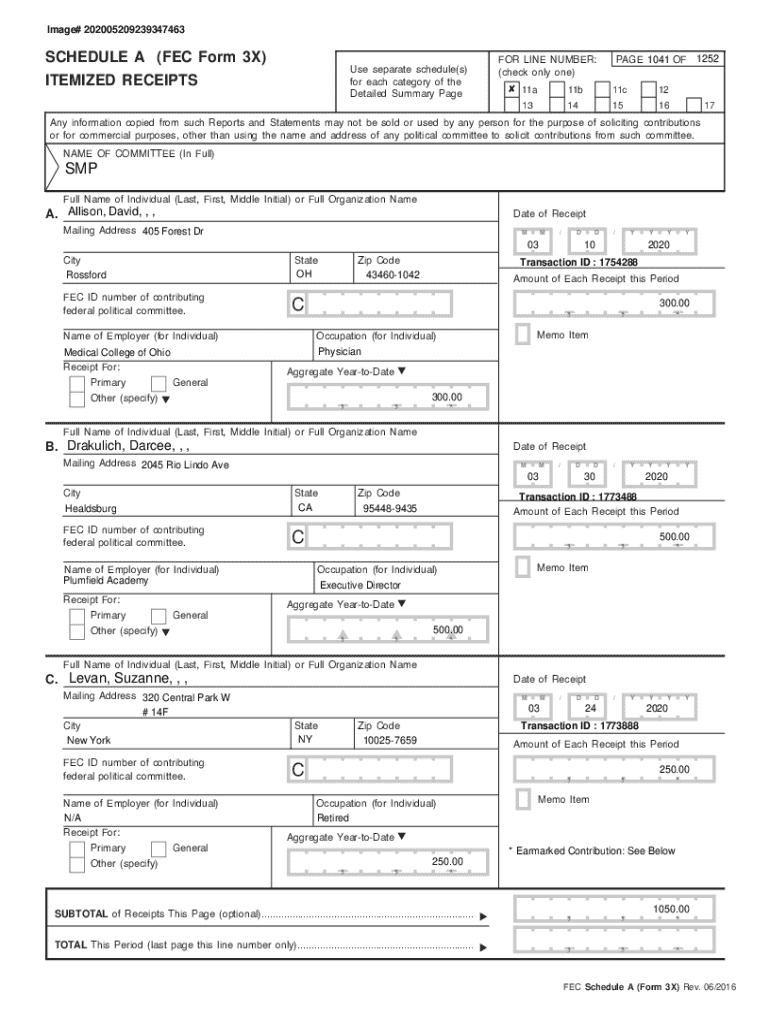

Get the free PAGE 1041 OF 1252

Get, Create, Make and Sign page 1041 of 1252

How to edit page 1041 of 1252 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out page 1041 of 1252

How to fill out page 1041 of 1252

Who needs page 1041 of 1252?

