Get the free Introduction of Liquidity Window facility for investors in debt ...

Get, Create, Make and Sign introduction of liquidity window

How to edit introduction of liquidity window online

Uncompromising security for your PDF editing and eSignature needs

How to fill out introduction of liquidity window

How to fill out introduction of liquidity window

Who needs introduction of liquidity window?

Introduction of liquidity window form

Understanding the liquidity window form

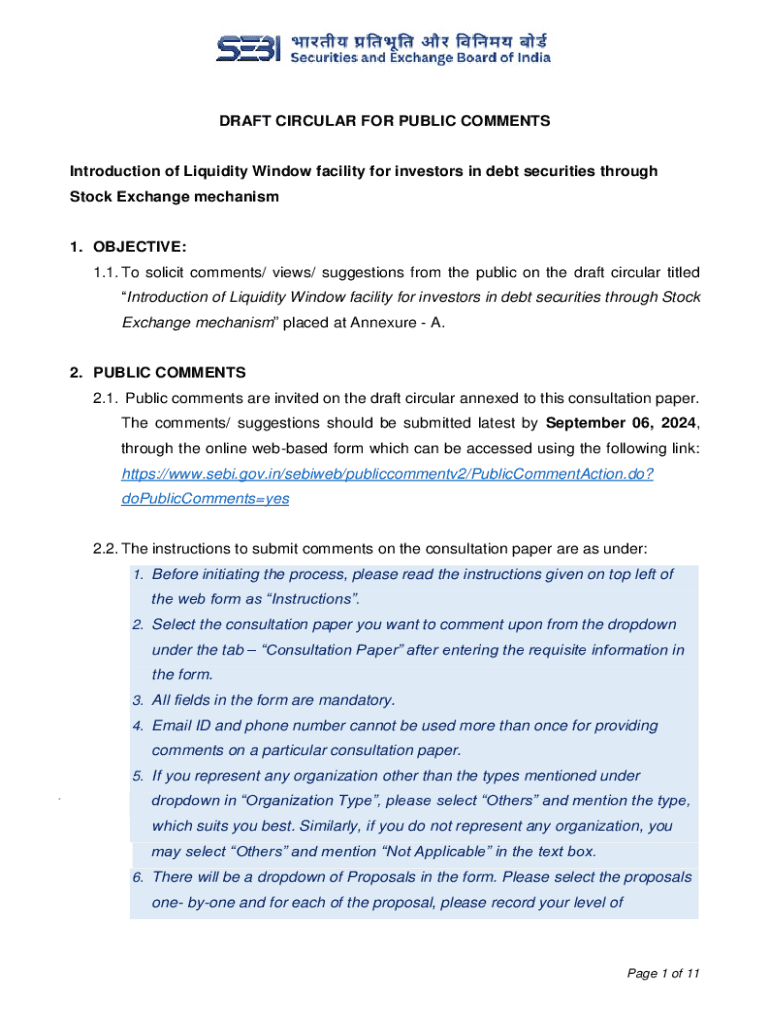

A liquidity window form plays a crucial role in financial management, particularly for institutions needing to assess liquidity positions. This form serves as a structured template that organizations can use to request financial assistance, loans, or securities in times of liquidity strain. Effectively, it outlines the issuer's requirements and details which can aid investors in making informed decisions regarding debt securities.

The liquidity window form provides clarity and uniformity in transactions involving liquid assets by specifying how funds will be allocated. Stakeholders such as financial institutions, corporate issuers, and investors interact through this medium. Effective utilization of the liquidity window ensures transparency and fosters trust among these parties.

Benefits of using the liquidity window form

Utilizing the liquidity window form offers several advantages to individuals and teams. First, it streamlines financial operations by providing a clear framework for financial requests, reducing ambiguity. This helps users to proceed confidently in capitalizing on liquidity opportunities, thus improving operational efficiency.

Moreover, effective cash flow management is facilitated through systematic application of this form. By carefully detailing liquidity situations, businesses can maintain better forecasts and adapt quickly as conditions change. Risk mitigation is another critical benefit. Implementing robust liquidity strategies through accurate and precise information can protect organizations from sudden financial setbacks.

