Get the free Form 941 Instructions: How to Fill Out the IRS Tax Return

Get, Create, Make and Sign form 941 instructions how

Editing form 941 instructions how online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 941 instructions how

How to fill out form 941 instructions how

Who needs form 941 instructions how?

Form 941 Instructions: How to Fill Out Form 941

Overview of Form 941

Form 941 is an essential document used by employers in the United States to report employment taxes: specifically, federal income tax withheld, social security tax, and Medicare tax. This form serves as a vital tool for the Internal Revenue Service (IRS) to ensure tax compliance among businesses, assisting both the government and employers in the process of tax management and reporting.

For employers, completing Form 941 accurately and timely is crucial. It not only helps organizations meet their tax obligations but also prevents penalties that arise from late submissions or inaccuracies. Understanding Form 941, its purpose, and filing frequency is a key responsibility for any business owner keen on staying compliant with federal tax laws.

Understanding the purpose of Form 941

The primary purpose of Form 941 is to report employment taxes. These taxes consist of withholdings from employee earnings, which employers must collect on behalf of the IRS. This includes federal income tax, social security tax, and Medicare tax, all of which fund vital programs, such as Social Security and Medicare, providing essential support to countless Americans.

Form 941 works in tandem with other IRS forms like Form 940 and Form W-2. While Form 941 focuses on quarterly employment taxes, Form 940 is an annual summary of federal unemployment tax, and Form W-2 details employee wage and tax information for annual reporting. Together, they contribute to an employer's overall tax filing responsibilities, ensuring a comprehensive overview of payroll-related taxes.

The regulatory framework governing Form 941 comes from the Internal Revenue Code. With guidelines set forth by the IRS, employers must adhere closely to the requirements outlined to avoid penalties and audits. Keeping abreast of any updates or changes to tax laws is integral for businesses aiming for compliance.

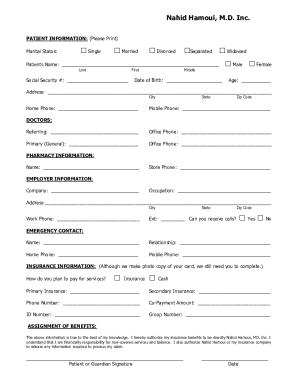

Preparing to complete Form 941

Completing Form 941 requires a systematic approach. Before diving into the form itself, employers should prepare the necessary information that will aid in the accurate reporting of wages and taxes.

How to fill out Form 941: step-by-step instructions

Filling out Form 941 can be straightforward if one adheres to a well-structured approach. Here are the steps to guide you.

Part 1: Business information

Begin by entering your business details. Accuracy is critical, so ensure you check the IRS guidelines to avoid errors in your submission.

Part 2: Wages and tax liability

In this section, provide a breakdown of wages paid during the quarter. You'll need to detail total wages, tips, and other compensations accurately. Understanding and calculating your total tax liability is also crucial. Be diligent about federal income tax withholdings along with social security and Medicare taxes.

