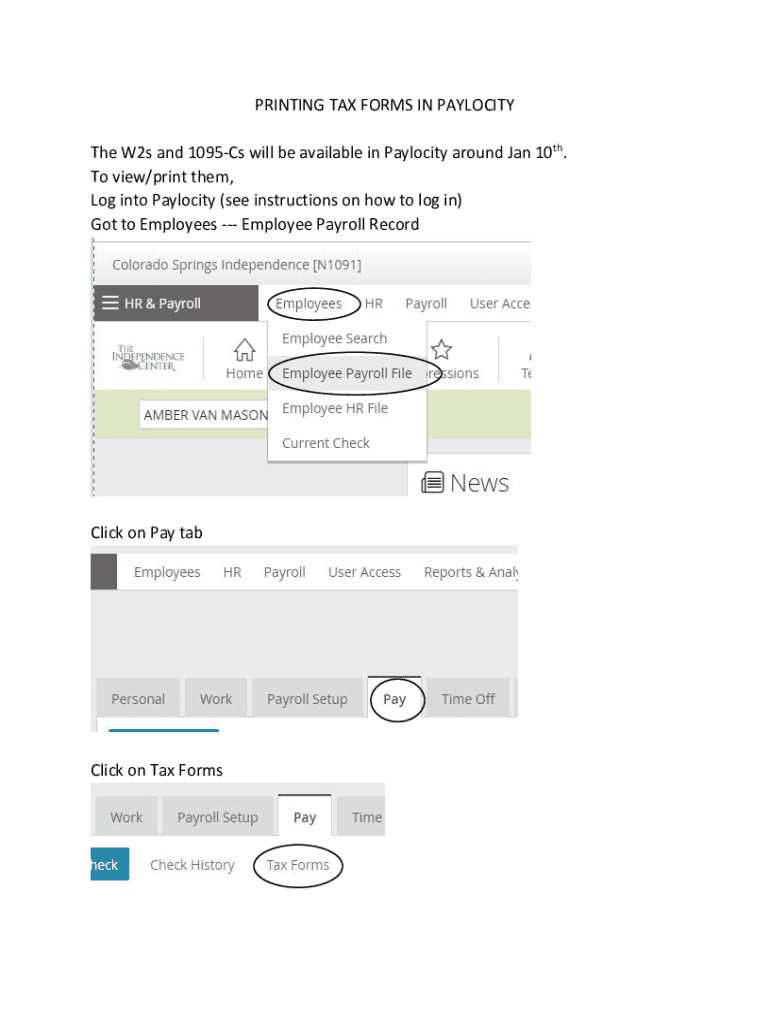

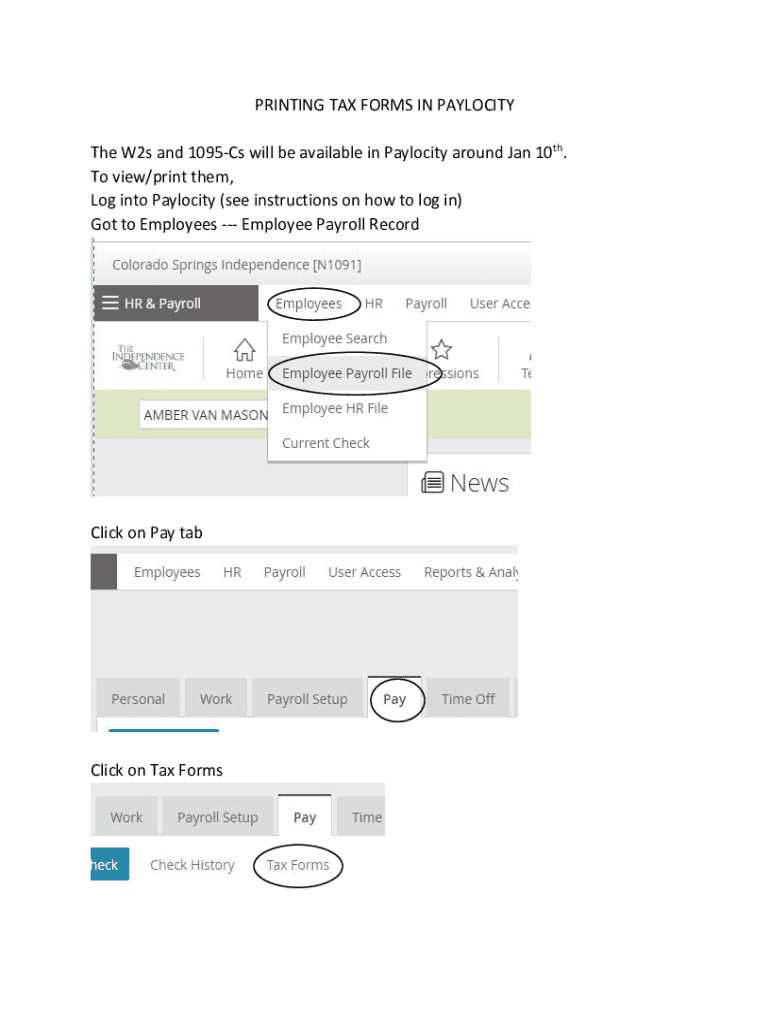

Get the free PRINTING TAX FORMS IN PAYLOCITY The W2s and 1095-Cs will ...

Get, Create, Make and Sign printing tax forms in

How to edit printing tax forms in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out printing tax forms in

How to fill out printing tax forms in

Who needs printing tax forms in?

