Get the free Instructions for Form 941 (Rev. June 2021). Instructions for Form 941, Employer'...

Get, Create, Make and Sign instructions for form 941

Editing instructions for form 941 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 941

How to fill out instructions for form 941

Who needs instructions for form 941?

Instructions for Form 941: A Comprehensive Guide

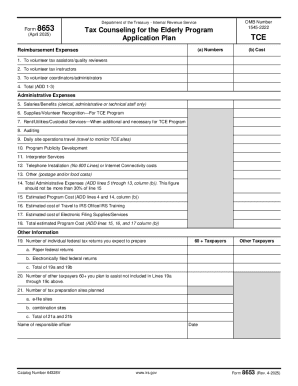

Understanding IRS Form 941: An Overview

IRS Form 941 is the Employer's Quarterly Federal Tax Return. It is a crucial document for employers as it reports employment taxes withheld from employee paychecks including federal income tax, Social Security, and Medicare taxes. Understanding the necessity of this form ensures that businesses maintain compliance with tax obligations, thus avoiding penalties.

Who needs to file Form 941?

All employers who withhold federal income tax, Social Security, or Medicare from employee wages must file Form 941. This includes corporations, partnerships, and sole proprietorships that have employees. However, smaller businesses or those with no employees may be exempt from filing.

Essential dates: 2025 tax filing deadlines and due dates

Form 941 must be filed quarterly. The deadlines for 2025 are as follows: the first quarter (January to March) must be filed by April 30, the second quarter (April to June) by July 31, the third quarter (July to September) by October 31, and the fourth quarter (October to December) by January 31 of the following year. Late filings can incur penalties, underscoring the importance of adhering to these deadlines.

Preparing to fill out Form 941

Before you start filling out Form 941, gather all necessary information. This includes employee details like Social Security numbers and total wages paid, as well as payroll records detailing taxes withheld. Keeping accurate payroll records ensures precise reporting and prevents compliance issues.

A step-by-step walkthrough of filling out Form 941

Filling out Form 941 can seem daunting, but breaking it down into manageable sections simplifies the task. Each part serves a specific purpose, and understanding the requirements is key to proficiency.

Filing options: online vs. paper submission

Filing Form 941 can be done online or via paper submission. Each method has its pros and cons. Filing online using services like pdfFiller offers convenience and immediate submission confirmation. It also minimizes errors by using digital tools that guide you through the process.

Final checklist before submitting Form 941

Before hitting ‘submit’, perform a thorough review of your Form 941. Accuracy is vital, as errors can cause delays and penalties. Ensure that you verify the following:

Tools and resources for managing Form 941 filing

Utilize interactive tools available on pdfFiller to manage Form 941 filing effectively. These tools assist with document organization and allow you to track changes easily. Accessing FAQs and customer support can also provide clarification on complex areas of the filing process.

Key considerations and common pitfalls in Form 941 filing

When filling out Form 941, precision is critical. Be aware of common mistakes such as miscalculating refunds or errors in employee information. Proper record-keeping is paramount and will help mitigate future audit risks.

Frequently asked questions about Form 941

Form 941 often raises questions for employers, especially regarding deductions and credits. Understanding common queries can alleviate confusion when filing. For example, many employers wonder how to claim employee retention credits within Form 941. Clarity in these areas can lead to more accurate filings.

Conclusion of key points to remember about Form 941

Understanding and properly filling out Form 941 is crucial for maintaining compliance with tax regulations. Be diligent with deadlines, accurate in your reporting, and proactive about seeking help if you are unsure regarding any aspect of the form. Continuous learning about tax responsibilities will empower businesses to navigate the complexities of payroll confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the instructions for form 941 form on my smartphone?

How do I edit instructions for form 941 on an iOS device?

How can I fill out instructions for form 941 on an iOS device?

What is instructions for form 941?

Who is required to file instructions for form 941?

How to fill out instructions for form 941?

What is the purpose of instructions for form 941?

What information must be reported on instructions for form 941?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.