Get the free Credit Card Auth Form - Barrington

Get, Create, Make and Sign credit card auth form

Editing credit card auth form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card auth form

How to fill out credit card auth form

Who needs credit card auth form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a pivotal document utilized in business transactions to secure the approval of a credit card payment. This form serves to formalize the transaction process, ensuring that merchants have permission to charge customers’ cards for goods or services. It specifically represents the customer's consent to allow a merchant to process a certain transaction on their behalf, safeguarding both parties involved.

The key differentiation between an authorization and a credit card charge lies in the nature of the transaction. An authorization merely reserves the funds for a specified period, while a charge deducts the amount from the customer’s account immediately. Understanding this distinction is crucial for businesses seeking to manage their payment processes effectively.

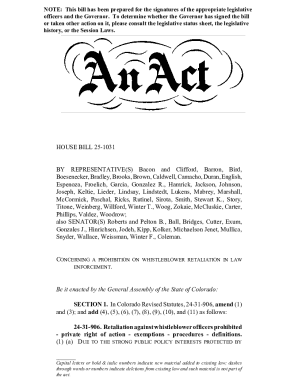

Credit card authorization forms are vital for business transactions, particularly for those that involve services, recurring payments, or large purchases. These forms contribute significantly to reducing the risk of chargebacks and misunderstanding, ensuring transparency and clarity throughout the payment process.

How credit card authorization forms work

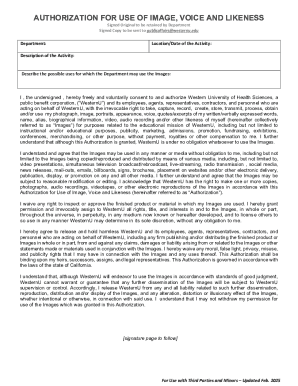

The authorization process involves several steps that must be meticulously executed to ensure validity. Initially, the merchant must collect essential information, including the cardholder's details and transaction specifics. This information may then be submitted to a payment processor for verification, where it will be recorded that the customer has authorized the transaction.

Security measures play a critical role in the authorization process. Most businesses follow compliance standards such as PCI DSS to ensure that sensitive customer information remains protected. These standards help minimize the risk of payment fraud and enhance the customers' trust in businesses.

For businesses, a credit card authorization form should be used whenever sensitive financial transactions are processed, especially for services rendered in advance or subscriptions. Using such a form can preempt potential disputes and build a more trustworthy relationship with customers.

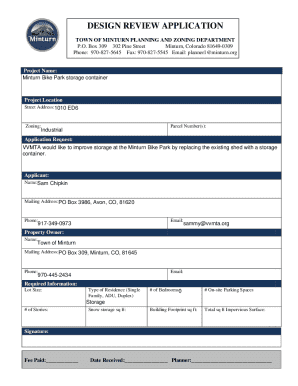

Components of an effective credit card authorization form

An effective credit card authorization form should encompass several essential components to ensure both clarity and legality. Key elements include the merchant's information, the cardholder's details, the billing address, and explicit transaction details such as the amount to be charged. Additionally, the authorization must be signed and dated by the cardholder to validate the transaction.

Optional sections can further enhance the security of the authorization process. These sections may include requiring the credit card expiration date and CVV code, as well as options for recurring payments. By including these details, businesses can mitigate fraud risks and enhance transaction security.

Best practices for filling out credit card authorization forms

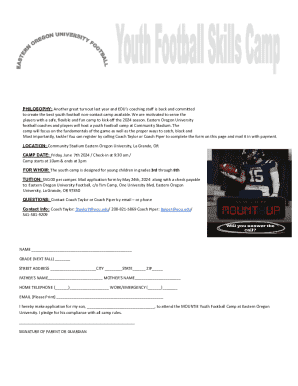

Filling out a credit card authorization form requires meticulous attention to detail to avoid pitfalls. To streamline this process, follow these step-by-step guidelines:

Avoid common mistakes such as incorrect card details or missing signatures, as these can result in authorization issues. Always prioritize security and patient privacy when handling sensitive information. Using secured networks and verified software, such as pdfFiller, can protect the information of your customers during the submission process.

Managing and storing credit card authorization forms

When it comes to managing and storing credit card authorization forms, businesses must choose between digital and physical storage options. Physical forms can be cumbersome to handle and store, whereas a secure digital solution allows for easier management. Utilizing a platform like pdfFiller enables businesses to store forms securely in a cloud environment, ensuring easy access while maintaining compliance with relevant laws.

Regardless of the chosen method of storage, ensuring the safety of these sensitive documents is of utmost importance. Proper procedures should be in place to restrict access to authorized personnel only. Moreover, businesses must stay informed on legal considerations surrounding customer data protection and compliance with regulations.

FAQ about credit card authorization forms

Credit card authorization forms are versatile documents with various applications across industries. They can be used by businesses ranging from retail to service providers. Understanding their function can help streamline payment processes and enhance customer relationships.

Troubleshooting common issues

Despite the straightforward nature of credit card authorization forms, issues can arise. Authorization denials can occur due to insufficient funds or incorrect details entered on the form. Cardholders should ensure all information is accurate and double-check the account’s status before submitting.

Chargebacks can also be a significant concern for businesses if customers dispute a transaction after unauthorized forms are submitted. In these cases, having proper documentation and records of all authorization forms becomes essential for resolution and maintaining good customer relations.

If a form is incomplete, contact the cardholder to clarify necessary details before proceeding. Clear communication is vital in resolving issues swiftly and efficiently.

Download our credit card authorization form templates

pdfFiller offers customizable templates for credit card authorization forms, simplifying the drafting process for businesses. Customize these templates to fit your specific needs, ensuring that all important elements are included.

The user-friendly interface of pdfFiller allows for easy adjustments, ensuring documents adhere closely to your business requirements. The step-by-step guide on utilizing these templates ensures that individuals and teams can efficiently implement the forms into their operations.

Interactive tools for credit card authorization management

pdfFiller is equipped with numerous interactive tools designed to facilitate the credit card authorization process. These features encompass eSigning capabilities, enabling users to sign authorization forms swiftly and securely.

Collaborative options for teams make it easier to share documents and obtain signatures from various stakeholders. Moreover, the ability to access forms from anywhere, anytime, provides businesses with the flexibility required to streamline operations and keep pace with customer demands.

User testimonials and case studies

Many businesses have leveraged the features of pdfFiller to enhance their credit card authorization processes. User reviews highlight the ease of customizing templates and obtaining timely signatures, significantly reducing administrative burdens.

Various case studies demonstrate how organizations have improved their operations by adopting streamlined credit card authorization forms through pdfFiller. Analysis of these examples unveils how effectiveness skyrocketed, thanks to better-organized documentation.

Stay updated: subscribe to our newsletter

To remain informed about best practices, new features, and important updates, subscribing to our newsletter offers numerous advantages. Not only will you receive insights into tools and tips for effective document management but also cover essential topics relevant to the credit card authorization landscape.

Regular updates empower businesses to enhance their operations continually, ensuring they stay responsive to changing landscapes and customer needs.

Thank you note

We appreciate your interest in exploring the resources surrounding credit card authorization forms. We encourage you to leverage the tools available on pdfFiller to enhance your document management capabilities.

Feel free to explore additional features that can streamline your workflow, ensuring a secure and efficient experience with credit card transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card auth form from Google Drive?

How do I edit credit card auth form in Chrome?

How can I edit credit card auth form on a smartphone?

What is credit card auth form?

Who is required to file credit card auth form?

How to fill out credit card auth form?

What is the purpose of credit card auth form?

What information must be reported on credit card auth form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.