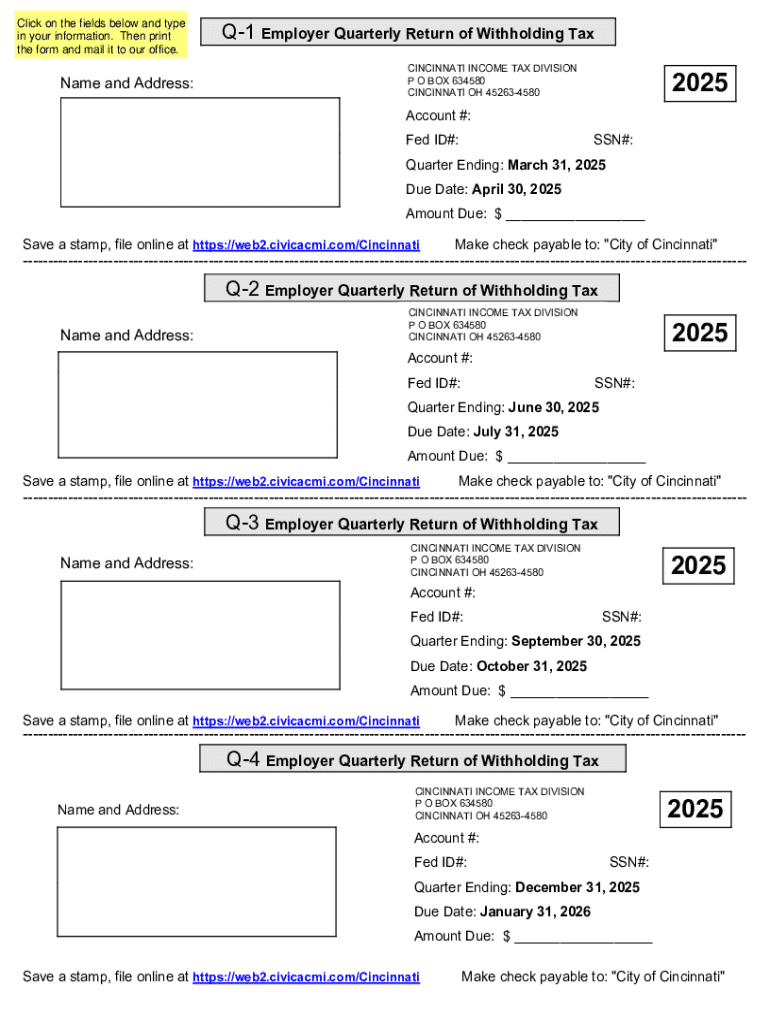

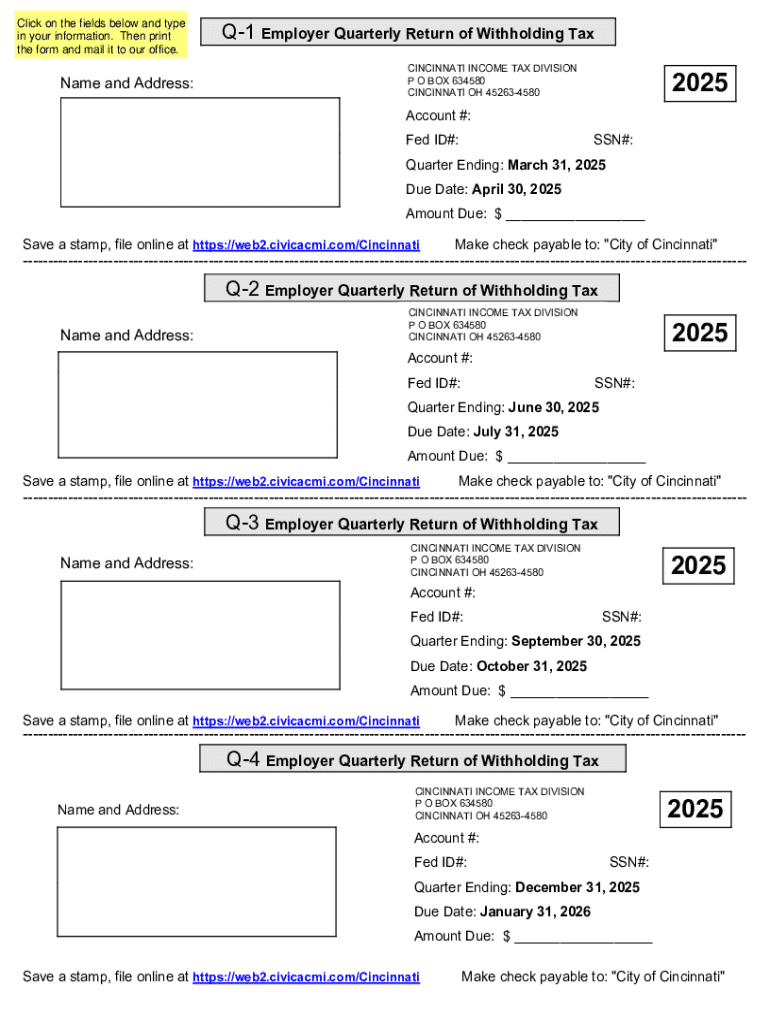

Part 3: Deposit schedule and liabilities

Identify your deposit schedule; you will either be a monthly or a semi-weekly depositor based on your total tax liability. Calculating the total tax due is a vital part of this section, ensuring you report any adjustments or changes accurately.

Part 4: About your business

Here, report information about your business type, whether it's a sole proprietorship, partnership, or corporation. Knowing the relevant IRS codes for your business structure will streamline this process. Understanding how your business type affects reporting can prevent future discrepancies.

Part 5: Third-party designee

A third-party designee is an individual that you authorize to represent you regarding Form 941. Consider choosing a designee when you want assistance with your filing. However, be aware of the implications of granting third-party access to your information and ensure you trust the individual.

Part 6: Signature and certification

Lastly, you need to sign Form 941. It's a declaration of accuracy and authenticity, and misrepresentations can lead to serious consequences, including penalties for errors or fraud. Remember, the integrity of your reported information is paramount.

How to file Form 941

Once you have filled out Form 941, you need to determine how to file it. The IRS offers multiple submission options, ensuring your form is filed accurately and on time.

Troubleshooting common issues with Form 941

Despite careful efforts, errors can occur. It's essential to recognize common mistakes that many employers make while filing Form 941 to avoid future hassles.

Utilizing pdfFiller for Form 941

Employers can leverage pdfFiller to streamline the process of completing Form 941. This platform not only simplifies the document management process but ensures ease of filing.

Using pdfFiller for Form 941 entails a few straightforward steps, simplifying the filing process for busy employers.

Conclusion

Filing Form 941 correctly and on time is crucial for maintaining compliance with IRS regulations. Utilizing tools like pdfFiller can provide simplicity and efficiency to the process, helping employers manage their reporting obligations with ease. By being diligent and thorough in completing this form, businesses can avoid penalties and ensure their staff receives the correct tax treatment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 941 instructions how directly from Gmail?

Where do I find form 941 instructions how?

How can I fill out form 941 instructions how on an iOS device?

What is form 941 instructions how?

Who is required to file form 941 instructions how?

How to fill out form 941 instructions how?

What is the purpose of form 941 instructions how?

What information must be reported on form 941 instructions how?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.