IRS 15397 2025-2026 free printable template

Get, Create, Make and Sign IRS 15397

How to edit IRS 15397 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out IRS 15397

How to fill out form 15397 rev 3-2025

Who needs form 15397 rev 3-2025?

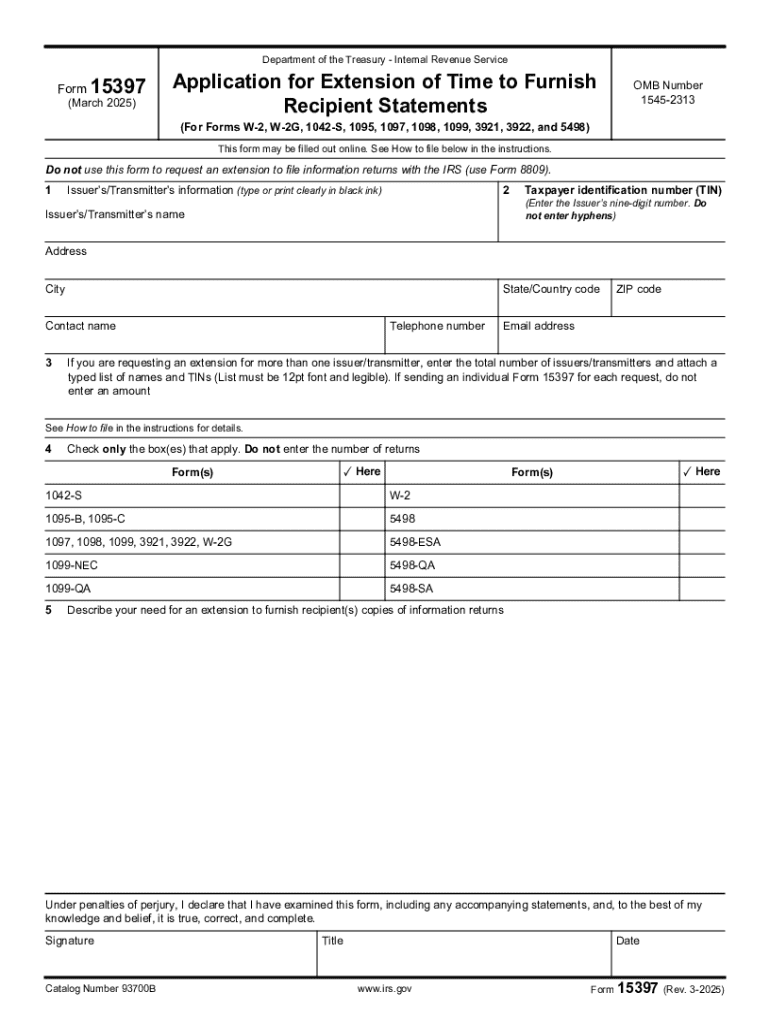

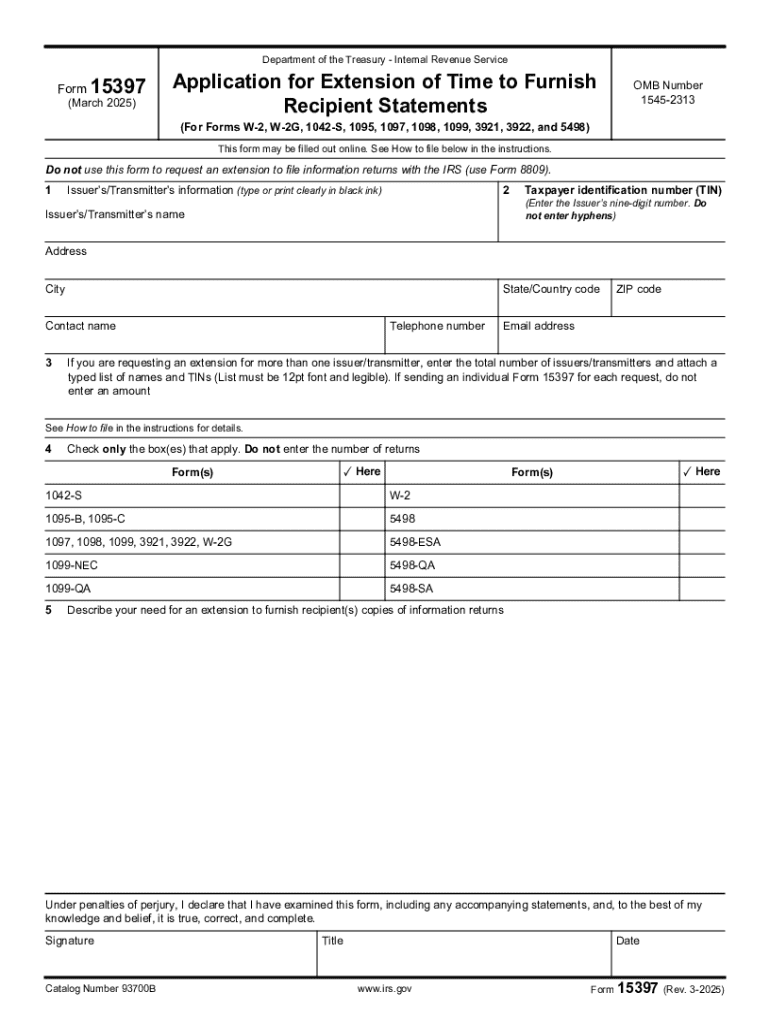

Understanding the form 15397 Rev 3-2025 Form

What is the 15397 Rev 3-2025 form?

The form 15397 Rev 3-2025 is a critical document used primarily in compliance with regulations set forth by various government agencies. This form plays a significant role in collecting information that helps ensure adherence to the Paperwork Reduction Act, aiming to reduce the burden of paperwork on the public while maintaining essential data collection practices.

Its importance cannot be overstated; the 15397 form facilitates transparency and accountability in communication between the taxpayer and the relevant offices, such as the office of information and regulatory affairs. For many individuals and organizations, filling out this form accurately is integral to meeting specific tax and regulatory compliance requirements.

Key features of the 15397 Rev 3-2025 form

The 15397 Rev 3-2025 form features several essential sections and fields designed to capture relevant information efficiently. The primary components usually include personal data, financial details pertinent to tax obligations, and required certifications that validate the information provided.

In its latest version, the 15397 Rev 3-2025 has unique attributes, including updated data fields intended to eliminate previous ambiguities and facilitate clearer communication of information to regulatory bodies.

Preparing to fill out the 15397 Rev 3-2025 form

Preparation is vital when it comes to filling out the 15397 Rev 3-2025 form. A thorough understanding of the required information can make the process smoother and more efficient. Begin by gathering all necessary documents that may be referenced during the completion of the form.

