Get the free Change Life Beneficiary

Get, Create, Make and Sign change life beneficiary

Editing change life beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change life beneficiary

How to fill out change life beneficiary

Who needs change life beneficiary?

A comprehensive guide to changing your life beneficiary form

Understanding the change life beneficiary form

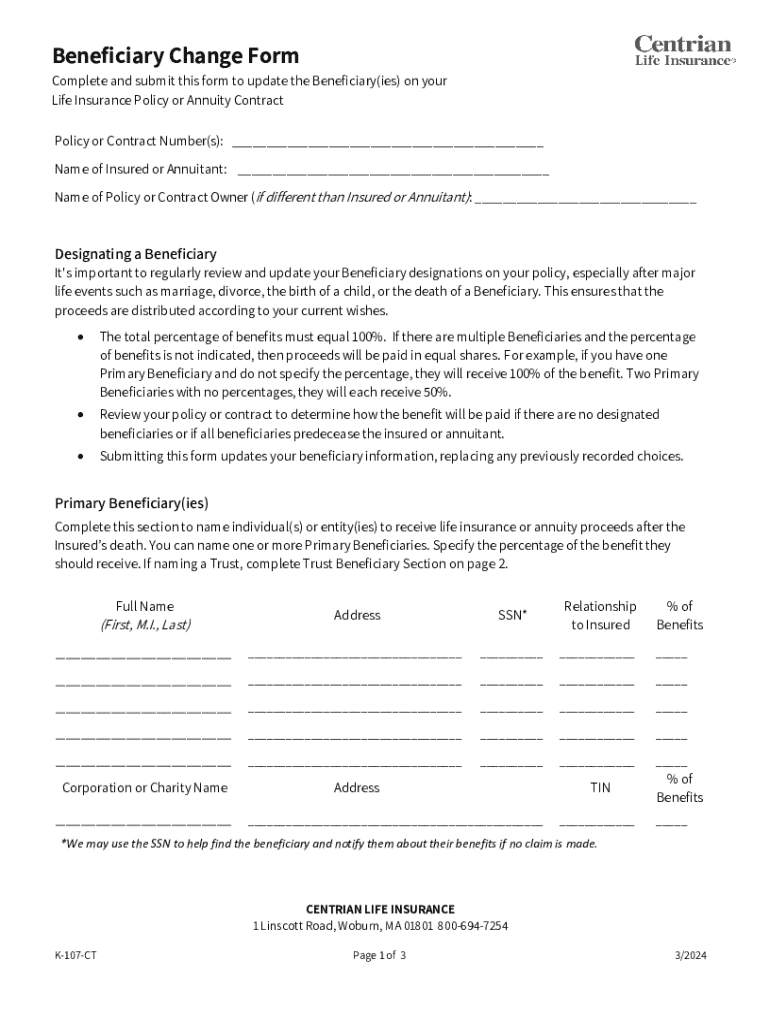

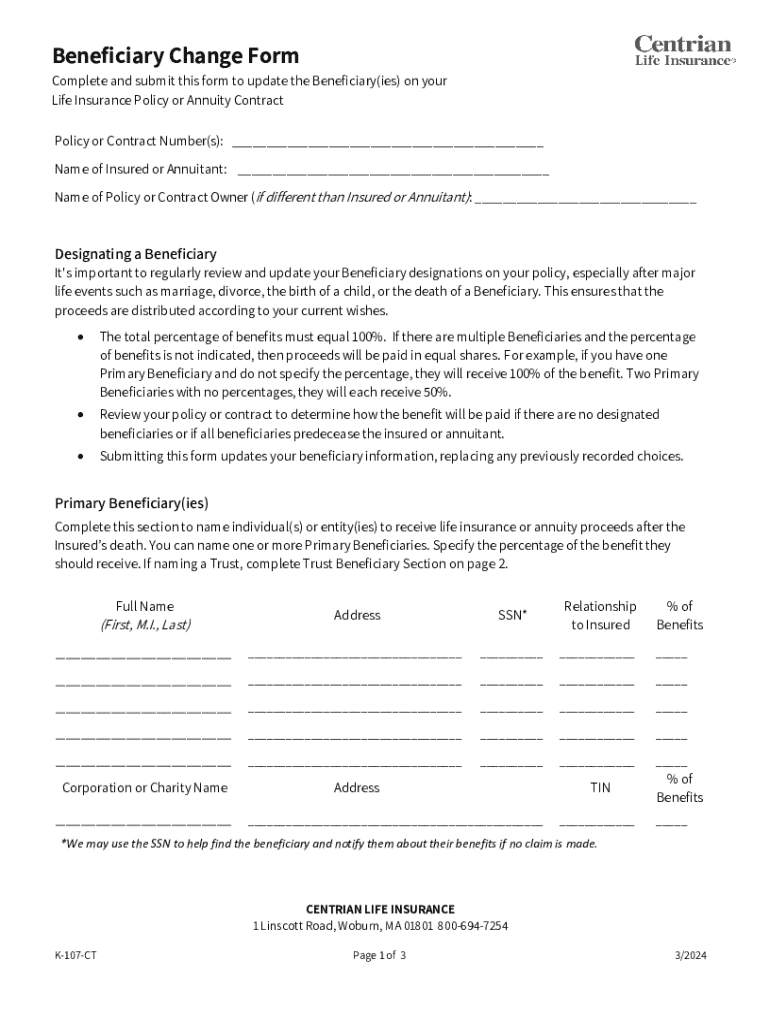

The change life beneficiary form is a vital document used to designate or alter the beneficiaries who will receive benefits from a life insurance policy or other financial accounts upon the policyholder’s death. This form ensures that the correct individuals receive the intended financial support and is crucial for effective estate planning.

