Get the free 24 Aggregate Verification Worksheet Dependent V5

Get, Create, Make and Sign 24 aggregate verification worksheet

How to edit 24 aggregate verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 24 aggregate verification worksheet

How to fill out 24 aggregate verification worksheet

Who needs 24 aggregate verification worksheet?

24 Aggregate Verification Worksheet Form: Your Comprehensive Guide

Understanding the 24 aggregate verification worksheet form

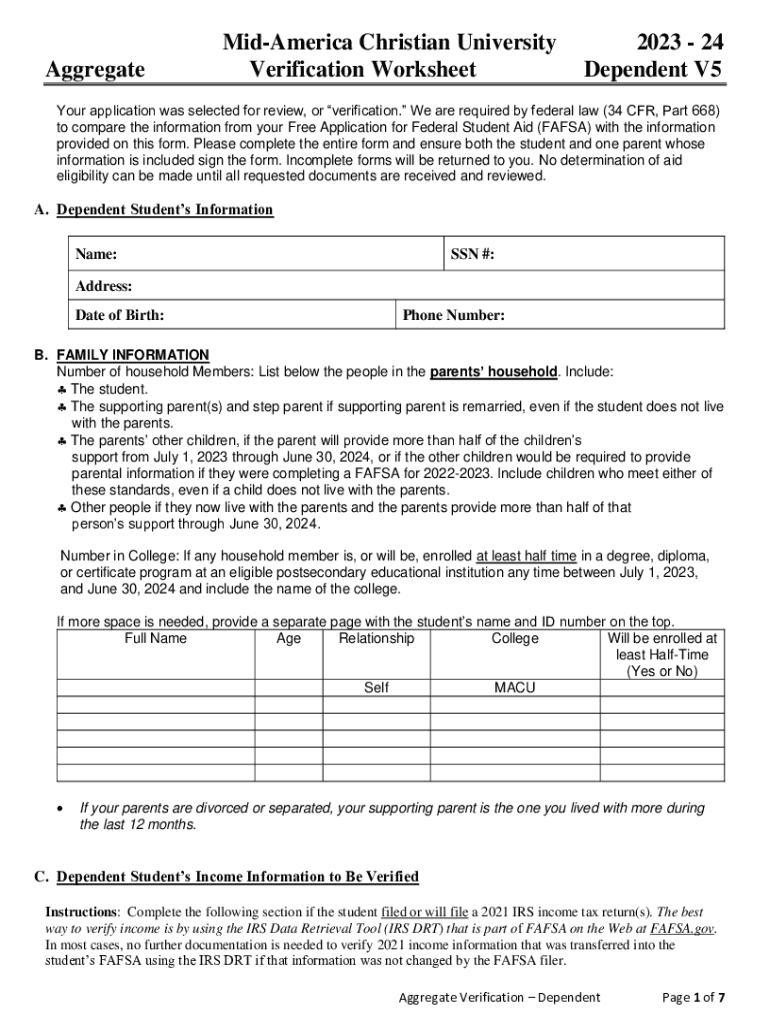

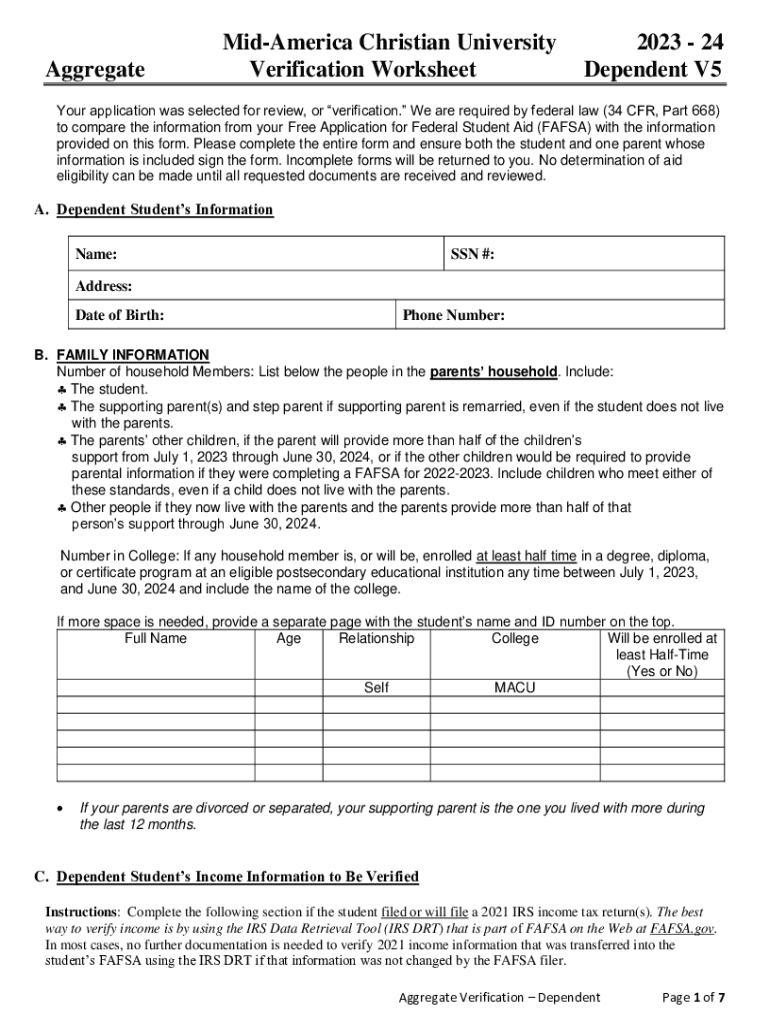

The 24 Aggregate Verification Worksheet is an essential document in the financial aid verification process. Its primary purpose is to collect and verify information regarding a student's financial status by analyzing income and household size to determine eligibility for federal student aid. Schools use this form to ensure that the financial circumstances reported on the FAFSA application are accurate, as discrepancies may impact funding decisions significantly.

The importance of this form cannot be overstated. Inaccuracies in financial data can lead to reduced aid or even loss of funding, making it crucial for students and their families to diligently provide correct information. This form acts as a safeguard for both students and educational institutions, ensuring that financial aid is allocated based on verified and truthful data.

Key components of the 24 aggregate verification worksheet form

The 24 Aggregate Verification Worksheet comprises several key components that must be filled out accurately. Understanding these components will streamline the verification process and ensure timely financial aid processing. First, personal identification information is required, including the student’s name, Social Security number, and details of family members who are part of the household.

Next comes income information, which is critical for establishing the financial need. You'll need to provide your Adjusted Gross Income (AGI) and income tax documentation. It's important to have on hand the tax returns or W-2 forms for the previous year. Additionally, you must indicate family size, documenting how many individuals rely on the reported income. Verification items may clarify specific details, such as untaxed income or benefits, requiring up-to-date and accurate information.

Acceptable documentation is essential for supporting the information provided on the worksheet. Commonly accepted evidence includes tax forms, pay stubs, child support documentation, and unemployment records. Gathering these documents efficiently can make the process smoother and help avoid delays in aid processing.

The verification process explained

Navigating through the verification process can feel daunting, but understanding the steps can alleviate some of that stress. The first step is to gather all necessary documents that support your financial claims. It is advisable to create a checklist of documents required to ensure nothing is missed. Once you have everything ready, you can then fill out the worksheet accurately, ensuring every approval box is checked.

After completing the worksheet, double-check all details for accuracy before submitting. Incorrect or missing information can lead to delays. Institutions have specific policies and procedures regarding verification, so familiarize yourself with them to avoid any missteps. Among common issues faced are mistakes in financial details or not providing required documents. If you realize you've made an error, contact your financial aid office for guidance on how to correct it promptly.