Printing Tax Forms in Form: A Comprehensive Guide

Understanding the basics of tax forms

When it comes to taxation, knowing the appropriate tax forms is crucial for accurate submissions. Various tax forms serve specific purposes in reporting income and claiming deductions. Among the most common forms are Form 1040 (the U.S. Individual Income Tax Return), W-2 (Wage and Tax Statement), and 1099 (a series of forms used to report income other than wages). Each of these forms plays a significant role in the tax filing landscape.

The significance of these forms cannot be understated. For example, the 1040 form is essential for individual taxpayers to disclose their income and calculate tax liability. Meanwhile, W-2 forms are provided by employers to report wages paid and taxes withheld, while 1099 forms cater to freelancers and contractors. Incorrectly filling out any of these forms can have serious implications, such as fines, delayed refunds, or audits from the IRS.

Preparing to print tax forms

Before printing tax forms, it is important to gather all necessary information and documentation. Collecting personal data such as Social Security numbers, income statements, and pertinent deductions is essential. Organize these documents into specific categories to streamline the filling process and avoid frenzied last-minute searches.

Digital preparation tools like pdfFiller can greatly enhance this preparation stage. The platform allows users to easily import documents and fill them out in an orderly manner. This reduces the risk of error in your submissions, as everything is stored in one convenient location, ensuring a smoother workflow.

Filling out tax forms: step-by-step guide

Accessing the correct forms is a pivotal step in the process of printing tax forms in form. pdfFiller makes it easy by offering a library of tax templates tailored to meet various tax needs. You can quickly navigate the platform to find the right forms and even make use of filter options to search for specific templates, such as 1040 or 1099.

Once you’ve found the right form, pdfFiller’s interactive editing tools come into play. These tools allow users to fill out forms easily, providing visual cues and prompts to highlight essential sections. Completing critical fields is more manageable due to these features, ensuring your forms are filled out accurately and efficiently.

Printing tax forms effectively

After you've filled out your tax forms, the next step involves printing. Setting up your print preferences is crucial as printer settings can vary greatly depending on the type of form. Make sure to select the right settings, such as paper size and quality, to ensure that your printed documents are clear and legible.

The process of printing a completed tax form using pdfFiller is straightforward. Simply navigate to the print options in the interface and follow the prompts. Be mindful of common printing issues, such as misalignment or low ink. Having troubleshooting tips handy can save you significant time and hassle, ensuring your forms are printed seamlessly.

eSigning and sending tax forms

Incorporating eSignatures into the tax-filing process is becoming increasingly essential. eSigning offers numerous benefits, including time efficiency and enhanced security in finalizing your documents. Furthermore, eSignatures hold legal validity for tax forms submitted to the IRS, making this feature on platforms like pdfFiller invaluable.

To add digital signatures using pdfFiller, you can follow a straightforward, step-by-step process that maintains the integrity of your forms while ensuring they are signed securely. Best practices for sending completed forms include utilizing secure transmission methods and keeping track of submission confirmations to avoid any potential issues with the IRS.

Managing and storing your tax forms

Once your tax forms are completed and submitted, effective document management is key. Organizing and archiving forms for future reference can streamline your financial practices down the line. Utilizing cloud storage options provided by pdfFiller enables you to safely store these documents and access them from anywhere.

Accessing past completed forms becomes hassle-free with pdfFiller’s user-friendly interface. By enabling easy retrieval, you’ll find managing your tax documents becomes less stressful, assisting you in maintaining accurate records. If you work in a team setting, pdfFiller also offers collaboration features that make sharing forms seamless.

Frequently asked questions (FAQs)

While navigating the realm of tax forms, questions often arise, particularly regarding printing tax forms in form. Common printing issues, such as misalignment, faded prints, or incorrect template selections, can stump users. However, having a plan for troubleshooting these problems can ease the experience. Always check printer settings and paper compatibility before starting your print job.

Many users have inquiries about the specific requirements of various tax forms, such as due dates and submission procedures. Understanding the intricacies of forms like 1099, which can require specific reporting for independent contractors, is critical. Addressing these inquiries is not only beneficial for compliance but for peace of mind.

Interactive tools and resources

For users looking for additional assistance in printing tax forms in form, integrating tools like tax calculators and estimators on pdfFiller can be extremely beneficial. These tools aid in estimating your tax returns accurately, ensuring that you’re prepared for filing. Furthermore, accessing tutorials and webinars can enhance your understanding of the tax form process, offering tips that are invaluable for both novice and experienced filers.

These interactive tools are designed to simplify your experience on pdfFiller, providing insights that empower users to manage their tax documentation confidently. Whether you're just starting or managing multiple forms for a team, having these resources at your fingertips can save time and effort.

User testimonials and case studies

Reading user testimonials provides insight into the effectiveness of pdfFiller in managing tax forms. Users often share real-world experiences that highlight how the platform streamlines their document handling processes, proving invaluable whether for individual tax preparation or team collaboration. Many clients report saving hours during tax season by switching to pdfFiller’s comprehensive features.

Furthermore, case studies reveal how businesses have transformed their tax form management by adopting pdfFiller. Emphasizing efficiency and accuracy, these stories showcase the platform's capabilities to handle various tax forms seamlessly, reinforcing the idea that utilizing modern document solutions can enhance overall productivity in any organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send printing tax forms in for eSignature?

How do I fill out the printing tax forms in form on my smartphone?

How do I edit printing tax forms in on an iOS device?

What is printing tax forms in?

Who is required to file printing tax forms in?

How to fill out printing tax forms in?

What is the purpose of printing tax forms in?

What information must be reported on printing tax forms in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.