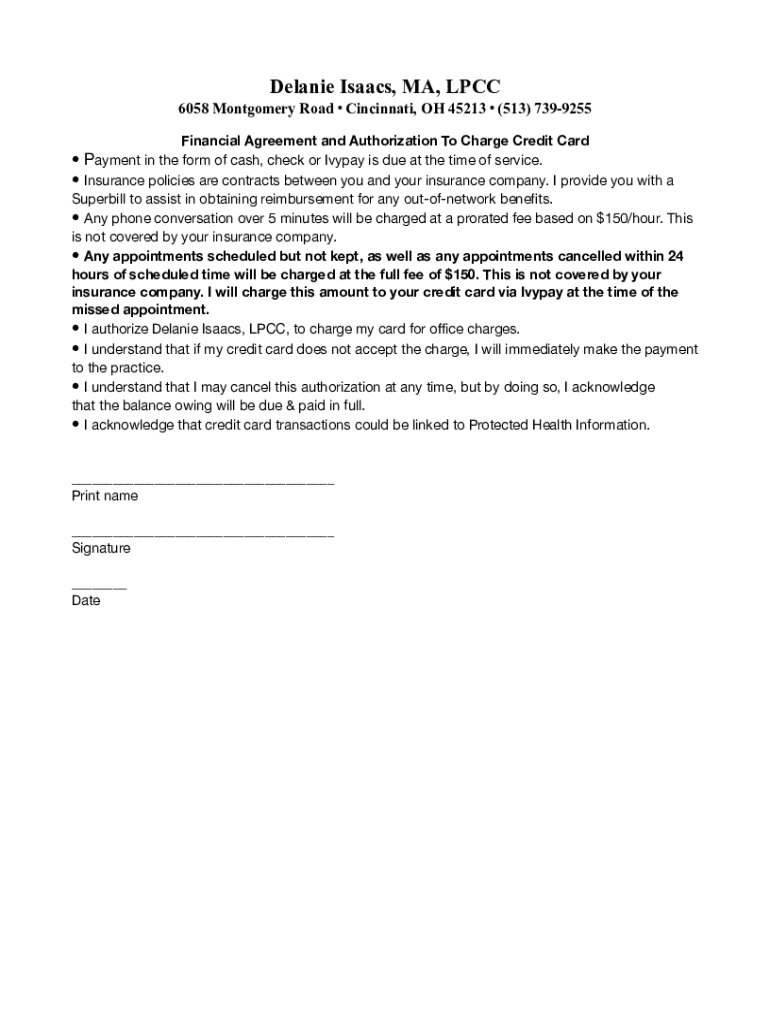

Get the free Financial Agreement updated May 2021 - Delanie Isaacs MA, LPCC

Get, Create, Make and Sign financial agreement updated may

How to edit financial agreement updated may online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial agreement updated may

How to fill out financial agreement updated may

Who needs financial agreement updated may?