Organizing this information before starting will save considerable time. Use folders—physical or digital—to categorize documents for easy access when needed.

Understanding form sections

The 15397 Rev 3-2025 form is composed of several distinct sections. Each part is aimed at a specific type of information that, when correctly filled, prevents misinformation that could lead to complications.

Common mistakes include skipping mandatory fields or misplacing decimal points in financial sections, so double-check your entries before finalizing.

Step-by-step instructions for completing the 15397 Rev 3-2025 form

Completing the 15397 Rev 3-2025 form involves a systematic, section-by-section approach for accuracy. Begin with the personal information section, where clarity is critical. Properly filling this out helps ensure that your submissions are traceable.

Personal information

In this section, provide your full legal name, current address, and any relevant identification numbers, such as Social Security numbers or Tax Identification Numbers. Avoid abbreviations unless they are officially part of your name, as this can raise issues with verification.

Financial details

For the financial details, ensure that you input accurate figures. Depending on the nature of your situation, this may include income statements, deductions, and other financial metrics. Again, always cross-reference with documentation to avoid discrepancies that could lead to compliance issues.

Certifications and signatures

Finally, this section certifies that all information provided is true and correct. Unsigned forms or lack of proper validation can lead to instant rejection, delaying your compliance process.

How to handle complex fields

Certain fields on the form can present challenges. For instance, complex financial calculations require careful attention. If you're required to input detailed financial statements, consider utilizing spreadsheets for accuracy before inputting the final numbers.

