Get the free North Carolina 2025 State Medical Facilities Plan

Get, Create, Make and Sign north carolina 2025 state

How to edit north carolina 2025 state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north carolina 2025 state

How to fill out north carolina 2025 state

Who needs north carolina 2025 state?

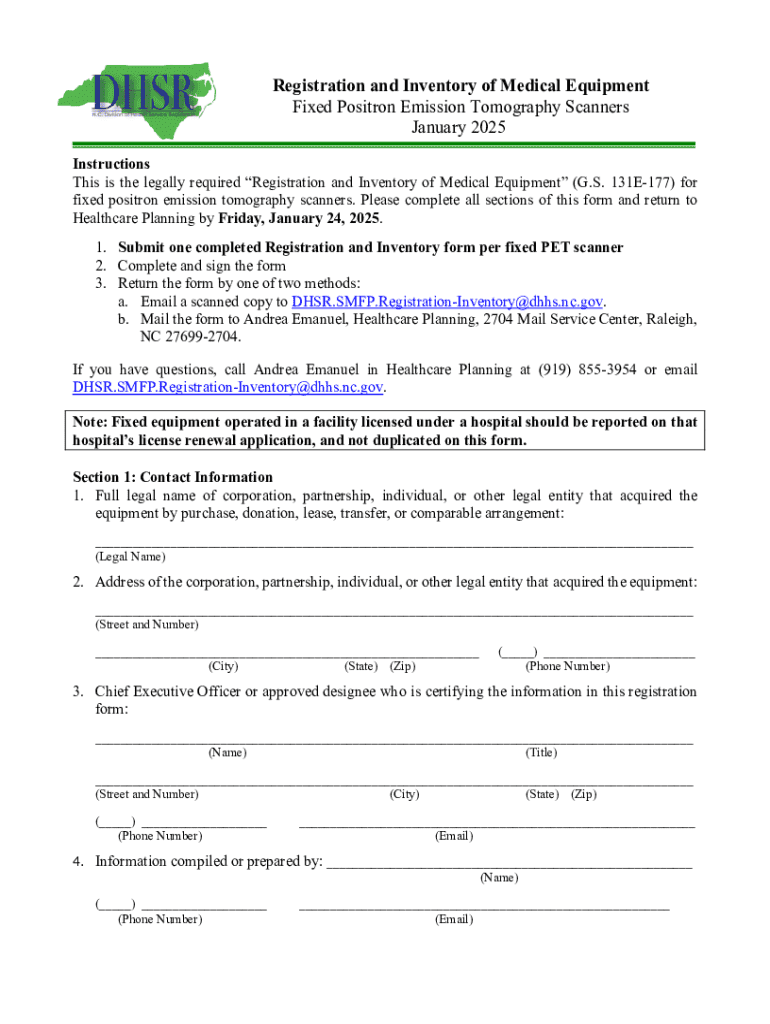

Understanding and Navigating the North Carolina 2025 State Form

Understanding the North Carolina 2025 State Form

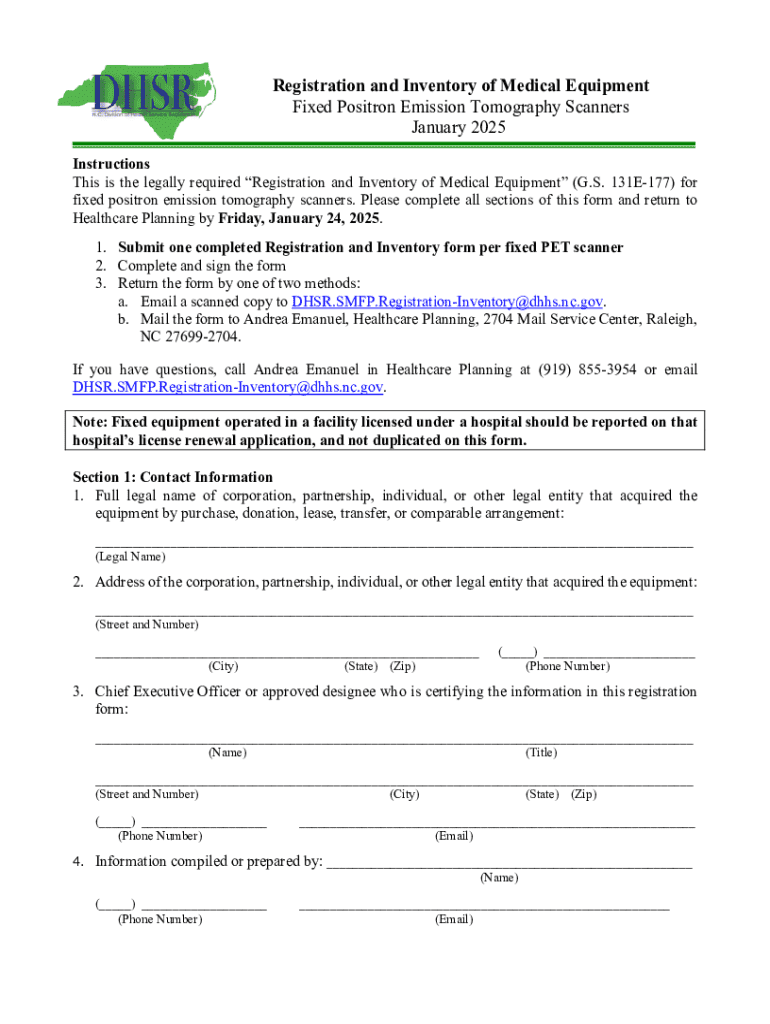

The North Carolina 2025 State Form is a crucial document for residents and businesses alike, ensuring compliance with state tax requirements. Submitting accurate and timely state forms is essential for avoiding penalties, assessing tax obligations, and receiving any potential refunds. These forms vary significantly based on the type of entity filing—individuals and businesses have distinct requirements and deadlines, which are outlined below.