Understanding verification exclusions

Certain situations exist where verification may not be necessary. For example, if you're part of specific student groups such as those who have been awarded a zero EFC (Expected Family Contribution), or if you're eligible for specific financial aid programs, verification might be waived. Many students aren't aware of these exclusions, and understanding them can help save time and effort.

To determine eligibility for verification exclusions, consult with your school's financial aid office. They can provide clearer guidance on specific family situations and contingencies that could exempt you from the verification process. By being proactive, you can leverage this knowledge to expedite your path to receiving financial aid.

Special considerations

The role of professional judgment (PJ) is significant in the verification process and can greatly impact your financial aid eligibility. Financial aid administrators at your institution have the discretion to make adjustments to your financial data. This may occur when unusual financial circumstances arise, such as loss of income due to unemployment or medical expenses. If you believe your situation warrants a review under PJ, initiate a conversation with your financial aid office.

Unique scenarios can also affect the verification process. For instance, students experiencing sudden changes in financial circumstances should promptly update their FAFSA data and the associated 24 Aggregate Verification Worksheet. Additional requirements may also apply to specific populations, such as dependent students or independent students with dependents. Being aware of these considerations will help you prepare effectively for the verification process.

Tools and resources for managing your 24 aggregate verification worksheet

Using interactive tools available on pdfFiller can significantly ease the burden of managing your 24 Aggregate Verification Worksheet. Their platform provides features that assist in document editing, allowing you to fill out, sign, and collaborate in real-time, ensuring your documents are accurate and complete. Leveraging these tools can save you time and allow for a more organized approach.

The benefits of cloud-based management include the ability to access your documents from anywhere, ensuring that you can stay on top of your verification process even while on the go. This capability permits you to work collaboratively with family members or financial advisors as needed. pdfFiller empowers you to manage all aspects of your documents seamlessly within one platform.

Frequently asked questions (FAQs)

Many students have inquiries about the 24 Aggregate Verification Worksheet that can lead to confusion. If you find yourself missing essential documents, contact your financial aid office immediately for advice on alternatives or extensions to submit the missing materials. Additionally, it's important to know that the verification process's timeline can vary widely based on your institution’s procedures and workload; generally, it can take several weeks.

If uncertainties arise during the process, don't hesitate to reach out for assistance. Financial aid offices are equipped to answer questions and provide clarity regarding your situation. Engaging with them early can prevent misunderstandings and help facilitate a smoother verification experience.

Tips for a smooth verification experience

To ensure a successful verification process, organizational skills are key. Keep a folder—digital or physical—with copies of all submitted documents. This will allow you to reference them as needed and keep track of any communications with your financial aid office. Furthermore, consider using tools that facilitate collaboration. If you require input from family members or financial advisors, utilize pdfFiller to share the 24 Aggregate Verification Worksheet seamlessly and ensure all parties are aligned.

Staying organized not only promotes a smoother process but also alleviates stress. Lastly, maintaining clear communication with your institution’s financial aid office will ensure you're informed about any additional requirements and can act promptly on any issues that may arise.

Final notes

Understanding the impact of the 24 Aggregate Verification Worksheet on financial aid decisions is crucial. Verification can be the determining factor in the financial support you receive. Students must be proactive and transparent about their financial situations and clarify any uncertainties during the process.

Encouraging clear communication with financial aid offices not only fosters understanding but also enhances the likelihood of a smooth verification experience. With the right tools and knowledge, completing your 24 Aggregate Verification Worksheet can be straightforward and manageable, paving the way for securing the financial aid you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 24 aggregate verification worksheet from Google Drive?

How do I execute 24 aggregate verification worksheet online?

Can I create an eSignature for the 24 aggregate verification worksheet in Gmail?

What is 24 aggregate verification worksheet?

Who is required to file 24 aggregate verification worksheet?

How to fill out 24 aggregate verification worksheet?

What is the purpose of 24 aggregate verification worksheet?

What information must be reported on 24 aggregate verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.