A Complete Guide to Page 1041 of 1252 Form

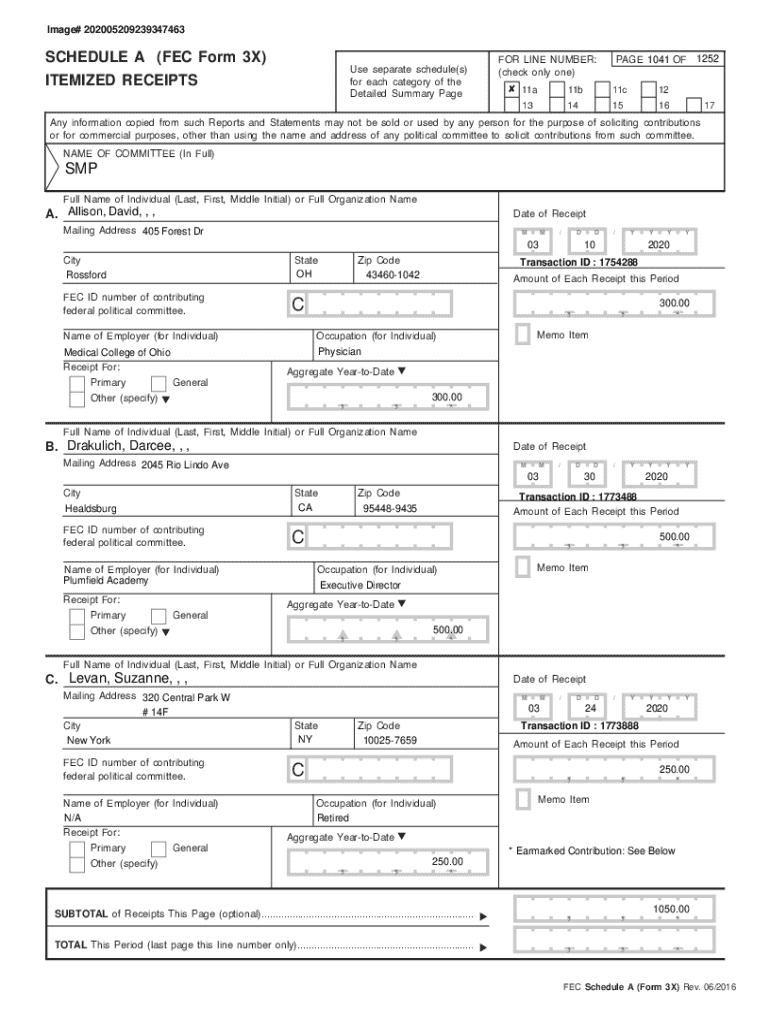

Understanding Page 1041 of 1252 form

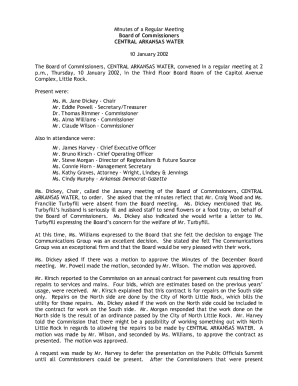

Page 1041 of 1252 is a critical component of a larger form often utilized in various administrative and legal contexts. Typically, this form plays a significant role in ensuring the accurate collection of specific information necessary for processing applications or claims. Understanding what constitutes Page 1041 and its importance within the context of the full 1252 form is essential for individuals and organizations alike.

This page often includes sections that capture personal, financial, and supplementary information. It serves as a reference point for the entire procedure and provides needed context for the data that follows. Its importance cannot be overstated, particularly when it is critical for compliance and legal documentation.

Common use cases

Page 1041 is often required in specific scenarios, particularly those involving financial declarations, tax documentation, or formal applications where precise information must be provided. This form is frequently filled out by individuals in varying situations, such as applying for loans, submitting tax forms, or other processes where detailed documentation of personal or financial status is needed.

Typically, this page is completed by individual taxpayers, business owners, or organizations seeking approval from governing bodies. Understanding these use cases lends insight into how to properly fill out the page and what the submitter needs to consider before doing so.

Step-by-step guide to completing Page 1041

Completing Page 1041 requires several essential pieces of information. To ensure accuracy, it is advisable to gather all necessary documents beforehand. This preparation will streamline the completion process and minimize the likelihood of error.

Essential data typically includes personal information, such as name, address, and identification numbers. Additionally, financial information including income sources, deductions, and significant expenses must be recorded accurately. Utilization of a checklist can help ensure all required data is collected.

Detailed instructions for each section

Section 1: Personal Information

Entering accurate personal details is critical. Ensure that names are correctly spelled and that all relevant identification numbers match official documents. This helps to prevent delays or rejections during processing.

Double-check your address and contact information to facilitate any necessary follow-ups.

Section 2: Financial Information

When reporting income or expenses, accuracy is paramount. Use official records such as tax forms or bank statements to ensure that the figures align with those documents. Any discrepancies can lead to complications down the line.

Include all relevant financial information and be prepared to provide additional documentation if required.

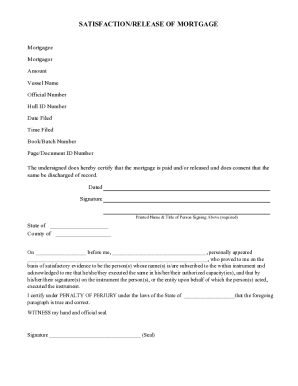

Section 3: Signatures

Ensure that all necessary signatures are obtained before submission. Signature fields must be filled out precisely according to the guidelines to ensure validity.