Tax compliance is vital, especially in North Carolina, where state tax revenues contribute significantly to public services. Understanding the various forms available is the first step to effective tax management.

Types of forms for individuals and businesses

North Carolina's tax filing system is categorized into several forms tailored to different entities. For individuals, common forms include the NC-1040 for standard income returns, whereas businesses may utilize forms such as the NC-BT for business taxes and transactions. Additionally, various supplementary forms like the NC-40 for estimated income tax serve specific purposes.

Awareness of the appropriate forms to file not only streamlines the process but ensures that residents meet all legal obligations. Each form comes with its own instructions, requirements, and potential benefits.

Navigating the North Carolina 2025 State Form

Once you have identified the required North Carolina 2025 State Form, the next step is to navigate the filling process. Each form is accompanied by specific instructions, designed to guide individuals and businesses through the necessary steps to ensure accurate completion.

Reading through the instructions carefully can mitigate the risk of mistakes that often lead to audits or penalties. Common errors stem from improperly filled fields or submitting forms past the deadline, so vigilance is key.

Common mistakes to avoid

When completing your North Carolina 2025 State Form, several pitfalls can lead to complications. Incorrect information—including Social Security numbers, income amounts, or deductions—can cause delays and audits. Therefore, double-checking your entries against documentation is crucial.

Additionally, missing deadlines can result in penalties ranging from late fees to interest charges on unpaid taxes. Mark your calendars and set reminders for important dates, such as the primary filing deadline, to stay ahead of your obligations.

Interactive tools for efficient form management

Modern document management solutions can significantly ease the process of filling out the North Carolina 2025 State Form. Utilizing fillable PDFs allows users to input information directly onto the form, reducing the time spent on manual entries and minimization of potential errors.

Additionally, eSignature solutions enhance the practicality of document management. North Carolina recognizes the legal validity of electronic signatures, making it easier to sign and submit forms without the need for physical paperwork.

Collaborating effectively on document creation

For teams working to prepare the North Carolina 2025 State Form, collaboration features in document management tools enhance productivity. These systems support real-time editing, allowing multiple users to work simultaneously, thus ensuring timely completion.

Moreover, implementing role-based access ensures that sensitive tax documents are secure, with only authorized personnel able to make changes or view specific data. This enhances accountability and diminishes the risk of data breaches.

Managing your documents post-filing

After submitting your North Carolina 2025 State Form, organizing and storing your documentation becomes a priority. Best practices suggest maintaining both physical copies and digital files of your completed forms, which can be helpful for future reference or audits.

Utilizing cloud-based solutions enhances accessibility, allowing users to view and manage their documents from virtually anywhere. Cloud storage also provides secure options for sensitive information.

Handling audits and amendments

In the event of an audit, it’s essential to remain calm and organized. Prepare all relevant documentation promptly, and consider consulting with a tax professional to navigate through the process efficiently. Keeping thorough records of filed forms, receipts, and communications can significantly expedite the audit process.

If you need to amend your North Carolina 2025 State Form post-filing, awareness of the amendment process is crucial. Form NC-40T is often used to correct previously submitted forms. Adhering to amendment deadlines is also vital to avoid complications.

Additional resources for North Carolina residents

Accessing additional resources can greatly aid in understanding and navigating the North Carolina 2025 State Form. The North Carolina Department of Revenue provides extensive guidance through their website, including forms, instructional videos, and contact resources for personalized assistance.

Local Taxpayer Assistance Centers are also available across the state, offering in-person help for residents who may need further clarification on tax matters or assistance in filling out their forms.

Conclusion: Empower your form-filling process with pdfFiller

The North Carolina 2025 State Form filing process doesn't have to be daunting. With tools like pdfFiller, users can seamlessly edit PDFs, electronically sign documents, and collaborate within teams, all from a single, cloud-based platform. This comprehensive approach not only simplifies tax management but empowers users to efficiently handle their documentation needs.

By leveraging user-friendly tools and interactive features, residents can tackle their tax filing confidently, ensuring compliance and transparency throughout the process. pdfFiller stands as a reliable partner in document management that enhances users' ability to manage forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get north carolina 2025 state?

How do I make edits in north carolina 2025 state without leaving Chrome?

How do I complete north carolina 2025 state on an iOS device?

What is north carolina 2025 state?

Who is required to file north carolina 2025 state?

How to fill out north carolina 2025 state?

What is the purpose of north carolina 2025 state?

What information must be reported on north carolina 2025 state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.