Financial Agreement Updated May Form - Your Comprehensive Guide

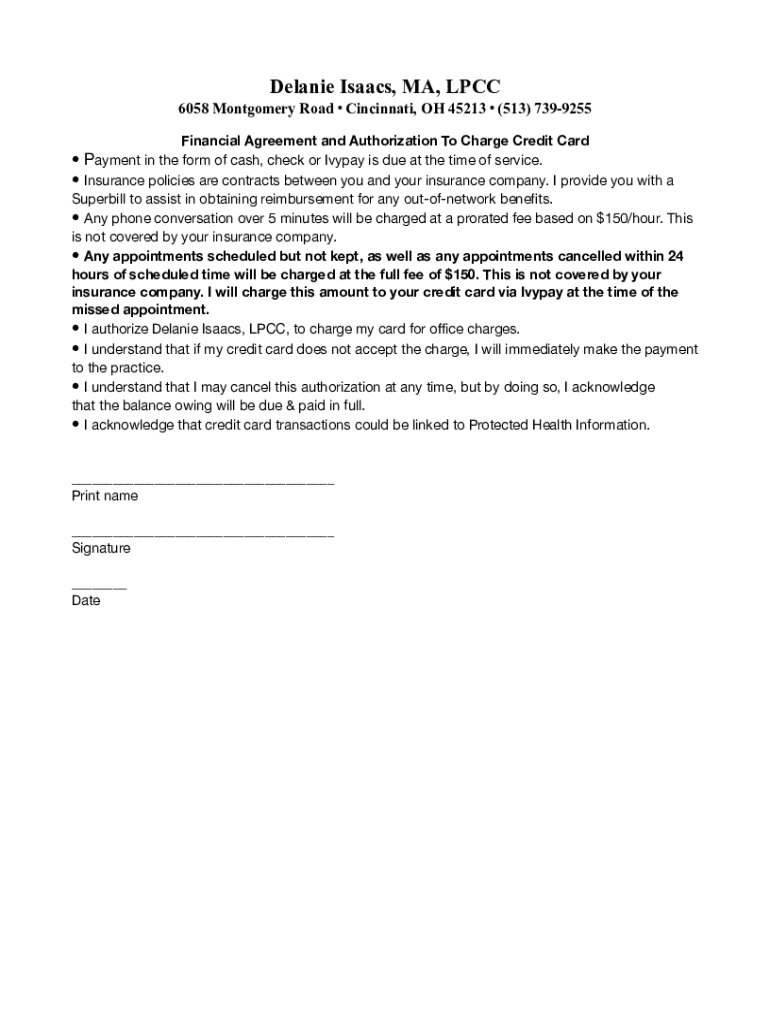

Understanding the financial agreement updated May form

The Financial Agreement Updated May Form serves a crucial purpose in formalizing financial transactions between parties. It outlines the obligations, rights, and details pertinent to loans, investments, or partnerships. By employing the updated form, stakeholders ensure clarity and uniformity in their financial dealings.

Key updates introduced in May typically include revisions to legal language, adjustments to interest rates, repayment terms, or enhancements to dispute resolution methods. Utilizing the latest version is crucial, as obsolete forms can lead to misunderstandings and legal complications.

Components of the financial agreement

A solid financial agreement contains several critical components. The first essential element is the identification of the parties involved. This should include the full legal names and any titles, confirming their identity to avoid future disputes.

Next, terms of the agreement must be clearly laid down. This includes the duration of the agreement and its effective date, detailing when the obligations commence. Each party’s general obligations should also be defined; this ensures everyone is informed of their responsibilities, paving the way for a transparent transaction.

Financial details

Financial agreements revolve around several key monetary details. Initially, the loan amount must be specific. It’s essential to outline the conditions tied to disbursement to avoid any ambiguity that may lead to disputes later.

Moreover, the repayment structure is crucial. It typically includes milestones, timelines for repayment, and details about early repayment options, including associated penalties. Understanding interest rates—whether fixed or variable—and the calculation methods is equally necessary to inform the borrower of total repayment amounts.

Security and collateral

In any financial agreement, the types of securities can vary significantly. Real estate might be contrasted against personal property, each requiring careful valuation. When collateral is involved, understanding its value and ensuring it corresponds with the loan amount requested is fundamental to protect both parties’ interests.

Security agreements should also contain clauses outlining the conditions surrounding collateral. These can protect lenders in case borrowers default, providing a legal recourse for recovering funds or assets.

Managing risks

Every financial agreement involves a certain degree of risk, particularly concerning defaults. Understanding what constitutes default—failure to meet repayment schedules, for instance—is vital. Clear definitions help mitigate potential conflicts down the line.

Consequences of default typically include penalties such as late fees or collateral repercussions. To safeguard parties involved, developing strategies for risk mitigation, such as maintaining insurance and establishing contingency plans, is key for long-term success.

Governing laws and regulations

Determining the appropriate jurisdiction for your financial agreement is vital. Different regions may have various regulations impacting financial transactions. Choosing the right legal framework ensures adherence to relevant laws, thus protecting all parties.