Mistakes in this section often lead to complications, so careful attention here is advisable.

Section 4: Additional Notes or Attachments

If there are any additional points of clarification or attachments to support your application, document them clearly. Include all necessary evidence to substantiate your claims or submissions.

Editing and customizing Page 1041

Using pdfFiller, accessing and editing Page 1041 is seamless. Users can upload their documents in various formats and select Page 1041 for editing tasks. The platform provides a user-friendly interface designed to streamline the editing process.

pdfFiller offers a variety of tools to edit text and fields, ensuring that users can make all the necessary modifications without hassle. Features such as text boxes, highlighting functionalities, and annotation tools make it easy to tailor the form to individual needs.

Collaborating with teams

Collaboration is simplified through sharing options available in pdfFiller. Users can easily share Page 1041 with colleagues or team members to gather input and conduct reviews. Tracking changes and comments ensures that everyone remains on the same page throughout the editing process.

eSigning Page 1041

The ability to electronically sign Page 1041 offers convenience and efficiency. eSigning eliminates the need for printing, signing, and scanning, expediting the submission process. This feature enhances both flexibility and accessibility.

By utilizing pdfFiller’s eSigning capabilities, users can authenticate their forms from anywhere, ensuring that their submissions are both compliant and timely.

Steps to eSign within pdfFiller

To eSign Page 1041 within pdfFiller, follow these straightforward steps: 1. Open your document in pdfFiller. 2. Navigate to the eSignature feature. 3. Either draw your signature using a mouse or stylus, upload an image of your signature, or type your name. 4. Place your signature on the designated area, and finally, save the document.

Managing Page 1041 effectively

Saving and downloading your completed Page 1041 provides important options for record-keeping. pdfFiller supports various formats for exporting documents, ensuring that users can select the most appropriate format for their needs, whether that be PDF, Word, or others.

Utilizing cloud storage options within pdfFiller ensures that the document is securely stored and accessible from any device. By adopting organized folder structures, users can ensure efficient document management and easy retrieval in the future.

Troubleshooting common issues

Filling out Page 1041 can present several common mistakes that users should be wary of. These include miskeying personal information, failing to include necessary financial details, and neglecting to sign the form properly. Awareness of these common pitfalls can help mitigate errors in completion.

If you encounter problems while using pdfFiller, solutions include refreshing the page, ensuring compatibility with your browser, or checking for updates in the app. Additionally, consulting pdfFiller’s support section can provide quick resolutions to frequent issues.

Tips and best practices

General tips for filling out forms include thoroughly reviewing your entries before submitting. Utilize the self-check checklist to verify completeness and accuracy. Have a dependable peer review the document to detect any possible oversights.

For document management, use specific nomenclature for filenames, categorize forms into specific folders, and maintain security protocols to ensure compliance with regulatory requirements. Adopting these practices can save time and improve efficiency.

FAQs about Page 1041

Frequently asked questions regarding Page 1041 often involve misunderstandings about specific sections and requirements. Many users seek clarity on what documentation is necessary, how to avoid common mistakes, and the implications of electronically submitting the form.

Addressing these queries promptly can enhance the user experience, ensuring that submitters feel confident as they finalize their documents.

Further customization and automation options

pdfFiller offers advanced features for customizing frequently-used forms such as Page 1041. These tools enable users to create templates that save time and effort during the completion process.

Integrating other tools with pdfFiller can further enhance the workflow, making it easier to manage multiple documents concurrently and streamline operations effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send page 1041 of 1252 for eSignature?

How do I edit page 1041 of 1252 straight from my smartphone?

How do I edit page 1041 of 1252 on an iOS device?

What is page 1041 of 1252?

Who is required to file page 1041 of 1252?

How to fill out page 1041 of 1252?

What is the purpose of page 1041 of 1252?

What information must be reported on page 1041 of 1252?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.