Who should use the liquidity window form?

The liquidity window form is tailored for various users, ranging from individual investors to financial teams within companies. It is particularly beneficial for those looking to secure immediate liquidity or assess their financial standing before undertaking significant investment or issuance activity.

Scenarios where the liquidity window form shines include financial downtime, pending payments, or strategic investments in securities. Common industries that see frequent use of this form include banking, asset management, and corporate finance, where the management of liquidity is paramount.

Step-by-step guide to filling out the liquidity window form

Filling out the liquidity window form requires careful preparation and attention to detail. Start by gathering all necessary personal or business information to ensure smooth completion. Essential data includes your contact details, organizational capacity, and liquidity needs.

Additionally, relevant financial documents such as recent balance sheets, cash flow statements, and statements of securities will be vital for supporting your request. Once armed with this information, navigate the form on pdfFiller. Our platform provides intuitive tools to assist users in successfully entering data.

Editing and signing the liquidity window form

Once the liquidity window form is completed, users often need to edit, sign, or modify the document before submission. pdfFiller's editing tools make it straightforward to modify content, ensuring that all inputs are accurate without hassle. You can visit any section of the form, adjust financial details, or add comments to enhance clarity.

For finalization, electronic signing ensures quick submissions. Users can follow a streamlined process for providing a secure eSignature, which holds legal validity in most jurisdictions, thus protecting the document's integrity and authenticity.

Collaboration features for teams

In a collaborative environment, the liquidity window form becomes a dynamic tool with features that facilitate teamwork. Team members can share the form in real-time, making it easy to collect insights and feedback. The ability to comment and suggest changes helps refine the document, creating a polished submission.

Moreover, pdfFiller includes version control capabilities, empowering users to manage document updates effectively. This means previous edits can be tracked, and changes can be reverted as necessary, ensuring everyone is on the same page.

Managing your liquidity window form after submission

Once submitted, it’s essential to manage the liquidity window form efficiently. Tracking the status of your application ensures you'll stay informed about its progression through various approval stages. pdfFiller makes it easy to monitor this process and notifies users of updates or required actions.

If additional information or clarification is necessary, follow up promptly to maintain momentum. Finally, storing and retrieving completed forms is effortless with pdfFiller, helping you maintain organized records for future reference.

Tips and best practices for using the liquidity window form

To maximize the effectiveness of the liquidity window form, it is advisable to keep all documentation up to date. Regularly reviewing financial policies in light of recent market changes will also enhance your readiness to respond to liquidity needs promptly.

Engaging with financial advisors can provide invaluable advice tailored to your specific circumstances. Their expertise may offer insights into optimizing your liquidity management strategies, making it easier to navigate financial challenges.

Frequently asked questions (FAQ) about the liquidity window form

As inquiries arise regarding the liquidity window form, several common queries can be addressed. Understanding the types of liquidity needs that can be requested through the form often tops the list. Users frequently ask about the necessary documents and whether any additional steps are required to complete the process.

Troubleshooting issues is also a significant area of focus for form users. Knowing how to approach common problems can prevent delays and ensure swift responses to liquidity needs.

Summary of key features of pdfFiller in relation to the liquidity window form

pdfFiller offers a comprehensive suite of document solutions designed to streamline the experience of filling out the liquidity window form. With access-from-anywhere convenience, users can create, edit, and manage their forms with ease, irrespective of location. This flexibility is vital for teams needing immediate access to financial documents anytime, anywhere.

Further enhancing user experience, pdfFiller empowers users to create, manage, and collaborate on documents efficiently. By providing an intuitive interface alongside robust editing functions, pdfFiller ensures that managing your liquidity window form can be done seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify introduction of liquidity window without leaving Google Drive?

How do I execute introduction of liquidity window online?

How do I edit introduction of liquidity window in Chrome?

What is introduction of liquidity window?

Who is required to file introduction of liquidity window?

How to fill out introduction of liquidity window?

What is the purpose of introduction of liquidity window?

What information must be reported on introduction of liquidity window?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.