Compliance with local and federal laws is non-negotiable. Regulatory bodies can vary depending on the nature of the financial agreement, making it essential to stay updated on changes to these laws. This provides additional assurance that your agreement will withstand scrutiny.

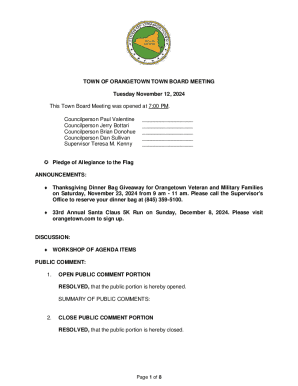

Dispute resolution

Disputes can arise even with the clearest of agreements. It’s imperative to establish methods for resolution upfront. Mediation might be preferable for parties seeking to maintain relationships, while arbitration provides a more binding solution. Should disputes escalate, court procedures might be necessary.

Preemptive measures can greatly reduce conflict likelihood. Clearly defined resolution procedures in the financial agreement foster understanding and cooperation, minimizing potential for litigation.

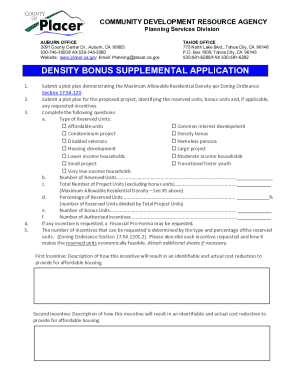

Filling out the financial agreement updated May form

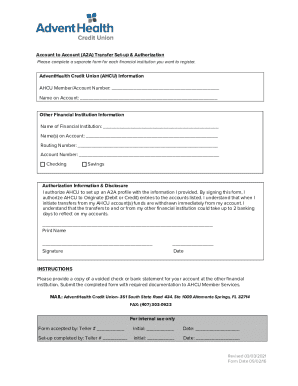

Completing the Financial Agreement Updated May Form requires attention to detail. Begin with a step-by-step approach, ensuring that critical sections—such as parties involved, terms, and financial details—are filled out accurately.

Avoid common mistakes, like incorrect names or dates, to ensure validity. Many agreements now necessitate notarization or witnesses to reinforce their legitimacy. Incorporating digital signatures can streamline this process, with platforms like pdfFiller simplifying document management through electronic signing solutions.

Collaborating on financial agreements

When several parties are involved, collaboration tools are vital. pdfFiller allows teams to share and edit documents simultaneously, enhancing efficiency. Real-time collaboration features mean changes can be tracked instantly, reducing the likelihood of errors.

Understanding the change history of your document is essential. pdfFiller automates document versioning so you can see what alterations were made, by whom, and when. This transparency promotes accountability and improves the overall integrity of the financial agreement.

Frequently asked questions (FAQs)

Addressing common concerns about the Financial Agreement Updated May Form is essential for user confidence. Many users may encounter terminology that can feel overwhelming; simplifying these terms offers clarity. Provide insights into frequently asked questions to assist users in their preparation.

Offering further assistance or resources through pdfFiller can help. For example, explanations about common errors, effective methods for collaboration on forms, and links to extra templates can be included. These steps contribute to a smoother completion experience.

Conclusion of the guide to the financial agreement updated May form

In summary, the Financial Agreement Updated May Form is an indispensable tool for ensuring that financial dealings are transparent and legally sound. By understanding each component—from financial details to dispute resolution—you can navigate the landscape of financial agreements with confidence.

It is essential to utilize modern solutions like pdfFiller for document management. Together, these tools help you to create, edit, and manage your financial agreements from anywhere, reinforcing your position in every business interaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the financial agreement updated may electronically in Chrome?

How do I edit financial agreement updated may straight from my smartphone?

How do I fill out the financial agreement updated may form on my smartphone?

What is financial agreement updated may?

Who is required to file financial agreement updated may?

How to fill out financial agreement updated may?

What is the purpose of financial agreement updated may?

What information must be reported on financial agreement updated may?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.