To prevent errors, double-check those figures and consider peer reviews when necessary to confirm your submissions’ integrity.

Completing and reviewing the form

After filling out the form, it's crucial to conduct a thorough review. A checklist can help: ensure all required fields are complete, verify that data is accurate, and confirm that your signature is in place. Not only does this step help with compliance, but it also minimizes the chances of submission rejections.

Editing and modifying the 15397 Rev 3-2025 form

Once your form is filled out, you might find the need to make modifications. PdfFiller provides a versatile platform for making edits directly to the PDF version of the 15397 Rev 3-2025 form. The interface is user-friendly, making it easy to navigate and modify content efficiently.

Using pdfFiller to edit the form

To begin editing, upload your form onto the pdfFiller platform. Once loaded, you can use various tool options to add, remove, or amend text. Take advantage of annotation tools for highlights or notes that might aid in your documentation process.

Best practices for form editing

When editing, it’s important to maintain compliance and accuracy. Any changes made post-initial filling must be documented thoroughly to prevent discrepancies during review. If you must edit, be sure to double-check any altered sections for accuracy.

Signing the 15397 Rev 3-2025 form

The signature process is crucial for the validity of the form. With advancements in technology, various options for digital signatures have emerged, streamlining this aspect further.

Digital signature options

Utilizing eSignature technology, you can create a legally binding signature using platforms like pdfFiller. This not only speeds up the signing process but also effectively minimizes paperwork. The digital signature process typically involves creating an electronic representation of your handwritten signature, which can be applied to the document instantly.

Securely sharing the signed form

Once your form is signed, the next step is sharing it securely. When submitting forms containing personal information, it’s essential to take precautions. Use encrypted emails or secure portals to send your completed document. This reduces the risk of unauthorized access and maintains your privacy.

Managing your form after submission

Once your 15397 Rev 3-2025 form is submitted, it is essential to have a strategy for managing your form's status and storage. Knowing where to find your form and how to track its progress can relieve anxiety during the waiting period.

Tracking form status

To monitor the status of your submitted form, most agencies provide a tracking system. Maintain a record of any reference numbers received upon submission. This reference can be invaluable for following up with agencies such as the taxpayer defense center or taxpayers' budget office if needed.

Storing and accessing completed forms

Organizing your digital documents smartly can save time in the long run. Utilize pdfFiller’s cloud-based storage features, which not only keep your documents safe but also accessible from anywhere. Having a structured folder system minimizes clutter, ensuring quick retrieval when necessary.

Common issues and troubleshooting

As with any form, issues can arise during filling or submission. Being prepared for these common pitfalls can save time and stress.

Frequently asked questions (FAQs)

Many individuals encounter similar queries while filling out the form. Understanding common doubts can streamline the process. Questions such as 'What documents do I need?' or 'What should I do if I notice a mistake after submission?' are frequently addressed by agencies through press releases or issue briefs.

Having this information readily available can make completing your form less daunting.

Troubleshooting tips

If you notice your submission has been rejected, first ensure that all sections are complete. If adjustments are necessary, identify which segments may need correction and promptly revise the form. Contacting customer support for specific insights can also expedite resolving issues.

Additional support and resources

Navigating through forms can pose challenges. To aid users, the pdfFiller Help Center provides invaluable resources, including tutorials and guides tailored to the 15397 Rev 3-2025 form.

Utilizing pdfFiller help center

The Help Center equips users with the necessary knowledge to manage forms adeptly, addressing the unique needs of individuals and teams. Access to video tutorials and step-by-step instructions can be particularly beneficial.

Contacting customer support

For personalized assistance, contacting pdfFiller customer support is straightforward. Whether you need help navigating the platform or specific advice on form submissions, the support team is readily available to assist, ensuring a smooth user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS 15397 online?

Can I create an eSignature for the IRS 15397 in Gmail?

How do I complete IRS 15397 on an iOS device?

What is form 15397 rev 3-2025?

Who is required to file form 15397 rev 3-2025?

How to fill out form 15397 rev 3-2025?

What is the purpose of form 15397 rev 3-2025?

What information must be reported on form 15397 rev 3-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.