Updating your beneficiary information is essential for several reasons. Life is unpredictable, and circumstances can change rapidly due to events such as marriages, divorces, and births. Regularly reviewing and updating the form ensures that your wishes are accurately reflected, ultimately providing peace of mind. Key terms relevant to this process include beneficiary, which refers to the person or entity designated to receive benefits; life insurance, a product that pays out a sum of money upon the death of the insured; and estate planning, the process of organizing the transfer of your assets after your death.

When should you change your beneficiary?

There are several life events that can prompt a change in your beneficiary designation. Major milestones such as marriage or divorce can significantly alter your intentions regarding who should inherit your assets. For instance, if you marry, your spouse may become your primary beneficiary, while a divorce could necessitate the removal of an ex-spouse from the list.

The birth or adoption of a child may also necessitate updates to ensure that your offspring receive benefits as intended. Additionally, the unfortunate death of a beneficiary should trigger a change to prevent unnecessary complications in the future. Regularly reviewing your beneficiary designations is a proactive approach to ensure they remain aligned with your current situation.

Failing to update your beneficiary information can lead to unintended consequences, such as an ex-spouse receiving funds or a child being omitted due to outdated designations. Understanding these implications is key for proper estate management.

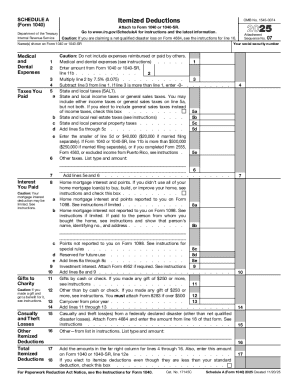

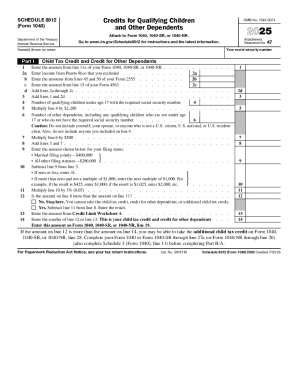

How to fill out the change life beneficiary form

Completing the change life beneficiary form correctly ensures that your wishes are honored and prevents complications down the line. The process can be broken down into several critical steps:

It's important to avoid common mistakes such as using outdated forms or failing to sign where indicated. Review your form thoroughly before submission to catch any errors that could delay the process or lead to complications.

Supporting documents and verification

Alongside the change life beneficiary form, you may be required to submit supporting documents to verify your relationship to your beneficiaries or to affirm the legitimacy of the changes you are making. It's essential to understand what documents are necessary, as these can vary depending on the issuing entity. Typical documentation may include:

Providing clear proof of your relationship to your beneficiaries is critical, as this helps to prevent challenges or disputes regarding your designations. Ensure you understand how to submit these documents, whether digitally or physically, and check with your issuing organization for specific requirements.

Submitting your change life beneficiary form

Once completed, you need to submit your change life beneficiary form to the appropriate entity, and you typically have two options for submission: online or via physical mail. Many institutions now facilitate online submissions for added convenience, allowing for instant processing in some cases.

To ensure timely processing, check the expected turnaround times based on your chosen submission method. After submitting your change life beneficiary form, keep an eye out for confirmation from the issuing entity and track your submission status when possible. It’s advisable to notify your beneficiaries about these changes, as transparency can prevent confusion in the future.

Special considerations for different audiences

Certain audiences may face specific requirements when changing their life beneficiary forms. If you are an employee of a public sector organization or a federal retiree, you might have unique guidelines that differ from private sector employees. These could include additional forms or verification processes mandated by government organizations.

Special considerations may also apply when dealing with trusts and other legal entities. For instance, a fiduciary might need to represent the interests of beneficiaries and provide documentation that reflects their authority to make changes. Always consult with a legal advisor or expert familiar with these nuances to ensure compliance with applicable laws and guidelines.

Understanding the consequences of designation changes

Changing your beneficiary designations can have significant impacts on both your life insurance policies and your overall estate planning. For instance, if you designate a new beneficiary that is not aligned with your estate plan, it could lead to unintended consequences, such as leaving out individuals you intended to support.

Therefore, it’s of utmost importance to consider how these changes will affect your estate's distribution upon your death. Regardless of your intention, improper designation changes can open the door for legal challenges. It’s advisable to protect your updates by keeping thorough documentation and potentially consulting an estate planning attorney to review your modifications.

Related information on beneficiary designations

It’s crucial to understand that beneficiary designations often prevail over wills. This means that if there’s a discrepancy between your will and your beneficiary designations, the designations will typically take precedence, potentially undermining your broader estate planning intentions.

Frequently asked questions often arise around areas such as how to address life beneficiary changes for minor or special needs beneficiaries. Understanding the considerations and protections available for these individuals is essential, as they may require a different approach to ensure their interests are safeguarded.

Keeping your designations up-to-date

Regularly assessing your designation status is vital for effective estate and financial planning. Set aside time annually to review your change life beneficiary form and other relevant documentation, ensuring they accurately reflect your current situation. Utilize resources provided by [website] to facilitate this review process, taking advantage of interactive tools that streamline modifications.

Additionally, keep an open line of communication with your financial advisors regarding any changes to your beneficiary designations. This proactive approach not only augments your financial planning but also helps ensure that your heirs will receive the intended benefits, regardless of changing circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit change life beneficiary online?

How do I edit change life beneficiary on an iOS device?

How can I fill out change life beneficiary on an iOS device?

What is change life beneficiary?

Who is required to file change life beneficiary?

How to fill out change life beneficiary?

What is the purpose of change life beneficiary?

What information must be reported on change life beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.