeking clarity in financial transactions.

Types of limited form bills

Limited form bills appear in various forms, primarily utility bills, medical bills, and tuition statements. Utility bills are perhaps the most common, providing consumers with a concise summary of their energy or water usage and associated costs. Medical bills often illustrate the charges for specific treatments or services provided by healthcare professionals, allowing patients to understand their financial obligations after a visit.

In educational contexts, tuition statements serve as limited form bills, listing tuition fees owed per semester or term. These examples highlight how limited form bills function across various situations, enabling streamlined communication between billers and payers.

Key features of limited form bills

Essential components of a limited form bill typically include the date of issuance, biller information, a unique bill number, itemized charges, and the total amount due. Each of these elements plays a vital role in clarifying the financial responsibilities. The date of issuance indicates when the bill was created, influencing due dates and payment timelines, while biller information establishes the source of the charges.

Legal terminology related to limited form bills often includes 'payer', referencing the individual or entity responsible for the payment; 'billing period', which specifies the time frame for services rendered; and 'due date', denoting when payments must be completed. Understanding these terms helps users grasp their rights and responsibilities associated with limited form bills.

Different sectors may showcase variations of limited form bills. For instance, in healthcare, bills may list detailed procedures while remaining simpler compared to full invoices, effectively highlighting amounts owed without overwhelming patients with excessive information.

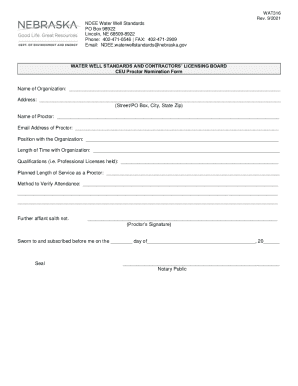

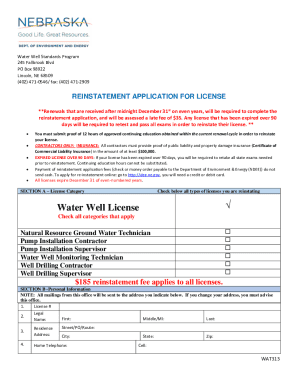

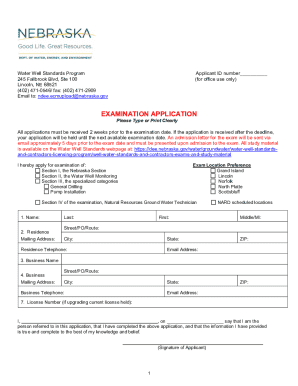

Filling out a limited form bill

Before filling out a limited form bill, it's essential to prepare adequately. Start by gathering specific information: biller information, account numbers, and service details. Ensure you have a clear understanding of what is being billed and verify any previous payments made.

A step-by-step guide for completing a limited form bill involves addressing the biller's name and contact details first, followed by itemizing charges according to the billing period. Pay attention to dates, specifically the issuance and due dates. Always double-check figures to avoid common mathematical errors, a frequent pitfall when filling these forms.

In our increasingly digital age, filling out a limited form bill is often easier on platforms like pdfFiller. Digital forms not only enhance user experience through convenient interfaces but also offer features for easy editing and electronic signatures, further minimizing the likelihood of errors associated with physical forms.

Editing and customizing your limited form bill

Ensuring accurate edits on a limited form bill is crucial to prevent disputes or penalties. A single mistake can lead to late fees, misunderstandings, or even legal consequences, underscoring the need for vigilance in reviewing details before submission.

When it comes to editing, pdfFiller provides an array of tools designed for users to manipulate their limited form bills effectively. Features like text editing allow for quick corrections, while annotations help clarify any comments or additional information pertinent to the bill. Moreover, the option for electronic signatures streamlines the finalization process, ensuring that the document is not only accurate but also legally binding.

Submitting your limited form bill

Once your limited form bill is completed and edited, it’s time to submit it. Users have various submission options, including online payment portals, mailing physical copies, or even delivering them in person, depending on the biller’s preferences. Always follow specific guidelines provided by the biller to ensure compliance and timely processing.

To track your submission effectively, consider opting for methods that provide confirmation, such as tracking numbers for mailed forms or receipts for online submissions. Additionally, maintain copies of any submitted limited form bills. This practice is essential for personal records and can serve as evidence in case of disputes regarding payments.

Managing and following up on limited form bills

Understanding the response dynamics after submitting a limited form bill is key to effective management. Billers typically process payments within a certain timeframe, and consumers should expect a receipt or confirmation once their submission is complete. By staying proactive, you can ensure that your financial obligations are met without accruing late fees.

Common issues faced with limited form bills often include unrecorded payments or miscommunication regarding amounts due. Identifying these problems early is crucial. If discrepancies arise, make sure to contact the biller directly to rectify the situation. Utilize features within pdfFiller for ongoing management, such as tracking previous submissions, which helps maintain complete oversight of your financial commitments.

Case studies and real-life applications

Examining real-life applications of limited form bills can be enlightening. For instance, a homeowner might manage their utility bills using templates designed to streamline tracking expenses. This approach helps them budget effectively, avoiding surprises at the end of each billing cycle.

Troubleshooting scenarios also present valuable insights. Consider an instance where a consumer notices discrepancies on a medical bill. Utilizing pdfFiller, they can quickly annotate and address these issues directly through the edited document, providing clarity to the healthcare provider. This real-time resolution aids in fostering better communication and ensures peace of mind.

FAQs about limited form bills

Several common queries often arise concerning limited form bills. They include questions about their legitimacy, how to dispute charges, and the rights of the payer regarding bill alterations. Understanding these concerns can significantly benefit individuals managing their finances.

Expert recommendation emphasizes the importance of comprehensively reading any documentation linked to limited form bills. This practice not only clarifies payment obligations but also empowers individuals to assert their rights confidently, particularly when confronted with uncommon charges.

Final considerations

The future of limited form bills is evolving, especially with the integration of digital technologies. Innovations will likely lead to more efficient bill management systems, making it easier for individuals and teams to track payments and access their financial responsibilities with ease.

pdfFiller stands out in this landscape by providing a comprehensive platform that streamlines the entire bill management process. By empowering users to edit, e-sign, and manage limited form bills, pdfFiller ensures accessibility and efficiency for anyone navigating their financial commitments. Utilizing such a robust tool is invaluable for both individuals and organizations aiming for precision in their document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit a bill for limited online?

Can I create an electronic signature for the a bill for limited in Chrome?

Can I create an eSignature for the a bill for limited in Gmail?

What is a bill for limited?

Who is required to file a bill for limited?

How to fill out a bill for limited?

What is the purpose of a bill for limited?

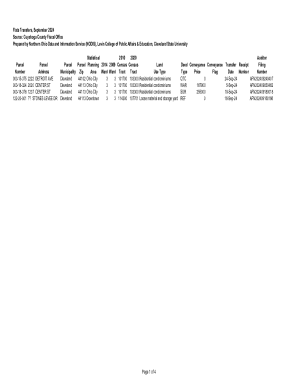

What information must be reported on a bill for limited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.