Get the free GENERAL ADMINISTRATION OF REVENUE LAWS

Get, Create, Make and Sign general administration of revenue

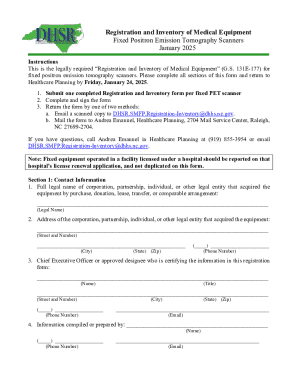

Editing general administration of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out general administration of revenue

How to fill out general administration of revenue

Who needs general administration of revenue?

Your Comprehensive Guide to the General Administration of Revenue Form

Understanding the General Administration of Revenue Form

The General Administration of Revenue Form is a crucial tool used by individuals and organizations within the United States to report income, deductions, and credits to government entities. This form facilitates the proper collection and management of revenue, ensuring compliance with tax laws and regulations. Its importance cannot be understated; accurate completion of this form impacts not only individual tax liabilities but also the broader financial health of the government.

A properly filled out General Administration of Revenue Form allows governments to assess and allocate resources effectively. It further serves as a record for taxpayers, detailing their contributions and responsibilities to the state. This form is generally available in various formats, enhancing its accessibility to a diverse user base—from individual taxpayers to businesses and organizations.

Step-by-step guide to filling out the form

Filling out the General Administration of Revenue Form requires precise attention to detail and organization. The first step involves gathering all necessary documentation and data. This includes tax forms from previous years, income statements from employers, and records of deductions that you intend to claim. Having these documents at hand will simplify the completion process and help you report more accurate information.

Once you've gathered all required documents, you can start completing the form. Each section has specific instructions that must be followed meticulously to avoid common pitfalls.

A. Gathering required information

B. Detailed instructions for each section

The form is typically divided into several key sections that require your attention:

Editing and signing the General Administration of Revenue Form

Once you have filled out the General Administration of Revenue Form, it’s critical to examine the information carefully for any errors. Tools like pdfFiller offer you the capabilities to edit PDF fields easily before finalizing the document. To edit effectively, simply upload your PDF form into the pdfFiller platform, where you can adjust text, rectify any mistakes, or add annotations to clarify complex areas.

After all edits are complete, e-signing becomes the final step in the submission process. E-signatures are not just convenient; they hold the same legal validity as handwritten signatures, making them a secure option for your document.

Common mistakes to avoid when completing the form

Completing the General Administration of Revenue Form is an intricate process, and numerous errors can hinder your submission. One common mistake is providing incomplete or inaccurate information, which can lead to unnecessary delays or even penalties. Always cross-referring with the most recent tax guidelines can help alleviate this issue.

Another prevalent issue is failing to understand the requirements set forth for each section of the form. If you’re in doubt, considerable resources are available for clarification, including government websites and tax professionals.

Managing your form after submission

Once the General Administration of Revenue Form is submitted, you may wonder what steps to take next. Keeping track of your submission is essential. You can typically monitor the status of your form via the online portal provided by the government entity to which you submitted the document.

In instances where your form is rejected or returned for corrections, familiarizing yourself with common rejection reasons is beneficial. Understanding these can guide your future submissions and mitigate risks.

FAQs about the General Administration of Revenue Form

As a user, you may have specific questions regarding the General Administration of Revenue Form. Common queries include:

Conclusion: Maximizing the use of pdfFiller for your document needs

Leveraging the capabilities of pdfFiller enhances the experience of using the General Administration of Revenue Form. The platform provides a range of tailored features, including custom templates and pre-filled forms that streamline the submission process.

Utilizing a cloud-based platform for your document management not only simplifies the editing and e-signing process but also empowers teamwork and collaboration. Future-proofing your document needs with pdfFiller equips you with the tools necessary to efficiently navigate any administrative revenue forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit general administration of revenue from Google Drive?

How do I make edits in general administration of revenue without leaving Chrome?

How do I fill out general administration of revenue on an Android device?

What is general administration of revenue?

Who is required to file general administration of revenue?

How to fill out general administration of revenue?

What is the purpose of general administration of revenue?

What information must be reported on general administration of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.