TN SS-4496 2008-2026 free printable template

Show details

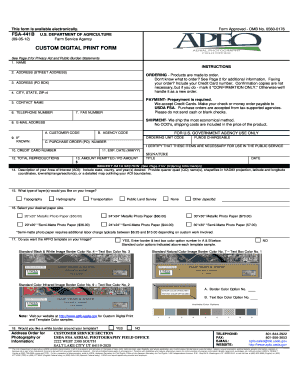

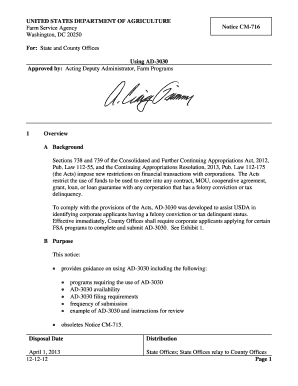

Print Form For OFCE Use Only Corporate Filings 312 Rosa L. Parks Avenue 6th Floor, William R. Snodgrass Tower Nashville, TN 37243 APPLICATION FOR REINSTATEMENT FOLLOWING ADMINISTRATIVE DISSOLUTION/REVOCATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tn application form

Edit your 79393419 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee limited liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN SS-4496 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TN SS-4496. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out TN SS-4496

How to fill out TN SS-4496

01

Gather necessary documents: Ensure you have all required information and documents related to your employment and tax situation.

02

Obtain the TN SS-4496 form: Download or request the TN SS-4496 form from the official website or relevant authorities.

03

Fill out your personal information: Enter your name, Social Security number, and address accurately.

04

Provide income information: Input your earning details for the specified period as required in the form.

05

Complete the tax withholding section: Fill in the necessary details regarding your federal and state tax withholding preferences.

06

Review your entries: Double-check all information for accuracy and completeness.

07

Sign and date the form: Ensure that your signature and the date are entered at the appropriate sections.

08

Submit the form: Follow the instructions for submission, whether online or by mail, to the applicable department.

Who needs TN SS-4496?

01

Individuals who need to report their earnings and tax withholding information to the relevant state or federal authorities.

02

Employees or contractors working within Tennessee who require documentation for income verification or tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a Tennessee tax return?

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

How to file Tennessee franchise and excise tax?

Registration of Franchise Tax & Excise Taxes is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to the Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business.

How do I get a tax clearance in Tennessee?

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Who must file Tennessee FAE 170?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

What income is taxable in Tennessee?

Tennessee does not have an individual income tax. Tennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Which people are legally required to file a tax return?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TN SS-4496?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the TN SS-4496 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete TN SS-4496 online?

With pdfFiller, you may easily complete and sign TN SS-4496 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit TN SS-4496 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing TN SS-4496.

What is TN SS-4496?

TN SS-4496 is a form used for reporting various information related to tax liabilities in Tennessee, specifically for the state’s sales and use tax.

Who is required to file TN SS-4496?

Businesses and individuals who are registered to collect and remit sales and use tax in Tennessee are required to file TN SS-4496.

How to fill out TN SS-4496?

To fill out TN SS-4496, gather your sales data, complete the necessary sections regarding taxes collected, exemptions, and any other pertinent information, and then submit it according to the provided guidelines.

What is the purpose of TN SS-4496?

The purpose of TN SS-4496 is to provide the state of Tennessee with information regarding sales and use tax collected by businesses for compliance and revenue purposes.

What information must be reported on TN SS-4496?

Information that must be reported on TN SS-4496 includes total sales, tax collected, exemptions claimed, and any adjustments or corrections to previous filings.

Fill out your TN SS-4496 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN SS-4496 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.